1. BACKGROUND

When any entity enters into any transaction in foreign currency, it is exposed to exchange fluctuation risk on such transaction unless the same is hedged by the entity through hedging techniques like Forward Contracts, Currency Invoicing etc. The risk associated with such transactions may result into either Exchange Gain or Exchange Loss. Moreover, both Accounting Standard – 11 and Indian Accounting Standard (Ind AS) 21 (both together can be termed as “Generally Accepted Accounting Principles” or “GAAP”) on Accounting of foreign currency transactions provides for the accounting of realized as well as unrealized gain/losses. In some cases, such foreign exchange gain/loss can also be capitalized in the cost of capital asset or in a separate account called “Foreign Currency Monetary Items Translation Difference Account”. In this Article, we will step by step understand the treatment to be given under Income tax laws to each of such transactions where exchange fluctuation gain/loss can arise. We will also discuss the impact of Income Computation and Disclosure Standards (ICDS) and recent judgment of Hon’ble Delhi High Court in the writ petition filed by The Chamber of Tax Consultants (CTC).

B. STEPS TO ASCERTAIN THE TAX TREATMENT

Step 1: Ascertain the amount of total foreign exchange fluctuation gain/loss arises:

First of all, we need to ascertain the sum total of Exchange Fluctuation Gain/Loss from the financial statements of the entity for the relevant previous year prepared as per GAAP. The same needs to be collected not only from the sources of Statement of Profit and Loss but also the amount which has been capitalized in any account including amount capitalized in any item of Property, plant and equipment or Intangible assets.

Step 2: Ascertain whether the Exchange Fluctuation is on Revenue/ Capital Account:

Exchange Fluctuations arises on Revenue Account:

The exchange fluctuations which are not related to acquisition, installation, disposition of any capital asset, such fluctuations are treated to arise on Revenue Account. For Example, the realized/ unrealized exchange fluctuation gain/loss which have been arisen on transaction with Trade Receivables, Trade Payables, Working Capital ECBs (External Commercial Borrowings) etc. are fluctuation impacts on Revenue Account.

Exchange Fluctuations arises on Capital Account:

The exchange fluctuations which are related to acquisition, installation, disposition of any capital asset, such fluctuations are treated to arise on Capital Account. For Example, the realized/ unrealized exchange fluctuation gain/loss which have been arisen on capital creditors, outstanding ECBs taken for acquisition/ installation of any capital assets etc. are fluctuation impacts on Capital Account.

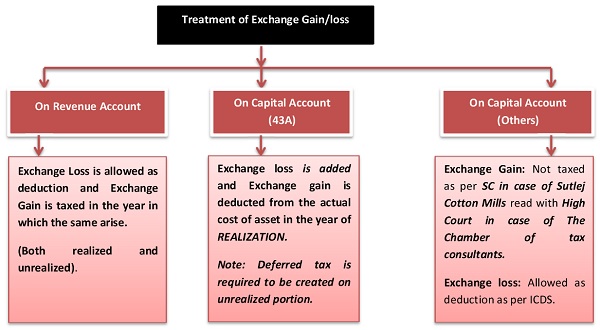

Step 3: Tax Treatment

Exchange Fluctuation Impacts on Revenue Account Transactions:

As per the provisions of Income tax laws, the exchange fluctuations arises on transactions relating to Revenue Account shall be allowed as deduction (in case of loss) or taxed (in case of gain) in the year in which such gain/loss arise. Further to clarify that the unrealized exchange fluctuation gain/loss are also allowed as deduction in the year in which the same has been accounted for. Supreme Court in the case of Commissioner of Income Tax, Delhi vs. M/s Woodward Governor India Private Limited.

Exchange Fluctuation Impacts on Capital Account Transactions:

The exchange fluctuation impacts on Capital Account Transactions can be further classified into two parts:

- Capital Account transactions which are covered under Section 43A of the Income tax Act, 1961;

- Other Capital Account transactions.

Transactions covered under Section 43A of the Income tax Act, 1961

Section 43A of the Income tax Act, 1961 applies on Capital Account Transactions when the following conditions are fulfilled:

- The asset MUST BE ACQUIRED FROM OUTSIDE INDIA;

- The asset must be acquired for the purpose of business and profession;

then, the amount of exchange gain/loss arisen on such asset shall be added to the actual cost of the asset on realization basis. In case of gain, the same shall be deducted from the same.

Such Exchange gain/loss can arise on the following:

- On payment of vendor from whom such capital asset has been procured;

- On repayment of any loan which has been borrowed for the purpose of such capital asset. (Foreign Currency Loan can be taken from India as well as Outside India but asset must be imported for the purpose of application of Section 43A).

- On payment of Interest on such loan.

Notes:

1. Paragraph 46A of Accounting Standard-11 which has also been allowed as an Exemption in Ind AS 101 “First Time Adoption” is of no use for the purpose of treatment of the same under Income tax. The capitalization under the Income tax Act is solely governed by the provisions of Section 43A of the Income tax Act, 1961.

2. The Unrealized Exchange Gain/loss arisen on account of any capital asset covered under Section 43A of the Act is not allowed to be added (in case of loss) or taxed (in case of gain) since Section 43A treats the same on REALIZATION BASIS. Further note that Ind AS -12 and Accounting Standard-22 on Taxes on Income come into play and you are required to compute deferred tax on the same due to timing difference.

Transactions of capital nature not covered under Section 43A of the Income tax Act, 1961:

Guidance given in Income Computation and Disclosure Standards (“ICDS”):

ICDS do not segregate the Exchange Gain/loss between revenue nature and capital nature. The same simply provides that except the Exchange Gain/loss dealt in by Section 43A of the Act, all other Exchange gain/loss arises on monetary items (e.g. cash, receivables, payables etc.) shall be allowed under the Act. The same gives a sense of Interpretation that even Exchange Gain/loss of Capital Nature not covered in Section 43A straight-away allowable as deduction (in case of loss) or taxed (in case of gain) in the Computation of Income for the relevant previous year. The same is contrary to the judgment of Hon’ble Supreme Court in the case of Sutlej Cotton Mills Ltd v CIT [1979] 116 ITR 1 (SC).

The Central Board of Direct Tax (CBDT) has issued circular 10/2017 dated 23rd March, 2017 in which it came up with some FAQs on notified ICDS. The relevant FAQ deal with the above contrary view is reproduced herein below:

Question: Certain ICDS provisions are inconsistent with judicial precedents. Whether these judicial precedents would prevail over ICDS?

Answer: The ICDS have been notified after due deliberation and after examining judicial views for bringing certainty on the issues covered by it. Certain judicial pronouncements were pronounced in the absence of authoritative guidance on these issues under the Act for computing Income under the head “Profits and gains of business or profession” or Income from other sources. Since certainty is now provided by notifying ICDS under section 145(2), the provisions of ICDS shall be applicable to the transactional issues dealt therein in relation to assessment year 2017-18 and subsequent assessment years.

The above FAQ mean that the provisions of ICDS would prevail over court judgments.

In this regard, Chamber of Tax Consultants (“CTC’”) filed a writ petition before Hon’ble Delhi High Court (‘HC’) challenging the constitutional validity of Section 145 of the Act to the extent it requires compliance with ICDS along with aforesaid CBDT Circular.

The Hon’ble Delhi High Court HC upheld the constitutional validity of ICDS but remarked that Sec. 145 only permits the CG to notify ICDS, but not to bring about changes to settled principles as laid down in judicial precedents.

However, the above clause in relation to treatment of capital nature gain/loss has not been particularly challenged before the Delhi High Court but the ruling applies to such scenario also.

Accordingly, the assessee can opt for the situation which is more beneficial to him which can be understood as follows:

- In case of Exchange gain: Do not tax the Exchange gain arisen on Capital Account Transaction (not related to Section 43A) by applying the Hon’ble Supreme Court in the case of Sutlej Cotton Mills Ltd v CIT [1979] 116 ITR 1 (SC) read with Hon’ble Delhi High Court Judgment in case of The Chamber of tax Consultants.

- In case of Exchange loss: Since the department is bound by the circulars issued by CBDT, hence the assessee can take a plea of allowing the same.

It is to note that once the assessee has taken any of the above option in a particular previous year, the same is not advisable to be changed in the subsequent years based on the beneficial status. Hence, the option should be chosen by due deliberation to be given to the future outcomes of foreign currency transactions.

C. SUMMARY:

If one sells land in canada but resides in the United States. Can the foreign exchange from CAD TO USD funds be claimed as a loss? Even if there is a capital gain on the sale of property. How would this be reported on a u.s tax return the exchange loss, along with the gain?

Thanks Sir

but whose reference rate has to be taken as at balance sheet date for foreign debtors and creditors is there any guideline for taking rbi reference rate., plz specify

if Advance payment has been done on import of material and invoice has not yet been received on year ending so, whether exchange fluctuation rate on date of year ending will have to take into consider?

Appreciate the content clarity.

pl send your write-ups to my mail id.