Case Law Details

Our reading of the provision makes it abundantly clear that the purchase do not include a purchase which is not a purchase of an asset which is not incapable of being used by the assessee. The assets for the purpose of Section of 54F should be an asset purchased by the assesse and if an assessee incurs a cost for making it useful and convenient after taking approval from the competent authority, as in the present case, then the assessee is entitled to deduction u/s. 54F of the Act.

FULL TEXT OF THE ITAT JUDGMENT

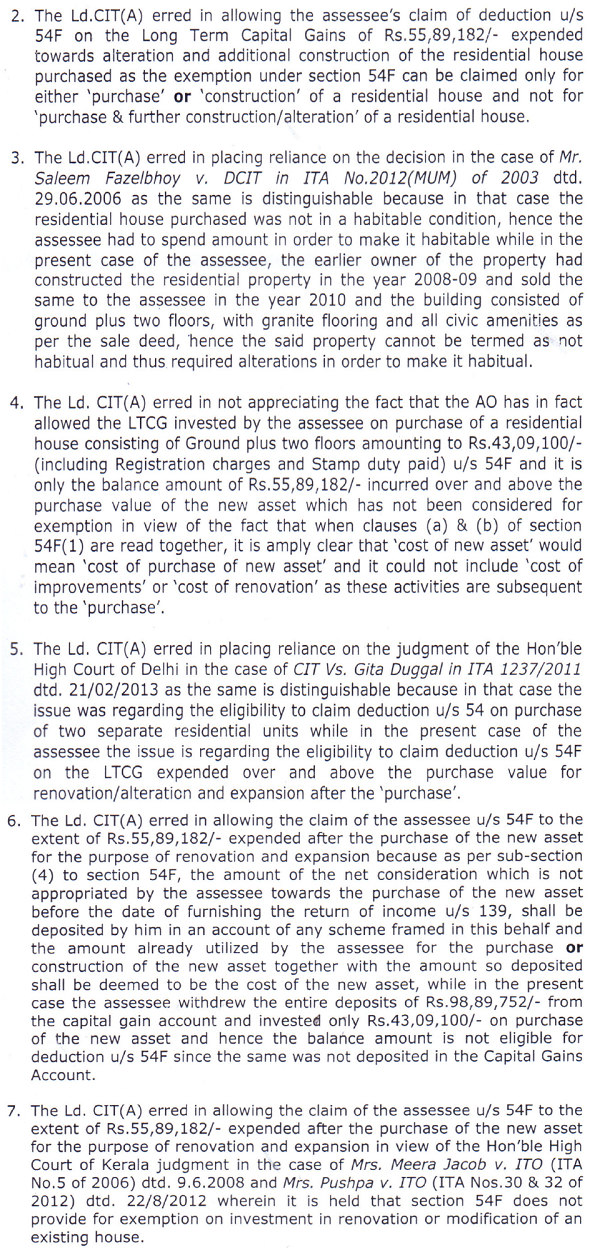

The present appeal is filed by the Revenue, against the order of the arising out of the order of the CIT (A)-I, Bengaluru, date 29.04.2016, for the assessment year 2010-11, on the following grounds :

02. Brief facts are, the assessee filed the return of income for the impugned assessment year declaring income of Rs. 2,06,130/-. Thereafter the case was selected for scrutiny and notice was issued. The assessee has submitted before the AO that he sold the site located at No. 1443, Judicial Layout, Yelahanka Hobli, Bangalore North Taluk, for a consideration of Rs. 1,00,80,000/-, which was purchased for Rs. 74,470/-. After indexation at Rs. 1,81,718/-, long capital gains was arrived at Rs. 98,98,282/-. The assessee deposited the entire proceeds of Rs. 1,00,80,000/- in the capital gains savings account on 09.02.2010 and subsequently paid a sum of Rs.2 lakhs as commission on sale proceeds. Thereafter the assessee purchased new property consisting of both land and building located at No. 733, I Block, 6th cross, Valagerhalli Extension, Jnanabharathi Layout, Bengaluru 560 059 on 01.07.2010, for a sale consideration of Rs.75,75,475/-. The break-up of the said amount is as under :

| Registration | Rs. 40,00,000 |

| Stamp duty | Rs. 3,09,100 |

| Paid to contractor Addition/ alteration | Rs. 32,50,000 |

| Cost of construction of 3rd floor | Rs. 23,00,000 |

Thus the assessee has utilized the entire amount for construction of new house within the provisions of Section 54F of the Act. The AO was not convinced with the submission made by the assessee and had made the addition of Rs. 55,89,182/-. Feeling aggrieved, the assessee filed an appeal before the CIT (A).

03. The CIT (A) has granted relief to the assessee. Paragraphs 7 and 8 of the order of CIT (A), is reproduced here under :

7. The Hon’ble Delhi High Court decision in the case of CIT v. Gita Diggal in ITA 1237/2011 dated 21/02/2013 has been cited and this reference helps the appellant case.

8. Accordingly, Rs. 32.50 lakh spent towards alteration and Rs. 23,00,000/- towards construction of 3rd floor are allowed as deduction u/s. 54F. Similarly claim of Rs. 2 lakh towards brokerage expense is allowable.

Feeling aggrieved by the above relief granted by the CIT (A), the Revenue is in appeal before us, on the grounds mentioned herein above.

04. The Ld DR has submitted that the CIT (A) has wrongly applied the judgment in the matter of Gita Duggal (supra) of the Hon’ble Delhi High Court and has wrongly held in favor of the assessee.

05. On the other hand, the Ld. AR has submitted that Section 54F is a beneficial provision and is in the statute book for promoting the construction of residential house and therefore this provision is to be applied liberally. For that purpose, the Ld. AR relied upon the following judgments :

- CIT v. Sambandam Udaykumar [345 ITR 389-Kar]

- CIT v. Smt. B. S. Shanthakumari [ITA.165/2014- Kar]

- Commissioner of Customs v. Jayshree Insulators [(1998) 104 E.L.T.748]

- State of Bihar v. S K. Raoy [AIR 1966 SC, date 24.04.1966]

06. We have heard the rival submissions and perused the material on record. Section 54F reads as under :

54F. Capital gain on transfer of certain. capital assets not to be charged in case of investment in residential house.—(1) Where, in the case of an assessee being an individual, the capital gain arises from the transfer of any long-term capital asset, not being a residential house (hereafter in this section referred to as the original asset), and the assessee has, within a period of one year before or after the date on which the transfer took place purchased, or has within a period of three years after that date constructed, a residential house (hereafter in this section referred to as the new asset), the capital gain shall be dealt with in accordance with the following provisions of this section, that is to say,—

(a) if the cost of the new asset is not less than the net consideration in respect of the original asset, the whole of such capital gain shall not be charged under section 45;

(b) if the cost of the new asset is less than the net consideration in respect of the original asset, so much of the capital gain as bears to the whole of the capital gain the same proportion as the cost of the new asset bears to the net consideration, shall not be charged under section 45:

Provided that nothing contained in this sub-section shall apply where the assessee owns on the date of the transfer of the original asset, or purchases, within the period of one year after such date, or constructs, within the period of three years after such date, any residential house, the income from which is chargeable under the head “Income from house property”, other than the new asset.

Explanation.—For the purposes of this section,—

(i) “long-term capital asset” means a capital asset which is not a short- term capital asset;

(ii) “net consideration”, in relation to the transfer of a capital asset, means the full value of the consideration received or accruing as a result of the transfer of the capital asset as reduced by any

expenditure incurred wholly and exclusively in connection with such transfer.

(2) Where the assessee purchases, within the period of one year after the date of the transfer of the original asset, or constructs, within the period of three years after such date, any residential house, the income from which is chargeable under the head “Income from house property”, other than the new asset, the amount of capital gain arising from the transfer of the original asset not changed under section 45 on the basis of the cost of such new asset as provided in clause (a), or, as the case may be, clause (b), of sub-section (1), shall be deemed to be income chargeable under the head “Capital gains” relating to long-term capital assets of the previous year in which such residential house is purchased or constructed.

(3) Where the new asset is transferred within a period of three years from the date of its purchase or, as the case may be, its construction, the amount of capital gain arising from the transfer of the original asset not charged under section 45 on the basis of the cost of such new asset as provided in clause, (a) or, as the case may be, clause (b), of sub-section (I) shall be deemed to be income chargeable under the head “Capital gains” relating to long-term capital assets of the previous year in which such new asset is transferred.’.

07. By relying upon Section 54F, the AO has noted that the assessee is not entitled to the deduction u/s.54F for the alteration / renovation carried out by him to the purchased unit, as also to the construction of the third floor. According to the AO it would amount to construction of new unit in addition to the unit that the assessee has purchased. The AO was of the opinion that the exemption is only available for purchase of units within two years out of the sale proceeds from the date of transfer of the capital asset. If we look into the facts then it is undisputed by both the parties before us that the assessee had spent an amount of Rs. 32,50,000/- towards alteration made to the house and that payment was made to the contractor. Along with this payment, the assessee had also spent an amount of Rs. 43,24,675/- towards the sale consideration, registration charges and stamp duty, totaling to an amount of Rs. 75,75,475/-. In our view, the word ‘constructed’ is used in the later part of Section 54F ______ and the assessee has within a period of one year before ______

If the interpretation as has been given by the AO is accepted, that the word used ‘purchased’ is required to be restricted only to actual purchase and if any addition, alteration or demolition of the property is carried out by the assessee for the purposes of reconstruction after the demolition and for making it convenient for his use, then the cost incurred by the assessee for that purpose would not be eligible for deduction u/s.54F, is against the very purpose of providing this deduction in the statute book. Our reading of the provision makes it abundantly clear that the purchase do not include a purchase which is not a purchase of an asset which is not incapable of being used by the assessee. The assets for the purpose of Section of 54F should be an asset purchased by the assesse and if an assessee incurs a cost for making it useful and convenient after taking approval from the competent authority, as in the present case, then the assessee is entitled to deduction u/s.54F of the Act. In our view, there is no irregularity or illegality in the order passed by the CIT (A). We hold accordingly.

08. In the result, appeal of the Revenue is dismissed.

Order pronounced in the open court on the 22nd day of September, 2017.

What is competent authority for approval here as mentioned in the judgement

Informative and insightful post. Thanks for writing and sharing this post with us.