SEBI Consultation Paper on Review of Total Expense Ratio charged by Asset Management Companies (AMCs) to unitholders of schemes of Mutual Funds to facilitate greater transparency and accrual of benefits of economies of scale to investors

The Securities and Exchange Board of India (SEBI) has released a consultation paper seeking public comments on the review of the total expense ratio (TER) charged by Asset Management Companies (AMCs) to unitholders of mutual fund schemes. The objective is to enhance transparency and ensure that investors benefit from economies of scale. The paper highlights the growth of the mutual fund industry and the need to align regulatory provisions with market dynamics. It proposes several changes, including bringing brokerage and transaction costs within the TER limit, eliminating double charging of investors, and introducing limited purpose membership for AMCs to execute trades for their own schemes. The aim is to improve accountability, transparency, and investor protection in the mutual fund industry.

Securities and Exchange Board of India

Consultation Paper on Review of Total Expense Ratio charged by Asset Management Companies (AMCs) to unitholders of schemes of Mutual Funds to facilitate greater transparency and accrual of benefits of economies of scale to investors

May 18, 2023 | Reports : Reports for Public Comments

1. Objective:

1.1. To solicit public comments / views on the changes proposed regarding fees and expenses charged by AMCs to unitholders of mutual fund schemes, under Regulation 52 of SEBI (Mutual Funds) Regulations, 1996 (“MF Regulations”) to facilitate greater transparency and accrual of benefits of economies of scale to investors.

2. Background and need for review:

2.1. In 2012, SEBI had reviewed the provisions relating to fees and expenses charged by Mutual Funds. Pursuant to the review, the following regulatory changes were inter-alia implemented (the industry Asset Under Management (“AUM”) was approx. INR 6 lakh crore)–

2.1.1. Introduction of direct plan;

2.1.2. Fungibility in Total Expense Ratio (TER) within existing slabs;

2.1.3. Four additional expenses (over and above the TER limits); and

2.1.4. Setting aside 2 basis points on daily net assets by AMCs for investor education and awareness initiatives.

2.2. Thereafter, another review was carried out in FY 2018-19, wherein, some additional policy measures were introduced (the industry AUM was approx. INR 21 lakh crore), which included –

2.2.1. Review of TER slabs,

2.2.2. Additional expenses for net inflows from B-30 cities (beyond top 30 cities) (instead of B-15 cities)

2.2.3. Additional expense to the extent of 5 bps (instead of 20 bps) in schemes having provision of exit load; and

2.2.4. Full trail commission model.

2.3. The AUM of the industry has increased almost twofold since the last review in the FY 2018-19 to approx. INR 39 lakh crore on March 31, 2023.

2.4. As an ongoing exercise to increase transparency and to continuously align regulatory provisions to reflect the market dynamics and their impact on investors’ interest, SEBI had once again initiated a study of existing regulatory provisions relating to fees and expenses in mutual fund scheme vis-à-vis market practices.

2.5. Based on the detailed study and findings from onsite and offsite inspections of Mutual Funds, a need has been felt for further streamlining of provisions relating to TER and therefore the matter was placed before the Mutual Fund Advisory Committee (“MFAC”) in January 2023. Considering the deliberations in MFAC members (comprising of AMCs, Stock Exchanges, Association of Mutual Funds in India (AMFI), Independent Trustees of Mutual Funds, market experts, Registrar and Share Transfer Agents (RTAs) and other stakeholders) and internal analysis, comments are being sought under the succeeding paragraphs.

3. Existing Regulatory Framework (Scheme Based):

3.1. Presently, a slab based TER is applicable for various categories of schemes viz, Equity Schemes, Debt Schemes, Hybrid Schemes and Solution Oriented Schemes. The existing slab-wise TER limits for open ended equity oriented and other than equity-oriented schemes are as provided below:

| Base TER | ||

| AUM Slab (In INR Crore) | TER limits for Equity

Oriented Schemes |

TER limits for other than equity-oriented

schemes |

| 1st INR 500 Crores of the daily net assets | 2.25% | 2.00% |

| Base TER | ||

| AUM Slab (In INR Crore) | TER limits for Equity

Oriented Schemes |

TER limits for other than equity-oriented

schemes |

| Next INR 250 crores of the daily net assets | 2.00% | 1.75% |

| Next INR 1,250 crores of the daily net assets | 1.75% | 1.50% |

| Next INR 3,000 crores of the daily net assets | 1.60% | 1.35% |

| Next INR 5,000 crores of the daily net assets | 1.50% | 1.25% |

| On the next INR 40,000 crores of the daily net assets | Total Expense ratio reduction of 0.05% for every increase of INR 5,000 crores of daily net assets or part thereof. | |

| On the balance of the assets | 1.05% | 0.80% |

3.2. The TER limits for the schemes other than above are as detailed below:

| Sr. No | Particulars | Max. TER |

| 1 | Index Fund/schemes and Exchange Traded Funds | 1.00% |

| 2 | Fund of Fund | |

| Investment in Liquid fund, Index Fund or ETFs | 1.00% | |

| Equity Oriented Schemes | 2.25% | |

| Other than equity oriented schemes | 2.00% | |

| 3 | Close ended and Interval Schemes | |

| Equity Oriented Scheme(s) | 1.25% | |

| Other than equity oriented scheme(s) | 1.00% | |

3.3. Mutual Fund schemes are currently permitted to charge following four additional expenses which are over and above the expense limits specified above:

i. Brokerage and transaction costs which are incurred for the purpose of execution of trade up to 0.12 per cent of trade value in case of cash market transactions and 0.05 per cent of trade value in case of derivatives transactions.

ii. Expenses not exceeding of 0.30 per cent of daily net assets, subject to new inflows from B-30 cities.

iii. Additional expenses not exceeding 0.05 per cent of daily net assets for the schemes having provision of exit load.

iv. Goods and Services Tax on investment and advisory fees charged by Mutual Funds /AMCs to the scheme.

3.4. Apart from the above, AMCs are permitted to deduct transaction charges of INR 100/- for existing investors in a mutual fund and INR 150/- for first time investor in mutual fund per subscription of INR 10,000/- and above from the subscription amount of the investor. The amount deduced as transaction charges is paid to the distributor.

3.5. Further, investors can directly pay upfront commission to distributors based on his assessment of various factors including the service rendered by the distributor.

4. Study analysis

As a part of the detailed study of the prevalent practices in the industry relating to the business as well as fees and expenses being charged, relevant data was collected from all the Mutual Funds. A summary of data analysis carried out is as under:

Growth of the Mutual Fund industry

4.1. During the period from March 31, 2012 to March 31, 2023, while there was a three-fold increase in movement of Nifty 50 (from 5,296 to 17,359), the Mutual Fund Industry witnessed an over six-fold increase in its AUM from approx. INR 6 lakh crores to approx. INR 39 lakh Crores.

4.2. The number of unique investors as on March 31, 2023 (3.77 Crores) was 2.94 times the number of unique investors as on March 31, 2017 (1.28 Crores). Similarly, number of total folios as on March 31, 2023 (14.57 Crores) was 2.63 times the number of folios as on March 31, 2017 (5.53 Crores).

4.3. The above data reflects that apart from the market movement, the increase in AUM of Mutual Fund industry may be attributed to increase in new investments/inflows during the last five years. The TER is based on the total AUM including both these components.

Investment Patterns

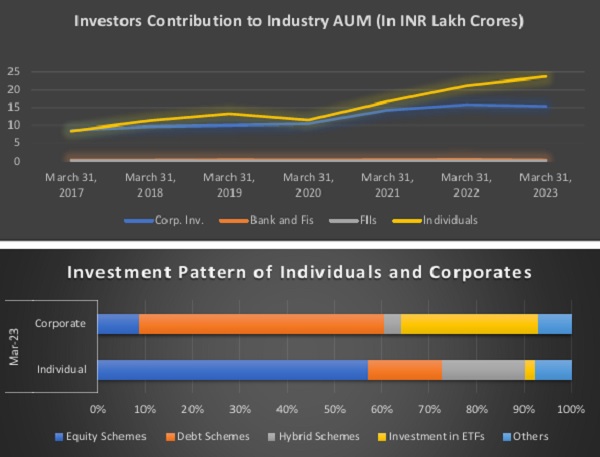

4.4. A break-up of investors’ contribution to the industry AUM during the FY 20172023 and investment preferences of individuals and corporate investors, who are the major investors in Mutual Fund industry, as on March 31, 2023, was as under:

4.5. As can be seen from the above, the investments by individual investors has grown by 180% (from INR 8.43 lakh crore to INR 23.67 lakh crore) and that of corporates has grown by 77% (from INR 8.68 lakh crore to INR 15.40 lakh crore) between March 31, 2017 to March 31, 2023.

4.6. The study further shows that the share of retail individual investors has increased from 19.06% of the total AUM as on March 31, 2017 to 25.55% of the total AUM as on March 31, 2023. Similarly, the share of HNI individual investors has increased from 28.93% of the AUM as on March 31, 2017 to 34.51% of the AUM as on March 31, 2023. Thus, share of individual investors was 60.06% as on March 31, 2023 and the remaining investment is of corporate investors, banks and financial Institutions, FIIs etc.,

4.7. Corporates have majority of their investment i.e. 51.75% of investments in Debt Schemes and 28.94% of their investment in Exchange Traded Funds (ETFs). Remaining 19.30% of their investment is seen to be in Hybrid schemes, Solution oriented schemes, Index fund, Fund of Funds etc.

4.8. Individual investors have invested more than 57.18% of their investment in equity schemes and 17.49% in Hybrid Schemes. Remaining 25.33% of their investment is in Debt schemes, ETFs and other schemes like Index fund, Solution oriented schemes, Fund of Funds etc.

4.9. The weighted average TER charged by the regular plan of different types of open ended schemes and ETFs during FY 2021-22 is as given below:

|

Sr. No. |

Scheme Type | Weighted Average TER excluding additional expenses (Base TER) of Regular Plan | Weighted Average TER including additional expenses (Total TER) of Regular Plan |

| 1 | Debt Schemes | 0.71% | 0.77% |

| 2 | Equity Schemes | 1.61% | 2.00% |

| 3 | Hybrid Schemes | 1.45% | 1.88% |

| 4 | ETFs | 0.08% | 0.11% |

4.10. Following are the observations from the above data:

i. Despite presence of various Mutual Funds with significantly large AUMs in schemes which are oriented towards retail investors i.e. Equity and Hybrid schemes, the TER charged is mostly close to the prescribed regulatory limits. However, in case of Debt schemes, with investors being mostly corporates/ institutional investors having bargaining power, the TER is much lower than the prescribed limit. Therefore, the benefit of economies of scale accruing in the debt schemes appears to be passed on to the investors but not so in the Equity and Hybrid schemes.

ii. The weighted average TERs for Debt schemes and ETFs (schemes with majorly corporates as investors) are much lower in comparison to the regulatory limits as well as weighted average TERs of Equity and Hybrid schemes (schemes with mostly individuals as investors).

4.11. As mentioned at para 3.1, 3.2 and 3.3, the regulatory limits of TER are specified for Mutual Fund schemes. Further, additional expenses such as brokerage and transaction cost, incentive for B30 investments etc. over and above the TER limits, are also permitted to be charged to unitholders. In this regard, a comparative analysis was carried out on the weighted average base TER and actual total TER that is charged to unitholders of open ended Equity schemes during FY 2021-22. The analysis is provided below –

Weighted Average TER of Open Ended Equity Schemes of different AUM slabs

DIRECT PLAN |

REGULAR PLAN |

|||||

A |

B |

C |

D |

E |

F |

G |

AUM of the Scheme |

No of |

Range of base |

Weighted |

Weighted |

Weighted |

Weighted |

Schemes |

TER rate, as |

average |

average TER |

average |

average TER |

|

per Regulatory |

Base TER |

(including all |

Base TER |

(including all |

||

Requirement |

paid by the |

additional |

paid by the |

additional |

||

(excluding |

investors |

expenses) |

investors |

expenses) |

||

additional |

of Direct |

paid by the |

of Regular |

paid by the |

||

expense), |

plan during |

investors of |

plan during |

investors of |

||

based on the |

FY 2021-22 |

Direct Plan |

FY 2021- |

Regular plan |

||

AUM of the |

during FY |

22** |

during FY |

|||

scheme |

2021-22* |

2021-22*** |

||||

500 Crores |

110 |

2.25 |

1.23% |

1.82% |

2.12% |

2.78% |

501 Crores to 750 Crores |

42 |

2.25 – 2.17 |

1.06% |

1.45% |

2.07% |

2.54% |

751 Crores to 2000 Crores |

85 |

2.17- 1.91 |

0.87% |

1.24% |

1.87% |

2.35% |

2001 Crores to 5000 Crores |

61 |

1.91 – 1.72 |

0.71% |

1.06% |

1.72% |

2.18% |

5001 Crores to 10000 Crores |

42 |

1.72- 1.61 |

0.68% |

0.98% |

1.58% |

1.94% |

10001 Crores to 15000 Crores |

14 |

1.61-1.56 |

0.66% |

0.91% |

1.54% |

1.93% |

15000 Crores to 20000 Crores |

5 |

1.56-1.52 |

0.74% |

0.99% |

1.56% |

1.93% |

> 20000 Crores |

14 |

<1.52 |

0.68% |

0.92% |

1.46% |

1.79% |

*Includes TER of column D plus expenses towards brokerage and transaction cost, 5 bps for schemes having provision of exit load and GST on Management Fees.

**Difference between base expense of Direct plan (Column D) and regular plan (Column F) is due to distribution commission charged to regular plans.

***Includes TER of column F plus expenses towards B-30, brokerage and transaction cost, 5 bps for schemes having provision of exit load and GST on Management Fees.

4.12. Considering that there is no upper cap on additional expenses, the actual expense to investor is considerably higher than the prescribed base TER limits for Regular Plan (as seen in column G above). It can be seen from the above data that the cost of investment (including all additional expenses) for direct plan is well below the regulatory limits.

Financial Data

4.13. As the books of accounts are prepared at entity level i.e. AMC level and not activity level, the data with respect to revenue and profit before tax pertaining to Mutual Fund operations were submitted to SEBI by AMCs, based on certain assumptions. In view of the same and for the sake of uniformity, data regarding revenue and profits at AMC level has been considered for the study and analysis.

4.14. Further, for the purpose of analysis, 42 Mutual Funds were categorized based on their AUMs as on March 31, 2022, as under:

i. Large MFs/AMCs– Mutual Funds having more than 5% share of industry AUM

ii. Medium MFs/AMCs– Mutual Funds with 1% to 5% share of industry AUM

iii. Small MFs/AMCs– Mutual Funds which had upto 1% share of industry AUM

4.15. As per the data, the percentage share of industry AUM as on March 31, 2022 is as under:

| Sr. No. | AMC Size | No. of Mutual Funds | % of total industry AUM |

| 1 | Large AMCs | 8 | 74.53% |

| 2 | Medium AMCs | 10 | 20.76% |

| 3 | Small AMCs | 24 | 4.71% |

4.16. The available data shows that while consolidated revenue of the industry has increased by 55.27% from INR 11,397 crores to approx. INR 17,697 crores in a span of 5 years, the figures for profits before tax (PBT) at industry level increased by 154% during the said period. The increase in AMC’s financials can be attributed to the economies of scale which the AMCs have achieved with tremendous increase in AUM during the above period.

4.17. The AMC level (including Portfolio Management Services and other activities) consolidated data for PBT and PBT margin of Large, Medium and Small AMCs for the period from FY 2016-17 to FY 2021-22 is as under:

| Year | Large | Medium | Small | |||

| Net PBT of the AMC (INR

Crore) |

PBT Margin of AMCs (PBT/ Total Revenue) | Net PBT of the AMC (INR Crore) | PBT Margin of AMCs (PBT/ Total Revenue) | Net PBT of the AMC (INR Crore) | PBT

Margin of AMCs (PBT/ Total Revenue) |

|

| 2016-17 | 3,296 | 43.40% | 835 | 31.45% | 171 | 14.95% |

| 2017-18 | 4,370 | 43.59% | 1,290 | 36.99% | 295 | 17.57% |

| 2018-19 | 5,332 | 49.54% | 1,285 | 36.59% | 331 | 20.63% |

| 2019-20 | 6,038 | 61.87% | 1,114 | 38.15% | 92 | 6.55% |

| 2020-21 | 7,282 | 71.01% | 1,226 | 42.90% | 567 | 33.01% |

| 2021-22 | 8,598 | 70.13% | 1,751 | 50.23% | 592 | 30.33% |

4.18. The following is further observed from the data on revenue, PBT and PBT margins of AMCs:

i. There is an increase of 173% and 93.25% in the profits made by Large AMCs and Medium AMCs respectively, during the period between FY 2016-17 and FY 2021-22.

ii. While 3 Medium AMCs turned from loss to profit making entities during the period from FY 2016-17 to FY 2021-22, all Large and Medium AMCs were in profit in FY 2021-22.

iii. At an aggregate level, the data indicates that the PBT for Small AMCs also grew except in FY 2019-20. However, 12 of the 24 small AMCs had incurred losses during FY 2019-20 and FY 2020-21. The number of loss making Small AMCs has since reduced to 10 in FY 2021-22. 5 of the said 10 AMCs are in existence for more than 5 years now and still have not reached break even.

iv. Further, although Small AMCs at AMC level collectively have made profits an analysis of data pertaining to their Mutual Fund operations alone shows that Small AMCs are making losses. Also, the data of losses from mutual fund operations does not show a definite pattern. It is seen that while the collective losses incurred by Small AMCs from their Mutual Fund operations increased from INR 21 Crores in FY 2016-17 to INR 167 Crores in FY 2019-20, there was a reduction in their collective losses to INR 6 crores in FY 2021-22.

4.19. In view of the foregoing paragraphs the framework of TER has been reviewed and certain proposals have been made keeping in view the following guiding principles:

i. Transparency in Total Expenses charges to investors

ii. Accrual of benefit of Economies of Scale to investors

iii. Encourage new participants/AMCs

iv. Facilitate financial inclusion

v. Removing dual charges, if any, to investors

vi. Addressing the likelihood of proliferation of schemes due to scheme level TER

vii. Addressing the issue of splitting of applications, churning of investors portfolio etc., for higher distribution commission

5. Issues for Public Consultation

5.1. TER limit inclusive of all expenses and charges

i. As mentioned at para 3.3 above, Mutual Funds are currently permitted to charge four additional type of expenses over and above the specified TER limits. The said additional expenses had been allowed to, inter-alia, address concerns relating to facilitating reach of Mutual Funds, concentration of Institutional investors in MFs and to facilitate growth in the MF industry.

ii. As mentioned at paras 4.1– 6, the Mutual Fund Industry has grown significantly over the last few years with considerable increase in participation of retail investors. Hence, the concerns existing at the time of introduction of additional expenses over and above the TER, may not hold true today and hence, needs a relook.

iii. The Total Expense Ratio, as the term suggests, should, in the interest of transparency, be inclusive of the total expenses charged to investors at any point of time. However, as presently certain additional expenses are permitted to be charged over and above the TER; thus there is ambiguity and lack of transparency in the manner in which unitholders are charged by different Mutual Funds. Thus, it is desirable that TER reflects the maximum expense ratio that an investor may have to pay and hence it should be inclusive of all the expenses permitted to be charged to an investor and the investor should not be charged any amount over and above the prescribed TER limits. Keeping the said principle in view, proposals have been made in succeeding paras with respect to the four additional expenses presently permitted over and above TER.

5.1.1. Brokerage and Transaction costs

5.1.1.1. Brokerage and transaction costs are part of the recurring expenses that can be charged to a scheme. The additional expense limit is specified as upto 0.12 percent of trade value in case of cash market transactions and 0.05 per cent of trade value in case of derivative transactions. Any payment towards brokerage and transaction cost, over and above the above mentioned transaction limits, are permitted to be charged to the schemes as recurring expenses, within the maximum limit of TER as prescribed.

5.1.1.2. Following is the data regarding spending of AMCs towards brokerage and transaction costs, in FY 2021-22:

|

Sr. No. |

Particulars | No. of Mutual Funds | Range of Spending Towards Brokerage and Transaction Cost (Amt. in Crores) | Total Spending towards Brokerage and Transaction Cost (Amt. in Crores) |

| 1 | Large AMCs | 8 | 60 – 524 crores | 2121 |

| 2 | Medium AMCs | 10 | 76- 146 crores | 1066 |

| 3 | Small AMCs | 24 | 0.03 – 35 crores* | 279 |

*One AMC having only Infra debt fund schemes has reported NIL expense towards brokerage and transaction cost in FY 2021-22. Therefore, second least cost is taken.

5.1.1.3. As the prescribed limits for cash and derivative transactions are chargeable for every transaction carried out by a scheme, the brokerage and transaction costs charged to the investors depend on the actual number and value of transactions undertaken by any scheme with no upper cap being applicable on total expenses towards such costs. As a result, there is no accountability of AMCs with respect to the total spending towards brokerage and transactions for any scheme.

5.1.1.4. From the data shared by AMCs, it is observed that spending of some schemes towards brokerage and transaction cost is more than even the maximum TER limits prescribed. This has resulted in investors paying more than double the permissible TER limits prescribed for the scheme towards expenses.

5.1.1.5. In this regard, it has been represented by industry that bringing brokerage and related costs within TER limits may discourage fund managers from churning of portfolios, which otherwise may be in the interest of unitholders. Further, the AMCs may have to take a reduction on profits owing to reduction in percentage of management fees.

5.1.1.6. In respect of concerns regarding AMCs having to bear the brunt in the form of reduced revenues, the study analysis at para 4.9 shows that weighted average TER of debt funds, ETFs and index funds is much below the regulatory limits and hence, impact of keeping brokerage and transaction cost within the TER limit may be negligible. However, as most of equity schemes and hybrid schemes currently charge expenses at maximum permissible TER, such schemes may have an impact.

5.1.1.7. While on the face of it, there may be some merit in industry’s arguments, it is felt that there is a greater need for accountability in the practices being followed for charging expenses from unitholders. It has been observed that AMCs have executed trades through brokers who were not part of the top brokers (in terms of percentage share of gross turnover of the stock exchange) and offered services at high brokerage costs compared to other empanelled brokers. If such high transaction cost is for the research reports, then the arrangement cannot be considered as soft dollar arrangement and investors end up paying twice for the research i.e., one which is charged as part of investment management and advisory fees and another which is covered under brokerage and transaction cost.

5.1.1.8. Further, as the transaction wise brokerage and related costs presently reside outside of TER, such practices of paying higher brokerage and transaction cost may not be coming under the radar or attention of Boards of AMCs. It is felt that if transaction costs were to be made part of TER limits, the Boards of AMCs will be bound to seek justification on practices and anomalies in this respect.

5.1.1.9. In view of the above and the underlying principle that TER should be inclusive of all costs charged to an investor, it is proposed that brokerage and transaction expenses may be included within the TER limit and the transaction wise limits prescribed for additional expenses towards brokerage may not be applicable. This may bring in much needed transparency in the costs charged to unitholders, and greater accountability in respect of the significant brokerage costs, with oversight from the AMC Board/Trustees.

5.1.1.10. It has also been discussed by industry in the past that the component of Securities Transaction Tax (STT) on cash as well as derivative transactions in transaction cost, should not be part of 12 bps or 5 bps limits presently applicable. However, Regulation 52 of MF Regulations, inter-alia, envisages all costs related to a transaction including STT to be within prescribed limits of additional charge. Thus, under the proposed framework, all expenses and costs of investment including STT, shall be within the TER limits, as may be prescribed and the cost of investment shall be expensed out (instead of being capitalised).

5.1.2. Limited purpose membership for AMCs

5.1.2.1. As per extant provisions of MF Regulations, AMCs can become a proprietary trading member for carrying out trades in the debt segment of the recognised stock exchange, on behalf of its mutual fund schemes and are also permitted to become a self-clearing member of the recognised clearing corporations to clear and settle trades in the debt segment on behalf of its mutual fund schemes. Considering the same and to enable AMCs to undertake their own transactions in the equity segment of stock exchanges, it is proposed to allow AMCs to obtain limited purpose membership with stock exchanges for executing trades for own mutual fund schemes. This would address the issue described in para 5.1.1.5.

5.1.2.2. In this regard, it is represented by AMCs that availing research services of professional stock brokers aids in better decision making by fund managers and the risk management systems at brokers’ ends helps in eliminating errors.

5.1.2.3. Considering AMCs charge management and advisory fees for managing scheme assets, which should ideally include cost of research for selection of assets/securities for any scheme, it is hard to understand as to why significant expenses towards brokerage and transaction costs need to be separately incurred by fund houses and charged to investors in the name of research. Thus, charging brokerage and transaction costs which includes cost of research not only amounts to double charging the unitholders but also induce certain undesirable practices, impacting interest of unitholders.

5.1.2.4. Therefore, brokerage and transaction cost may be within the TER limits and an option for obtaining limited purpose membership may be provided to AMCs. However, the choice of obtaining limited purpose membership should rest with AMCs and desirous AMCs may voluntarily undertake trading activities, which will enable them to reduce expenses towards brokerage and transaction cost. Further, exercising this choice of obtaining limited purpose membership shall help in preventing instances of misuse of information and market abuse including front running.

5.1.2.5. Consultation no 1:

a. Whether proposals at paras 5.1.1.9 and 5.1.2.4 are appropriate?

b. Whether limited purpose membership for AMCs to execute transactions on stock exchange platform, be kept voluntary or mandatory?

5.1.3. Additional TER charged to the investors for distribution commission for inflows from B-30 cities

5.1.3.1. Mutual Funds are permitted to charge expenses not exceeding of 0.30 per cent of daily net assets, if the new inflows from individual retail investors from beyond top 30 cities (B -30 cities) are atleast:

(i) 30 per cent of gross new inflows in the scheme or;

(ii) 15 percent of the average assets under management (year to date) of the scheme, whichever is higher.

If inflows from such cities is less than the higher of the above two conditions, the additional expenses on daily net assets of the scheme can be charged on proportionate basis.

5.1.3.2. The additional expenses charged under this provision is to be utilised for distribution expenses incurred for bringing inflows from B-30 cities. Thus, for inflows from retail individual investors from B-30 cities, additional expense is charged to unitholders of regular plans of a scheme, which is thereafter utilised by AMCs for payment of distribution commission.

5.1.3.3. Based on the study referred to earlier and findings of inspections of Mutual Funds, observations regarding B-30 expenses charged to the investors are as under:

i. The additional expenses are not charged by AMCs to all schemes uniformly as B-30 charges are often not included in schemes where the AMCs intend to keep low expense ratio. Thus, this incentive is often used as a mechanism to promote one scheme over an another by showing lower expenses, instead of consistently encouraging financial inclusion.

ii. Applications with investment amount higher than INR 2 lakhs (threshold for classification as retail investment) are often split to make each application for investment of less than INR 2 lakh, so that B-30 expenses can be charged.

iii. Investments of B-30 investors are often churned by way of withdrawal and re-investment after a year (one year is the minimum holding period requirement) which results in charging of additional expenses to schemes for the same investment.

iv. The methodology of computing additional expenses for inflows from B-30 cities is not uniform across Mutual Funds. While some fund houses calculate additional expense based on AUM of the entire scheme and charge the expense to investors of regular plans, there are others who calculate additional expense based on AUM of only regular plan and charge to investors of regular plan.

v. The expenses charged are usually based on projections of weekly or fortnightly inflows and not on actuals which may be different from the projections.

5.1.3.4. Considering the above, the following is proposed.

i. The additional commission to distributors may continue for inflows from B30 cities.

ii. The distributors may be paid only for investment/inflows from new individual investors (new PAN) from B-30 cities at the industry level.

iii. Such additional commission may be fixed at 1% of the size of the 1st application or amount committed through SIP of the individual investor at an industry level, subject to a maximum of INR 2000/-.

iv. Presently, 1 basis point of daily net assets within the maximum limit of TER is set aside by the AMCs for investor education and awareness initiatives. The cost of distribution commission for inflows from B-30 cities, which results in financial inclusion, may be paid from investor education and awareness expense charged to the scheme. Alternatively, such commission can be permitted under Regulation 52 (4) of the MF Regulations which includes distribution commission that can be charged to the scheme.

v. Any such additional commission paid to distributor should be credited back to the scheme or investor education and awareness fund (as the case may be), if inflows are redeemed within a period of one year from the date of investment.

vi Actual cost towards B-30 distribution commission should be charged to the scheme and no expenses may be charged based on the projected new inflows from B-30 cities.

vii. The benefit of such additional commission, if opted for by AMCs, should be made applicable for all schemes or none. However, exemption may be granted for schemes with duration requirement of less than 1 year (i.e. Overnight Fund, Liquid Fund, Ultra Short Duration Fund and Low Duration Fund) as the schemes are meant for investment for shorter duration and the above proposed policy requires claw back of commission if inflows are redeemed within a period of one year from the date of investment.

5.1.3.5. In addition to the above, it is desirable that AMCs design their distribution commission structure/policy with an intent to encourage/promote financial inclusion and reward inflows from B-30 cities. In this regard, AMCs can consider to pay a higher percentage of commission for inflows from B-30 cities as compared to commission for inflows from T-30 cities.

5.1.3.6. Consultation no 2:

a. Whether the changes proposed at para 5.1.3.4 are appropriate?

b. Whether the payment towards additional distributor commission be made from 1 bps charged to the scheme for investor education and awareness or should it be part of the distribution commission charged to the scheme?

c. Should AMCs be mandated to have a policy to pay higher distribution commission for inflows from B-30 cities to promote financial inclusion?

5.1.4. Additional expenses not exceeding 0.05 per cent of daily net assets due to credit of any exit load to the scheme

5.1.4.1. In terms of SEBI circular dated June 30, 2009 regarding exit load charged to the investors, a maximum of 1% of the redemption proceeds was permitted to be maintained in a separate account for payment of distribution commission to the distributors, other marketing /selling expenses and balance amount was required to be credited back to the scheme.

5.1.4.2. Pursuant to amendments to MF Regulations and circular issued thereunder in 2012, it was mandated that exit load charged to investors exiting from a scheme should be credited back to the scheme. The intent behind the said amendment was that early redemptions by investors from the scheme has impact on the non-exiting investors and thus they should be compensated by crediting exit load to the scheme. In that context, AMCs were allowed to charge additional 20 bps as additional expense to the scheme. The said additional charge, which was reduced from 20 bps to 5 bps in 2018, was allowed for schemes where SIDs have a provision of charging of exit load.

5.1.4.3. Thus, AMCs can presently charge additional 5 bps to the scheme even if there is no claw back/exit load credited to the scheme. The available data of additional expenses charged to schemes and the actual exit loads recovered from the investors was analysed and it is seen that in FY 2021-22, while the total amount of additional expenses charged to the schemes was INR 735 crores, the exit load recovered from exiting investors and credited to the schemes was around INR 611 crores.

5.1.4.4. In view of the above and considering that for more than 10 years AMCs have been permitted to charge additional expenses, it is proposed that the provision enabling charging of additional expense of 5 bps for schemes having provision of exit load, may be discontinued.

5.1.4.5. Consultation no 3:

a. Whether the proposal for discontinuing additional charge of 5 bps charged by AMCs for schemes having provision of exit load is appropriate?

b. Any other comment on the proposal?

5.1.5. Goods and Service Tax (GST) on Investment and Advisory Fees

5.1.5.1. Presently, GST on all services except for GST on Investment and Advisory Fees is charged to the investors and is part of the total TER limits specified by SEBI. GST on Investment and Advisory Fees is permitted to be charged over and above the specified TER limits.

5.1.5.2. While it is agreed that GST is a statutory indirect tax which is not under the control of the AMCs, considering the overall intent of increasing transparency in expenses charged to unitholders by making TER inclusive of all charges, it is proposed that TER may be inclusive of GST on investment and advisory fees also.

5.1.5.3. However, it is noted that this would have a significant impact on the utilization of the TER, and thus a suitable adjustment in the maximum TER needs to be made.

5.1.5.4. Consultation no 4:

a. Whether the proposal at para 5.1.5.2 is appropriate?

b. Any other comment on treatment of GST on investment and advisory fees?

5.2. Review of slab wise TER structure

5.2.1. The slab wise TER structure in the MF Regulations has been specified to enable passing of some of the benefit of economies of scale achieved by AMCs, to investors. While the TER slabs are presently based on the AUM of the schemes, the AMCs enjoy economies of scale which is linked to their asset class levels and not schemes. The manpower for research and other core activities of AMCs may be different for equity and debt products but every new scheme does not necessarily attract additional spending towards the core activities by AMCs. Thus, while the size of the asset grows, the cost for investment may not go up in the same proportion and the same results in economies of scale as the AUM grows significantly.

5.2.2. The data presented at para 4.16 also shows that while consolidated revenue of AMCs increased by 55.27% from INR 11,397 crores to approx. INR 17,697 crores in a span of 5 years (FY 2016-17 to 2021-22), the profits before tax (PBT) of AMCs increased by 154%, from 4,302 crores to 10,940 crores, during the said period. Further, it can be seen from the data given at paras 4.17 and 4.18 above that increase in the profits of large AMCs was of 173% during the same period FY 2016-17 to FY 2021-22 whereas the increase in the profit of medium AMCs was 93.25% during the same period.

5.2.3. At the same time, there is a need for AMCs of all sizes to have an opportunity to grow. Also, an arbitrage opportunity exists between different schemes of same AMC due to scheme level slabs as new scheme of AMC (NFO) with small sized AUMs can charge higher TER compared to the existing large schemes of AMC with bigger AUMs. As AMCs can give higher commission to distributors for NFO schemes (new schemes), this often results in switch transactions from existing large AUM schemes where average TER a scheme can be charged is less as compared to NFO scheme where higher TER can be charged (discussed in detail at para 5.4.3). Consequently, AMCs can end up charging higher TER without substantial increase in AUM or number of investors.

5.2.4. Further, considering the skill set required for analysing and taking decision of investments for equity & equity related products is different from the skill sets required for other than equity related products, manpower for research and other core activities of AMCs may also be different for equity products and debt products. Hence, the cost required would be different.

5.2.5. Considering the above, the following is proposed –

i. The TER slabs should be at the level of the AMC and not at the scheme level.

ii. AUM of open-ended schemes, wherein slab based TER is presently applicable, may be bucketed into Equity based AUM (equity & equity related instruments) and other than equity based AUM of the AMC (other than equity & equity related instruments).

iii. Since Overnight funds of AMCs invest in securities with maturity of 1 day, which includes overnight repos, TREPS etc., the AUM of such schemes may not be considered in any of the above referred buckets for the purpose of calculation of TER. However, TER rate derived based on all investments other than equity & equity related product shall be the maximum TER for Overnight funds also.

5.2.6. Consultation no 5:

a) Whether the proposal to replace scheme based slab structure with AMC level AUM based slabs is appropriate?

b) Whether the proposal to segregate slabs based on underlying investment by equity and other than equity products is appropriate?

c) Any other comment on the proposals made at para 5.2.5?

5.3. Revised TER limits

5.3.1. As mentioned at paras above, limits on TER are proposed to be kept at AMC level and inclusive of all costs and expenses including GST on management fees, brokerage and transaction costs, B-30 incentive etc. Considering that 20% of the AMCs are presently managing around 75% of the industry AUM and many of the small AMCs continue to be loss making entities, the revised TER slabs are proposed ensuring small AMCs are not at a disadvantage, and to encourage competition amongst AMCs of all sizes, which will be in the interest of investors.

5.3.2. Further, as discussed at above paras, the economies of scale of the MF industry are linked to their asset class levels and not scheme levels. In view of the same, separate slabs have been proposed for equity & equity related instruments and instruments other than equity & equity related instruments.

5.3.3. The revised slabs are proposed with higher TER limits so as to cover all costs and expenses including GST on management fees. Accordingly, AMC level slabs for equity based AUM of schemes (investment in equity & equity related instruments) are proposed as specified below:

|

Sr. No |

AMC level AUM (in INR) | Equity & Equity Oriented Instruments (Maximum TER for Regular Plan) | Weighted Average TER chargeable at the upper limit of the AMC level AUM (Maximum TER for Regular Plan)* |

| 1 | Upto INR 2,500 Crores | 2.55% | 2.55% |

| 2 | On the next INR 2,500 Crores | 2.45% | 2.50% |

| 3 | On the next INR 5,000 Crores | 2.30% | 2.40% |

| 3 | On the next INR 40,000 crores of the daily net assets (Upto INR 50,000 Crores) | Reduction of 0.05% for every increase of INR 5,000 Crores of daily net assets or part thereof of the AUM of equity & equity related instruments. | 2.14% |

| 4 | On the next INR 50,000 crores of the daily net assets (Upto INR 1,00,000 Crores) | Reduction of 0.10% for every increase of INR 10,000 Crores of daily net assets or part thereof of the AUM of equity & equity related instruments. | 1.87% |

| 5 | On balance of the assets | 1.30 | Depends on the AUM |

* Rates given are for Regular Plan. TER of Direct Plan will be TER charged to Regular Plan minus distribution commission.

5.3.4. Further, TER slabs for AUM of other than equity based AUM (investment in other than equity & equity related instruments), but excluding the AUM of overnight schemes, are proposed as under:

| Sr. No. |

AMC level AUM (in INR) | Max. TER for Other than Equity & Equity related Instruments |

Weighted Average TER chargeable at the upper limit of the AMC level AUM* |

| 1 | Upto INR 5,000 Crores | 1.20% | 1.20% |

| 2 | On the next INR 25,000 Crores | 1.10% | 1.12% |

| 3 | On the next INR 30,000 Crores | 1.00% | 1.06% |

| 4 | On balance of the assets | 0.9% | Depends on the AUM |

* Rates given are for Regular Plan. TER of Direct Plan will be TER charged to Regular Plan minus distribution commission.

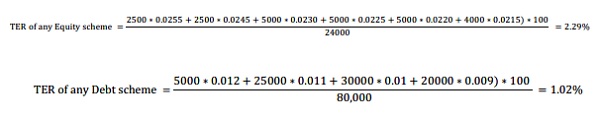

5.3.5. In view of the slabs proposed above, the TER slab for active mutual fund schemes will be based on the investments of schemes in equity & equity related instruments and other than equity & equity related instruments. For example, if the value of investments in equity & equity related instruments of active schemes is INR 24,000 crores and value of investment of other than equity & equity related instruments of active schemes excluding AUM of Overnight Fund is INR 80,000 crores, then TER of any plan of equity schemes cannot be more than 2.29% and TER of all plans of debt schemes cannot be more than 1.02% in view of the below given formula:

5.3.6. For Hybrid and Solution oriented schemes, TER of equity & equity related instruments as derived based on the above given methodology is to be applied for equity portion of AUM of schemes and on the remaining AUM of the scheme, the TER for other than equity & equity related instruments may be applied. Thus, TER of the Hybrid and Solution Oriented schemes shall be the weighted average of TER of equity & equity related instruments and TER of other than equity & equity related instruments.

5.3.7. Based on an impact analysis of the above proposed slabs, it is seen that there would be a benefit of reduced expenses for investors of equity, hybrid and solution oriented schemes. Further, as per the analysis it is seen that the impact of the revised slabs for debt schemes, even after adding all cost of AMCs towards additional expenses, would be minimal. As per the proposed slabs at para 5.3.3, the maximum TER for equity schemes shall not be above 2.55%. Therefore, schemes charging TER of more than 2.55%, as seen from the data at para 4.11 above will have to reduce the total effective TER. For instance, a scheme charging the weighted average TER of 2.78% will need to reduce its TER to 2.55%, an effective reduction of 8% of the extant TER.

5.3.8. Further, the impact of the revised slabs of TER on AMCs collectively, which in turn would result in reduction in expenses of equity, hybrid and solution oriented schemes for investors can be seen in the below given table:

| Total Expenses charged during FY – 2021-22 (Amt. in Crores) | Total Expenses chargeable based on revised slabs* (Amt. in Crores) | Impact level | at | industry |

| 30,806 | 29,404 | 4.55% |

*total expenses chargeable includes expenses for direct plan plus regular plan.

5.3.9. In order to understand the impact of revised TER on investors, the change in calculation of TER of equity oriented open ended schemes can be understood from the below given example –

| A | B | C | D | E |

| Scheme | Weighted Average TER (including all additional expenses) charged to regular investors |

Maximum TER chargeable with New Proposed Slabs to Regular plan |

Difference in current TER charged vs revised permissible TER of the scheme (B–C) |

Change in TER (D/B*100) |

| AMC – A | 1.80% | 1.64% | 0.16% | 8.89% |

| AMC – B | 1.75% | 1.63% | 0.12% | 6.86% |

| AMC – C | 2.02% | 1.62% | 0.40% | 19.80% |

| AMC – D | 2.10% | 1.83% | 0.27% | 12.86% |

| AMC – E | 1.86% | 1.85% | 0.01% | 0.54% |

5.3.10. The proposed new methodology of calculation of TER would bring about transparency and reduction in cost of investment in mutual funds for the investors based on economies of scale. Pursuant to the last review of TER (i.e. in 2018) there has been a considerable increase in the AUM of the industry (almost 2 times). In view of the proposed benefits of limited purpose membership of the stock exchange for the AMCs coupled with the increasing AUM of the industry, the impact of the revised slabs may be mitigated to a large extent.

5.3.11. Further, in the above given paras the revision in TER is proposed for Active Open Ended schemes and no change is proposed for TER of passive schemes (Index Funds and ETFs).

Glide Path

5.3.12. For the proposals at para 5.1.1.9, 5.1.2.4, 5.1.3.4 (iv), 5.1.5.2 and 5.3 a time period of six months from the date of notification of Regulation / issuance of Circular may be given to AMCs as a glide path for compliance. Further, the revised policy on benefit to distributors for B-30 investments, as detailed at para 5.1.3.4 above, is proposed to be made applicable from the date of notification of Regulation / issuance of Circular in this regard.

5.3.13. Consultation no 6:

a. Whether the proposed TER slabs for investment in equity & equity related instruments and for other than equity & equity related instruments is appropriate?

b. Whether the methodology proposed to arrive at TER for Hybrid and Solution Oriented schemes is appropriate?

c. Whether the glide path for AMCs proposed at para 5.3.12 above is appropriate?

d. Any other comment on the proposal?

5.4. Other Proposals:

5.4.1. Commission/fees paid to distributors

5.4.1.1. In terms of SEBI Circular no. CIR/IMD/DF/13/2011 dated August 22, 2011, AMCs are presently permitted to deduct transaction charges of INR 100/- for existing investors in a Mutual Fund and INR 150/- for first time investor in Mutual Fund per subscription of INR 10,000/- and above from the subscription amount of the investor. The amount deduced as transaction charges is paid to the distributor.

5.4.1.2. Further, the above circular provides for payment of an upfront commission by investors directly to distributors, based on investor’s assessment of various factors including the services rendered by a distributor.

5.4.1.3. In view of the overall proposal that all expenses should be included in the prescribed TER and considering that the distributors being agents of AMCs should be entitled to remuneration for services rendered only from AMCs, it is proposed that payment of upfront commission by investor directly and transaction costs deductible from investments of investors, may not be permitted.

5.4.1.4. The measures proposed at para 5.4.1.3 may be made applicable from the date of notification of Regulation / issuance of Circular.

5.4.1.5. Consultation no 7

a. Whether the measures proposed at para 5.4.1.3 are appropriate?

b. Any other comment on the proposal?

5.4.2. Expense Ratio of Fund of Fund (FoF) Schemes

5.4.2.1. Under the extant provisions for FoF schemes, the TER charged is based on the TER of the underlying scheme. It is specified that for FoF schemes the TER to be charged over and above the weighted average of the total expense ratio of the underlying scheme(s)cannot exceed two times the weighted average of the total expense ratio levied by the underlying scheme(s), subject to the overall ceiling.

5.4.2.2. In this regard, it has been represented by some industry participants that international funds with large AUM have a low cost structure and thus Indian AMCs are often left with less room to charge desired TER for managing investments in such international FOFs. Further, AMCs are also required to pay licensing fees for using an overseas benchmark. Thus, it leads to relatively high-cost international funds being sold to Indian investors instead of low cost efficient funds, which is not in the best interests of investors.

5.4.2.3. In view of the above and to facilitate AMCs to launch FoFs on low cost international funds, it is proposed that for schemes investing only in international funds, the TER over and above the weighted average of the TER of the underlying scheme(s) shall not exceed higher of two times the weighted average of the TER levied by the underlying scheme(s) and the actual cost of running a scheme including distribution commission of not more than 50 bps but excluding AMC Management Fees, subject to the overall regulatory limit.

5.4.2.4. The measures proposed at para 5.4.2.3 may be made applicable from the date of notification of Regulation / issuance of Circular.

5.4.2.5. Consultation no 8

a) Whether the measures proposed at para 5.4.2.3 are appropriate?

b) Any other comment on the proposal?

5.4.3. Switch Transactions and Distributor Commission

5.4.3.1. The data regarding NFOs during the period from April 01, 2021 to September 30, 2022, is as under:

| Particulars | Active Schemes | Passive Schemes | Total |

| NFOs during the period | 47 | 39 | 86 |

| Amount garnered (INR Crores) | 82,733 | 2,552 | 85,285 |

| Amount garnered through Switch (Regular Plan) (INR Crores) | 22,437 | 386 | 22,823 |

| Amount garnered through switch (Direct Plan) (INR Crores) | 1,206 | 302 | 1,508 |

| Percentage of amount garnered

through switch by distributors |

27.12% | 15.12% | 26.76% |

5.4.3.2. The following is observed from the above data:

i. Switch transactions in regular plans amounted to INR 22,823 crores i.e. 93% of total switch transactions. No such pattern of switch was seen in case of investments through direct plans.

ii. The amount garnered by new active schemes was INR 82,733, out of which INR 22,437 crores i.e. 27.12% of the amount garnered, was through switch transactions from regular plans of other schemes of the same AMC.

iii. In one of the schemes, upto 55% of the fund garnered in NFO was through switch transactions from other schemes of the Mutual Fund.

5.4.3.3. Under the present provisions, owing to scheme level slab based TER structure, a new scheme with small size of AUM is able to charge higher TER as compared to an existing scheme with higher AUM. Thus, AMCs can be motivated to give high distribution commission for new NFO schemes wherein it can charge high TER and nudge the switch transactions from existing schemes with large size AUM to the new schemes with smaller AUM size. It can be seen from the above given data that the switches to NFO were mainly in regular plans i.e. through distributors.

5.4.3.4. Thus, having higher distribution commission structures for NFOs as compared to existing schemes may induce some distributors to churn their investors’ portfolios or mis-sell investment products for higher commissions, which is not desirable. Further, it is understood that the trail commissions paid by AMCs is often higher in the first /initial year(s) of inflows/investments and reduces in subsequent years. This practice of paying lower trail commissions after initial years of investments also encourages churning and/or mis-selling of products by distributors after the first year of investments.

5.4.3.5. Vide circular dated October 22, 2018, SEBI has mandated MFs/ AMCs to adopt a full trail model for distributor commission i.e, without payment of any upfront commission or up fronting of any trail commission, directly or indirectly, in cash or kind, through sponsorships, or any route. The abovementioned instances of payments of commission in the first year of investment/inflows results in an upfronting of the trail commission.

5.4.3.6. The following table gives an analysis of redemptions that took place in FY 202122 and FY 2022-23:

| Sr. No | Period | % of units of Regular Plan sold/redeemed in the given period – FY 2021-22 | % of units of Regular Plan sold/redeemed in the given period – FY 2022-23 |

| 1 | 0 – 1 years | 56.83% | 50.11% |

| 2 | 1 – 2 years | 15.14% | 23.04% |

| 3 | 2 – 3 years | 5.03% | 9.81% |

| 4 | 3 – 5 years | 20.41% | 13.96% |

| 5 | More than 5 years | 2.59% | 3.09% |

The above data shows that during FY 2021-22, around 71% of the total Mutual Fund units were redeemed within 2 years of investment. Similarly, during FY 2022-23, 73% of units were redeemed within 2 years of investment. Only investments in 3% of the units continued for more than 5 years.

5.4.3.7. In view of the above and to discourage churning / mis-selling by distributors, it is proposed as under:

a. In the case of a switch transaction, the distributor shall be entitled to lower of the commissions offered under the two schemes of any switch transaction. For example, if the distribution commission offered by AMC for Scheme A is 1%, Scheme B is 1.5% and Scheme C is 2% the entitlement of commission for switch transaction will be as under:

| Sr. No. | Scenario | Commission Payable |

| 1 | Switch from A to B | 1% |

| 2 | Switch from C to B | 1.5% |

| 3 | Switch from A to B then from B to C | 1% |

| 4 | Switch from C to A | 1% |

b. Mandate one of the following:

i. The commission to distributor should be in increasing trend with the first year’s commission not being more than 25% committed to the distributor for first three years, OR

ii. The commission paid to distributor should be equal for all years.

5.4.3.8. The measures proposed at para 5.4.3.7 (a) may be made applicable from the date notification of Regulation / issuance of Circular. Regarding the proposal at para 5.4.3.7 (b), three-month time may be given to AMCs from the date notification of Regulation / issuance of Circular, for compliance.

5.4.3.9. Consultation no 9:

a. Whether the measures proposed at para 5.4.3.7 are appropriate?

b. Whether the glide path proposed at para 5.4.3.8 is appropriate?

c. Any other suggestions for reduction of churning / mis-selling due to variable trail commission models?

5.4.4. Exit Load

5.4.4.1. MF Regulations presently states that the repurchase price of units of an open ended scheme shall not be lower than 95 per cent of the Net Asset Value (“NAV”). This enables Mutual Fund schemes to charge exit load of upto 5% to investors, which gets credited back to the scheme. The maximum permissible exit load was revised from 7% of the NAV to 5% in March 2021.

5.4.4.2. SEBI has received representations that AMCs can charge high exit loads even when a scheme does not perform well and the value of investment goes down. In this regard, it cannot be denied that the early redemption by investors from the scheme has impact on the non-exiting investors and exit load discourages early exit from the scheme. Also, it is observed that Mutual Funds generally charge one to two percent as exit load. In view of the same and considering that exit load is credited back to the scheme, it is proposed that the exit load of an open ended scheme may be lowered to a maximum permissible limit of 2%.

5.4.4.3. The proposal may be made applicable with immediate effect, from the date of notification of Regulation / issuance of Circular.

5.4.4.4. Consultation no 10:

a. Whether the maximum permissible exit load may be reduced from 5% to 2%?

b. Any other comment on the issue of charging exit load?

5.4.5. Issue and Redemption expenses of the scheme

5.4.5.1. The expenses that can be charged to Mutual Fund schemes are laid down in Regulations 52(2) and 52(4) of the MF Regulations. Further, Regulation 52(5) clarifies that any expenses other than those specified in the Regulations 52(2) and 52(4), shall be borne by the AMC or Trustee or Sponsors.

5.4.5.2. To provide better clarity, it is proposed that MF Regulations may be appropriately amended to state that any expense other than those specified in Regulations 52(2) and 52(4) of MF Regulations, including initial expenses of launching schemes, shall be borne by the AMC or Trustees or Sponsors.

5.4.5.3. Further, AMCs are presently permitted to charge winding up costs for terminating a fund or a scheme. The proceeds of sale realised from disposal of the assets of the scheme under winding up is to be first utilised towards discharging of such liabilities that are due and payable under the scheme and after making appropriate provision for meeting the expenses connected with such winding up.

5.4.5.4. In this regard, it has been argued in the past that mutual fund distributors are entitled to payment of commission (trail commission) agreed between distributors and AMC before the announcement of winding up of the scheme, as the expense is in the nature of recurring expense as per Regulation 52 of MF Regulations.

5.4.5.5. In this regard, Hon’ble Supreme Court in its order dated August 12, 2022 has held that if and only when recurring expenses mentioned under Regulation 52 (4)(b) of the MF Regulations fall under and meet the requirement of the expenses connected with the winding up can they be allowed under Regulation 41(2)(b) of the MF Regulations. Such expenses are allowed not because of clause (b) to Regulation 52(4), but because the expenses incurred would satisfy the requirement of being connected with such winding up under Regulation 41(2)(b).

5.4.5.6. In view of the same, it is proposed to amend the MF Regulations to clarify that after the announcement of winding-up of the scheme, unless the decision is reversed by the investors, the expenses charged to the scheme/investors shall be restricted to such recurring expenses permitted under Regulation 52(4)(b), which pertain to winding up of a scheme.

5.4.5.7. The proposal may be made applicable from the date of notification of Regulation / issuance of Circular.

5.4.5.8. Consultation no 11

a. Whether the proposed clarifications at paras 5.4.5.2 and 5.4.5.6 are appropriate?

b. Any other comment on the proposed changes?

5.4.6. Performance based TER

5.4.6.1. As per the extant industry practice, irrespective of the performance of a scheme (relative to its Benchmark) the AMCs are charging the management fees and expenses on a daily basis. An analysis of the data of performance of active schemes over a period of 1 year, 3 years, 5 years and 10 years as on February 2023, indicates the following:

Scheme Performance vis- à-vis Benchmark |

Number of Schemes (Active Schemes) |

|||||||

1 Year Return |

3 Year Return |

5 Year Return |

10 Years Return |

|||||

Direct |

Regular |

Direct |

Regular |

Direct |

Regular |

Direct |

Regular |

|

More than 1.25% of underperformance to the Benchmark |

17.23% |

25.75% |

26.70% |

37.57% |

26.22% |

40.30% |

10.18% |

22.80% |

Upto 1.25 % (equivalent to max. tracking difference permissible for debt ETFs/Index Funds) of underperformance to the Benchmark |

26.04% |

32.24% |

25.78% |

29.71% |

29.01% |

33.04% |

23.53% |

37.74% |

% of Schemes meeting the Benchmark or Outperforming |

56.73% |

42.01% |

47.53% |

32.72% |

44.77% |

26.67% |

66.29% |

39.46% |

5.4.6.2. From the above, it is observed that underperformance of regular plans of schemes is higher as compared to direct plans. Further, more than 22% of the regular plans of schemes have underperformance of more than 1.25% (equivalent to max. tracking difference permissible for debt ETFs/Index Funds) vis-à-vis the benchmark for all periods mentioned above.

5.4.6.3. The above table gives comparison of the performance of active schemes vis-à-vis performance of respective benchmarks. In this regard, it can be argued that given that there are certain constraints applicable to Mutual Fund schemes which are not applicable to the benchmarks, replication of benchmarks’ performance may not always be possible. Even in case of passive schemes such as ETFs/ Index funds, which replicate the relevant benchmarks, there may be variance between the performance of the schemes and the benchmarks. The underperformance of schemes can be to an extent attributed to the following factors/constraints which the benchmark does not have:

a. Sectoral, issuer level investment limits for Mutual Fund schemes

b. Scheme expenses (TER)

c. Transaction, liquidity, impact cost

d. Cost of rebalancing of portfolio due to daily investment and redemptions in the scheme

5.4.6.4. Notwithstanding the above, any significant underperformance of the fund versus its benchmark is not in the interest of unitholders. Further, AMCs outperforming the market may find merit in charging unitholders with performance linked TER, wherein the management fee is based on scheme performance. Thus, the concept of variable TER based on performance of the schemes can be explored and accordingly, views on the same are sought in this paper.

5.4.6.5. To start with, performance linked TER can be enabled for active open ended equity schemes wherein AMCs can charge higher management fees if the scheme performance is more than an indicative return above the tracking difference adjusted benchmark (Tracking difference adjusted benchmark means benchmark returns adjusted for permissible operational cost of managing the fund). Alternatively, AMC can be permitted to charge higher management fee based on a pre-decided hurdle rate as may be disclosed in the SIDs. Such higher management fees under both models can be either at a fixed rate or on returns sharing basis.

5.4.6.6. In such cases, the base expense ratio (for Direct and Regular plans) can be at TER limits as applicable for passive schemes, which are lower than active schemes.

5.4.6.7. Approach A: During the period in which the investor remains invested, the base expense ratio may be charged to the investor. At the time of redemption, the management fees may be charged if return of more than indicative rate is generated or annualised returns received by the investor is above the hurdle rate. The maximum management fees may also be specified to discourage fund managers from taking imprudent risk in order to earn higher fees. The NAV paid out at the time of redemption may be netted for the management fees and the balance amount may be paid to the investor.

5.4.6.8. Approach B: There can be another approach where higher expense limit for performance based TER may be fixed and TER inclusive of management fees is charged to the investor. The TER charged by the schemes in such cases should be based on the schemes’ performance during the previous year. At the time of redemption by the investor, if AMC fails to generate return above the indicative returns for investor or the annualised returns for the investor is below the hurdle rate fixed in advance, the AMC may retain base TER as may be applicable and return the remaining expenses charged to the investor, along with the redemption amount.

5.4.6.9. It will be optional to the AMCs to offer such a scheme(s). Further, as performance based TER is a new concept for the Indian Mutual Fund industry, at this stage, it is proposed to test the model under the Regulatory Sandbox.

5.4.6.10. Consultation no 12

a. Whether Mutual Funds should be provided with an option to have schemes with performance based TER?

b. If yes, should it be allowed on a voluntary basis or made mandatory?

c. If yes, which of abovementioned approaches (A or B) should be adopted?

d. Any other comment regarding Performance based TER?

5.4.7. Financial inclusion of women in Mutual Fund space

5.4.7.1. The data for statement of account folios of individual investors in mutual fund industry indicates that out of total folios, approx. 25% of folios belong to only women investors and approx. 16% of the folios are in the joint holding wherein one holder is a woman. Thus, there is a considerable scope for gender inclusion in the Mutual Fund space, which requires the industry to create awareness and promote financial inclusion amongst women.

5.4.7.2. There have been initiatives taken by State Governments towards encouraging investments by women in house property, by providing waiver of certain percentage of registration charges if the house property is in the name of a woman. Also, some banks offer lower home loan rates to women borrowers. Since investment products need effective selling, in order to encourage Mutual Funds to reach out to more women investors, the following is proposed:

i. An additional incentive may be introduced for distributors for new investments/inflows from women investors (new PAN) at the industry level.

ii. In case of joint holding, the additional incentive may be for inflows wherein 1st holder is a woman investor and the said woman investor is new (new PAN) at the industry level.

iii. Such additional commission to distributors may be fixed at 1% of the investment amount of the 1st application or amount committed through SIP of the woman investor at industry level, subject to a maximum of INR 2000/- per investor.

iv. Presently, 1 basis point of the daily net assets within the maximum limit of TER is set aside by the AMCs for investor education and awareness initiatives. The cost of the proposed additional distribution commission for first time investment by a woman investor, which results in financial inclusion, may be paid from investor education and awareness expense charged to the scheme. Alternatively, such distribution commission can be permitted to be charged under Regulation 52 (4) of SEBI (Mutual Funds) Regulations, 1996 which includes distribution commission that can be charged to the scheme.

v. Any such additional commission paid to distributor should be credited back to the scheme or investor education and awareness fund (as the case may be), if inflows are redeemed within a period of one year from the date of investment, as done for distribution commission of inflows from B-30 cities.

vi. Actual cost towards distribution commission should be charged to the scheme.

vii. Such additional commission should be made applicable for all schemes of an AMC except for schemes with duration requirement of less than 1 year (i.e. Overnight Fund, Liquid Fund, Ultra Short Duration Fund and Low Duration Fund) as the schemes are meant for investment for shorter duration and the above proposed policy requires claw back of commission if inflows are redeemed within a period of one year from the date of investment.

viii. As similar incentive is also available for B-30 investors, it shall have to be ensured by AMCs that the proposed incentive for women investors is extended only in those cases where B-30 incentive is not given.

5.4.7.3. AMCs may be granted two months from the date of notification of Regulation / issuance of Circular for compliance with the above proposed policy.

5.4.7.4. Consultation no 13

a. Whether additional incentive should be introduced for encouraging financial inclusion of women investors in Mutual Funds?

b. If yes, are the proposed measures appropriate?

c. Any other suggestions for encouraging financial inclusion of women investors in Mutual Funds?

d. Whether the glide path proposed at para 5.4.7.3 is appropriate?

5.4.8. Increase in Total Expense Ratio of locked-in and quasi locked-in schemes

5.4.8.1. In terms of the extant regulatory provisions, any change in the base TER in comparison to previous base TER charged to any scheme/plan is to be communicated to investors of the scheme/plan through notice via email or SMS at least three working days prior to effecting such change. Further, the notice of change in base TER is to be updated on the website of the AMC at least three working days prior to effecting such change.

5.4.8.2. In this regard, it is proposed that unitholders may be given an option to exit at the prevailing NAV without any exit load when there is an increase in TER.

5.4.8.3. Further, for schemes where investment of investors is under a lock-in or quasi lock-in (such as under ELSS schemes, Close Ended schemes and also for Target Maturity scheme wherein investment is intended to be held till maturity to mitigate interest rate risk and getting projected yield on maturity), the TER may not be increased for the existing investors. Any increase in TER of schemes (ELSS and Target Maturity funds) may be applicable only for new investments and the existing investments in such schemes shall be grandfathered.

5.4.8.4. However, any such exit to investors or grandfathering of investments may not be required if the increase in TER of a Mutual Fund scheme is as per the regulatory requirement due to change in AUM.

5.4.8.5. The above proposal may be made applicable from the date of notification of Regulation / issuance of Circular.

5.4.8.6. Consultation no 14:

a. Whether investor should be provided exit without exit load on increase in TER by AMC?

b. Whether the proposal of grandfathering of existing investments in locked-in/quasi locked-in schemes on increase in TER rate is appropriate?

c. Any other comment on the proposal?

5.4.9. TER of Regular and Direct plans

5.4.9.1. Direct plans were mandated by SEBI from January 01, 2013 wherein investments are not routed through a distributor. Regarding TER of direct plan, it has been stated that direct plan shall have a lower expense ratio excluding distribution expenses, commission, etc., and no commission shall be paid from such plans. It is also clarified that that all fees and expenses charged in a direct plan (in percentage terms) under various heads including the investment and advisory fee shall not exceed the fees and expenses charged under such heads in a regular plan.

5.4.9.2. It is understood that the TER charged to investors is based on estimations and actual expense may be higher or lower than the estimated cost. Consequently, if higher investment and advisory fees are charged to regular plan as compared to direct plan, for the same service, it may not be in the interest of investors of regular plan. The issue of difference in actual and estimated cost charged to investors can be addressed by increasing the frequency of reconciliation of TER and crediting back the difference of accrued cost vs actual cost, if any, to the respective plan at the end of the financial year/fixed frequency e.g. weekly/monthly.

5.4.9.3. In view of the above, it is proposed that there should be uniformity in charging of each and every expense to the investor of regular plan and direct plan and the only difference between the TER of regular plan and direct plan should be the expenses towards distribution commission.

5.4.9.4. The above proposal may be made applicable from the date of notification of Regulation / issuance of Circular.

5.4.9.5. Consultation no 15:

a. Whether the proposal of uniformity in charging of each and every expense to the investor of regular plan and direct plan (other than distribution commission) is appropriate?

b. Any other comment on the proposal?

6. Public Comments

6.1. Considering the implications of the said matter on the market participants, public comments are invited on the above proposals.

6.2. Comments may be sent by email to Ms. Manaswini Mahapatra, General Manager (manaswinim@sebi.gov.in), Mr. Peter Mardi, Deputy General Manager (peterm@sebi.gov.in) and Ms. Laxmi Rampurawala, Assistant General Manager (laxmir@sebi.gov.in) latest by June 01, 2023. While sending the email, kindly mention the subject as “Consultation Paper on Review of Total Expense Ratio charged by Asset Management Companies (AMCs) to unitholders of schemes of Mutual Funds to facilitate greater transparency and accrual of benefits of economies of scale to investors”

6.3. The comments should be sent by email in MS Excel file in the following format only: link to download the format.

Issued on: May 18, 2023