Securities and Exchange Board of India

CIRCULAR

SEBI/HO/DDHS/DDHS_Div3/P/CIR/2021/690

December 16, 2021

To,

All Registered Merchant Bankers

Madam/Sir

Sub: Publishing Investor Charter and Disclosure of Investor Complaints by Merchant Bankers on their Websites for private placement of units by InvITs proposed to be listed

1. With a view to provide investors relevant information about the primary market issuances by InvITs, an Investor Charter has been prepared by SEBI in consultation with Merchant Bankers for private placement of units by InvITs propose to be listed.

2. This charter is a brief document containing different services to investors at a single place for ease of reference.

3. All registered Merchant Bankers are hereby advised to disclose on their websites, the Investor Charter for private placement of units by InvITs proposed to be listed, as provided at Annexure – A to this circular.

4. Additionally, in order to bring about transparency in the Investor Grievance Redressal Mechanism, it has also been decided that all the registered Merchant Bankers shall disclose on their respective websites, the data on complaints received against them or against issues dealt by them and redressal thereof, latest by 7th of succeeding month, as per the format enclosed at Annexure – B to this circular.

5. The provisions of this circular shall come into effect from January 01, 2022.

6. This circular is being issued in exercise of powers conferred under Section 11(1) of the Securities and Exchange Board of India Act, 1992, Regulation 33 of the REIT Regulations and Regulation 33 of the InvIT Regulations.

7. This circular is available on the website of the Securities and Exchange Board of India at sebi.gov.in under the category “Legal” and under the drop down “Circulars”.

Yours faithfully,

Deena Venu Sarangadharan

Deputy General Manager

Department of Debt and Hybrid Securities

Tel No. 022-2644-9266

Email – deenar@sebi.gov.in

Annexure – A

Private Placement of units by InvITs

VISION STATEMENT

To continuously earn trust of investors and emerge as solution provider with integrity.

MISSION STATEMENT

1. Act in investors’ best interests by understanding needs and developing solutions.

2. Enhance and customise value generating capabilities and services.

3. Disseminate complete information to investors to enable informed investment decision.

DESCRIPTION OF ACTIVITIES / BUSINESS OF THE ENTITY

Act as Merchant Banker for private placement of units by InvITs

SERVICES PROVIDED FOR INVESTORS

1. Upload Draft Placement Memorandum on SEBI / Stock Exchanges website.

2. Upload Placement Memorandum with issue period details on SEBI / Stock Exchanges Website.

3. Electronically or physically circulate serially numbered copies of the Placement Memorandum and the Application Form to Eligible Investors, in consultation with the Investment Manager.

| Sr. No. | Activity | Timeline for which activity takes place | Information where available |

| 1 | Filing of draft Placement Memorandum by Trust | 0 | Websites of SEBI, Stock Exchanges |

| 2 | Filing of Placement Memorandum | At least 5 days prior to opening of the issue | Websites of SEBI, Stock Exchanges |

| 3 | Circulation of Placement Memorandum along with application form to eligible investors as determined by investment manager | After filing of Placement Memorandum with SEBI and Stock Exchanges | Placement Memorandum |

| 5 | Issue opening date | After 5 working days of filing of Placement Memorandum with SEBI | Placement Memorandum |

| 7 | Availability of material documents for inspection by investors | Till issue closure date | Address given in Placement Memorandum |

| 9 | Allotment status and allotment advice | completion of basis of allotment | Confirmation of Allocation Note or CAN |

RIGHTS OF INVESTORS

1. Eligible investors as decided by the investment manager to receive copy of Placement Memorandum.

2. Right to inspect the material documents during the issue.

3. If allotted units, all Rights as a Unitholder (as per Placement Memorandum)

DO’s and DON’Ts FOR INVESTORS

DO’S FOR THE INVESTORS

1. Check eligibility to apply as per the terms of the Placement Memorandum and under Applicable Laws and approvals;

2. Application Form must be completed in full, in BLOCK LETTERS in ENGLISH and in accordance with the instructions contained herein and in the Application Form;

3. Make bids only in the prescribed application form;

4. Ensure that the category and Bidder status is indicated;

5. Provide details of valid and active DP ID, Client ID and PAN clearly and without error and ensure that the Beneficiary Account is activated, as Allotment will be in dematerialized form only;

6. Bidders are required to sign the Application Form. Ensure that the signature of the First Bidder in case of joint Bids, is included in the Application Form;

7. Application Forms must be duly completed with information including the name of the Bidder, the number of the Units applied for and the Bid Amount deposited in the Designated Account, and include details of the bank account from which payment of the Bid Amount was made as well as a confirmation of funds transfer.

8. Submit the Application Form to the Lead Manager either through electronic form or through physical delivery at the address mentioned in the Placement Memorandum only during the Bid/issue period

9. Make payment of the entire Bid Amount for the Units at the Issue Price, only through electronic transfer to the Designated Account during the Bid/Issue Period, along with the Application Form.

10. Payment of Bid Amount for Units shall be made from the bank account of the relevant Bidder applying for Units. The Bid Amount payable on Units to be held by joint holders shall be paid from the bank account of the person whose name appears first in the Application Form.

11. Ensure that the name(s) given in the Application Form is/are exactly the same as the name(s) in which the beneficiary account is held with the Depository Participant;

12. Instruct the respective Depository Participants’ to accept the Units that may be Allotted pursuant to the Issue into the respective demat accounts;

DON’TS FOR THE INVESTORS:

1. Do not Bid for lower than the Minimum Bid Size;

2. Do not submit a Bid without payment of the entire Bid Amount;

3. Do not pay the Bid Amount in cash, by money order or postal order or stock invest

4. Do not fill up the Application Form such that the Units Bid for exceed, the issue size or investment limits, or the maximum number of Units that can be held or the maximum amount permissible under applicable laws or under the terms of the Placement Memorandum;

5. Do not submit the Bid for an amount more than the bid amount deposited in the designated account

6. Do not submit Bids on plain paper or on incomplete or illegible Application Forms

7. Do not submit a Bid in case you are not eligible to acquire Units under applicable law or your relevant constitutional documents or otherwise;

8. Do not Bid if you are not either an Institutional Investor or a Body Corporate;

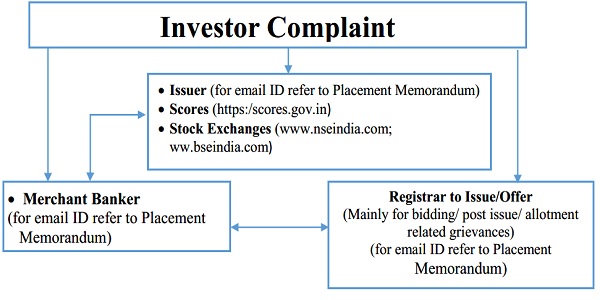

GRIEVANCE REDRESSAL MECHANISM FOR INVESTORS AND HOW TO ACCESS IT

TIMELINES FOR RESOLUTION OF INVESTOR GRIEVANCES IN A PUBLIC ISSUE (INVIT)

| Sr. No. | Activity | No. of calendar days |

| 1 | Investor grievance received by the lead manager | T |

| 2 | Lead Manager to the offer to identify the concerned intermediary and it shall be endeavoured to forward the grievance to the concerned intermediary/ies on T day itself | T+1 |

| 3 | The concerned intermediary/ies to respond to the lead manager with an acceptable reply | X |

| 4 | Investor may escalate the pending grievance, if any, to a senior officer of the lead manager of rank of Vice President or above | T+21 |

| 5 | Lead manager, the concerned intermediary/ies and the investor shall exchange between themselves additional information related to the grievance, wherever required | Between T and X |

| 6 | Lead Manager to respond to the investor with the reply | Upto X+3 |

| 7 | Best efforts will be undertaken by lead manager to respond to the grievance within T+30 | |

Nature of investor grievance for which the aforesaid timeline is applicable

1. Non receipt of units in demat account

2. Non receipt of refund, if applicable

3. Any other grievance as may be informed from time to time

Mode of receipt of investor grievance

The following modes of receipt will be considered valid for processing the grievances in the timelines discussed above

1. Letter or e-mail from the investor addressed to the lead manager at its address or e-mail ID mentioned in the Placement Memorandum, detailing nature of grievance, details of application, details of bank account, date of application etc.

2. Letter or e-mail from the investor addressed to the issuer, registrar to the issue, stock exchanges, at their address or e-mail ID mentioned in the Placement Memorandum, detailing nature of grievance, details of application, details of bank account, date of application etc.

3. On SEBI SCORES platform.

Nature of enquiries for which the Lead manager shall endeavour to resolve such enquiries/ queries

promptly during the issue period.

1. Process for applying in the private placement of units and making payment for the same

2. Terms of private placement, allotment methodology, Issue Period, date of allotment, date of listing

3. Any other query of similar nature

RESPONSIBILITIES OF INVESTORS

1. Read and understand the terms of Placement Memorandum, application form, and issue related literature carefully and fully before investing

2. Consult his or her own tax consultant with respect to the specific tax implications arising out of their participation in the issue

3. Provide full and accurate details when making investor grievances to Lead Managers and the registrar to the issue

4. After listing, Investors should regularly check for such information on the stock exchange website regarding all material developments including information corporate actions like mergers, de-mergers, splits, rights issue, bonus, dividend etc.

Annexure – B

Format for Investors Complaints Data to be displayed by Registered Merchant Bankers on their respective websites (For each category, separately as well as collectively)

Data for every month ending

| SN | Received from |

Carried forward from previous month |

Received during the month |

Resolved during the month* |

Pending at the end of month # | Pending complaints > 3 month |

Average Resoluti on time^ (in days) |

| 1 | Directly from Investors | ||||||

| 2 | SEBI (SCORES) | ||||||

| 3 | Stock Exchanges (if relevant) | ||||||

| 4 | Other Sources (if any) | ||||||

| 5 | Grand Total |

Monthly trend for the financial year

| SN | Month | Carried forward from previous month |

Received during the month | Resolved during the month * |

Pending at the end of month # |

| 1 | April-YYYY | ||||

| 2 | May-YYYY | ||||

| 3 | June-YYYY | ||||

| 4 | July-YYYY | ||||

| …. | |||||

| …. | |||||

| March-YYYY | |||||

| Grand Total |

^Average Resolution time is the sum total of time taken to resolve each complaint in days, in the current month divided by total number of complaints resolved in the current month

* Inclusive of complaints of previous months resolved in the current month

# Inclusive of complaints pending as on the last day of the month

Last 3 years’ trend

| SN | Year | Carried forward from previous year | Received during the year | Resolved during the year | Pending at the end of the year |

| 1 | 2018-19 | ||||

| 2 | 2019-20 | ||||

| 3 | 2020-21 | ||||

| Grand Total |