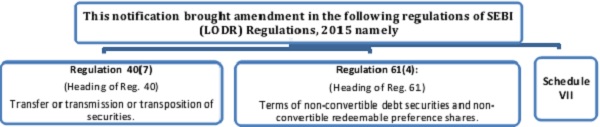

Securities and Exchange Board of India vide its Notification No. SEBI /LAD-NRO/GN/2022/80 dated April 25, 2022 has issued SEBI (Listing Obligations and Disclosure Requirements) (Fourth Amendment) Regulations, 2022.

Article Analyses SEBI (Listing Obligations and Disclosure Requirements) (Fourth Amendment) Regulations, 2022

Note: Red text means deleted words form original content; whereas green text is newly added in original content.

The comparative analysis of the above mentioned regulations before and after the amendment is as follows: –

| Regulation | As per SEBI (LODR) Regulations, 2015 (Before) |

SEBI (LODR) (Fourth Amendment) Regulations, 2022 (After) |

Remarks (Exactly changes) |

| Regulation 40(7)

|

The Listed entity shall comply with all the procedural requirements as specified in Schedule VII with respect to transfer of Securities | The Listed entity shall comply with all the procedural requirements as specified in Schedule VII with respect to transfer and transmission of Securities | After the word “transfer” and before the words” of securities” the words “and transmission” has been inserted |

| Regulation 61(4)

|

The Listed Entity shall comply with the requirements as specified in Regulation 40 for transfer of securities including procedural requirements specified in Schedule VII | The Listed Entity shall comply with the requirements as specified in Regulation 40 for transfer and transmission of securities including procedural requirements specified in Schedule VII | After the word “transfer” and before the words” of securities” the words “and transmission” has been inserted |

The comparative analysis of the Schedule VII

|

(Before) |

(After) |

| Transfer of Securities [See Regulation 40(7) and 61(4)].

C. Additional Documentation Requirements in case of Transmission of Securities. |

Transfer and transmission of Securities [See Regulation 40(7) and 61(4)].

C. Documentation requirements in case of transmission of securities. |

| 1) In case of transmission of securities held in dematerialized mode, where the securities are held in a single name without a nominee, for the purpzse of following simplified documentation, as prescribed by the depositories vide bye-laws or operating instructions, as applicable, the threshold limit is rupees five lakhs only per beneficiary owner account. | (1) In case of transmission of securities, where the securities are held in single name with nomination, the following documents shall be submitted:

(a) duly signed transmission request form by the nominee; (b) original death certificate or copy of death certificate attested by the nominee subject to verification with the original or copy of death certificate duly attested by a notary public or by a Gazetted Officer; (c) self-attested copy of the Permanent Account Number card of the nominee, issued by the Income Tax Department. |

| 2) In case of transmission of securities held in physical mode:

where the securities are held in single name with a nominee: (i) duly signed transmission request form by the nominee; (ii) original or copy of death certificate duly attested by a notary public or by a gazetted officer; (iii) self-attested copy of PAN card of the nominee. where the securities are held in single name without a nominee, an affidavit from all legal heir(s) made on appropriate non judicial stamp paper, to the effect of identification and claim of legal ownership to the securities shall be required; Provided that in case the legal heir(s)/claimant(s) is named in the succession certificate or probate of will or will or letter of administration, an affidavit from such legal heir(s) / claimant(s) alone would be sufficient. Provided further that: (i) for value of securities, threshold limit of up to rupees two lakh only, per listed entity, as on date of application, a succession certificate or probate of will or will or letter of administration or court decree, as may be applicable in terms of Indian Succession Act, 1925 may be submitted: Provided that in the absence of such documents, the following documents may be submitted: 1. no objection certificate from all legal heir(s) who do not object to such transmission or copy of family settlement deed duly notarized and executed by all the legal heirs of the deceased holder; |

(2) In case of transmission of securities, where the securities are held in single name without nomination, the following documents shall be submitted:

(a) a notarized affidavit from all legal heir(s) made on non-judicial stamp paper of appropriate value, to the effect of identification and claim of legal ownership to the securities: Provided that in case the legal heir(s)/claimant(s) are named in the Succession Certificate or Probate of Will or Will or Letter of Administration as may be applicable in terms of Indian Succession Act, 1925 (39 of 1925) or Legal Heirship Certificate or its equivalent certificate issued by a competent Government Authority, an affidavit from such legal heir(s)/claimant(s) alone shall be sufficient; (b) duly signed transmission request form by the legal heir(s)/claimant(s); (c) original death certificate or copy of death certificate attested by the legal heir(s)/claimant(s) subject to verification with the original or copy of death certificate duly attested by a notary public or by a Gazetted Officer; (d) self-attested copy of the Permanent Account Number card of the legal heir(s)/claimant(s), issued by the Income Tax Department; e) a copy of Succession Certificate or Probate of Will or Will or Letter of Administration or Court Decree as may be applicable in terms of Indian Succession Act, 1925 (39 of 1925) or Legal Heirship Certificate or its equivalent certificate issued by a competent Government Authority, attested by the legal heir(s)/claimant(s) subject to verification with the original or duly attested by a notary public or by a Gazetted Officer: Provided that in a case where a copy of Will or a Legal Heirship Certificate or its equivalent certificate issued by a competent Government Authority is submitted, the same shall be accompanied with a notarized indemnity bond from the legal heir(s) /claimant(s) to whom the securities are transmitted, in the format specified by the Board: Provided further that in a case where a copy of Legal Heirship Certificate or its equivalent certificate issued by a competent Government Authority is submitted, the same shall also be accompanied with a No Objection from all non-claimants, stating that they have relinquished their rights to the claim for transmission of securities; (f) for cases where value of securities is up to rupees five lakhs per listed entity in case of securities held in physical mode, and up to rupees fifteen lakhs per beneficial owner in case of securities held in dematerialized mode, as on date of application, and where the documents mentioned in para (e) are not available, the legal heir(s) /claimant(s) may submit the following documents: (i) no objection certificate from all legal heir(s) stating that they do not object to such transmission or copy of family settlement deed executed by all the legal heirs duly attested by a notary public or by a Gazetted Officer; and (ii) a notarized indemnity bond made on non-judicial stamp paper of appropriate value, indemnifying the Share Transfer Agent/ listed entity, in the format specified by the Board: Provided that the listed entity may, at its discretion, enhance the value of securities from the threshold limit of rupees five lakhs, in case of securities held in physical mode.] |

Summary of exactly change in the Schedule VII: Existing Clause (C) “Additional Documentation Requirements in case of Transmission of Securities “has been removed and substituted with “Documentation requirements in case of transmission of securities”