360 Degree analysis on Sovereign gold bonds (SGBs)

A. Basics of SGBs

1. SGBs are government securities expressed in grams of gold, allowing the individuals to invest in gold without the strain of safekeeping physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity. The Bond is issued by RBI on behalf of Government of India.

B. Features of SGBs

1. Who can invest in SGBs?

Persons resident in India as defined under Foreign Exchange Management Act, 1999 are eligible to invest in SGB. Eligible investors include individuals, HUFs, trusts, universities and charitable institutions. Individual investors with subsequent change in residential status from resident to non-resident may continue to hold SGB till early redemption/maturity.

2. Interest rate on SGBs and periodicity of receipt of interest

The bond bears an interest rate of 2.5% per year (fixed rate).

Interest amount is to be calculated on the face value of the bond.

Interest will be credited semi-annually to the investor’s account.

3. Tenor of the bond

SGBs are issued for a period of 8 years, with premature withdrawal permissible from 5th year.

Persons willing to cash-in their investment can do so after a mandatory holding period of 5 years. This payout benefit can be exercised for the 5th, 6th and 7th year of bond tenor and can be exercised on the interest payment dates.

Now the question comes into mind that what if the bond needs to be encashed prior to 5th year. The sovereign gold bond can be traded in the secondary market i.e on the stock exchange after 14 days from an initial subscription date. For trading on stock exchange, the holding certificate of SGBs has to be digitized and stored in demat account of the investor. Prices at which these bonds are transacted depend on the prevailing gold prices on the sale date, as well as its corresponding demand and supply in the stock market.

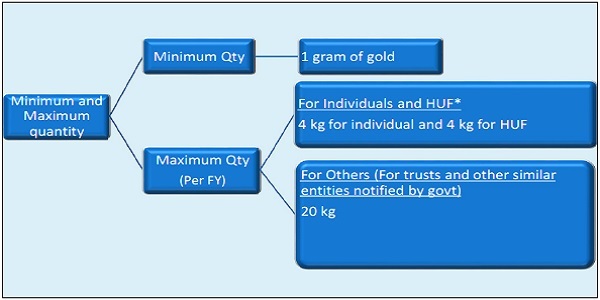

Minimum and Maximum quantity of subscription

* In case of joint holding, the investment limit of 4 kg will be applied to the first applicant only

5. Issue price and redemption price of the bonds

Issue Price: Based on of average of closing price of gold of 999 purity published by the India Bullion and Jewelers Association Ltd (IBJA) for the last 3 business days of the week preceding the subscription period.

Redemption price: Based on simple average of closing price of gold of 999 purity published by IBJA of previous 3 business days from the date of repayment.

6. Other features

- SGBs are eligible for conversion into demat form

- Bonds will be tradable on stock exchanges within 14 days of the issuance on a date as notified by the RBI

C. Advantages of investing in sovereign gold bonds over physical gold

|

Particulars |

Physical Gold | SGBs |

| A. Safety | Risk of theft, wear and tear | No such risks since bonds are held in the books of the RBI or in demat form eliminating risk of loss of scrip. |

| B. Purity | Purity of gold always remains a question. | No issues of purity as SGBs are in electronic form |

| C. Making charges | Have to bear making charges | No such charges |

| D. Interest Income | Holding of physical gold yields no interest | SGBs provide an interest of 2.5% per annum |

| E. GST on purchase |

On purchase of physical gold, one needs to pay GST | On Purchase of SGBs no GST amount needs to be paid |

| F. Capital gains tax | On sale of physical gold, one needs to pay capital gains tax | On redemption of SGBs, capital gains tax is exempt. (Subject to certain exception discussed below) |

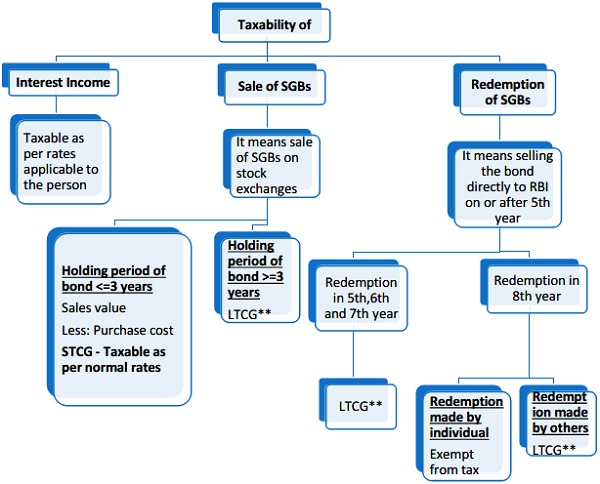

D. Income tax on SGBs

SGBs yields income in two forms i.e yearly interest income and sale/redemption of SGBs. The taxation of these two incomes is discussed as below -:

**Note 1: Manner of computation of LTCG

|

Particulars |

If Indexation benefit is opted for | If Indexation benefit is not opted for |

| A. Sales Amount of SGB | 1,00,000 | 1,00,000 |

| B. Indexed Cost of Acquisition/Cost of acquisition

Cost of acquisition – 40000 |

51,176

[40000*(348÷272)] |

40,000 |

| C. LTCG (A-B) | 48,824 | 60,000 |

| D. Tax rate | 20% | 10% |

| E. Tax amount (C*D) | 9,765 | 6,000 |

E. GST on sale and purchase of SGBs

As per section 2 (52) read with section 2 (102) of the CGST Act, 2017, SGBs are neither goods nor services.

Since SGBs are neither goods nor services, therefore no GST is applicable on sales and purchase of SGBs