Reserve Bank of India’s Governor released the first monetary policy statement of 2024, reflecting on the institution’s 90-year legacy and addressing the current economic landscape.

Reserve Bank of India

Governor’s Statement: February 8, 2024

This is the first monetary policy statement of 2024, a momentous year for the Reserve Bank of India which enters its 90th year of existence and operations on April

1. Over the years, the Reserve Bank has established itself as a credible institution which stands for stability, trust and economic progress. In recent years, it has become a pioneer in fostering innovation and technology in the financial system. Customer centricity and financial inclusion have always been its priorities. The Reserve Bank’s tireless efforts towards maintaining a fine balance among price stability, financial stability and external sector stability have paid rich dividends as the country embarks on a higher growth trajectory in the years to come. As India gains a pole position in the new global order, the contribution of the Reserve Bank is getting widely recognised in India and abroad.

2. The global economy continues to present a mixed picture. On the one hand, the odds of soft-landing have increased with inflation moving closer to the target and growth holding up better than expected in major advanced and emerging market economies. On the other hand, the ongoing wars and conflicts and the emergence of new flashpoints in different parts of the world, with disruptions in the Red Sea being the latest in the series, impart uncertainty to the global macroeconomic outlook.

3. In this unsettled global environment, the Indian economy has performed remarkably well in the recent years. Growth is accelerating and outpacing most forecasts, while inflation is on a downward trajectory. At the current juncture, India’s potential growth is propelled by structural drivers like improving physical infrastructure; development of world class digital and payments technology; ease of doing business; enhanced labour force participation; and improved quality of fiscal spending. Our multi-pronged, proactive, and calibrated policies on the monetary, regulatory and supervisory fronts have worked well to maintain and strengthen macroeconomic and financial stability.

Decisions and Deliberations of the Monetary Policy Committee (MPC)

4. The Monetary Policy Committee (MPC) met on 6th, 7th and 8th February, 2024. After a detailed assessment of the evolving macroeconomic and financial developments and the outlook, it decided by a 5 to 1 majority to keep the policy repo rate unchanged at 6.50 per cent. Consequently, the standing deposit facility (SDF) rate remains at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent. The MPC also decided by a majority of 5 out of 6 members to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

5. I shall now briefly set out the rationale for these decisions. The momentum in domestic economic activity continues to be strong. Headline inflation, after moderating to 4.9 per cent in October, rose to 5.7 per cent in December 2023. This was primarily due to food inflation, mostly vegetables. The softening in core inflation (CPI inflation excluding food and fuel) continued across both goods and services, reflecting the cumulative impact of monetary policy actions as well as significant softening in commodity prices. The uncertainties in food prices, however, continue to impinge on the headline inflation trajectory.

6. Taking into account this growth-inflation dynamics and the fact that transmission of the cumulative 250 bps policy rate hike is still underway, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent. The MPC will carefully monitor any signs of generalisation of food price pressures which can fritter away the gains in easing of core inflation. Monetary policy must continue to be actively disinflationary to align inflation to the target of 4 per cent on a durable basis. The MPC will remain resolute in this commitment. The MPC also decided to remain focused on withdrawal of accommodation to ensure fuller transmission and anchoring of inflation expectations.

Assessment of Growth and Inflation

Global Growth

7. Global growth is expected to remain steady in 2024 with heterogeneity across regions.1 Though global trade momentum remains weak, it is exhibiting signs of recovery and is likely to grow faster in 20242. Inflation has softened considerably and is expected to moderate further in 2024.3 Financial markets are volatile as market participants adjust their expectations on the timing and pace of rate cuts by major central banks who remain cautious against premature easing in their fight against inflation.

8. Amidst the current headwinds, elevated level of public debt is raising serious concerns on macroeconomic stability in many countries, including some of the advanced economies (AEs). Global public debt to GDP ratio is projected to reach 100 per cent by the end of this decade. The public debt levels in AEs are in fact much higher than those in the emerging market economies (EMEs). The challenges of debt sustainability in an environment of high interest rates and low growth at the global level can become new sources of stress. Reducing debt burdens is necessary to create fiscal space for new investments in priority areas, including green transition. As regards India, given the fiscal consolidation path as well as improving growth prospects, we expect the general government debt to gradually come down.5

Domestic Growth

9. Domestic economic activity remains strong. The first advance estimates (FAE) placed the real gross domestic product (GDP) growth at 7.3 per cent for 2023-24, marking the third successive year of growth above 7 per cent.6

10. Going forward, the momentum of economic activity witnessed during 2023-24 is expected to continue in the next year (2024-25). Agricultural activity is holding up well despite lower rainfall, lower reservoir levels and delayed sowing.7 Rabi sowing has surpassed last year’s level as well as the normal acreage.8 The allied sector is also expected to provide major support to agriculture with continued momentum in horticulture and fisheries.9

11. Industrial activity is gaining steam on the back of improving performance of manufacturing.10 The early results of corporates in the manufacturing sector remain upbeat, driven by higher profit margins.11 The purchasing managers’ index (PMI) for manufacturing is displaying expansion along with strengthening of future activity index.12

12. Services sector activity is expected to remain resilient on the back of strong domestic demand and stable global prospects.13 The PMI services increased significantly in January (2024), suggesting continued strong expansion.14 The buoyant demand for residential housing, coupled with increased thrust on government capex, is expected to propel construction activity.15

13. On the demand side, improving employment conditions16 and moderating inflation, together with a rebound in agricultural activity should push up household consumption. Rural demand continues to gather pace.17 Strengthening farm level activity as reflected in declining MNREGA demand18 and the extension of Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) should further support rural consumption.19 Urban consumption remains strong on the back of improved income levels.20

14. Investment cycle is gaining steam, aided by sustained thrust on government capex;21 increasing capacity utilisation;22 rising flow of resources to the commercial sector;23 and policy support from schemes such as production linked incentive (PLI).24 Revival in private corporate investment is also underway.25 Our survey suggests that investment intentions of private corporates remain upbeat and both services and infrastructure firms are optimistic about overall business conditions. Net external demand is also improving with narrowing merchandise trade deficit.26 Taking all these factors into consideration, real GDP growth for 2024-25 is projected at 7.0 per cent with Q1 at 7.2 per cent; Q2 at 6.8 per cent; Q3 at 7.0 per cent; and Q4 at 6.9 per cent. The risks are evenly balanced.

Inflation

15. Headline inflation moderated to an average of 5.5 per cent during April-December 2023 from 6.7 per cent during 2022-23. Food price inflation, however, continued to impart considerable volatility to the inflation trajectory.27 In contrast, the deflation in CPI fuel deepened and core inflation (CPI inflation excluding food and fuel) moderated to a four-year low of 3.8 per cent in December. The decline in core inflation continued to be broad based with inflation remaining steady or softening across its constituent groups and sub-groups.28

16. The inflation trajectory, going forward, would be shaped by the outlook on food inflation, about which there is considerable uncertainty. Adverse weather events remain the primary risk with implications for the rabi Increasing geopolitical tensions are leading to supply chain disruptions and price volatility in key commodities, particularly crude oil. On the positive side, the progress in rabi sowing has been satisfactory and augurs well for the season. Prices of key vegetables, especially onions and tomatoes, are registering seasonal price correction. Taking into account these factors, CPI inflation is projected at 5.4 per cent for the current year (2023-24) with Q4 at 5.0 per cent. Assuming a normal monsoon next year, CPI inflation for 202425 is projected at 4.5 per cent with Q1 at 5.0 per cent; Q2 at 4.0 per cent; Q3 at 4.6 per cent; and Q4 at 4.7 per cent. The risks are evenly balanced.

What do these Inflation and Growth Conditions mean for Monetary Policy?

17. Inflation has seen a significant moderation from the highs of the summer of 2022. Over the last two years, monetary policy has prioritised inflation over growth, undertaking calibrated increase in policy repo rate by 250 basis points and withdrawal of stimulus measures. Monetary policy was supported by pro-active supply-side measures by the government. That said, the job is not yet finished, and we need to be vigilant about new supply shocks that may undo the progress made so far.

18. Headline inflation has remained high and has seen considerable volatility, moving in a range of 4.3 per cent to 7.4 per cent during the current financial year.29 Recurring food price shocks could interrupt the ongoing disinflation process, with risks that it could lead to de-anchoring of inflation expectations and generalisation of price pressures. Adding to these are the renewed flash points on the geo-political front, including supply chain disruptions. Importantly, the CPI inflation target of 4.0 per cent is yet to be reached. Monetary policy, in the midst of these lingering uncertainties, has to remain vigilant to ensure that we successfully navigate the last mile of disinflation. Stable and low inflation at 4 per cent will provide the necessary bedrock for sustainable economic growth.

Liquidity and Financial Market Conditions

19. After remaining in surplus during April-August 2023, system level liquidity30 turned into deficit from September after a gap of four and half years.31 Adjusted for government cash balances, potential liquidity in the banking system is still in surplus. During December-January, the Reserve Bank pro-actively injected liquidity through both the main and the fine-tuning repo operations to ease liquidity tightness in the system.32 With government spending picking up and augmenting system level liquidity, the Reserve Bank undertook six fine-tuning variable rate reverse repo (VRRR) auctions during February 2-7, 2024 to absorb surplus liquidity.33

20. Financial market segments have adjusted to the evolving liquidity conditions in varying degrees. While the short-term rates have fluctuated, long term rates have remained relatively stable, reflecting better anchoring of inflation expectations as indicated in the softening of term spread in the G-sec market.34 In the credit market, monetary transmission remains incomplete.35

21. Let me reiterate that our policy stance is in terms of interest rate which is the principal tool of monetary policy in the current framework. Our stance of withdrawal of accommodation should be seen in the context of incomplete transmission and inflation ruling above the target of 4 per cent and our efforts to bring it back to the target on a durable basis. So far as liquidity conditions are concerned, these are being driven by exogenous factors, which are likely to correct in the foreseeable future, aided by our market operations. On our part, the Reserve Bank remains nimble and flexible in its liquidity management through two-way main and fine-tuning operations, in both repo and reverse repo. We will deploy an appropriate mix of instruments to modulate both frictional and durable liquidity so as to ensure that money market interest rates evolve in an orderly manner and financial stability is maintained.

22. The reversal of liquidity facilities under both SDF and MSF even during weekends and holidays, announced in our December policy statement, has facilitated better funds management by the banks.36

23. As of February 7, 2024, the Indian rupee (INR) has remained stable compared to both its emerging market peers and a few advanced economies37. In terms of coefficient of variation (CV), the INR exhibited the lowest volatility in 2023-24 (April to January) compared to the corresponding period in the previous three years.38 Let me reiterate that the exchange rate of the Indian rupee is market determined. Its relative stability in the recent period, despite a stronger US dollar and elevated US treasury yields, reflects the strength and stability of the Indian economy, its sound macroeconomic fundamentals, financial stability and improvements in India’s external position, particularly the significant moderation in the current account deficit (CAD), comfortable foreign exchange reserves and return of capital inflows.

Financial Stability

24. The domestic financial system remains resilient with healthy balance sheets of banks and financial institutions.39 The financial parameters of non-banking financial companies (NBFCs) are also improving in tandem with those of the banking system.40 Good governance, robust risk management, sound compliance culture and protection of customers’ interest are of paramount importance for the safety and stability of the financial system and individual institutions. The Reserve Bank lays great emphasis on these aspects. We expect all regulated entities to accord the highest priority to these functions.

External Sector

25. India’s current account deficit (CAD) declined sharply to 1.0 per cent of GDP in Q2:2023-24 from 3.8 per cent in Q2:2022-23. Going ahead, the net balance under services and remittances is expected to remain in large surplus, partly offsetting the trade deficit. India’s services exports remained resilient in October-December 2023, driven by software, business and travel services. 41 Moreover, with around 10.2 per cent share in world telecommunications, computer and information services exports, India is a significant player in the world software business.42 According to the World Bank, with an estimated US$135 billion in inward remittances in 2024, India would remain the largest recipient of remittances globally.43 Thus, the CAD for 2023-24 and 2024-25 is expected to be eminently manageable.

26. On the financing side, net foreign direct investment (FDI) stood at US$ 13.5 billion in April-November 2023 as compared with US$ 19.8 billion a year ago.44 Foreign portfolio investment (FPI) witnessed a sharp turnaround during 2023-24 (up to February 6) with net FPI inflows of US$ 32.4 billion as against net outflows of US$ 6.7 billion a year ago. Net accretions to non-resident deposits and net inflows under external commercial borrowings were also higher during the year.45 As on February 2, 2024, India’s foreign exchange reserves stood at US$ 622.5 billion.46 Vulnerability indicators suggest greater resilience of India’s external sector.47 We are confident of comfortably meeting all our external financing requirements.

Additional Measures

27. I shall now announce certain additional measures.

Review of the Regulatory Framework for Electronic Trading Platforms (ETPs)

28. The Reserve Bank’s extant regulatory framework for electronic trading platforms (ETPs) was issued in 2018. In view of the subsequent developments in markets, products, and technology, etc., a revised regulatory framework for ETPs will be issued for stakeholders’ feedback.

Hedging of Gold Price Risk in the Over the Counter (OTC) Market in the International Financial Services Centre (IFSC)

29. In December 2022, the Reserve Bank had permitted resident entities to hedge their gold price risk in recognised exchanges in the IFSC. It has now been decided to also allow resident entities to hedge the price of gold in the over the counter (OTC) segment in the IFSC. This will provide more flexibility to resident entities in hedging their exposure to gold prices.

Key Fact Statement (KFS) for Retail and MSME Loans & Advances

30. At present, the loans and advances availed by borrowers, apart from including the rate of interest, also include other fees and charges such as processing fees, documentation charges, etc. To enhance transparency in disclosure of such information, the Reserve Bank had mandated certain categories of lenders to provide the borrower a Key Fact Statement (KFS) containing essential information such as the all-inclusive annual percentage rate (APR) and recovery and grievance redress mechanism. The requirement of KFS is now being extended to cover all retail and MSME loans. This measure will lead to enhanced transparency in lending and enable customers in making informed decisions.

Enhancing the Robustness of AePS

31. Aadhaar Enabled Payment System (AePS) has played an important role in financial inclusion by enabling customers to make digital payment transactions through service providers such as business correspondents. Given their significance, it is proposed to streamline the process for on-boarding of AePS service providers and introduce some additional fraud risk management measures. These measures will further strengthen the security of the AePS system and enhance its robustness.

Principle-Based Framework for Authentication of Digital Payment Transactions

32. Over the years, the Reserve Bank has proactively facilitated introduction of various mechanisms such as Additional Factor of Authentication (AFA) for securing digital payments. While no particular mechanism was specified by the Reserve Bank, SMS-based OTP has become very popular. With technological advancements, however, alternative authentication mechanisms have emerged in recent years. Therefore, to facilitate adoption of alternative authentication mechanisms for enhancing the security of digital payments, it is proposed to put in place a principle-based framework for authentication of such transactions.

Introduction of Programmability and Offline Functionality in Central Bank Digital Currency (CBDC) Pilot

33. The CBDC Retail (CBDC-R) pilot currently enables Person to Person (P2P) and Person to Merchant (P2M) transactions. It is now proposed to enable additional functionalities of programmability and offline capability in CBDC retail payments. Programmability will facilitate transactions for specific/targeted purposes, while offline functionality will enable these transactions in areas with poor or limited internet connectivity.

Conclusion

34. The Indian economy is making confident progress on a strong, sustained and transformative growth path. Domestic and international investors are reposing greater confidence on India’s economic prospects. In our assessment, the current setting of monetary policy is moving in the right direction with growth holding firm and inflation trending down to the target. Therefore, much has been achieved, but we must remain vigilant. Policymaking during uncertain times has to be based on a continuous assessment of the incoming data and its implications for the evolving outlook.

35. We reaffirm our commitment to bring down inflation to the target of 4 per cent in a timely and sustainable manner. Price and financial stability are the foundations for strong, sustainable and inclusive growth. Our endeavour all along has been to take a holistic approach to keep the economy in balance. We must not only preserve the hard-earned strength and stability of the Indian economy but also build on this further for a long haul of higher growth with price and financial stability. In the current environment, what Mahatma Gandhi said long ago remains relevant and I quote: “I am moving cautiously, watching myself at every step. ….. but there is the fixed determination behind every act of mine…”48

Thank you. Namaskar.

(Yogesh Dayal)

Chief General Manager

Press Release: 2023-2024/1825

****

Monetary Policy Statement, 2023-24 Resolution of the Monetary Policy Committee (MPC) February 6 to 8, 2024

On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (February 8, 2024) decided to:

- Keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.50 per cent.

Consequently, the standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

- The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

Assessment and Outlook

2. Global growth is likely to remain steady in 2024 after a surprisingly resilient performance in a turbulent year gone by. Inflation is edging down from multi-decade highs, with intermittent upticks. Financial market sentiments have been fluctuating with changing views about an early pivot by central banks in advanced economies (AEs). The likelihood of lower interest rates has spurred rallies in equity markets, although uncertainty about the timing of interest rate reduction is reflected in bidirectional movements in the US dollar and sovereign bond yields. Emerging market economies (EMEs) are facing currency fluctuations amidst volatile capital flows.

3. Domestic economic activity is strengthening. As per the first advance estimates (FAE) released by the National Statistical Office (NSO), real gross domestic product (GDP) is expected to grow by 7.3 per cent, year-on-year (y-o-y) in 2023-24, underpinned by strong investment activity. On the supply side, gross value added (GVA) expanded by 6.9 per cent in 2023-24, with manufacturing and services sectors as the key drivers.

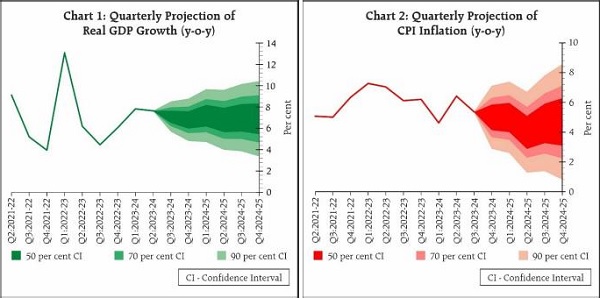

4. Looking ahead, recovery in rabi sowing, sustained profitability in manufacturing and underlying resilience of services should support economic activity in 2024-25. Among the key drivers on demand side, household consumption is expected to improve, while prospects of fixed investment remain bright owing to upturn in the private capex cycle, improved business sentiments, healthy balance sheets of banks and corporates; and government’s continued thrust on capital expenditure. Improving outlook for global trade and rising integration in global supply chain will support net external demand. Headwinds from geopolitical tensions, volatility in international financial markets and geoeconomic fragmentation, however, pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2024-25 is projected at 7.0 per cent with Q1 at 7.2 per cent; Q2 at 6.8 per cent; Q3 at 7.0 per cent; and Q4 at 6.9 per cent (Chart 1). The risks are evenly balanced.

5. From its October 2023 trough of 4.9 per cent, CPI inflation increased successively in the next two months to 5.7 per cent by December. Food inflation, primarily y-o-y vegetable price increases, drove the pick-up in headline inflation, even as deflation in fuel deepened. Core inflation (CPI inflation excluding food and fuel) softened to a four-year low of 3.8 per cent in December.

6. Going forward, the inflation trajectory would be shaped by the evolving food inflation outlook. Rabi sowing has surpassed last year’s level. The usual seasonal correction in vegetable prices is continuing, though unevenly. Yet considerable uncertainty prevails on the food price outlook from the possibility of adverse weather events. Effective supply side responses may keep food price pressures under check. The continuing pass-through of monetary policy actions and stance is keeping core inflation muted. Crude oil prices, however, remain volatile. Manufacturing firms covered in the Reserve Bank’s enterprise surveys expect some softening in the growth of input costs and selling prices in Q4:2023-24, while services and infrastructure firms expect higher input cost pressures and growth in selling prices. Taking into account these factors, CPI inflation is projected at 5.4 per cent for 2023-24 with Q4 at 5.0 per cent. Assuming a normal monsoon next year, CPI inflation for 2024-25 is projected at 4.5 per cent with Q1 at 5.0 per cent; Q2 at 4.0 per cent; Q3 at 4.6 per cent; and Q4 at 4.7 per cent (Chart 2). The risks are evenly balanced.

7. The MPC noted that domestic economic activity is holding up well and is expected to be backed by the momentum in investment demand, optimistic business sentiments and rising consumer confidence. On the inflation front, large and repetitive food price shocks are interrupting the pace of disinflation that is led by the moderation of core inflation. Geopolitical events and their impact on supply chains, and volatility in international financial markets and commodity prices are key sources of upside risks to inflation. The cumulative effect of policy repo rate increases is still working its way through the economy. The MPC will carefully monitor any signs of generalisation of food price pressures to non-food prices which can fritter away the gains in the easing of core inflation. As the path of disinflation needs to be sustained, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent in this meeting. Monetary policy must continue to be actively disinflationary to ensure anchoring of inflation expectations and fuller transmission. The MPC will remain resolute in its commitment to aligning inflation to the target. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

8. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to keep the policy repo rate unchanged at 6.50 per cent. Prof. Jayanth R. Varma voted to reduce the policy repo rate by 25 basis points.

9. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. Prof. Jayanth R. Varma voted for a change in stance to neutral.

10. The minutes of the MPC’s meeting will be published on February 22, 2024.

11. The next meeting of the MPC is scheduled during April 3 to 5, 2024.

(Yogesh Dayal)

Chief General Manager

Press Release: 2023-2024/1826

****

Statement on Developmental and Regulatory Policies

This Statement sets out various developmental and regulatory policy measures relating to (i) Financial Markets; (ii) Regulations; and (iii) Payment Systems and Fintech.

I. Financial Markets

1. Review of the Regulatory Framework for Electronic Trading Platforms

In October 2018, the Reserve Bank had put in place a regulatory framework for electronic trading platforms (ETPs) for executing transactions in financial instruments regulated by it. Under the framework, which aimed to ensure fair access through transparent, safe, and efficient trading processes, robust trading infrastructures and prevent market abuse, thirteen ETPs operated by five operators have since been authorised. Over the last few years, there has been increased integration of the onshore forex market with offshore markets, notable developments in the technology landscape and an increase in product diversity. Market makers have also made requests to access offshore ETPs offering permitted Indian Rupee (INR) products. In view of these developments, it has been decided to review the regulatory framework for ETPs. The revised regulatory framework will be issued separately for public feedback.

2. Hedging of Gold Price Risk in the Over the Counter (OTC) Market in the International Financial Services Centre (IFSC)

With a view to providing flexibility to resident entities to hedge their exposures to gold price risk efficiently, resident entities were permitted, in December 2022, to access recognised exchanges in the International Financial Services Centre (IFSC). It has now been decided to also allow them to hedge the price of gold in the over the counter (OTC) segment in the IFSC. This will provide resident entities more flexibility and easier access to derivative products in hedging their exposure to gold prices. The related instructions are being issued separately.

II. Regulations

3. Key Fact Statement (KFS) for Retail and MSME Loans & Advances

The Reserve Bank has announced several measures in the recent past to foster greater transparency and disclosure by the regulated entities (REs) in pricing of loans and other charges levied on the customers. One such measure is the requirement for lenders to provide their borrowers a Key Fact Statement (KFS) containing the key information regarding a loan agreement, including all-in-cost of the loan, in simple and easy to understand format. Currently KFS is specifically mandated in respect of loans by scheduled commercial banks to individual borrowers; digital lending by REs; and microfinance loans. Now, it has been decided to mandate all REs to provide the ‘Key Fact Statement’ (KFS) to the borrowers for all retail and MSME loans. Providing critical information about the terms of the loan agreement, including all-inclusive interest cost, shall greatly benefit the borrowers in making an informed decision.

III. Payment Systems and Fintech

4. Enhancing the Robustness of AePS

Aadhaar Enabled Payment System (AePS), operated by NPCI, enables customers to perform digital payment transactions in assisted mode. In 2023, more than 37 crore users undertook AePS transactions, which points to the important role played by AePS in financial inclusion. To enhance the security of AePS transactions, it is proposed to streamline the onboarding process, including mandatory due diligence, for AePS touchpoint operators, to be followed by banks. Additional fraud risk management requirements will also be considered. Instructions in this regard shall be issued shortly.

5. Principle-based Framework for Authentication of Digital Payment Transactions

Over the years, the Reserve Bank has prioritised security of digital payments, in particular the requirement of Additional Factor of Authentication (AFA). Though RBI has not prescribed any particular AFA, the payments ecosystem has largely adopted SMS-based One Time Password (OTP). With innovations in technology, alternative authentication mechanisms have emerged in recent years. To facilitate the use of such mechanisms for digital security, it is proposed to adopt a principle-based “Framework for authentication of digital payment transactions”. Instructions in this regard will be issued separately.

6. Introduction of Programmability and Offline Functionality in Central Bank Digital Currency (CBDC) Pilot

The CBDC Retail (CBDC-R) pilot currently enables Person to Person (P2P) and Person to Merchant (P2M) transactions using Digital Rupee wallets provided by pilot banks. It is now proposed to enable additional use cases using programmability and offline functionality. Programmability will permit users like, for instance, government agencies to ensure that payments are made for defined benefits. Similarly, corporates will be able to program specified expenditures like business travel for their employees. Additional features like validity period or geographical areas within which CBDC may be used can also be programmed. Second, it is proposed to introduce an offline functionality in CBDC-R for enabling transactions in areas with poor or limited internet connectivity. Multiple offline solutions (proximity and non-proximity based) across hilly areas, rural and urban locations will be tested for this purpose. These functionalities will be introduced through the pilots in a gradual manner.

(Yogesh Dayal)

Chief General Manager

Press Release: 2023-2024/1827

Notes

1 According to the latest update of the World Economic Outlook (WEO) of the IMF released on January 30, 2024, global growth is expected to remain steady at 3.1 per cent during 2024, the same as in 2023.

2 As per the latest WEO of the IMF, world trade volume (goods and services) growth is expected to accelerate to 3.3 per cent in 2024 from 0.4 per cent in 2023.

3 As per the latest WEO of the IMF, world consumer price inflation is expected to moderate to 5.8 per cent in 2024 from 6.8 per cent in 2023.

4 According to the IMF, the gross public debt to GDP ratio of Advanced Economies (AEs) is projected to increase from 104.1 per cent in 2019 to 112.1 per cent in 2023. For Emerging Market Economies (EMEs), the gross public debt to GDP ratio is estimated to increase from 55.9 per cent in 2019 to 68.3 per cent in 2023 (Fiscal Monitor, October 2023).

5 According to IMF, the general government debt of India increased to 88.5 per cent of GDP during the pandemic year 2020. This has come down to 81 per cent of GDP in 2022 and is projected to decline to 80.5 per cent in 2028 (IMF Fiscal Monitor, Oct 2023).

6 GDP expanded by 9.1 per cent and 7.2 per cent in 2021-22 and 2022-23, respectively. On the supply side, enhanced contribution from manufacturing sector and sustained buoyancy in construction activity and other services led to a growth of 6.9 per cent in gross value added (GVA) for 2023-24. Manufacturing expanded by 6.5 per cent while construction sector registered double digit growth of 10.7 per cent, respectively, during 2023-24.

7 Northeast monsoon ended with 9 per cent below long period average (LPA) rainfall. At the all-India level, the water storage position at 52 per cent of total reservoir capacity as of February 1, 2024 is lower by 17.3 per cent over the last year and 2.8 per cent over the decadal average.

8 As on February 2, 2024, rabi sowing has surpassed last year’s level and was higher by 5.2 percent over the normal 5-year average acreage. The acreage of wheat, oilseeds and coarse cereals has exceeded that of last year’s level by 0.7 per cent, 1.1 per cent and 7.1 per cent, respectively.

9 As per the 3rd AE (released on January 18, 2024), the production of horticultural crops during 202223, driven by higher production of fruits and vegetables, is placed at a record 355.3 million tonnes, 2.3 per cent higher over the final estimate of 2021-22. With record fish production of 175.45 lakh tons in 2022-23 (162.48 lakh tonnes in 2021-22), India is the third largest fish producing country in the world accounting for 8 per cent of global production and contributing over 6.7 per cent to the agricultural gross value added (GVA).

10 Index of industrial production (IIP) for manufacturing posted a growth of 5.6 per cent during October-November, while core industries recorded a robust growth of 7.8 per cent during Q3.

11 The early results of 494 listed manufacturing companies suggest GVA in nominal terms expanded by 15.4 per cent y-o-y driven by increase in gross profits by 16.8 per cent.

12 PMI manufacturing increased to 56.5 in January from 54.9 in December and remained above the long run trend. Business expectations, measured by future activity index over 12 months, strengthened to a 13-month high in January, boosted by increased new enquiries and product diversification, and robust demand.

13 E-way bills and toll collections increased by 17.1 per cent and 12.8 per cent, respectively, in Q3:2023-24, while port cargo rose by 10.1 per cent during this period. Railway freight traffic expanded by 6.4 per cent both in Q3 and January 2024. Goods and services tax (GST) collections growth accelerated to 12.9 per cent in Q3:2023-24 from 10.6 per cent growth in the preceding quarter. GST collections expanded by 10.4 per cent y-o-y to ₹1.72 lakh core in January to record second highest collection ever.

14 PMI services rose to 61.8 in January 2024 from 59.0 in December 2023, with the rate of expansion picking up to a six-month high.

15 The central government’s capital expenditure recorded a growth of 37.5 per cent in April-December 2023, on the top of 25.1 per cent growth during the same period last year. Steel consumption rose by 14.5 per cent, while cement production increased by 4.5 per cent during Q3.

16 According to Periodic Labour Force Survey (PLFS), urban unemployment rate has been secularly declining from 9.8 per cent in Q2: 2021-22 to 7.2 per cent in Q2:2022-23 and further to 6.6 per cent in Q2:2023-24.

17 Two-wheeler sales expanded by 22.6 per cent during Q3:2023-24, while tractor sales contracted by 4.9 per cent during this period.

18 Mahatma Gandhi National Rural Employment Guarantee Act or MGNREGA work demand declined by 5.5 per cent in December 2023 and 4.8 per cent in January 2024.

19 According to the press release issued on November 29, 2023, the Central government will provide free food grains to about 81.35 crore beneficiaries under the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) for a period of five years with effect from 1st January 2024, aimed at ensuring food and nutrition security.

20 Domestic air passengers traffic expanded by 9.1 per cent while passenger vehicles sales posted a growth y-o-y of 8.3 per cent in Q3:2023-24. Early corporate results suggest that staff cost of listed manufacturing companies increased by 11.0 per cent in Q3: 2023-24.

21 Capital expenditure in BE 2024-25 increased to ₹11.1 lakh crore (3.4 per cent of GDP), an increase of 16.9 per cent over ₹9.5 lakh crore in RE 2023-24 and 11.1 per cent over ₹10.0 lakh crore in BE 202324.

22 Final results suggest capacity utilisation increased by 40 bps to 74.0 per cent in Q2:2023-24. The long-term average is 73.7 per cent which pertains to the period Q1:2008-09 to Q2:2023-24 excluding Q1:2020-21. Seasonally adjusted CU, however, declined by 90 bps and stands at 74.5 per cent in Q2:2023-24.

23 As on January 12, 2024, the total flow of resources to the commercial sector from banks and other sources at ₹23.6 lakh crore during the current financial year so far is significantly higher than that of last year (₹19.8 lakh crore).

24 Investment under PLI scheme has already matured to the extent of ₹1.03 lakh till November 2023 so far.

25 This was primarily driven by key industries such as steel, petroleum, textiles, power, chemicals, food processing, and construction.

26 Merchandise trade deficit declined to US$ 70.5 billion in Q3 from US$ 71.5 billion during the same quarter last year.

27 As headline inflation edged up to 5.7 per cent in December from a low of 4.9 per cent in October, CPI food inflation increased to 8.7 per cent in December 2023 from 6.3 per cent in October. The pick-up in food inflation since November was primarily driven by vegetables along with fruits, pulses and sugar.

28 In December, CPI excluding food and fuel inflation moderated in eight of the 10 sub-group/groups and remained steady in the remining two. Inflation moderated in sub-groups/groups such as clothing and footwear, health, transport and communication, education, personal care and effects, among others.

29 Headline inflation was 4.3 per cent in May 2023 and 7.4 per cent in July 2023.

30 System level liquidity is measured by the difference between liquidity absorption and liquidity injection under the liquidity adjustment facility (LAF). Liquidity absorption under LAF includes reverse repos (main as well as fine-tuning operations) and standing deposit facility (SDF). Liquidity injection under LAF includes repos (main as well as fine-tuning operations) and marginal standing facility (MSF). In other words, System level liquidity = [(Reverse repos +SDF) – (Repo + MSF)]. A net positive number represents system surplus level liquidity, while a net negative number represents system level deficit liquidity.

31 The system level liquidity deficit widened from an average of ₹0.42 lakh crore during September-November 2023 to ₹1.61 lakh crore during December-January.

32 Between December 15, 2023 – January 31, 2024, nine fine tuning variable rate repo (VRR) operations of 1-7 days maturity were conducted amounting to ₹7.75 lakh crore, while two main VRR operations injected ₹4.25 lakh crore into the system.

33 The Reserve Bank conducted two 4-day VRRR auctions of ₹50,000 crore each on February 2 and February 5, 2024, respectively. In addition, two 1-day VRRR auctions of ₹75,000 crore and ₹50,000 crore were conducted on February 6 and two 1-day VRRR auctions of ₹50,000 crore each on February 7, 2024. Thus, against a total notified amount of ₹3,25,000 crore, the amount absorbed through these auctions was ₹1,53,915 crore.

34 During December-January, the average term spread (10-year minus 91-day Treasury Bills) softened to 24 basis points (bps) from 40 bps in October-November.

35 The weighted average lending rate (WALR) on fresh rupee loans rose by 181 bps while that on outstanding loans rose by 113 bps during the current tightening cycle (May 2022 – December 2023). During the same period, the weighted average domestic term deposit rates (WADTDR) on fresh deposits and outstanding deposits rose by 246 basis points and 180 bps, respectively.

36 This has indeed been reflected in the behavior of banks with lower placement of funds under the SDF and lower recourse to the MSF on Fridays since December 30. Average placement of funds under the SDF and funds availed under the MSF have moderated to ₹0.64 lakh crore and ₹0.38 lakh crore, respectively, during the Friday’s since December 30 (up to February 2, 2024) as compared with ₹0.70 lakh crore and ₹0.86 lakh crore, respectively, in the Fridays since the beginning of December.

37 As of February 7, 2024, the depreciation of Indian rupee (INR) at 0.9 per cent against the US dollar on a financial year basis is lower as compared to emerging market peers like Chinese yuan, Thailand baht, Indonesian rupiah, Vietnamese dong and Malaysian ringgit and a few advanced economy currencies like Japanese yen, Australian dollar, Korean won and New Zealand dollar.

38 For the period April to January, the coefficients of variation (CV) of the INR were 1.4 per cent, 1.0 per cent, 2.7 per cent, and 0.6 per cent for the years 2020-21, 2021-22, 2022-23 and 2023-24 respectively. For the period April to January 2022-23 and 2023-24, the INR was one of the least volatile in terms of CV among various peer EME currencies including the Chinese yuan, the Thailand baht, Indonesian rupiah, and the Malaysian ringgit.

39 The key indicators of capital and asset quality of scheduled commercial banks (SCBs) improved further as of end-September 2023. The capital adequacy ratio (CRAR) and the liquidity coverage ratio (LCR) of SCBs were well above the regulatory threshold. The CRAR ratio of SCBs stood at 16.8 per cent in September 2023. The LCR of SCBs was comfortable at 135.4 per cent, much above the minimum stipulation of 100 per cent. SCBs’ gross non-performing assets (GNPA) ratio and the net nonperforming assets (NNPA) ratio declined to a multi-year low of 3.2 per cent and 0.8 per cent, respectively, in September 2023.

40 The resilience of the NBFCs sector improved with CRAR at 27.6 per cent, GNPA ratio at 4.1 per cent and return on assets (RoA) at 2.9 per cent, respectively, in September 2023.

41 India’s services exports grew by 5.1 per cent on a y-o-y basis during October-December 2023.

42 India’s rising software and business services exports through Global Capability Centres (GCCs) are a testament to its growing dominance in high-skilled and high-value services exports. Riding on the wave of big data, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT) and advancements in compatible hardware, generative AI, and spatial computing opens up newer dimensions for Indian software exports.

43 According to the World Bank, India’s inward remittances would rise by 8.0 per cent in 2024. India’s share is around 15 per cent of the global inward remittances.

44 Net inflows were lower during April-November 2023 due to higher repatriation at US$ 25.6 billion as against US$ 19.9 billion during same period last year. Gross inward FDI was marginally lower at US$ 47.0 billion during April-November 2023 as against US$ 49.0 billion during the same period last year.

45 Net accretions to non-resident deposits increased by US$ 7.3 billion during April-November 2023 from US$ 3.6 billion a year ago, led by higher inflows in NRE and FCNR(B) accounts. Net inflows of ECBs to India were US$ 1.6 billion during April-December 2023 as against net outflows of US$ 5.9 billion a year ago.

46 The Foreign exchange Reserves cover more than ten months of projected imports for 2023-24 and 97.1 per cent of total external debt as on end-September 2023.

47 India’s external debt/GDP ratio fell from 20.0 per cent at end-March 2022 to 18.6 per cent at end-September 2023. The debt service ratio increased from 5.2 per cent to 6.7 per cent during the same period.

48 Mahatma Gandhi, Collected Works, Vol. 82