1. The season to file Income Tax Returns has just started. The due date to file a TDS return by the deductor got over on 31st May 2022 and it’s high time for the taxpayers to focus on filing Income Tax Returns.

1.1 It is advisable to download Form 26AS from the Income Tax portal and match the same with documents like Form 16, Bank Statement, etc. before filing the ITR.

1.2 Form. 26AS is like a consolidated tax passbook that contains details of the taxes deducted and deposited against the taxpayer’s PAN with the Government.

1.3 A situation where the tax deducted by the payer is not reflected in Form 26AS, is called a Tax Credit Mismatch.

2. Reasons for Tax Credit Mismatch: The possible reasons for Tax Credit Mismatch are as follows:

(a) TDS is not deposited with the Government by the Deductor.

(b) TDS is deposited, but the TDS statement is not yet filed.

(c) The deductor has quoted the wrong PAN in the TDS statement.

(d) An incorrect TDS amount has been mentioned in the TDS statement.

3. Corrective Action: These errors can be rectified by the deductor only. The taxpayer should approach the deductor to correct the mistake and ensure the corrective action before the filing of ITR as the TDS credit shall not be allowed to him in case of Credit Mismatch.

3.1 What if, the deductor refuses to entertain the taxpayer’s request? A taxpayer has no legal right to force the deductor to deposit TDS or make any corrections in TDS Statement / Revised Return.

4. Remedy to the Taxpayer: The only remedy available to the taxpayer is to file a grievance. The assessee shall log in to the e-portal and submit a grievance to the concerned Authority with relevant documents and a description of the grievance.

4.1 Steps to Submit Grievance

(a) Visit https://eportal.incometax.gov.in

(b) Login using registered PAN and password

(c) Click on Grievance > submit Grievance

(d) Select from the drop-down menu the Grievance details such as department, category, and sub-category of grievance, Assessment Year to which the grievance relates, and the description of the grievance. The following screen will be displayed:

(e) The assessee can also upload the files from the given list or other files. Upload the file by clicking on ‘Upload Attachment and then click ‘Preview and Submit’.

4.2 On Receipt of Notice: Even after doing all this, the assessee may get a Notice from the department. In response to the demand notice, he can file a reply on the e-filing portal with supporting documents of TDS deducted from his income.

The taxpayer can submit Form 16/16A, salary slips, and bank statement showing credit of net salary/other income after deduction of TDS.

It is advisable to obtain Form 16 / 16A from the deductor. If tax is deducted and a TDS certificate is issued, credit of TDS cannot be denied to the recipient solely on the ground that such credit does not appear in Form 26AS. The last date for issuing Form 16 by an employer is 15th June.

AO is bound to allow TDS credit to the taxpayer if the documents submitted are found correct. However, if he still doesn’t allow the credit, the last option left is to file an appeal before CIT(A).

5. Statutory Provisions Section 205 of the Act provides that where tax is deductible at the source under Chapter XVII of the Act, the assessee shall not be called upon to pay the tax. Further, according to Section 191 of the Act, a person is liable to pay the tax directly (on his/her own) on salary income only if tax has not been deducted from the salary in the form of TDS.

6. Judicial Pronouncement The Courts have dealt with this matter on multiple occasions and have ruled in favor of the taxpayer:

In the case of Kartik Vijaysinh Sonavane Vs DCIT (2021) Gujarat, it is held by the Honorable Gujarat High Court that the Assessing Officer cannot deny credit of TDS to the employee if the employer had deducted the TDS but not deposited it in the Central Government Account. In such cases, the only course of action that remains with the income-tax department is resorting to Section 201 and recovering TDS from the employer.

The Gujarat High Court allowed the petition of the assessee and held that no separate reasoning was desirable. The department is precluded from denying the benefit of the tax deducted at source by the employer during the relevant financial years to the assessee.

The credit of tax shall be given to the assessee, and if in the interim any recovery or adjustment is made by the AO, the assessee shall be entitled to the refund of the same along with the statutory interest.

7. CBDT’s Clarification: The CBDT vide Instruction No. 5/2013, dated 8-7-2013 issued instructions for the processing of Income-tax returns and giving credit for TDS thereon in the case of TDS mismatch.

7.1 It has been decided by the Board that when an assessee approaches the Assessing Officer with requisite details and particulars in the form of a TDS certificate as evidence against any mismatched amount, the said Assessing Officer will verify whether or not the deductor has made payment of the TDS in the Government Account and if the payment has been made, credit of the same should be given to the assessee.

No recovery can be made from deductee if tax has been deducted but not deposited by the deductor:

7.2 CBDT vide letter of even number dated 1-6-2015, issued directions to the field officers that in case of an assessee whose tax has been deducted at source but not deposited to the Government’s account by the deductor, the deductee assessee shall not be called upon to pay the demand to the extent tax has been deducted from his income.

It was further specified that section 205 puts a bar on direct demand against the assessee in such cases and the demand on account of tax credit mismatch in such situations cannot be enforced coercively.

8. Other Relevant Points:

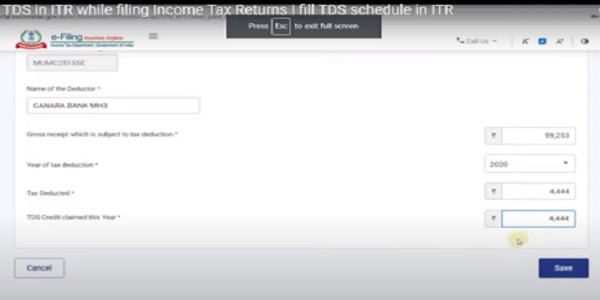

8.1 The details of TDS deducted need to be reported in Schedule “Tax Paid “in Income Tax Return

8.2 The Credit for the tax deducted at source is allowed in the assessment year in which respective income is assessable. If income is assessable over several years, credit for the tax deducted at source will be allowed across those years in the same proportion in which such income is assessable.

8.3 The taxpayer shall claim TDS credit on income that is paid or accrues in the financial year. If TDS is deducted on advance payment, then the portion of TDS relating to the advance income will have to be carried forward to the next FY in which the income is earned.

Disclaimer: The article is for education purposes only.

The author can be approached at canitabhadra@gmail.com

Our case is related to AY 2009-10 and 2010-10. TDS Credit has been corrected by the employer this month. Demand is still existing from 2010, 2011. How to get the same rectified / adjusted.

Hlw Sir

I’m I used to do driver job in government office but the poor mindset government officials never paid me. So filed a case in court and won it. So some how they provided me salary of previous 5 years on 24/03/2021. But they deducted my TDS on because they credited salary in once so the total amount of salary was 12.76L and deducted TDS 2.04L.

But they didn’t provided me form 16 and also the data was not reflecting in 26 AS. I again started forcing them through courts and executive departments. Then some how they provided me form 16 in last August 2022. And filed challans of TDS on 2nd of August 2022.But they credited TDS in AY 21-22.

I had already filed ITR 21-22 without claiming that tds. I was afraid that.. I don’t have any proof regarding this TDS. Except the bank account.

So as per now.. What can I do.. To get that TDS. My salary was never taxable. It was merely between 19-21K per

I submitted my return taking the receipt amount and TDs as in 26AS. However post submission to my return one TDs deductor uploaded payment of TDs in the portal. There after I received a demand notice from IT Department taking it as as unexplained income u/s 68. Can they treat this as an “Unexplained” Income

No it’s not unexplained income. Reply to notice and if the TDS uploaded is correct as per your records, you can revise your return

TDS DEDUCTED SHOWN IN 26 AS IS RS 13111 BUT UNDER TAX PAID SCHUDLE IN ITR 3 IN PREFILLED DATA AMOUNT SHOWN IS RS 10140.HOW TO CORRECT THE FIGURE IN PREFILLED DATA.

The TDS in ITR can be added by click on Add details in the schedule Tax Paid

If critically read and insightfully considered, the writer of the Article could have more usefully covered many more not-so-obvious areas of most common concern ?!

On the aspect of TDS/TCS, not only under the DT regime but also under the IDT regime and the own quota of woes and criticalities that has given rise to, look through the several related Pr. Posts.

WRT the comment posted herein, it needs to be kept in focus that the deductor , besides clarifying the date on which the higher interest amount as displayed on 26AS was credited , should also clarify WHEN- that is, before the end of the relevant Fiscal Year or not. If not but later, then the deductor is duty bound ensure that the deductee is not put any loss/inconvenience by taking appropriate steps as warranted!?

To narrate own personal bitter experience of a varying kind(:

As a loyal holder of a Flexi Deposit Account with a PSB ,for over 2 decades now, have been facing in recent years, the problem of MISMATCH between certified statement of Interest and TDS and the DATA, in excess/on a higher side, as uploaded on 26 AS.

Further, the Br. Head successively in charge, has no clue or explanation to offer as to when that PLUS difference in interest credited to my ACCOUNT. Hence suspect that, may be, there is something fishy?!

To be noted, if me go by the DATA as disclosed on 26 AS, will be offering the excess interest for tax, though not received; also pay tax on such excess- a double whammy ?!

Does anyone else have similar untoward experience, to openly share for THE COMMON GOOD !

I send my compliments for very useful article. Property of the assessee mortgaged with the bank was auctioned. TDS was not deposited by the auction purchaser but paid full auctioned price to the bank which has been credited to the account of the assessee. TDS @ 1% was deducted from the account of the assessee by the bank and deposited but bank mentioned the pan no of the auction purchaser instead of the seller ie assesses with the result the credit of tds has been given to the auction purchaser and is not reflected to the credit of the assesses with the result credit is not given .correction is not applied by the bank inspite of sending 50 reminders. what can be done?

Glitches in itr 1.80ttb not reflected.for deduction for sr citizen.