Audit of accounts of certain persons carrying on business or profession. 44AB.

Every person –

(a) carrying on business shall,

> if his total sales, turnover or gross receipts,

> as the case may be,

> in business exceed or exceeds

> one crore rupees in any previous year

Following proviso is inserted after clause (a) of section 44AB by the Finance Act, 2021, w.e.f. 1-4-2021:

[Provided that in the case of a person whose—

(a) aggregate of all amounts received including amount received for sales, turnover or gross receipts during the previous year, in cash, does not exceed five per cent of the said amount; and

(b) aggregate of all payments made including amount incurred for expenditure, in cash,

During the previous year does not exceed five per cent of the said payment, this clause shall have effect as if for the words “one crore rupees”, the words “ten crore rupees” had been substituted; or]

It has been provided further that for the purposes of this clause, the payment or receipt, as the case may be, by a cheque drawn on a bank or by a bank draft, which is not account payee, shall be deemed to be the payment or receipt, as the case may be, in cash.

Section 44AB(b)

carrying on profession shall,

> if his gross receipts in profession

> Exceed fifty lacs rupees

> in any previous year; or

Section 44AB(c)

carrying on the business shall,

> if the profits and gains from the business are deemed to be the profits and gains of such person

> under section 44AE or section 44BB or section 44BBB,

> as the case may be,

> and he has claimed his income to be lower than the profits or gains

> so deemed to be the profits and gains of his business,

> as the case may be,

> in any previous year; or

Section 44AB(d)

carrying on the profession shall,

> if the profits and gains from the profession are deemed to be the profits and gains of such person under section 44ADA and

> he has claimed such income to be lower than the profits and gains so deemed to be the profits and gains of his profession and

> his income exceeds the maximum amount

> which is not chargeable to income-tax in any previous year; or

Section 44AB(e)

carrying on the business shall,

> if the provisions of sub-section (4) of section 44AD are applicable in his case and

> his income exceeds the maximum amount which is not chargeable to income-tax in any previous year,

> get his accounts of such previous year audited by an accountant before the specified date and

> furnish by that date the report of such audit

> in the prescribed form duly signed and

> verified by such accountant and

> setting forth such particulars as may be prescribed :

Provided that this section shall not apply to the person,

> who declares profits and gains for the previous year in accordance with the provisions of sub-section (1) of section 44AD and

> his total sales, turnover or gross receipts,

> as the case may be,

> in business does not exceed two crore rupees in such previous year:

> Provided further that this section shall not apply to the person,

> who derives income of the nature referred to in section 44B or section 44BBA,

> on and from the 1st day of April, 1985 or,

> as the case may be,

> the date on which the relevant section came into force,

> whichever is later :

Provided also that in a case,

> where such person is required by or under any other law to get his accounts audited,

> it shall be sufficient compliance with the provisions of this section

> if such person gets the accounts of such business or profession audited under such law

> before the specified date and

> furnishes by that date the report of the audit as required under such other law and

> further report by an accountant in the form prescribed under this section.

Amendment in Tax Audit Provisions

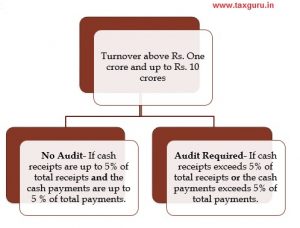

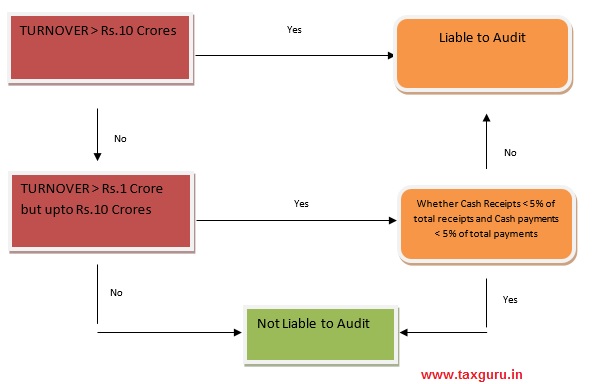

Finance Act, 2020 has introduced a proviso to sec 44AB(a) to encourage less-cash economy and to encourage digital transactions. If the turnover of the assessee is up to Rs.5 crores and his cash receipts are up to 5% of total receipts and the cash payments are up to 5 % of total payments, then the assessee would not be required to get his books of accounts audited.

The Finance Act, 2021 has increased the threshold limit of turnover for tax audit u/s 44AB from Rs.5 crores to Rs.10 crores where cash transactions do not exceed 5% of total transactions. This amendment will take effect from 1st April 2021 and will, accordingly, apply in relation to the assessment year 2021-22. Thus, the higher limit of turnover will take effect from F.Y. 2020-21 itself.

The Finance Act, 2021 has added a new second proviso to section 44AB(a) which is reproduced below-

“Provided further that for the purposes of this clause, the payment or receipt, as the case may be, by a cheque drawn on a bank or by a bank draft, which is not account payee, shall be deemed to be the payment or receipt, as the case may be, in cash.”

As per provisions of section 44AB, turnover limit for tax audit has been increased from 1 crore to 10 crore if receipts and payment are within the permissible cash limit. The Finance Act, 2021 has introduced new proviso to section 44AB(a) wherein it has been stated that transactions through non account payee cheques shall be considered as deemed cash for this clause. This point is very important because large chunk of audit shall be governed on interpretation and adoption of this proviso. Here it is interesting to state that deeming provisions is with respect to only cheques and not for E-Payment or digital payment hence RTGS/NEFT etc. shall always be treated as non-cash. Now most important question is how to prove receipt and payment of cheque through account payee mode is a burning issue as assessee does not possess any documentary evidence thereof and only option left with the assessee to collect scanned copies of all cheques from the bank. After introduction of CTS clearing system, scanned copies all receipts and issued cheques remain with the banks but it is very cumbersome to get scanned copies of cheques from the bank looking to the magnitude of cheques. Though intention of the legislature is to ease the compliance burden of small assessee if they are dealing mostly through banking channel accordingly threshold limit for tax audit shall be 10 crore but

This will lead to a situation where the assessee has to prove that the transactions are indeed carried on through account payee cheques. In the case of RTGS, NEFT or other digital modes of receipts or payments, there will not be any problem in proving that those transactions are carried on digitally in non-cash mode. The problem will be there in case of transactions carried on through cheques. Both the bearer/crossed and account payee cheques will be reflected as ‘cheque transactions’ in the bank statements. Thus it will not be possible for the assessee to prove that such cheque transactions are indeed account-payee cheque. Remember, one needs to prove it for both the receipts of cheques and payments by cheques.

Following observations can be made regarding the increased threshold limit for Tax Audit under section 44AB –

a) The amendment is carried out only in section 44AB and no amendment has been made in section 44AD. Thus, the turnover limit of 2 crores for opting Section 44AD shall continue.

b) The term aggregate of all receipts and aggregate of all payments‟ is very wide and covers not only receipts and payments on account of sale and purchase but also all other business transactions.

All the payments or receipts including capital introduction, drawings, receipt and repayment of loans, purchase of fixed assets, etc. shall be considered. Even taxes paid in cash shall be included for the calculation.

In other words, all the receipts and payments made by the entity shall be considered for calculating total value of receipts and payments as well as the aggregate value of receipts or payments made in cash.

c) It is not pointed out who will certify the margin of transactions in cash mode of 5%. It appears that assessee himself shall declare the percentage of receipts in cash and non-cash mode.

d) This increased threshold limit for Tax Audit is applicable for a business entity only and the threshold limit for Tax Audit for a professional shall continue to be at Rs.50 lacs even if more than 95% of the transactions are in digital mode.

e) Any assessee whose turnover exceeds Rs.10 crores (5 crores for A.Y. 2020-21), is required to get the books of accounts audited. The rate of profits declared, or method of receipt and payment is irrelevant.

Discussion on new proviso on the subject matter of Deemed Cash for turnover purpose:

It is to be noted that cash receipts are to be compared with total receipts and cash payments are to be compared with total payments separately. Cash Receipts/Payments are not to be compared with aggregate of receipts and payments.

The expression “aggregate of all amounts received” denotes the Total Receipts of the assessee in cash and through banking channels. Total receipts invariably include receipt from sales or turnover of the business of the assessee. The words ‘in cash’ only includes receipts in cash mode only. In other words, the assessee must have received the amount in cash.

The words ‘said amount’ refers to “aggregate of all amounts received” (Total Receipts) and not to the turnover or sales amount.

Similarly, the expression “aggregate of all payments” denotes the Total Payments of the assessee in cash and through banking channels. Similarly, the words ‘said payment’ refer to the total payment which is invariably the “aggregate of all payments”.

In certain provisions, the law has used the words “an account payee cheque or an account payee bank draft or use of electronic clearing system through a bank account or through such other electronic mode as may be prescribed” and not the ‘cash’.

Hence transactions in the following modes will be regarded as transactions not carried on in cash-

(i) Account Payee Cheques

(ii) Demand Draft/Pay Order

(iii) Credit Card

(iv) Debit Card

(v) Net Banking

(vi) IMPS (Immediate Payment Service)

(vii) UPI (Unified Payment Interface)

(viii) RTGS (Real Time Gross Settlement)

(ix) NEFT (National Electronic Funds Transfer)

(x) BHIM (Bharat Interface for Money) Aadhaar Pay

CBDT has notified the ‘other electronic mode of payments‘ by Notification No. 08/2020 dated 29.01.2020.

The limit of 5% receipt in cash or payments in cash is not limited to sale or purchase transactions. It rather covers all receipts and payments in cash including sales and purchases. In general receipts in cash of the following nature are included-

- Receipt on Sale of goods and services

- Receipt from debtors for the current year sales/outstanding receivables from earlier years

- Sale of fixed assets

- Sale of scrap

- Receipt of Loans and Advances

- Trade advances

- Receipt of deposits

- Sale of investments

Some typical payments in cash of a business concern included are-

- Payments for Purchases

- Payment to Creditors for current year purchases/outstanding creditors

- Purchase of Fixed Assets and other Capital Expenditure

- Payments for salary, electricity, telephone charges, and other revenue expenditure

- Payments for Insurance

- Repayment of Loans and Advances

- Loans given

- Trade Advances given

- Deposits made, etc.

Issues while Computing the Limit of 5% Cash Transactions

Some of the issues in computing the limit of 5% cash transactions (receipts and payments) for the purpose of applicability of higher turnover limit of Rs.5 crore u/s 44AB are discussed below-

1. Capital Contribution: When an Individual/sole proprietor introduces capital in his business in cash, then the same shall not be included in the total receipts in cash of the assessee. This is for the simple reason that one cannot transact with himself.

However, the notified ITR forms do not follow this principle. It requires that all the cash receipt of the business including capital contribution should be considered in determining the 5% cash transactions limit.

However, in case of partnership firms, the situation is different since a firm is assessed as a separate person under income tax law and is considered distinct from its partners. To clarify, if a firm receives any capital contribution in cash from any partner, it shall be counted towards the limit of 5%.

2. Direct cash deposit into bank account by customers: In this case, it will be included in cash transactions. Even if the assessee debits the bank account in his books, it will be regarded as a cash transaction since the account is ultimately settled in cash. The Allahabad high Court has held in the case of Ajai Kumar Singh KhaldelialTS-35-HC-2020(ALL) that cash deposit in the bank account of supplier is disallowed u/s 40A(3) of the Act. The court held that depositing cash directly in the bank account of the supplier / beneficiary cannot be referred to as payment made through electronic clearing system, covered as an exception under Rule 6DD(c)(v); Observes that the term use of electronic clearing system through bank account” as stipulated in Rule 6DD(c)(v) would necessarily include the transaction of funds by electronic mode through clearing system i.e. through electronic mode of transfer such as NEFT, RTGS, IMPS, etc.; Opines that, Such transaction by depositing cash directly in the bank account of the beneficiary is not routed through any clearing house nor is the money send through electronic mode and therefore such a transaction in my considered opinion cannot be covered by Rule 6DD(c)(v) ”; Moreover notes that the assessee failed to provide any evidence to show that he had deposited the amount on the instructions of the beneficiary or due to any business exigency, thus holds that, In absence of such evidence, the assessing authority rightly denied the benefit of exemption to the petitioner.”, cites SC ruling in Attar Singh Gurmukh Singh.

3. Direct Cash deposit in creditors account: It will be included in computing cash payments of the assessee since the account is ultimately settled in cash.

4. Receipts/Payments in bearer cheques: In case the amount is received by a ‘bearer cheque’ and the same is used for withdrawing cash from the payer’s account, it will amount to a cash transaction.

5. Capital Expenditure: All the payments in cash are included whether it is paid for revenue expenditure or capital expenditure. There is no differentiation provided in the law.

6. Capital Receipt/Exempt Income- All receipts include receipts of capital nature and also the exempt income for e.g. Agricultural Income.

7. Adjustment by book entry: In a case where a person is a customer as well as vendor of the assessee. The debtors’ amount is set-off with the amount payable to the same person/vendor. Since no cash is involved in settling the due amount, this will be considered as non-cash transactions.

8. Cash deposited and Cash Withdrawals from bank account: Cash deposit and the cash withdrawals from the bank account amounts to contra entry or transactions with self and hence are excluded for computing the 5% cash limit.

Thus, any receipt of advance, receipt and repayment of loan, direct and indirect expenses, etc. – every transaction is covered in calculating the limit of 5% transactions in cash.

In order to compute the limit, the assessee should aggregate all the receipts from his cash ledger and bank ledger and then find out the percentage of cash receipts.

Similarly, the assessee should aggregate all the payments from his cash ledger and bank ledger and then find out the percentage of cash payments.

If both the cash receipts and cash payments is 5% or less, he shall get the benefit of higher turnover limit of Rs.5 crore for tax audit. Otherwise, the limit of turnover for applicability of tax audit shall be Rs.1 crore.

Conditions for the Applicability of New provisions of tax audit

Limit of Rs.10 crore applicable when following conditions are satisfied:

(a) aggregate of all amounts received in cash does not exceed 5% of the said amount;

AND

(b) aggregate of all payments made in cash does not exceed 5% of the said payment

Example: Mr. X, is into business and has turnover of less than Rs.10 crores during the financial year 2020-21. The following transactions in FY 2020-21 are hereunder:

A. Calculation of Total Receipts:

| Particulars | CASH | CHEQUE | TOTAL |

| Cash Sales | 100 | 380 | 480 |

| Receipt from debtors | 20 | 1300 | 1320 |

| Loan receipts | – | 200 | 200 |

| Total | 120 | 1880 | 2000 |

B. Calculation of Total Payments:

| Particulars | CASH | CHEQUE | TOTAL |

| Payment of expenses | 81 | 519 | 600 |

| Payment to creditors | – | 1080 | 1080 |

| Loan payments | – | 120 | 120 |

| Total | 81 | 1719 | 1800 |

C. Computation of percentage of cash receipts & payments

| Particulars | TOTAL (A) | CASH (B) | % in cash (B/A *100) |

| Receipts | 2000 | 120 | 6 |

| Payments | 1800 | 81 | 4.5% |

In the given case, Mr. X isn’t entitled to the benefit of the increased threshold limit of Rs.10 crores for the tax audit. In his case, though the payment made in cash during the year does not exceed 5% of total payments, the percentage of cash receipts exceeds the limit of 5%. In this case Mr. X is fulfilling only one condition of payments and the condition in case of receipts is not fulfilled. To take the benefit of this section he has to follow both the conditions.

Whether Mr. X is entitle to get benefit of threshold, if he into the profession?

Clause (a) of Section 44AB talks about a person carrying on business whereas clause (b) talks about a person carrying on a profession. The new proviso to section 44AB providing the enhanced turnover limit of Rs.10 crores for the tax audit is inserted to clause (a) to section 44AB. Thus, the persons engaged in the profession aren’t entitled to claim enhanced turnover limit of Rs.10 crore for the tax audit.

Whether the Amendment brought by FA 2020 is applicable retrospectively?

Yes, it is trite law that where a provision is curative or merely declaratory / clarificatory of provisions of law shall be applied retrospectively.

- Allied Motors Pvt Ltd Vs. ITO (1997) 224 ITR 677 (SC).

- CIT Vs. Gold Coin Health Food Pvt Ltd (2008) 304 ITR 308 (SC).

- CIT Vs. Calcutta Export Co (2018) 404 ITR 654 (SC).

- CIT Vs. Ansal Landmark Township Pvt Ltd (2015) 377 ITR 635 (Del.HC).

The following table shows the different situations under which the books of accounts are to be audited under section 44AB of the Act.

| Sr. No. | Person | When required to get accounts audited in terms of section 44AB | Clause of section 44AB |

| 1. | Every person carrying on profession referred to in section 44AA(1) profits from which are assessable on presumptive basis under section 44ADA | If he claims his profits and gains from such profession are lower than 50% of his gross receipts for the previous year in question and his total income exceeds the maximum amount which is not chargeable to income-tax in any previous year | Clause (d) |

| 2. | Every person carrying on profession [other than those covered by clause (d) of section 44AB] | If his total gross receipts from profession exceed Rs.50 lacss in any previous year | Clause (b) |

| 3. | Every person who derives income of the nature referred to in section 44B or section 44BBA | Section 44AB does not apply to such person & hence no need to get accounts audited u/s 44AB | 2nd proviso to section 44AB |

| 4. | Every person carrying on business profits of which are assessable on presumptive basis under section 44AE or section 44BB or section 44BBB | If he claims his profits and gains from such business are lower than the amount deemed to be profits and gains under the said section | Clause (c) |

| 5. | Every person carrying on business where the provisions of section 44AD(4) are applicable in his case | If his total income exceeds the maximum amount which is not chargeable to income-tax in any previous year

Section 44AB shall not apply to the person who declares profits and gains for the previous year in accordance with section 44AD(1) and his total sales, turnover or gross receipts, as the case may be, in business does not exceed Rs.2 crore [first proviso to section 44AB] |

Clause (e) first proviso |

| 6. | Every person carrying on any agency business | If his total sales, turnover or gross receipts , as the case may be, in business exceed or exceeds Rs.1 crore in any previous year | Clause (a) |

| 7. | Every person carrying on business who is earning income in the nature or commission or brokerage | If his total sales, turnover or gross receipts , as the case may be, in business exceed or exceeds Rs.1 crore in any previous year | Clause (a) |

| 8. | Every person carrying on profession referred to in section 44AA(1) who is also carrying on any business | Gross receipts of profession and business not to be clubbed for computing the limits of Rs.1 crore [clause (a)] and/or Rs.50 lacss [clause (b)]. Account of profession to be audited if clause (b) or (d) of section 44AB applies. Accounts of business to be audited if total sales, turnover or gross receipts, as the case may be, in business exceed or exceeds Rs.1 crore in any previous year since section 44AD is not applicable to person carrying on profession referred to in section 44AA(1) | Clause (a) |

| 9. | Every “eligible assessee” (as defined in section 44AD) carrying on “any eligible business” (as defined in section 44AD) turnover of which exceeds Rs.2 crores in any previous year, and proviso to sec 44AB(a) not applicable.

Both payment and receipt in cash does not exceed 5% of the total receipts and payment respectively Either payment or receipt in cash exceeds 5% of the total receipts and payment respectively |

Assessee not eligible to opt for section 44AD. Therefore, he must get his accounts audited in terms of section 44AB(a) since his turnover exceeds Rs.2 crores and thus exceeds Rs.1 crore limit in clause (a)

Audit u/s 44AD not applicable if total sales, turnover or gross receipt from business during the previous year does not exceed Rs.10 crore If total sales, turnover or gross receipt from business during the previous year exceeds Rs.1 crore |

Clause (a)

Proviso to Clause (a) Clause (a)

|

| 10. | Every assessee who is not an “eligible assessee” as defined in section 44AD i.e. LLPs, companies, AOPs, BOIs, AJPs | If total sales, turnover or gross receipts , as the case may be, in business exceed or exceeds Rs.1 crore in any previous year | Clause (a) |

| 11. | Every non-resident assessee not covered by section 44AE or 44B or 44BB or 44BBA or 44BBB | If total sales, turnover or gross receipts , as the case may be, in business exceed or exceeds Rs.1 crore in any previous year | Clause (a) |

Audit of entities engaged in Commission, Brokerage and Agency Business

a) Where accounts are audited under companies Act: Then it will be sufficient if the accounts are audited under such law before the specified date and assessee obtains a report from a chartered accountant in the prescribed form under Income Tax Act, 1961.

Under section 141 of Companies Act, 2013, only a Chartered Accountant is qualified to conduct audit of companies. A question often arises whether the audit under section 44AB is required to be conducted by the statutory auditor? In this connection, it may be stated that Section 44AB stipulates that only Chartered Accountants should perform the tax audit. This section does not stipulate that only the statutory auditor appointed under the Companies Act, 2013 or other similar Statute should perform the tax audit. As such the tax audit can be conducted either by the statutory auditor or by any other chartered accountant in full time practice. In a case where statutory auditor is not appointed, where such appointment is required by a statute the chartered accountant appointed to conduct audit under section 44AB can commence and complete his audit without waiting for the appointment of statutory auditor and report on the accounts audited by the statutory auditors. The tax auditor in such cases will, however, have to conduct the financial audit as well in order to enable him to certify whether or not the accounts reported upon by him give a true and fair view of the state of affairs of the assessee whose accounts are audited by him under section 44AB. And, the tax auditor provides his report in Form No. 3CB and to furnishes/certifies the relevant particulars in Form No.3CD.

b) Where accounts are audited under any other provisions of the Income Tax Act 1961: Where a person is required to get his accounts audited under any other law, then it shall be sufficient compliance with the provisions of this section if such person gets the accounts audited under such other law before the specified date and furnish by that date the report of the audit as required under such other law and a further report by an accountant in the form prescribed under this section.

c) Report of audit of accounts to be furnished under section 44AB.

Rule 6G.

(1) The report of audit of the accounts of a person required to be furnished under section 44AB shall,

(a) in the case of a person who carries on business or profession and who is required by or under any other law to get his accounts audited, be in Form No. 3CA:

(b) in the case of a person who carries on business or profession, but not being a person referred to in clause (a), be in Form No.3CB.

Submission of Audit Report in Form 3CB instead of Form 3CA along with Form 3CD is sufficient compliance of Tax Audit u/s 44AB hence no penalty u/s 44AB.

SPA Lifestyle (P) Ltd Vs. ACIT (2014) 46 taxmann.com 347 (Del.Trib)

M/s PMC Rubber Chemicals India Pvt Ltd Vs. ACIT. ITA NO: 2065 / KOL / 2018. Order Dated 28/06/2019.

(2) The particulars which are required to be furnished under section 44AB shall be in Form No. 3CD.

Tax auditor shall furnish tax audit report online by using his login details in the capacity of ‘chartered accountant’. Taxpayer shall also add CA details in their login portal. Once audit report is uploaded by tax auditor, same should either be accepted/rejected by taxpayer in their login portal. If rejected for any reason, all the procedures need to be followed again till the audit report is accepted by the taxpayer.

In case of LLP should reporting for Tax Audit be in Form 3CA or 3CB?

In case of company, which follows April-March period as its financial year, the Tax Audit report would in Form No. 3CA, if the Tax Audit is applicable to it. However, in case of partnership firm or proprietary concern, which is not required to get their accounts audited under any other Law, Tax Audit report would be in Form No. 3CB.

In case of LLP following April-March as its financial year and if it is required to get its account audited under the LLP Rules, 2009, then the Tax Audit report would be in Form No. 3CA. However, if it is not required to get its accounts audited under the LLP Rules, 2009 then Form No. 3CB would be applicable. It may be noted that under r 24 of the LLP Act, audit is mandatory in case the LLP whose turnover in the relevant financial year exceeds Rs.40 lacs or whose contribution exceeds Rs.25 lacs.

Points to be considered by the Tax Auditor

1. The tax auditor should obtain from the assessee a letter of appointment for conducting the audit as mentioned in section 44AB.

2. The tax auditor is required to upload the tax audit report directly in the e-filing portal. In case of joint auditors, management representation has to be obtained about responsibility of uploading Tax Audit Report & ITR by particular auditor.

3. The appointment of the auditor for tax audit in the case of a company need not be made at the general meeting of the members. It can be made by the Board of Directors or even by any officer, if so authorised by the Board in this behalf.

4. The appointment in the case of an assessee, being a firm or a proprietary concern, can be made by a partner or a person authorized by the assessee in the case of a firm or by the proprietor himself or a person authorised by him in the case of the assessee being a proprietary concern.

5. It is possible for the assessee to appoint two or more chartered accountants as joint auditors for carrying out the tax audit, in which case, the audit report will have to be signed by all such chartered accountants. In case of disagreement, they can give their reports separately. (Refer: Para 12 of the SA 299 “Responsibility of Joint Auditors” issued by ICAI)

6. The Act prohibits a relative or an employee of the assessee being appointed as a tax auditor under section 44AB, besides ICAI has also laid in the code of ethics that a chartered accountant should not express his opinion on financial statements of any business or enterprise in which he, his firm or a partner in his firm has a substantial interest.

7. A chartered accountant who is responsible for writing or maintenance of the books of account of the assessee should not audit such accounts (including tax audits). This principle will apply and extend to any partner of such a chartered accountant as well as to the firm in which he is a partner.

8. The audit of accounts of a Firm of chartered accountants, under section 44AB, cannot be conducted by any partner or employee of such a firm. Similarly, where such a firm is a proprietary one, the said audit cannot be conducted by the proprietor or his employee.

9. A chartered accountant/ firm of chartered accountants, who is appointed as tax consultant of the assessee, can conduct tax audit under section 44AB. But an internal auditor of the assessee cannot conduct tax audit if he is an employee of the assessee.

10. The tax auditor cannot be removed on the ground that he has given an adverse audit report or the assessee has an apprehension that the tax auditor is likely to give an adverse audit report. If there is any unjustified removal of tax auditors, the Ethical Standards Board constituted by the Council of the Institute if approached, may intervene in such cases. No chartered accountant should accept the audit assignment if the removal of his predecessor is not on valid grounds.

How many tax audit reports a Chartered accountant can Sign?

Specified Number of Tax Audit Assignments It is to be noted that a Chartered Accountant in practice can conduct 60 tax audits relating to an assessment year. The ICAI had clarified that audit prescribed under any statute which requires the assessee to furnish an audit report in the form as prescribed under section 44AB of the Income-tax Act, shall not be considered for the purpose of reckoning the specified number of tax audit assignments if the turnover of the assessee is below the turnover limit specified in section 44AB of the Income-tax Act. The ICAI has modified the guidelines on August 23, 2018 to provide that the audits conducted under Section 44AD, 44ADA and 44AE of the Income-tax Act(Presumptive Taxation Schemes) shall not be considered for the purpose of reckoning the ‘specified number of tax audit assignments’

Before accepting a tax audit, the chartered accountant should ensure that taking such audit will not exceed the specified number of tax audits assignments, which at present are 60 in a given financial year. This said specified number of 60 Needless to mention, a chartered accountant in practice, is deemed to be guilty of professional misconduct if, he accepts more than 60 tax audit assignments relating to an assessment year.

In case, a member is a partner in a firm of chartered accountants in practice, the ceiling of 60 tax audit assignments shall be computed with reference to each of the partners in the said firm. Where any partner of the firm of chartered accountants in practice is also a partner of any other firm or firms of chartered accountants in practice, the ceiling limit of 60 shall apply with reference to all the firms together in relation to such a partner. Similarly, where any partner accepts one or more tax audit assignments in his individual capacity, the total number of such assignments under section 44AB which may be accepted by him whether directly in his individual capacity or as partner in one or more firms of chartered accountants in practice shall not exceed 60 tax audit assignments. If two chartered accountants already in practice or two of such chartered accountants are appointed as joint tax auditors, then the assignment will have to be included in the case of both the members and firms separately. It is, however, clarified that the audit of an assessee head office and branch offices shall be regarded as one tax audit assignment. The audit of one or more branches of the same concern by one chartered accountant in practice shall be construed as only one tax audit assignment.

Example: A firm has 4 partners. Each partner already has 4 Tax Audit assignments in their personal capacity. Now a question arises that how many tax audit assignments can the firm undertake? ü Maximum number of audits that a firm can take in an assessment year => 60 x 4 = 240 ü Since, the partners each have 4 Tax Audit assignments engaged in personal capacity, the number of total assignments to be deducted as a partner’s capacity => 4 x 4 = 16 ü Total number of Tax Assignments that can be taken up by the firm =>240-16 = 224

Question: If there are 10 partners in a firm of Chartered Accountants, then how many tax audits reports can each partner sign in a financial year?

Answer: As per amended Chapter VI of Council General Guidelines, 2008, Tax Audit Assignments under Section 44AB of the Income Tax Act, 1961, A member of the Institute in practice shall not accept, in a financial year, more than the specified number of tax audit assignments as prescribed under Section 44AB of the Income Tax Act, 1961. The specified number of tax audit assignments under Section 44AB of the Income Tax Act, 1961 is 60.

It is further provided in amended Chapter VI of Council General Guidelines, 2008 that in case of firm of Chartered Accountants in practice, specified number of tax audit assignments means 60 tax audit assignments per partner of the firm, in a financial year.

Therefore, if there are 10 partners in a firm of Chartered Accountants in practice, then all the partners of the firm can collectively sign 600 tax audit reports. This maximum limit of 600 tax audit assignments may be distributed between the partners in any manner whatsoever. For instance, 1 partner can individually sign 600 tax audit reports in case remaining 9 partners are not signing any tax audit report.

Code of Ethics and Eligibility

The Tax Auditor has to follow the following code of ethics–

a) Tax Auditor is required to communicate with the previous Tax Auditor.

b) No need to communicate with Statutory Auditor.

c) A person is disqualified u/s. 288 from being appointment as an auditor if he or his relative is :

> indebted to the Assessee. (Relative may be indebted up to Rs.1,00,000/- )

> Holds security (Relative can hold up to Rs.1,00,000/-)

> gives guarantee on behalf of third person (Relative can give guarantee up to Rs.1,00,000/-)

A. X is appointed as Tax Auditor for the March 31,2021, whether it is necessary to communicate with previous Tax auditors / statutory auditors? What if the firm was not subject to Tax audit in the previous year but was subject to Tax audit a year before?

Communicating with previous auditor being a CA in practice would apply to all types of audit viz., statutory audit, tax audit, internal audit, concurrent audit or any other kind of audit. Mandatory communication with previous auditor being a CA required even if previous auditor happens to be an auditor for a year other than the immediately preceding year.

B. If he has communicated with previous tax auditor Y and who has objected that he cannot accept the tax audit as Y’s professional fee for consultancy is outstanding. Should X accept the audit?

In case of an undisputed audit fees for carrying out the statutory audit under Companies Act, 1956 or various other statutes having not been paid, incoming auditor should not accept the appointment unless such fees are paid. In respect of other dues, the incoming auditor should in appropriate circumstances use his influence in favour of his predecessor to have the dispute as regards the fees settled.

What is the specified date up to which the report under Section 44AB of the Income Tax Act1961 should be furnished? (Analysis of Explanation (ii) of Section 44AB of the Income Tax Act, 1961)

In terms of section 44AB, report of audit is required to be furnished by the specified date. In terms of the Explanation (ii) to the said section, specified date meant the due date for furnishing the return of income under sub-section (1) of section 139. The said Explanation has been amended, w.e.f. 01-04-2020 by the Act No.12 of 2020. The amended Explanation provides that “specified date”, in relation to the accounts of the assessee of the previous year relevant to an assessment year, means [date one month prior to] the due date for furnishing the return of income under sub-section (1) of section 139 [inserted]. In terms of sub-section (1) of section 139, Explanation 2, 31st day of October of an assessment year is the due date (in cases other than an assessee required to furnish a reported referred to in section 92E). Accordingly, 30th September (of and in relation to an assessment year) would be the specified date by which report of audit under section 44AB is required to be furnished.

Applicability of Tax Audit in following cases:

Such cases may cover those assessees who are wholly outside the preview of income-tax law as well as those whose income is otherwise exempt under the Act. It is felt that neither section 44AB nor any other provisions of the Act stipulate exemption from the compulsory tax audit to any person whose income is exempt from tax. This section makes it mandatory for every person carrying on any business or profession to get his accounts audited where conditions laid down in the section are satisfied and to furnish the report of such audit in the prescribed form.

A trust/association/institution carrying on business may enjoy exemptions as the case may be under sections 10(21), 10(23A), 10(23B) or section 10(23BB) or section 10(23C) or section 11. A co-operative society carrying on business may enjoy deduction under section 80P. Such institutions/associations of persons will have to get their accounts audited and to furnish such audit report for purposes of section 44AB if their turnover in business exceeds the prescribed limit (Presently Rs.100 lacss w.e.f. A.Y. 2013-14).

Only Agriculture Income (Tax Audit Not Applicable) But an agriculturist, who does not have any income under the head “Profits and gains of business or profession” chargeable to tax under the Act and who is not required to file any return under the said Act, need not get his accounts audited for purposes of section 44AB even though his total sales of agricultural products may exceed the prescribed limit (Presently Rs.100 lacss w. e. f. A.Y. 2013-14)

Non-Residents: –

The case of non-residents may be considered separately.

Section 44AB does not make any distinction between a resident or non-resident. Therefore, a non-resident assessee is also required to get his accounts audited and to furnish such report under section 44AB if his turnover/sales/gross receipts exceed the prescribed limits. This audit, however, would be confined only to the Indian operations carried out by the non-resident assessee since he is chargeable to income-tax in India only in respect of income accruing or arising or received in India

Income below Taxable Limit: – It may be appreciated that the object of audit under section 44AB is only to assist the Assessing Officer in computing the total income of an assessee in accordance with different provisions of the Act. Therefore, even if the income of a person is below the taxable limit laid down in the relevant Finance Act of a particular year, he will have to get his accounts audited and to furnish such report under section 44AB, if his turnover in business exceeds the prescribed limit (Presently Rs.100 lacss w. e. f. A.Y. 2013-14).

Whether a tax audit report can be revised?

In certain cases, members are called upon to report on the accounts reopened and revised by the board of directors. The accounts of a company once adopted at its annual general meeting should not normally be reopened and revised. The Institute and the Ministry of Corporate Affairs have affirmed this position. In case of revision, the audit report should be given in the manner as required by the Institute in SA-560 (Revised), Subsequent Events. The Ministry of Corporate Affairs had also clarified that accounts can be revised to comply with technical requirements.

It may be pointed out that report under section 44AB should not normally be revised.

However, sometimes a member may be required to revise his tax audit report on grounds such as:

(i) revision of accounts of a company after its adoption in annual general meeting.

(ii) change of law e.g., retrospective amendment.

(iii) change in interpretation, e.g. CBDT Circular, judgments, etc.

****

Extract of Section 44AB of Income Tax Act, 1961

Audit of accounts of certain persons carrying on business or profession.

44AB. Every person,—

(a) carrying on business shall, if his total sales, turnover or gross receipts, as the case may be, in business exceed or exceeds one crore rupees in any previous year 7[***]:

[Provided that in the case of a person whose—

(a) Aggregate of all amounts received including amount received for sales, turnover or gross receipts during the previous year, in cash, does not exceed five per cent of the said amount; and

(b) Aggregate of all payments made including amount incurred for expenditure, in cash, during the previous year does not exceed five per cent of the said payment:

9[Provided further that for the purposes of this clause, the payment or receipt, as the case may be, by a cheque drawn on a bank or by a bank draft, which is not account payee, shall be deemed to be the payment or receipt, as the case may be, in cash,]

this clause shall have effect as if for the words “one crore rupees”, the words “ [ten] crore rupees” had been substituted; or]

(b) carrying on profession shall, if his gross receipts in profession exceed fifty lacs rupees in any previous year; or

(c) carrying on the business shall, if the profits and gains from the business are deemed to be the profits and gains of such person under section 44AE or section 44BB or section 44BBB, as the case may be, and he has claimed his income to be lower than the profits or gains so deemed to be the profits and gains of his business, as the case may be, in any previous year; or

(d) carrying on the profession shall, if the profits and gains from the profession are deemed to be the profits and gains of such person under section 44ADA and he has claimed such income to be lower than the profits and gains so deemed to be the profits and gains of his profession and his income exceeds the maximum amount which is not chargeable to income-tax in any previous year; or

(e) carrying on the business shall, if the provisions of sub-section (4) of section 44AD are applicable in his case and his income exceeds the maximum amount which is not chargeable to income-tax in any previous year,

get his accounts of such previous year audited by an accountant before the specified date and furnish by that date the report of such audit in the prescribed form duly signed and verified by such accountant and setting forth such particulars as may be prescribed :

Provided that this section shall not apply to the person, who declares profits and gains for the previous year in accordance with the provisions of sub-section (1) of section 44AD and his total sales, turnover or gross receipts, as the case may be, in business does not exceed two crore rupees in such previous year:

Provided further that this section shall not apply to the person, who derives income of the nature referred to in section 44B or section 44BBA, on and from the 1st day of April, 1985 or, as the case may be, the date on which the relevant section came into force, whichever is later :

Provided also that in a case where such person is required by or under any other law to get his accounts audited, it shall be sufficient compliance with the provisions of this section if such person gets the accounts of such business or profession audited under such law before the specified date and furnishes by that date the report of the audit as required under such other law and a further report by an accountant in the form prescribed under this section.

Explanation.—For the purposes of this section,—

(i) “Accountant” shall have the same meaning as in the Explanation below sub-section (2) of section 288;

(ii) “specified date”, in relation to the accounts of the assessee of the previous year relevant to an assessment year, means 11[date one month prior to] the due date for furnishing the return of income under sub-section (1) of section 139.

Kindly share with me all tax updates and other related tax matters.

Always grateful.

Thnks Sir.

i’m having income of LIC commission , share sub broker commission, mutual fund commission, and dealing in share trading of my own under all segments(cash, F&O, Intraday). i;m having loss in FY21-22 . my turn over is between 2 to 10 crores. AM i eligible for return under section 44 AB and to not get my books audited and can i claim my loss???

my turnover is between 2 to 10 crores, i’m having income of LIC commission, share sub brokerage and business of share trading in all segments- Equity , Future and speculation. (intraday) . rental income and i’m filing return under business income since last 10 years , under section 44 AB ,,is it mandatory to get books audited or not for FY21-22??????

according to turnover calculation for ceiling limit of 60. it will be Rs. 1 crore or 2 crore turnover considered for calculation.

VERY GOOD ARTICLE.

enhansed limit is applicable from FY 2021-22 or FY 2020-21? the acts says “10. Sub. for “five” by the Act No. 13 of 2021, w.e.f. 1-4-2021″

Very elaborate article. No need of other references. Thank You, Sir.