Presumptive Taxation Scheme under Income Tax Act, 1961

Details of Presumptive Taxation Scheme

For small taxpayers the Income Tax Act has framed three presumptive taxation schemes as given below:

Provisions of Sec 44AB

Audit of accounts of certain persons carrying on business or profession

- Every person –

44AB(a)

carrying on business shall,

-

- if his total sales, turnover or gross receipts,

- as the case may be,

- in business exceed or exceeds

- one crore rupees in any previous year

- 44AB(b)

- carrying on profession shall,

- if his gross receipts in profession

- Exceed fifty lacs rupees

- in any previous year; or

- 44AB(c)

- carrying on the business shall,

- if the profits and gains from the business are deemed to be the profits and gains of such person

- under section 44AE or section 44BB or section 44BBB,

- as the case may be,

- and he has claimed his income to be lower than the profits or gains

- so deemed to be the profits and gains of his business,

- as the case may be, in any previous year; or

- 44AB(d)

- carrying on the profession shall,

- if the profits and gains from the profession are deemed to be the profits and gains of such person under section 44ADA and

- he has claimed such income to be lower than the profits and gains so deemed to be the profits and gains of his profession and

- his income exceeds the maximum amount

- which is not chargeable to income-tax in any previous year; or

- 44AB(e)

- carrying on the business shall,

- if the provisions of sub-section (4) of section 44AD are applicable in his case and

- his income exceeds the maximum amount which is not chargeable to income-tax in any previous year,

- get his accounts of such previous year audited by an accountant before the specified date and

- furnish by that date the report of such audit

- in the prescribed form duly signed and

- verified by such accountant and

- setting forth such particulars as may be prescribed

Amendment in Tax Audit Provisions

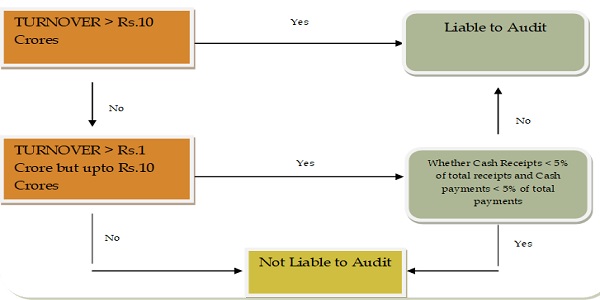

- The Finance Act, 2021 has increased the threshold limit of turnover for tax audit u/s 44AB from Rs.5 crores to Rs.10 crores where cash transactions do not exceed 5% of total transactions. This amendment will take effect from 1st April 2021 and will, accordingly, apply in relation to the assessment year 2021-22. Thus, the higher limit of turnover will take effect from F.Y. 2020-21 itself.

- The Finance Act, 2021 has added a new second proviso to section 44AB(a) which is reproduced below-

“Provided further that for the purposes of this clause, the payment or receipt, as the case may be, by a cheque drawn on a bank or by a bank draft, which is not account payee, shall be deemed to be the payment or receipt, as the case may be, in cash.”

observations regarding the increased threshold limit for Tax Audit under section 44AB –

1. The amendment is carried out only in section 44AB and no amendment has been made in section 44AD. Thus, the turnover limit of 2 crores for opting Section 44AD shall continue

2. All the payments or receipts including capital introduction, drawings, receipt and repayment of loans, purchase of fixed assets, etc. shall be considered. Even taxes paid in cash shall be included for the calculation.

3. It is not pointed out who will certify the margin of transactions in cash mode of 5%. It appears that assessee himself shall declare the percentage of receipts in cash and non-cash mode.

4. This increased threshold limit for Tax Audit is applicable for a business entity only and the threshold limit for Tax Audit for a professional shall continue to be at Rs.50 lacs even if more than 95% of the transactions are in digital mode.

Discussion on new proviso on the subject matter of Deemed Cash for turnover purpose:

Issues while Computing the Limit of 5% Cash Transactions

1. Capital Contribution: When an Individual/sole proprietor introduces capital in his business in cash, then the same shall not be included in the total receipts in cash of the assessee. This is for the simple reason that one cannot transact with himself.

- However, the notified ITR forms do not follow this principle. It requires that all the cash receipt of the business including capital contribution should be considered in determining the 5% cash transactions limit.

- However, in case of partnership firms, the situation is different since a firm is assessed as a separate person under income tax law and is considered distinct from its partners. To clarify, if a firm receives any capital contribution in cash from any partner, it shall be counted towards the limit of 5%.

2. Direct cash deposit into bank account by customers: In this case, it will be included in cash transactions. Even if the assessee debits the bank account in his books, it will be regarded as a cash transaction since the account is ultimately settled in cash.

3. Capital Expenditure: All the payments in cash are included whether it is paid for revenue expenditure or capital expenditure. There is no differentiation provided in the law.

4. Capital Receipt/Exempt Income: All receipts include receipts of capital nature and also the exempt income for e.g. Agricultural Income.

5. Adjustment by book entry: In a case where a person is a customer as well as vendor of the assessee. The debtors’ amount is set-off with the amount payable to the same person/vendor. Since no cash is involved in settling the due amount, this will be considered as non-cash transactions.

6. Cash deposited and Cash Withdrawals from bank account: Cash deposit and the cash withdrawals from the bank account amounts to contra entry or transactions with self and hence are excluded for computing the 5% cash limit.

Example:

- Mr. X, is into business and has turnover of less than Rs.10 crores during the financial year 2020-21. The following transactions in FY 2020-21 are hereunder:

- A. Calculation of Total Receipts:

| Particulars | CASH | CHEQUE | TOTAL |

| Cash Sales | 100 | 380 | 480 |

| Receipt from debtors | 20 | 1300 | 1320 |

| Loan receipts | – | 200 | 200 |

| Total | 120 | 1880 | 2000 |

B. Calculation of Total Payments

| Particulars | CASH | CHEQUE | TOTAL |

| Payment of expenses | 81 | 519 | 600 |

| Payment to creditors | – | 1080 | 1080 |

| Loan payments | – | 120 | 120 |

| Total | 81 | 1719 | 1800 |

C. Computation of percentage of cash receipts & payments

| Particulars | TOTAL (A) | CASH (B) | % in cash (B/A *100) |

| Receipts | 2000 | 120 | 6 |

| Payments | 1800 | 81 | 4.5% |

In his case, though the payment made in cash during the year does not exceed 5% of total payments, the percentage of cash receipts exceeds the limit of 5%. In this case Mr. X is fulfilling only one condition of payments and the condition in case of receipts is not fulfilled. To take the benefit of this section he has to follow both the conditions.

Different situations under which the books of accounts are to be audited under section 44AB of the Act

| Sr. No. | Person | When required to get accounts audited in terms of section 44AB | Clause of section 44AB |

| 1. | Every person carrying on profession referred to in section 44AA(1) profits from which are assessable on presumptive basis under section 44ADA | If he claims his profits and gains from such profession are lower than 50% of his gross receipts for the previous year in question and his total income exceeds the maximum amount which is not chargeable to income-tax in any previous year | Clause (d) |

| 2. | Every person carrying on profession [other than those covered by clause (d) of section 44AB] | If his total gross receipts from profession exceed Rs.50 lacs in any previous year | Clause (b) |

| 3. | Every person who derives income of the nature referred to in section 44B or section 44BBA | Section 44AB does not apply to such person & hence no need to get accounts audited u/s 44AB | 2nd proviso to section 44AB |

| 4. | Every person carrying on business profits of which are assessable on presumptive basis under section 44AE or section 44BB or section 44BBB | If he claims his profits and gains from such business are lower than the amount deemed to be profits and gains under the said section | Clause (c) |

| 5. | Every person carrying on business where the provisions of section 44AD(4) are applicable in his case | If his total income exceeds the maximum amount which is not chargeable to income-tax in any previous year

Section 44AB shall not apply to the person who declares profits and gains for the previous year in accordance with section 44AD(1) and his total sales, turnover or gross receipts, as the case may be, in business does not exceed Rs.2 crore [first proviso to section 44AB] |

Clause (e) first proviso |

| 6. | Every person carrying on any agency business | If his total sales, turnover or gross receipts , as the case may be, in business exceed or exceeds Rs.1 crore in any previous year | Clause (a) |

| 7. | Every person carrying on business who is earning income in the nature or commission or brokerage | If his total sales, turnover or gross receipts , as the case may be, in business exceed or exceeds Rs.1 crore in any previous year | Clause (a) |

| 8. | Every person carrying on profession referred to in section 44AA(1) who is also carrying on any business | Gross receipts of profession and business not to be clubbed for computing the limits of Rs.1 crore [clause (a)] and/or Rs.50 lacss [clause (b)]. Account of profession to be audited if clause (b) or (d) of section 44AB applies. Accounts of business to be audited if total sales, turnover or gross receipts, as the case may be, in business exceed or exceeds Rs.1 crore in any previous year since section 44AD is not applicable to person carrying on profession referred to in section 44AA(1) | Clause (a) |

| 9. | Every “eligible assessee” (as defined in section 44AD) carrying on “any eligible business” (as defined in section 44AD) turnover of which exceeds Rs.2 crores in any previous year, and proviso to sec 44AB(a) not applicable.

Both payment and receipt in cash does not exceed 5% of the total receipts and payment respectively Either payment or receipt in cash exceeds 5% of the total receipts and payment respectively |

Assessee not eligible to opt for section 44AD. Therefore, he must get his accounts audited in terms of section 44AB(a) since his turnover exceeds Rs.2 crores and thus exceeds Rs.1 crore limit in clause (a)

Audit u/s 44AD not applicable if total sales, turnover or gross receipt from business during the previous year does not exceed Rs.10 crore If total sales, turnover or gross receipt from business during the previous year exceeds Rs.1 crore |

Clause (a)

Proviso to Clause (a) Clause (a) |

| 10. | Every assessee who is not an “eligible assessee” as defined in section 44AD i.e. LLPs, companies, AOPs, BOIs, AJPs | If total sales, turnover or gross receipts , as the case may be, in business exceed or exceeds Rs.1 crore in any previous year | Clause (a) |

| 11. | Every non-resident assessee not covered by section 44AE or 44B or 44BB or 44BBA or 44BBB | If total sales, turnover or gross receipts , as the case may be, in business exceed or exceeds Rs.1 crore in any previous year | Clause (a) |

Audit of entities engaged in Commission, Brokerage and Agency Business

Applicability of Tax Audit in following cases:

- A trust/association/institution carrying on business may enjoy exemptions as the case may be under sections 10(21), 10(23A), 10(23B) or section 10(23BB) or section 10(23C) or section 11. A co-operative society carrying on business may enjoy deduction under section 80P. Such institutions/associations of persons will have to get their accounts audited and to furnish such audit report for purposes of section 44AB if their turnover in business exceeds the prescribed limit (Presently Rs.100 lacs w.e.f. A.Y. 2013-14).

- Only Agriculture Income (Tax Audit Not Applicable) But an agriculturist, who does not have any income under the head “Profits and gains of business or profession” chargeable to tax under the Act and who is not required to file any return under the said Act, need not get his accounts audited for purposes of section 44AB even though his total sales of agricultural products may exceed the prescribed limit (Presently Rs.100 lacs w. e. f. A.Y. 2013-14)

Concept & Meaning of Turnover

- Meaning of turnover

The term “turnover” has been understood for the purpose of Section 44AB to mean:

- The aggregate amount for which sales are effected or services rendered by an enterprise. In case the assessee has opted for inclusive method of accounting and the sales price are inclusive of sales tax and excise duty, then no adjustment in respect thereof should be made for considering the quantum of turnover.

- Trade discounts can be deducted from sales but not the commission allowed to third parties. In case assessee is following the practice of crediting the Excise duty and / or sales tax recovered separately to Excise duty or Sales tax Account (being separate accounts) and payments to the authority are debited in the same account, then the same will not be included in the turnover.

- Sales of scrap shown separately under the heading ‘miscellaneous income’ will form part of turnover.

- Applying the above generally accepted accounting principles, a few typical cases may be considered:

- Discount allowed in the sales invoice will reduce the sale price and, therefore, the same can be deducted from the turnover.

- Cash discount otherwise than that allowed in a cash memo/sales invoice is in the nature of a financing charge and is not related to turnover. The same should not be deducted from the figure of turnover.

- Turnover discount is normally allowed to a customer if the sales made to him exceed a particular quantity. This being dependent on the turnover, as per trade practice, it is in the nature of trade discount and should be deducted from the figure of turnover even if the same is allowed at periodical intervals by separate credit notes.

- Special rebate allowed to a customer can be deducted from the sales if it is in the nature of trade discount. If it is in the nature of commission on sales, the same cannot be deducted from the figure of turnover.

- Price of goods returned should be deducted from the figure of turnover even if the returns are from the sales made in the earlier year.

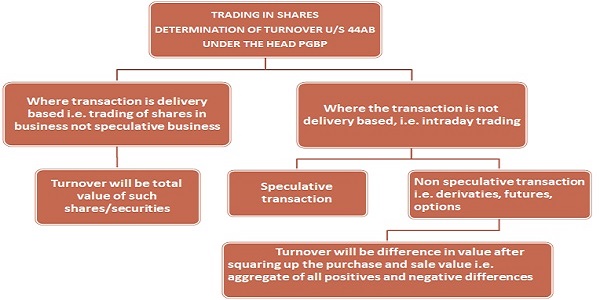

Turnover in case of Speculative Transactions

- In a speculative transaction, the contract for sale or purchase which is entered into is not completed by giving or receiving delivery so as to result in the sale as per value of contract note.

- The contract is settled otherwise and squared up by paying out the difference which may be positive or negative. As such, in such transaction the difference amount is ‘turnover’.

- In the case of an assessee undertaking speculative transactions there can be both positive and negative differences arising by settlement of various such contracts during the year. Each transaction resulting into whether a positive or negative difference is an independent transaction.

- Further, amount paid on account of negative difference paid is not related to the amount received on account of positive difference. In such transactions though the contract notes are issued for full value of the purchased or sold asset the entries in the books of account are made only for the differences.

- Accordingly, the aggregate of both positive and negative differences is to be considered as the turnover of such transactions for determining the liability to audit vides section 44AB, whether the differences are positive or negative.

turnover in case of Non-Speculative transactions

- Determination of turnover in case of F&O is one of the important factors for every individual for the Income Tax purpose. F&O is also considered as non-speculative as these instruments are used for hedging and also for taking/giving delivery of underlying contract. Turnover must be firstly calculated, in the manner explained below:

1. The total of positive and negative or favorable and unfavorable differences shall be taken as turnover.

2. Premium received on sale of options is to be included in turnover.

3. In respect of any reverse trades entered, the difference thereon shall also form part of the turnover.

Here, it makes no difference, whether the difference is positive or negative. All the differences, whether positive or negative are aggregated and the turnover is calculated.

DETERMINATION OF TURNOVER IN CASE OF TRADING IN SHARES

Examples on Meaning of Turnover Or Gross Receipts

- Treatment of discounts: Trade discount should be excluded from ‘sales’ or ‘turnover’ for purpose of qualifying limit u/s. 44AB that discounts are allowed in sales bills themselves or at the time when payment were made by the parties to the assessee and the discount amounts are properly recorded in the assessee accounts.

- Receipts from Job Work :“It may be noticed that “sales”, “turnover” or “gross receipts” are not words of art used in relation to any individual transaction independently, but have been used as “sales”, “turnover” or “gross receipts”. The expression ‘total’ qualifies all the other three expressions viz. ‘sales’, ‘turnover’ and ‘gross receipts’.” So, job work receipts have to be clubbed to the total turnover.

- Turnover for a chit fund: Subscription amount collected by the foreman of a chit fund from subscribers is on capital account and thus not part of turnover/ gross receipts/ sales for the purpose of Sec. 44AB.

- Income of a nursing home, whether professional or business income: Activities of a nursing home constitute business and not profession – “activities of the nursing home”…constitute business activity, and ITAT Rejects Revenue’s contention that activities of assessee-firm constitute a vocation/ profession.

- For Leasing transactions: Value of lease rentals or interest on lease financing should be forming part of receipts for computation of limits.

- For Hire purchase transactions: The sale on hire purchase is completed when the borrower exercises his option to purchase. When the option is exercised, the price of the equipment sold will be considered as turnover. During the hire purchase period, the hire charges received shall form part of gross receipts. Installments towards principal repayment to be excluded.

- A clearing and forwarding agent: Not to include reimbursement of customs duty and other charges collected by an agent.

Sec. 44AA-Maintenance of accounts by certain persons carrying on profession or business

Maintenance of books of account by ‘specified (including notified) professionals’

Section 44AA(1) prescribes for compulsory maintenance of such books of accounts and other documents which will enable the Assessing Officer to compute his total income in accordance with the provisions of this Act. sub-section (1) applies to the followings-

- A person carrying on a legal profession.

- A person carrying on a medical profession.

- A person carrying on engineering or architectural profession.

- A person carrying on the profession of accountancy.

- A person carrying on the profession of technical consultancy.

- A person carrying on the profession of interior decoration.

- Any other profession as notified by the Board. The CBDT has notified the following professions u/s 44AA(1) of the Act.

Prescribed books of account and documents to be kept and maintained under section 44AA(3) read with Rule 6F

The prescribed books of account and other documents under Rule 6F(2) are as follows:

- a cash book;

- a journal, if the accounts are maintained according to the mercantile system of accounting;

- a ledger;

- carbon copies of bills, whether machine numbered or otherwise serially numbered wherever such bills are issued by the person and carbon copies or counterfoils of machine numbered or otherwise serially numbered receipts issued by him. However, an exception is provided where the amount of the bill or receipts is less than Rs.25; and

- original bills wherever issued to the person and receipts in respect of expenditure incurred by the person or, where such bills and receipts are not issued and the expenditure incurred does not exceed Rs.50, payment vouchers prepared and signed by the person. However, the requirements as to the preparation and signing of payment vouchers shall not apply in a case where the cash book maintained by the person contains adequate particulars in respect of the expenditure incurred by him.

Conditions for non-specified professions and business u/s 44AA(2)

- If the business or profession is newly set up in the previous year-

| In case of Individual or HUF | (i) if income from the business or profession likely to exceed Rs.2,50,000 in the previous year, or |

| (ii) if total sales, turnover or gross receipts from the business or profession likely to exceed Rs.25,00,000 in the previous year | |

| In case of other persons | (i) if income from the business or profession likely to exceed Rs.1,20,000 in the previous year, or |

| (ii) if total sales, turnover or gross receipts from the business or profession likely to exceed Rs.10,00,000 in the previous year. |

- In any other case-

| In case of Individual or HUF | (i) if income from the business or profession exceeds Rs.2,50,000 in any one of 3 years immediately preceding the previous year or |

| (ii) if total sales or gross receipts from the business or profession exceed Rs.25,00,000 in any one of 3 years immediately preceding the previous year. | |

| In case of other persons | (i) if income from the business or profession exceeds Rs.1,20,000 in any one of 3 years immediately preceding the previous year or |

| (ii) if total sales or gross receipts from the business or profession exceed Rs.10,00,000 in any one of 3 years immediately preceding the previous year. |

–

| Nature of Business or profession | Category of Taxpayer | Threshold limit for Income | Threshold limit for Gross Turnover or Receipt |

| Specified Profession | Any | – | Mandatory in every case except when presumptive taxation scheme under Sec. 44ADA is opted by the assessee. |

| Non-Specified Professions | Individual or HUF | Rs.2,50,000 | Rs.25 Lakh in any of the 3 year immediately preceding the previous year. |

| Non-Specified Professions | Others | Rs.1,20,000 | Rs.10 lakh in any of the of the 3 years immediately preceding the previous year. |

| Business | Individual or HUF | Rs.2,50,000 | Rs.25 lakh in any of the 3 years immediately preceding the previous years. |

| Business | Other | Rs.1,20,000 | Rs.10 lakh in any of the 3 years immediately preceding the previous years. |

| Presumptive Tax Scheme Under Sec.44AD | Resident Individual or HUF | Rs.2,50,000 | Taxpayer opted for scheme in any of last 5 previous year but not opt for in current year. |

| Presumptive tax scheme under section 44ADA | Resident Assessee | – | Taxpayer claims that his profits computed under Section 44ADA and total income exceeds the maximum exemption limit. |

Presumptive Taxation Scheme Section 44AD

- Section 44AD (1) determines the taxability by invoking a deeming clause. Further, the section is titled as “Special provision for computing profits and gains of business on presumptive basis”. Hence one may infer that Section 44AD is a self-contained code by its own means devoid of Section 28 to 43C as both chargeability and computation are embedded in it. Having inferred that Section 44AD(1) is a separate code by itself wherein it determines the profit computation without referring to Section 29 of the Act. Section 44AD(2) of the Act specifically mentions that the deduction allowable under Section 30 to 38 of the Act are deemed to have been allowed. Such a provision, prima facie appears unnecessary especially considering that Section 44AD (1) begins with a non-obstante clause “(1) Notwithstanding anything to the contrary contained in sections 28 to 43C” which on a literal reading specifies that Section 44AD will override all the other provisions relevant for computing profits and gains from business i.e., Sections 28 to 43C of the Act, even if the same are contrary.

Issue on Disallowance U/S 43B

- A very interesting issue on the disallowance u/s 43B of the Income Tax Act,1961 has been considered by Panaji Tribunal in case of Good Luck Kinetic v. ITO (2015) 58. The Tribunal held that 44AD starts with “notwithstanding anything to the contrary contained in Sec. 28 to 43C” whereas section 43B starts with the words “notwithstanding anything contained in any other provisions of this Act”. The non-obstante clause in Sec. 43B has far wider amplitude. Hence, disallowance could be made by invoking the provisions of Sec. 43B.

- Therefore, even assuming that the deduction is permissible or the deduction is deemed to have been allowed under any other provisions of this Act, still the control placed by the provisions of Sec. 43B in respect of the statutory liabilities still holds precedence over such allowance. This is because the dues to the crown has no limitation and has precedence over all other allowances and claims. The disallowance made by the AO by invoking the provisions of Sec. 43B of the Act in respect of the statutory liabilities are in order even though the Assessee income has been offered and assessed under the provisions of Sec. 44AF of the Act.

- Therefore, considering the view held by the aforesaid Tribunal, addition/ disallowance can be made u/s 43B even though the income has been declared u/s 44AD, 44ADA or 44AE

- On analysis of both the sections, the amplitude of non-obstante clause of section 44AD is higher than the non-obstante clause of section 40. Section 40 relates to disallowance of certain expenses due to non-deduction of TDS or non-deduction/ non-payment of equalisation levy, remuneration/ interest by firm to partners in excess of allowed etc.

- Therefore, these expenses would not be disallowed even if TDS has not been deducted. However, the assessee may be deemed as assessee in default as per section 201 as sec 44AD override provisions of section 28 to 43C but not the provisions of TDS.

Example: Mr. X declaring income u/s 44AD has made payment of interest to non-resident. However, no TDS has been deducted. Whether the expense will be disallowed u/s 40(a)?

- The interest expense will not be disallowed as sec 44AD overrides sec 40(a). The assessee was required to deduct TDS as per sec 195. Although, he has not deducted the TDS, expense will not be disallowed. However, he may be considered as assessee in default as per sec 201 and other penal provisions may be applicable as sec 44AD does not override TDS provisions.

No TDS default disallowance u/s. 40(a)(ia) for assessee opting presumptive basis taxation u/s 44AD

- Surat ITAT in the case of Shri Bipinchandra Hiralal Thakkar [TS-539-ITAT-2020(SUR)] rules in favour of assessee-individual [who offered income to tax on presumptive basis u/s. 44AD @ 8% on gross turnover), deletes TDS default disallowance u/s 40(a)(ia) for AY 2013-14; Noting that assessee made interest payments on unsecured loans and job work expenses without deducting TDS u/s 194A/194C, AO made disallowance u/s. 40(a)(ia); However, ITAT refers to the non-obstante” clause at the beginning of section 44AD overriding the provisions of sections 28 to 43C; Relies on the judgement of SMS Bench Kolkata in the case of Jaharlal Mukherjee, wherein it was held ..the provisions of section 44AD of the Act overrides all other provisions contained in section 28 to 43C. Admittedly, the provisions of section 40(a)(ia)of the Act falls within this range of sections 28 to 43C of Chapter-XVII B of the I.T. Act.” ; Rejects Revenue’s stand that the dues to the crown has no limitation and has precedence over all other allowance and claims”, opines that provisions of section 44AD have been enacted by the Legislature/Crown to provide benefit to small businessmen in terms of cost savings.

Issue of disallowance u/s 40A

- Sec 40A relates to disallowance related to excess payment of related party, cash payment to a person in excess of Rs.10,000 in a day, payment to unapproved fund, mark to market losses etc. The section begins with “The provisions of this section shall have effect notwithstanding anything to the contrary contained in any other provisions of this Act relating to the computation of income under the head “Profits and gains of business or profession”. The non-obstante clause of this section seems to override provisions of sec 44AD. However, the Panaji Tribunal in case of Good Luck Kinetic v. ITO (2015) 58 relating to disallowance u/s 43B have considered two points:

- Amplitude of non-obstante clause

- Payment to crown i.e. statutory dues

- The provisions of sec 40A are not related to statutory dues and such other dues. It just imposes restrictions on payments and disallows amount which is not paid as per the provisions of the Act. It is also to be noted that provisions of sec 40A of the Act are with regard to allowability of expenditure which has been actually incurred and claimed by the assessee from sec 30 to 38 of the Act. Therefore, if the assessee declares income as per the provisions of sec 44AD of the Act, no disallowance shall be made u/s 40A of the Act.

Interplay of Section 43CA vS Section 44AD

- It is to be noted that section 44AD starts with “Notwithstanding anything to the contrary contained in sections 28 to 43C….” meaning thereby, indirectly, section 44AD is subject to section 43CA. This is not correct position of law. It is to be noted that the open ended coverage of section 44AD(1) is puzzling since sale of immovable property held as stock in trade governed by section 43CA is not brought within the provisions of section 44AD. Section 44AD starts with non-obstante clause by saying that the provisions would prevail over sections 28 to 43C of the Act. The applicability of the section is however optional. Only when the taxpayer opts for the provisions of section 44AD, it would prevail over the provisions of sections 28 to 43C. Now a question arises, whether the provisions of sec 43CA of the Act are applicable in case of presumptive tax. In this connection it is to be noted that both these sections i.e.44AD and 43CA of the Act are deeming sections. A legal fiction is created only for a definite purpose and is limited to that purpose and should not be extended beyond it. It should be within the framework of the purpose for which it is created. Deemed to be is not an admission that it is in reality, rather it is an admission that it is not in reality what it is deemed to be.

- In Sec.44AD(1), the words used are total turnover of such business. This means the assessee has to take actual turnover or gross receipts’ and not the deemed turnover or receipts. Further, the terms ‘total sales, turnover or gross receipts’ are fiscal facts and cannot include deeming fiction created by section 43CA which categorically apply only ‘for the purpose of computing profits and gains from transfer of asset’ and is meant for taxing sale of immovable assets held as stock in trade where value adopted for stamp duty purposes by State Government authorities is more than 110% of the consideration. Similarly, new provision of section 43CA should not apply in cases governed by section 44AD for assessment of presumptive profits on sale of land/building.

Example: Mr. X is engaged in business of sale and purchase of property. He sells a property for Rs.10,00,000. The stamp duty value of the same is Rs.15,00,000. His total turnover other than is property is Rs.60,00,000. What will be his total turnover?

- The stamp duty value of the property is more than 110% of consideration i.e. Rs.11,00,000 (110% of 10,00,000). If Mr. X opts for sec 44AD Rs.10,00,000 will be added in turnover as sec 43CA is not applicable in case income is declared u/s 44AD. The total turnover will be Rs.70,00,000.

- If Mr. X not opts for sec 44AD, Rs.15,00,000 will be added in turnover. His total turnover will be considered as Rs.75,00,000.

Meaning of Eligible assessee

- Eligible assessee:

1) Resident Individual

2) Resident Hindu Undivided Family

3) Resident Partnership Firm (Except an Limited Liability Partnership Firm as defined under LLP Act, 2008)

- Non Eligible Assessee under Sec.44AD of the Act

- An Individual / HUF / Partnership Firm who is a resident and claiming deduction under chapter III of the Act section10A, 10AA, 10B, 10BA relating to units located in FREE Trade Zone, Hardware & Software Technology Park etc. OR

Claiming deduction under Chapter VI-A Part-C (deductions in respect of certain Incomes) i.e. Sections80HH to 80RRB.

- The following are not covered u/s 44AD

- Individual /HUF who is not Resident

- Association of Person

- Firm having non-resident Status.

- A local Authority

- A co-operative Society

- LLP both Indian as well as Foreign

- Companies both Domestic and Foreign company

- Every Artificial Juridical Person

Can income be offered under 44AD when one Partner is Non Resident?

- As per Provision of Section 44AD, only a Resident Partnership Firm is an eligible assessee u/s 44AD partnership firm is a resident in India if then control and management of its affairs wholly or partly situated within India during the relevant previous year. Thus, the firm can opt for taxation u/s 44AD provided control and management of its affairs wholly or partly situated within India during the relevant previous year.

- It is noteworthy that an assessee except resident individual/HUF/ Partnership Firm eligible u/s 44AD, such as company or a LLP shall not be required to get its accounts audited u/s 44AB of the act, even if :

- his gross receipts during the year do not exceed Rs.1 Crore.

- he reports income lower than the deemed profit under the presumptive rate of tax at 6 per cent or 8 per cent as the case may be, and

- his taxable income exceeds maximum amount of taxable income not chargeable to tax.

Meaning of Eligible Business

- The term has been defined under Explanation to subsection 6 of Section 44AD as under; “eligible business” means,—

- Any business except the business of plying, hiring or leasing goods carriages referred to in section 44AE; and

- Whose total turnover or gross receipts in the previous year does not exceed an amount of two crore rupees.’

- The presumptive taxation scheme under section 44AD covers all small businesses with total turnover/ gross receipts of up to 2crores (except the business of plying, hiring and leasing goods carriages covered under section 44AE).

Restrictions to opt the provisions of presumptive taxation u/s 44AD (6) of the Act

- The provisions of this section, notwithstanding anything contained in the foregoing provisions, Shall not apply to—

(i) a person carrying on profession as referred to in sub-section (1) of section 44AA;

(ii) a person earning income in the nature of commission or brokerage; or

(iii) a person carrying on any agency business.

- As per the provisions of sub-section 6 of section 44AD, if an assessee has earned any income from specified activities such as commission, then provisions of section 44AD shall have no bearing on such assessee.

- Commission or brokerage includes any payment received or receivable, directly or indirectly, by a person acting on behalf of another person:

- for services rendered (not being professional services), or

- for any services in the course of buying or selling of goods, or

- in relation to any transaction relating to any asset, valuable article or thing, not being securities.

Assessee and Several Businesses

- The provisions of Sec. 44AD of the Act apply to an ‘Assessee’. Hence when a person carries on several businesses, viz. wholesale and/or retail and or manufacture, the turnover or gross receipts of all the businesses are to be considered for the purposes of this section. Whether separate books or combined books are maintained by the assessee is not material. Combined turnover or gross receipts of all the businesses would form the basis for calculation of presumptive income.

Example: Mr. X A Resident individual, is carrying on three eligible businesses, the turnover of which is as under –

- Business A (Rs.145 Lac)

- Business B (Rs.35 Lac)

- Business C (Rs.25 Lac)

Whether he can opt for sec 44AD?

- The Answer is NO because turnover of eligible business exceeds Rs.2 Crores. It is to be noted that when we take when we take combined turnover of three businesses, it exceeds Rs.2 crore. Hence, the assessee is not eligible for sec 44AD of the Act.

Can assessee opt for Sec. 44AD and Sec. 44AE together?

- Now a question arises that whether an assessee can take the benefit of sec 44AD and sec 44AE together. To resolve this issue when we have to see the provisions of sec 44AD which reads –“…an eligible assessee engaged in an eligible business… sum equal to eight per cent of the total turnover or gross receipts of the assessee in the previous year on account of such business…”It clearly lays down that sec 44AE is not eligible business and it does not make the assessee ineligible to take the benefit of sec 44AD.The business covered under 44AE is not mentioned in 44AD(6), but only excluded from definition of “Eligible Business”. So these two provisions can be claimed simultaneously

Example: Mr. X a Resident individual, is carrying on two businesses, the turnover of which is as under –

- Business A (Eligible Business) Rs.70 Lacss

- Business B (Transport u/s 44 AE) Rs.8 Lacss

- Section 44AD and 44AE both are applicable. In the above said case, turnover of both the business shall not be clubbed and both the business shall be chargeable to tax u/s 44AD and 44AE of the Act respectively.

B) A sum equal to eight percent of the total turnover or gross receipts of the assessee in the previous year on account of such business…

- The minimum rate of the profit is 8% on Total Turnover or Gross Receipts of the Assessee. Now, the question arises what does Total Turnover or Gross Receipts means?

- For the calculation of Total Turnover or gross receipts reference of section 145 & Section 145A must be given. Section 145 of the Income Tax Act, 1961 deals with the method of accounting to be followed by the assessee. It gives an option to the assessee that while calculating the income under the head Business/Profession assessee may opt for Cash system or accrual system of accounting. This is the reason Section 44AD also gives reference to the word Gross Receipts with intent to cover those cases where assessee follows the cash system of accounting. Gross Turnover means without including any purchase cost & any other direct or indirect cost. It should be the Gross revenue which is received or to be received by the assessee from the sale of goods or services.

- Therefore where the Purchase of Goods or services & other expenditures are inclusive of taxes or not is not a matter of concern for the assessee who is covered by Section 44AD. However, whether tax, duties, cess, etc. which is collected by the Assessee covered u/s 44AD should be part of turnover or not is a matter of consideration. As per Section 145A(ii), the valuation of goods or services shall be adjusted including the amount of any tax, duty, cess, or fess by whatever name called….. It means CGST/SGST/IGST etc. collected from the buyer by the assessee should also become part of the Gross Turnover. There are divergent views on this point.

C). ….as the case may be, a sum higher than the aforesaid sum claimed to have been earned by the eligible assessee, shall be deemed to be the profits and gains of such business chargeable to tax under the head “Profits and gains of business or profession”…

- It is to be noted that in Section 44AD, the assessee must have to declare a minimum of 8% of the Gross turnover or gross receipts as his deemed income. However, Section 44AD(1) further gives an option to the assessee to claim more than 8% in his return of Income. It means it is the option given to the assessee & not to the Revenue to presume higher income of the assessee while making an assessment.

Ms. SURBHI AGARWAL V. PRINCIPAL COMMISSIONER OF INCOME TAX-2 -Jaipur ITAT

- The ld. A/R of the assessee has submitted that the case of the assessee is covered under section 44AD of the Act as the turnover of the assessee is Rs.85 lacs which is not exceeding the limit provided under section 44AD. The ld. A/R further submitted that the assessee has declared profit of Rs.7.64 lacs which is 8.99% of the turnover. Therefore, even if there is a payment in cash which is hit by the provisions of section 40A(3), once the case of the assessee is covered under section 44AD and assessee has declared more than 8% of profit on the said turnover, then no further disallowance is called for.

- Merely because the turnover of the assessee for the year under consideration is less than the limit provided under section 44AD, would not preclude the ld. PCIT to exercise his jurisdiction under section 263 regarding violation of provisions of section 40A(3) of the Act. Thus 44AD has to be ‘claimed’.

- Once income declared as per books of accounts, assessee cannot claim that since turnover is within limits of 44AD, therefore disallowances u/s 40A (or others) would not apply.

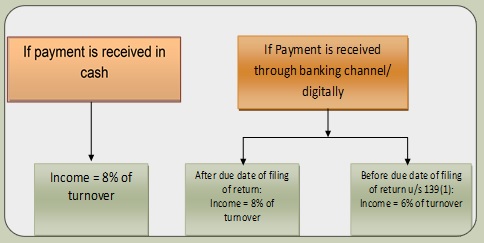

- The presumptive rate of income would be 8% of total turnover or gross receipts. However, Proviso to sub-section (1) provides that the presumptive rate of 6% of total turnover or gross receipts will be applicable in respect of amount which is received

- By an account payee cheque or

- By an account payee bank draft

- By use of electronic clearing system through a bank account OR through such other electronic mode as may be prescribed.

Meaning of words ‘claimed to have been earned by the eligible assessee’

- By the introduction of the words “claimed to have been earned by the eligible assessee” in section 44AD(1), the legislature shows his intention to accept specified income as returned income even if higher sum is earned by eligible assessee unless it is claimed by assessee in his Income Tax Return. The word “Claim” signifies the right of assessee to the extent to opt between actual profits and presumptive profits. It is further to be noted that to claim the profits upto presumptive rate is the right of the assessee and if the actual profits are more than the presumptive profits then it is an obligation of assessee to declare the actual profits to the department. In other words, the scheme of presumptive taxation provides both right- to the extent of presumptive profits and obligation to the extent of actual profits. It cannot be said that if an assessee who has opted for presumptive taxation is not liable to produce the evidence of the actual profits shown by him.

- The distinction between Right and obligation is very necessary here. The language of section 44AD(1) requires claims to have been made by an assessee for returning higher income. If there is no claim made by assessee in return for higher income, there is no higher income. The assessee, who has opted presumptive taxation system, is under no obligation to explain individual entry of cash deposit in bank unless such entry has no nexus with gross receipts

Computation of Income under Section 44AD

Benefit of the reduction of deemed profit rate under Section 44AD of the Income Tax Act, 1961 to taxpayers who will accept digital payments

| Particular | 100% Cash Turnover | 80% Digital Turnover | 100% Digital Turnover |

| Total Turnover | 1.90 Crore | 1.90 Crore | 1.90 Crore |

| Cash Turnover | 1.90 Crore | 38 Lacs | NIL |

| Digital Turnover | NIL | 1.52 Crore | 1.90 Crore |

| Profit on Cash Turnover @ 8% | 15.20 Lacs | 3.04 Lacs | NIL |

| Profit on Digital Turnover @ 6% | NIL | 9.12 lacs | 11.40 Lacs |

| Total Profit | 15.20 Lacs | 12.16 Lacs | 11.40 Lacs |

| Tax Payable under New Regime | 201240 | 122928 | 107120 |

| Tax Saving | NIL | 78312 | 94120 |

From the above table, it is clear that if an assessee makes his transactions in cash on a turnover of Rs.1.90 crore, then his income under the presumptive scheme will be presumed to be Rs.15.20 Lacs at the rate of 8 per cent of turnover, his total Tax Liability under new tax regime will be Rs.2,01,240. However, if an assessee shifts to 100 percent digital transactions and his profit will be presumed to be Rs.11.40 Lacs at the rate of 6 per cent of turnover, his total Tax Liability under new tax regime will be Rs.107120. It is to be noted that by adopting digital system i.e. non cash system. He will save income tax of Rs.94,120

No further deduction would be allowed

- Section 44AD (2): All deductions allowable under sections 30 to 38 shall be deemed to have been allowed in full and no further deduction shall be allowed. However, Deduction u/s 80C to 80U will be given from GTI of the assessee even from the deemed income included in the GTI.

Example: Mr. X is running a Printing Press. His gross receipts from this business during year is Rs.85,00,000 and declared income as per the provisions of section 44AD. After computing the income @ 8% of such gross receipts, he wants to claim further deduction on account of depreciation on the press building. Can he do so as per the provisions of section 44AD?

- As per the provisions of section 44AD, from the net income computed at the prescribed rate, i.e., 8% of sales or gross receipts from the eligible business during the previous year, an assessee is not permitted to claim any deduction or any business expense from such income. Thus, in this case Mr. Shan cannot claim any further deduction from the net income of Rs.6,80,000 i.e., @ 8% of gross receipts of Rs.85,00,000.

Section 44AD (4): Consequences of opting out of the section 44AD(1)

The provisions of Sec. 44AD(4) postulates as the following:

a. The assessee should have declared profit as per section 44AD for any previous year; and

b. The assessee should have declared profit not in accordance with section 44AD in any of the five assessment years succeeding the previous year in which profit was declared as per section 44AD as per condition (a).

- If above two conditions are satisfied, such assessee shall not be eligible to claim the benefits of Section 44AD for five assessment years subsequent to the assessment year in which profit was not declared as per section 44AD as given in condition (b) above.

- It means that if a person has opted for a presumptive scheme of taxation u/s 44AD in any one year then he has to remain in the umbrella of section 44AD for the next 5 years. If he goes out of the umbrella of section 44AD in any one of the subsequent 5 years then such person cannot take the shelter in the umbrella of section 44AD for next 5 years thereafter (i.e., such person has to remain out of Section 44AD for 6 years in continuation).

PROVISIONS OF Section 44AD (5):

- Section 44AD (5):Notwithstanding anything contained in the foregoing provisions of this section, an eligible assessee to whom the provisions of sub-section (4) are applicable and whose total income exceeds the maximum amount which is not chargeable to income-tax, shall be required to keep and maintain such books of account and other documents as required under sub-section (2) of section 44AA and get them audited and furnish a report of such audit as required under section 44AB.

- It is to be noted that the basic exemption limit of Rs.2,50,000 is to be considered in case of an assessee who has not attained the age of 60 years during the previous year and Rs.3,00,000 is basic exemption limit for senior citizens and Rs.5,00,000 is for super senior citizens who are of 80 years or above. In this connection it is to be noted that rebate u/s 87 A is the tax rebate and it comes into play once the tax liability after the basic exemption limit is computed. Hence for the purposes of section 44AD(5) is of no relevance. Since the relevance of rebate u/s 87A will arise only when the total income of the assessee increased beyond Rs.2,50,000. If the case of the assessee is covered u/s 44AD(5) & his total income exceeds the maximum amount not chargeable to the Income Tax he is subject to Tax Audit.

Sub Section 5 will be applicable if following conditions are satisfied.

a. An eligible assessee to whom the provisions of sub-section (4) are applicable; and

b. The total income of that assessee has exceeded the maximum amount which is not chargeable to income-tax.

- In other words, sub-sections (4) and (5) are mutually inclusive. Provisions of sub-section (4) shall not be applicable to an assessee who never opted for the scheme in any of the earlier previous years, as it provides that the eligible assessee should have declared profits as per section 44AD for any previous year. Under this situation, assessee who have never ever opted for the scheme till the AY 2016-17 can enjoy the benefits by showing lesser profits for the subsequent assessment years.

Example: Mr. X commenced his business during FY 2019-20 relevant to AY 2020-21. He was engaged in a business of trading of goods. He reported total turnover of the business during the year as Rs.85 Lacs, entire sales were in cash. Mr. X computed profit from the aforesaid business to be Rs.2.30 Lacs which was his sole income during the year. Whether Mr. X is required to maintain books of accounts in accordance with provisions of section 44AA and whether he has to get his accounts audited u/s 44AB?

- Firstly, Mr. X is not required to get his accounts audited u/s 44AB of the Act his total income for the FY 2019-20 is less than maximum amount not chargeable to tax even if he had claimed profit from business less than deemed income u/s 44AD i.e., actual income of Rs.2.30 Lacs is less than deemed income of Rs.6.8 Lacss (8% of 85 Lacs). (Section 44AD(5)]

- However, Mr. X is required to maintain such books of account and other documents as may enable the AO to compute his total income in accordance with Second proviso to section 44AA(2) of I.T. Act, 1961 as his total turnover is more than limit of Rs.25 Lacs.

Exceptions to the provisions of section 44AD(4) & Sec. 44AD(5)

1. Assessee has not opted for presumptive taxation because of ineligible business

If a person has opted for presumptive taxation during previous years and due to increase in turnover over 2 crores during the current year, he is ineligible to opt the provisions of sec 44AD(1) of the Act. His business is an not eligible assessee u/s 44AD of the Act being total turnover is more than Rs.2 Crore. [Section 44AB(a) r.w.s. 44AD(1)] It is pertinent to note that person is not eligible to claim presumptive taxation for the year, he will not be covered by the provisions of section 44AD(4) and option to opt for presumptive taxation u/s 44AD(1) will be available in subsequent assessment years also.

Exceptions to the provisions of section 44AD(4) & Sec. 44AD(5)

2. Assessee has not opted for presumptive taxation because of commission income

- As per the provisions of sub section 6 of section 44AD, if an assessee has earned any income from specified activities such as commission, then provisions of section 44AD shall have no bearing on such assessee .In such a case, the assessee is not entitled to opt the provisions of sec 44AD.If ,in a year, the chain of sec 44AD is broken due to the receipt of commission ,that will not be considered as the assessee has gone out of the umbrella of sec 44AD.The assessee is entitled to opt for sec 44AD in subsequent years.

- It can be implied that where an assessee has turnover less that threshold specified u/s 44AB(a) and have earned any income as commission or brokerage, then he can file income with lower profits without getting its books of account audited.

Controversial Issue – Needs CBDT Clarification

- The amendment was brought by Finance Act, 2016 w.e.f 01/04/2017. The government is discouraging taxpayers from misusing the scheme and constantly changing their option often. If any assessee opts for presumptive taxation, he has to continue it for 5 years and if he wants to opt out, he will be barred from resuming presumptive taxation for a period of 5 years. There is an important issue which emerges for reckoning the period of 5 years. Amendment to section 44AD (i.e., new sub section (4) and (5) is applicable from 01/04/2017 i.e., from Assessment Year 2017-18. Now, question arises regarding the counting of the continuous 6 assessment years for the purpose of sub section (4). Will it be done initially from the Assessment Year 2017-18 itself or even the options exercised in the earlier years can also be counted?

- Another important question is, if the person has continuously opted for 5 years period in the past then the provision of 5 years restrictions will not be there as the sub section means that if a person has opted for 44AD for 5 years period continuously then no 5 years restrictions would be there if assessee decides to opt out. The issues are controversial and it would be in the interest of the masses if the CBDT clarifies it suitably.

Interesting issue in Sec. 44AD

- No presumptive taxation benefit u/s 44AD to partner on interest, remuneration from firm

- This issue has been decided by Hon’ble Madras High Court In Anandkumar [TS-690-HC-2020(MAD)]Mr. A. Anandkumar (Assessee) is an individual, who had received remuneration and interest from partnership firms during subject AY 2012-13. While filing the return, assessee had applied the presumptive rate @8% u/s 44AD. Revenue noted that assessee was not doing any business independently but was only a partner in the firms. Moreover, as assessee had no turnover and receipts on account of remuneration and interest from the firms could not be construed as gross receipts mentioned u/s 44AD. Therefore, Revenue denied the benefit of Sec.44AD and brought to tax the entire amount of remuneration and interest from the firms. The assessment order was confirmed by CIT(A) and Chennai ITAT. Aggrieved, assessee filed appeal before the Madras HC.

- HC upholds ITAT order and denies presumptive taxation benefit u/s 44AD to assessee-partner on interest, remuneration from firm.

PRESUMPTIVE TAXATION SCHEME under Section 44ADA

- Eligible Profession:

Meaning of “Professional services”

- “Professional services” means services rendered by a person in the course of carrying on legal, medical, engineering or architectural profession or the profession of accountancy or technical consultancy or interior decoration or advertising or such other profession as is notified by the CBDT for the purposes of section 44AA(1) of the Act.

- Section 44AA(1) prescribes for compulsory maintenance of such books of accounts and other documents which will enable the Assessing Officer to compute his total income in accordance with the provisions of this Act. Sub-section(1) applies to the followings-

- A person carrying on a legal profession.

- A person carrying on a medical profession.

- A person carrying on engineering or architectural profession.

- A person carrying on the profession of accountancy.

- A person carrying on the profession of technical consultancy.

- A person carrying on the profession of interior decoration. Any other profession as notified by the Board. The CBDT has notified the following professions u/s44AA(1) of the Act.

Whether a Model can opt the provisions of sec 44ADA ?

- In the case of DCIT (TDS) Vs Kodak India (P) Ltd. (ITAT Mumbai) the issue under consideration is whether the services, the modeling, rendered by Ms. Katrina Kaif constitutes professional service and the fee paid to her for modeling with the purpose of marketing of the camera products of the assessee liable for TDS u/s 194J?

- Undisputedly, Ms. Katrina Kaif has received the said fee not in connection with production of a cinematographic film and the same received admittedly for modeling. She has not received the sum for acting in an autographic Film. Receipts for all modeling and acting skills of an individual do not attract the said section 194J, unless, they are part of the production of a cinematographic film. In the original sense of the modeling, the same may be a profession and the receipts earned by such models may be professional receipts. But the fact is that modeling is not a defined or notified profession either in the Income Tax Act, 1961 or in the Notifications, In fact, there are many such un-notified professions and as such ones cannot be brought under the provisions of section 194J of the Act. In the instant, admittedly, the services rendered have nothing to do with the production of a cinematographic film. Further, before parting with the order, it is pertinent to mention that a person can have many skills i.e acting skills in Films, modeling skills for display of merchandise, singing skills etc. and such person can make earning out of such skills. It is not that total earning of that person in lieu of services rendered must attract the provisions of section 194J of the Act. Therefore, the taxable receipts u/s 194J of the Act are services-specific and not person specific. Therefore, the impugned payments made by the assessee to Matrix India on behalf of Ms. Katrina Kaif do not attract the provisions of section 194J of the Act.

- A model can’t opt the provisions of sec 44ADA of the Act on his income from modeling as a model is not a specified professional for the purposes of sec44ADA of the Act.

Applicability of provisions of Sec 44ADA in case TDS has been deducted u/s 194J

- Shri Arthur Bernard Sebastine Pais V. Deputy Commissioner Of Income-Tax, CPC, Bengaluru – Bangalore ITAT (2019). In this case TDS was deducted u/s 194J. The assessee had offered income under 44AD. There was CPC mismatch and was assessed under sec 44ADA. The ITAT held that fees of technical services as enumerated in section 194J is a very broad term which encompasses any services in the nature of managerial, technical or consultancy services. Though the deduction of tax on fees paid to Assessee has been done u/s 194J as mandated by the Act, the services rendered by the Assessee do not fall under section 44AA(1) which is a pre-condition to tax the receipts @ 50% on presumptive basis under section 44ADA. The Assessee cannot be said to be providing technical consultancy as mentioned in section 44AA(1) of the Act.

- Example: An Individual who is doing financial consultancy business and the service receiver while he is paying service charge, he is deducting TDS u/s 194J. Whether he can offer income u/s 44ADA? – Sec. 44ADA will be applicable only to the Notified Professions. It is an inclusive definition, it doesn’t cover financial consultancy business, hence he can’t offer income u/s 44ADA. – Notifications No. SO-18[E] dated 12.01.1977, No. SO 2675 dt.25.09.1992 and S.O. 385[E] dt.04.05.2001

Eligible Assessee: All the three conditions should be satisfied:

1. Resident assessee being an individual or a partnership firm other than a limited liability partnership

2. engaged in notified profession u/s 44AA(1)

3. Total gross receipts ≤ 50 lakhs

- No further deduction would be allowed: Section 44ADA(2) :Under the scheme, the assessee will be deemed to have been allowed the deductions under section 30 to 38. Accordingly, no further deduction under those sections shall be allowed.

- Written down value of the asset: Section 44ADA(3) :The written down value of any asset used for the purpose of the profession of the assessee will be deemed to have been calculated as if the assessee had claimed and had actually been allowed the deduction in respect of depreciation for the relevant assessment years.

- Option to claim lower profits: Section 44ADA(4): An assessee may claim that his profits and gains from the aforesaid profession are lower than the profits and gains deemed to be his income under section 44ADA(1); and if such total income exceeds the maximum amount which is not chargeable to income-tax, he has to maintain books of account under section 44AA and get them audited and furnish a report of such audit under section 44AB.

Partner’s Salary, Remuneration, Interest even though charged under the head as income from Business or Profession can be taxed u/s 44ADA in the hands of the individual partner having professional income

- A question comes to our mind that whether the provisions of Section 44ADA shall be applicable to the remuneration and other receipts by a partner from a professional services firm?

- In this connection, it is to be noted that the Income Tax Act, 1961 vide Section 40(b) states that the firm is eligible to claim remuneration as deduction to the extent specified therein and such remuneration is deductible in hands of the firm. The balance amounts are subjected to tax as profits in the hands of the firm. In other words, the eligible remuneration is deductible in the hands of firm and taxable in hands of partners, the remainder (profit) is taxable in hands of the firm and exempted in the hands of partners u/s 10(2A).

- Whether the remuneration and other income received from the firm can be called as ‘gross receipts’ for the purposes of Section 44ADA. Whether the share of profits of a partner can be considered as gross receipts for the purpose of Section 44ADA?

- The Mumbai Bench of the Income Tax Appellate Tribunal in the case of ACIT v. India Magnum Fund (81 ITD 295) held that in order to trigger the provisions of Section 44AB, there should be first computation of profits and gains of business or profession i.e. computation of total income as per Section 4. As the income exempt under Section 10 does not form part of the total income, such exempt income cannot be subjected to the provisions of Section 44AB. Consequently, one may argue that share of partners profit which is exempt under section 10(2A) would not be considered for the purposes of the gross receipts This view is also supported by the guidance note issued by The Institute of Chartered Accountants of India on tax audit. As per the guidance note, gross receipts exclude partner’s share of profit which is exempt u/s 10(2A).

Whether option of sec 44ADA optional or mandatory?

- Further, one more question that is to be answered is whether the provision of Section 44ADA is optional or mandatory, that is to say, is it mandatory for the partner whose gross receipts is less than Rs.50 lacs to apply the provisions of Section 44ADA or is it optional. Once the gross receipts are less than Rs.50 lacs the partner has to mandatorily offer 50% of such gross receipts for tax. In a case, where the partner thinks his expenditure is more than 50% or want to offer lower amounts of gross receipts for tax, he should then get his books of accounts audited as per provisions of sub-section (4) of Section 44ADA.

Radiology & pathological laboratory run by a physician (M.D./ M.B.B.S. not specialized in radiology or Bio-chemistry) will be considered as profession or business for limits of tax audit?

- S. 2(13) of the Income-tax Act, 1961 defines ‘business’ which includes any trade, commerce or manufacture or any adventure or concern in the nature of trade, commerce or manufacture. The word ‘business’ is one of wide import and it means activity carried on continuously and systematically by a person by the application of his labour or skill with a view to earning an income. While S. 2(36) of the Act defines ‘profession’ to include vocation. The Supreme Court in CIT vs. Manmohan Das (deceased) [59 ITR 699] has held that, the expression ‘profession’ involves the idea of an occupation requiring purely intellectual skill or manual skill controlled by the intellectual skill of the operator, as distinguished from an operation which is substantially the production or sale or arrangement for the production or sale of the commodities. So, from the facts of the case it is clear that radiology and pathology operated by a doctor who is not specialized would be a business. This view is supported by the Guidance Note on Tax Audit u/s. 44AB of the Income-tax Act, 1961, issued by the Institute of Chartered Accountants of India.

Presumptive Taxation in case of Partnership firms

- Resident Partnership Firms are eligible to opt for presumptive taxation u/s 44AD or 44ADA or 44AE. Sec 44AD and 44AE were amended in 1997 w.e.f. 01/04/1994 to allow remuneration and interest to partners (subject to conditions and limits specified in section 40(b)) after determination of profits as per sec 44AD or 44AE. However, by Finance Act, 2016, second proviso to Section 44AD(2) has been omitted which provided for deduction under section 40(b) with regard to the salary and interest to partners. However, sec 44AE has not been amended. Hence, remuneration and interest to partners will not be allowed in sec 44AD of the Act. However, remuneration and interest to partners will be allowed if income is declared u/s 44AE. The provisions of sec 44ADA of the Act are silent for the allowance remuneration and interest on capital to partners. The professional firms can take this benefit as is explained in the following example.

- Example : RSK & Associates, a firm of Chartered Accountants provides the following information:

| Receipts | Net Profit | 50% of receipt

|

Allowability of remuneration |

| Rs.40,00,000 | Rs.20,00,000 | Rs.20,00,000 | No remuneration and interest will be allowed as expense. |

| Rs.40,00,000 | Rs.24,00,000 | Rs.20,00,000 | Remuneration and interest can be allowed up to Rs.4,00,000, subject to sec 40(b) |

| Rs.40,00,000 | Rs.18,00,000 | Rs.20,00,000 | Sec 44ADA not applicable as profit is claimed to be less than 50% of receipts. RSK & Associates will be required to get their books of account audited u/s 44AB(d). Remuneration may allowed as per sec 40(b). |

Presumptive Taxation Scheme under Section 44AE

- Assessee engaged in the business of plying, hiring or leasing such goods carriages can opt for presumptive income in certain cases [section 44AE(1)]:

Notwithstanding anything to the contrary contained in sections 28 to 43C:

- in the case of an assessee,

- who owns not more than ten goods carriages at any time during the previous year and

- who is engaged in the business of plying, hiring or leasing such goods carriages,

- the income of such business chargeable to tax under the head “ Profits and gains of business or profession” shall be deemed to be the aggregate of the profits and gains, from all the goods carriages owned by him in the previous year, computed in accordance with the provisions of section 44AE (2)

The provisions of section 44AE (1) shall not apply in the following circumstances:

(i) If such person owns more than ten goods carriages at any time during the previous year.{Section 44AE(1}

(ii) If such person owns not more than ten “goods carriages” at any time during the previous year but is not engaged in the business of plying, hiring or leasing of such goods carriage.

(iii) If such person is not covered by any of the above conditions and but who declares lower profits and gains than the profits and gains specified in sub- section (1) and (2) of section 44AE as income from such goods carriages

Presumptive Taxation Scheme under Section 44AE

- Benefit of section 44AE is available to all the categories of taxpayers:

Individual, HUF, firm, company, etc., who are engaged in the business of plying, hiring or leasing of goods carriages and who does not own more than 10 goods vehicles at any time during the year. Person opting for section 44AE would not be required to get the books of accounts audited even if turnover exceeds the limit of Rs.1 Cr or 2 Cr.

- No turnover limit

The tax audit Limit is only applied on number of vehicle, so gross receipts may even exceed audit limits, still if opt for 44AE then no need for audit.

Example: A transport contractor having 6 trucks is having gross receipts of Rs.105 Lacs for the F.Y. 2020-21. Is he liable for the tax audit?

- Section 44AB does not contain any condition for tax audit of assessees engaged in transport operations (of goods) where the gross receipt exceeds Rs.100 lacss. Only where the assessee offers income below the presumptive limit prescribed in section 44AD or section 44AE, the accounts have to be audited under section 44AB.

- Only where the assessee offers income below the presumptive limit given in section 44AE irrespective of the quantum of receipt, the accounts have to be audited under section 44AB.

Presumptive Taxation Scheme under Section 44AE

- Presumptive amount of income to be computed: The presumptive income computed above is the final income and no further expenses will be allowed or disallowed. Separate deduction towards other business expenses like salary, depreciation etc. will not admissible. Written down value of any asset used in such business shall be calculated as if depreciation u/s 32 is claimed and has been actually allowed. However, taxpayers can claim deduction under chapter VI-A like deduction u/s 80C, 80D etc. No disallowance can be made u/s 40, 40A, 43B etc. for the taxpayers who have opted section 44AE.

- Allowability of remuneration: Where the assessee is a partnership firm, the remuneration & interest on capital to the partners can further be claimed as deduction subject to conditions & limit specified u/s 40(b). In case of presumptive scheme of taxation u/s 44AD and sec 44ADA, deduction towards interest & remuneration to partners is not available. However, it is not so in section 44AE.

- Benefit of set off and carry forward: Sec 70-80 will be applicable to the deemed income: The brought forward losses of this business or any other business and current year losses from other businesses & other heads shall be allowed to be set off from the deemed income subject to rules framed under the Income Tax Act, 1961 for “set off and carry forward” of losses.

- Non allowance of depreciation and unabsorbed depreciation: Since depreciation and carry forward of unabsorbed depreciation is covered by Sec 32, depreciation shall not be allowed from the deemed Income, however a notional depreciation is provided in the Block to arrive at the opening WDV of the next year.

- Deduction u/s 80C to 80U will be given from GTI of the assessee even from the deemed income included in the GTI.

Minimum Income to be offered for taxation u/s 44AE: 1988) which reads as under:

- For heavy goods vehicle, income shall be an amount equal to Rs.1,000/- per ton of gross vehicle weight or unladen weight, as the case may be, for every month or part of a month during which the heavy goods vehicle is owned by the assessee in the previous year or an amount claimed to have been actually earned from such vehicle, whichever is higher;

- For other than heavy goods vehicle, income shall be an amount equal to Rs.7,500/- for every month or part of a month during which the goods carriage is owned by the assessee in the previous year or an amount claimed to have been actually earned from such goods carriage, whichever is higher.

Concept of Unladen Weight :

- No meaning or definition is specifically given for “unladen weight” in section 44AE. However, in Motor Vehicles Act the concept of “unladen weight” has been attached to a vehicle or a trailer whereas the concept of “gross vehicle weight” has been attached with goods carriages (the total weight of the vehicle and load certified).

- It is but obvious that in case of any normal goods carriage, the gross vehicle weight is going to be more than “unladen weight” of the vehicle. The word “as the case may be” used in section 44AE means that either gross vehicle weight or unladen weight need to be taken for computing income. Where gross vehicle need to be used and where unladen weight need to be used is not provided in section 44AE. The word used in section 44AE to some extent conveys the idea that either the gross vehicle weight would be applicable or unladen weight would be applicable. The wording used in section 44AE conveys that both the weight cannot be simultaneously applicable.

- If definition of “heavy goods vehicle” in Section 44AE would have been same as in Motor Vehicle Act 1988, no disputes or confusion would have been there. The concept of unladen weight in the motor vehicle Act is attached with Tractor, road roller.

- While drafting Section 44AE, words “tractor and road roller” as available in the definition of heavy goods vehicle in the Motor Vehicle Act 1988 is not taken but the word “unladen weight” is duly taken. In my view, there appears to be an error as unladen weight is not attached to the “goods carriage” but attached to “tractor and road roller”.

- It is to be noted here that section 44AE is applicable for “Goods carriage” and in my view “Tractor or Road Roller” are not goods carriage.

Can assessee apply Sec 44AE selectively on some trucks?

- Sec 44AE does not permit the assessee to apply the provisions of this section on some of the truck while he claims the income from the others as per the books prepared. Thus this section applies to all the trucks owned by the assessee. He may opt for or out of the provisions of this Section for all the trucks.

Dy. CIT v. C.P. Kunhimohammed(2005) 94 ITD 278 (Cochin-Trib)

- The assessee having 3 lorries, 2 of them are old and the one being new, wanted to claim the benefit of section 44AE for 2 lorries and normal income scheme for the new lorry.

- The Tribunal held as below: “There is no provision which enables an assessee to apply the provisions of section 44AE in the case of some lorries and to go for regular assessment on the basis of books of account in respect of the remaining lorries. As plying hiring or leasing the goods carriages is treated as a separate business, all the lorries owned by the assessee form part of the said business and the tax treatment of all those lorries needs to be an uniform manner.”

Is JCB a goods Carriage?

Gaylord Constructions v. Income-tax Officer

- The contention of the assessee is that JCB is analogous to goods carrier and the provisions of section 44AE are applicable. The Assessing Officer rejected the contention of the assessee as in the opinion of the Assessing Officer JCB is an earth mover machinery, cannot be equated with goods carrier like lorries and trucks.

- The ITAT held -In the case of JCB, the principal function is not carriage of goods. In our opinion, by no stretch of imagination, JCB can be termed as “goods carriage”. We, therefore, hold that the income from JCBs cannot be computed by applying section 44AE of the Act.

- No benefit of income below the basic exemption limit : Contrary to the provisions of sec 44AD and sec 44ADA of the Act, the assessee has to get its books audited if he declares his income below the benchmarks given and his taxable income does not exceed the basic exemption limit.

Example: a truck owner having 2 trucks, each having 15 ton gross weight, offering rs.600 per ton per month.

Total income = 600*15*2*12= rs.2,16,000. is he liable for tax audit?

- Under section 44AE, if profits offered are less than the prescribed limits, tax audit is applicable even if the income is below the non-taxable limits.

- Example: Mr. X owns 8 goods carriage vehicles, 3 of which have unladen weight of 15MT, 18MT and 20MT and the rest are below 12MT capacity. The vehicle with 20MT was purchased on 22/07/19 and was used only from 21/01/2020.

| Vehicle | Gross Weight in Kg | Presumptive Income Per Month in Rs. | No. of Months | Total Presumptive Income in Rs. |

| 1 | 7500 | 7500 | 12 | 90000 |

| 2 | 7500 | 7500 | 12 | 90000 |

| 3 | 7500 | 7500 | 12 | 90000 |

| 4 | 7500 | 7500 | 12 | 90000 |

| 5 | 7500 | 7500 | 12 | 90000 |

| 6 | 15000 | 15000 | 12 | 180000 |

| 7 | 18000 | 18000 | 12 | 216000 |

| 8 | 20000 | 20000 | 9 | 180000 |

| Total Business Income | 1026000 | |||

Interplay of Sec 44AA, 44AB and 44AD of the Income Tax Act,1961

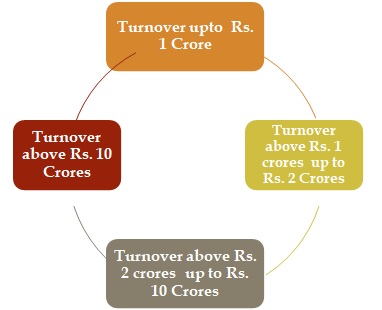

We can divide our study in the following 4 parts:

A. When business turnover is upto Rs.1 crore

B. When business turnover is exceeding Rs.1 crore but upto Rs.2 crores

C. When business turnover exceeding Rs.2 crore but upto Rs.10 crores

D. When business turnover exceeding Rs.10 crores

These all four categories can be shown as under

A. When business turnover is upto Rs.1 crore

- If a person is having turnover/ gross receipts up to Rs.1 crore, clause (a) of Sec 44AB will not be applicable. If the person is declaring profits as per sec 44AD(1), he will not be required to get his books of accounts audited. If in case he is declaring profits less the 8% of turnover (6% in case of sale is through banking channels), then we have to check two more conditions:

- Whether in any of the preceding previous years, the person has declared profits as per sec 44AD.

AND

- Whether the income of the person exceeds the basic exemption limit.

- If both the above conditions are satisfied, then the person is required to get books of accounts audited. In case any of the condition is not satisfied or both the conditions are not satisfied, then the person would not be required to get the books of accounts audited.

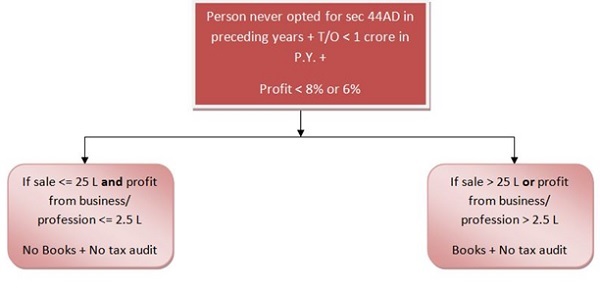

(a) A person who has started a new business

- It is a very interesting issue in which an assessee who has started a new business during the previous year and he is unable to decide whether to opt for sec 44AD of the Act or not. If he decides to avail the benefits of sec 44AD, then he has to declare profits at the rate of 8% or 6% of turnover or at higher rate as specified in sec 44AD. Then he shall neither be required to maintain books of account nor required to get them audited. In case, he decides to not opt for sec 44AD, the situation will be entirely different.