Section 194IA is inserted by Finance act 2013 and it is applicable from 01st of June, 2013.

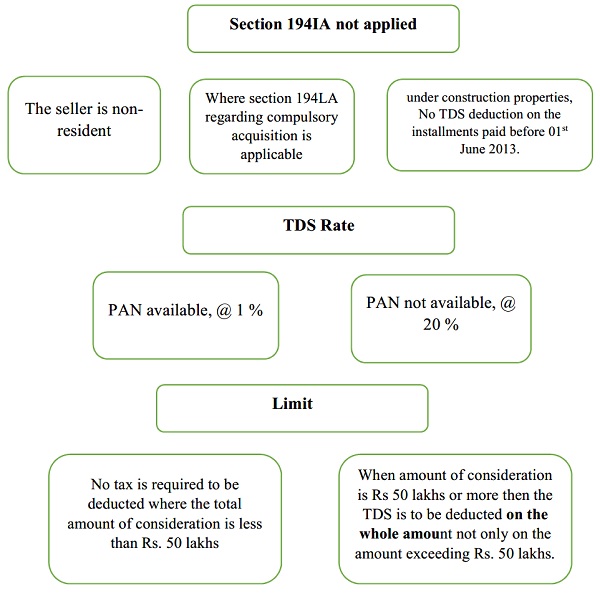

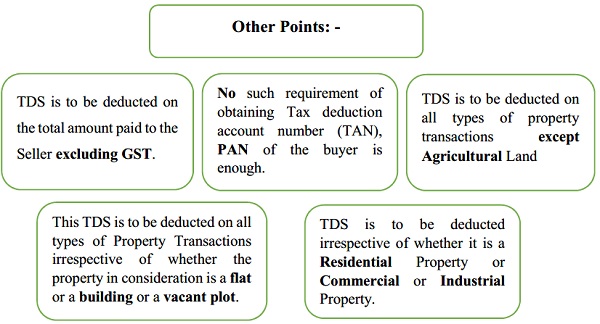

A person who is purchasing any immovable property (other than agricultural land) from a resident is required to deduct TDS @ 1% from the amount payable.

On Installments or Loan

If the purchase value is greater than Rs. 50 lakhs then TDS is to be deducted from the first instalment itself and for each and every instalment. The purchaser should not wait for the aggregate instalment amounts to exceed Rs. 50 lakhs.

The view that TDS is to be deducted from final instalment or after exceeding Rs. 50 lakhs are not right.

If the purchaser has availed loan from a bank and bank pays directly to the seller, then it’s also considered as a payment and TDS needs to be deducted on date of such payment to seller.

The date of payment of EMI by buyer to bank is irrelevant.

Due Date of TDS Payment and Form 26QB

The deductor i.e. the purchaser of property has to file form 26QB which is a Challan cum declaration statement within 30 days from the end of the month in which payment is made.

No separate TDS return is to be filed in respect of such deduction.

Example-1: –

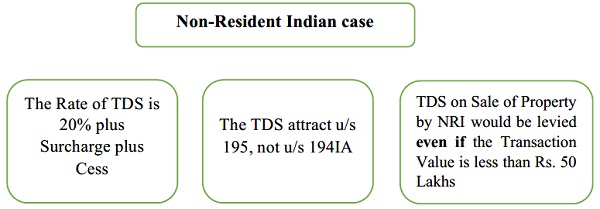

Mr. Gayle, non-resident, sold his residential building situated at Jaipur, Rajasthan to Mr. Rahul for a total consideration of ₹ 2.50 crore.

In such a case, Mr. Rahul will make the payment to Mr. Gayle after deduction of tax @20% plus surcharge and Health & Education Cess @ 4% under Section 195.

Section 194-IA does not apply where the payment is made to a non-resident.

Example-2: –

Mr. Sachin, resident in India, sold his house situated in Jaipur, Rajasthan, to Mr. John who is resident of USA for a total consideration of ₹ 4.20 crores.

In that case, Mr. John is required to deduct TDS @ 1% under section 194-IA while making payment to Mr. Sachin.

In case of payment in installments to a builder, do the buyer needs to deduct TDS on every installment and deposit TDS and file challan-cum-return every month (every installment payment)?

Hi, you have mentioned no TAN need to be obtained.

Is it true even if the seller is an NRI?

Am told that a Resident buyer has to obtain a TAN, if the seller is an NRI.

pls correct me.

If Seller is an NRI and buyer is resident then buyer has to apply for TAN but this condition is applicable only if seller is NRI and buyer is Resident. Accordingly buyer has to file TDS return also to pass TDS credit to NRI Seller.