Union Budget 2020 proposed significant changes in compliance and registration procedure of Religious or Charitable Trusts/ Institutions etc. which are registered under section 12AA of the Income Tax Act.

Accordingly, the following amendment was made in the Finance Act, 2020 which reads as:-

Under Section 11:-

In section 11 of the Income-tax Act, in sub-section (7), with effect from the 1st day of June, 2020,––

(a) for the words, brackets, letters and figures “under clause (b) of sub-section (1) of section 12AA”, the words, figures and letters “under section 12AA or section 12AB” shall be substituted;

(b) for the words, brackets, figures and letter “clause (1) and clause (23C)”, the words, brackets, figures and letter “clause (1), clause (23C) and clause (46)” shall be substituted;

(c) the following provisos shall be inserted, namely:––

“Provided that such registration shall become inoperative from the date on which the trust or institution is approved under clause (23C) of section 10 or is notified under clause (46) of the said section, as the case may be, or the date on which this proviso has come into force, whichever is later:

Provided further that the trust or institution, whose registration has become inoperative under the first proviso, may apply to get its registration operative under section 12AB subject to the condition that on doing so, the approval under clause (23C) of section 10 or notification under clause (46) of the said section, as the case may be, to such trust or institution shall cease to have any effect from the date on which the said registration becomes operative and thereafter, it shall not be entitled to exemption under the respective clauses.”.

As a result of the above amendment, following effect shall take place with effect from 1st June 2020:-

All the existing charitable and religious institutions (including NGOs) which are registered or approved under the following sections-

- Section 12A

- Section 12AA

- Section 10(23C)

- Section 80G

are compulsorily required to switch to section 12AB for fresh registration in order to continue availing exemption under section 10 or 11, as the case may be.

Currently several institutions of trusts registered under section 10(23C) or section 12AA are now required to renew their registration under section 12AB.

As a result of which, Section 12AA which prescribes the registration process for the registration Trusts or Institutions will cease to exist and a new section 12AB will come into force with effect from-

the date of grant of registration under section 12AB or;

the last date by which the application for registration and approval is required to be made;

whichever is earlier.

The above section shall come into effect from 1st June 2020 and the trusts or institutions are required to apply for registration and approval under section 12AB within 3 months from 1st June 2020, i.e., by 31st August 2020.

Similarly, charitable trusts and exempt institutions which are availing exemption benefit under section 80G will also now be required to apply for fresh registration under section 12AB by 31st August 2020.

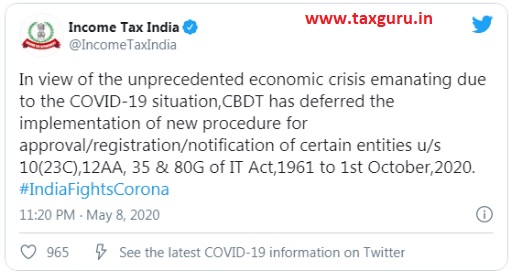

Further following the tweet made by CBDT on May 8, 2020 which is iterated as follows:-

“In view of the unprecedented economic crisis emanating due to the COVID-19 situation, CBDT has deferred the implementation of new procedure for approval/registration/notification of certain entities u/s 10(23C),12AA, 35 & 80G of IT Act,1961 to 1st October 2020.”

As a result of the above, the new compliances mentioned under the above sections which were applicable with effect from 1st June 2020 are now deferred and will be applicable from 1st October 2020 and have to complied latest by 31st December, 2020.

Also, a press note was released on 9th May 2020 deferring the implementation of new procedure under section 12AB. The press note in regard of the same was released on May 9th 2020.

Appropriate Authority for Application:-

The application shall be made online by Filing Form 10A along with the required documents to the Commissioner or Principle Commissioner who shall pass an order granting approval or rejection within three months from date of commencement of new provisions, i.e., by 31st August 2020.

Further, in case where Commissioner or Principle Commissioner is satisfied that the charitable/religious trusts institution etc. have not complied with the objects mentioned or any other law, shall cancel the registration of charitable/religious trusts institution etc. after providing the reasonable opportunity of being heard.

Similarly there are different time limits under different categories which can be summarized below:-

| Category | Time Limits |

| Institutes already registered under section 12A or 12AA or having certificate under section 80G | By 31st August (Now by 31st December 2020) |

| Institutes who have obtained registration under section 12AB | 6 months prior to the expiry of tenure of 5 years (refer the Validity Period of Registration Paragraph) |

| Institutions that have provisionally obtained registrations under section 12AB | 6 months prior to the expiry date of the provisional registration; or

Within 6 months of the commencement of its activities; Whichever is earlier. |

| Where institutions have modified the objectives | Within 30 days from the date of such modifications. |

| In any other case | At least one month prior to the commencement of the previous year. |

Validity period of Registration:-

The registration once granted shall be valid for 5 years.

Registration Procedure:-

- The application can be made by filing form 10A online on the income tax site incometaxindiaefiling.gov.in

- The form is available on the income tax website under Income Tax Forms Section under e-file menu which is visible after login on the website.

Contents required to be furnished in Form 10A:-

(1) Name of the Trust, Society or Institution.

(2) PAN details of the Trust, Society or Institution.

(3) Registered Address of the Trust, Society or Institution.

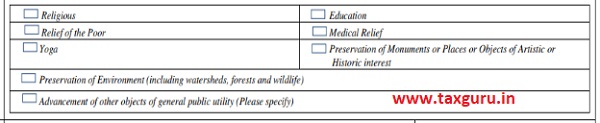

(4) Select the type of Trust:- Religious/ Charitable/ Religious-cum-Charitable

(5) E-Mail and Mobile number of the Managing Trustee/Chairman/Managing Director/Any authorized person by whatever name called

(6) Legal Status of the Trust

(7) Objects of the Trust

(8) Date of Modification of Objects, if any.

(9) Whether the application granted in the past is rejected or the registration is cancelled ? If yes, details of the order cancelling the same.

(10) If the applicant is registered under FCRA, 2010? If yes, then details of the same.

Documents required for Registration:-

Following is the list of documents as mentioned on the Income Tax Website:-

(a) Where the trust is created, or the institution is established, under an instrument, self-certified copy of the instrument creating the trust or establishing the institution;

(b) Where the trust is created, or the institution is established, otherwise than under an instrument, self-certified copy of the document evidencing the creation of the trust, or establishment of the institution;

(c) Self-certified copy of registration with Registrar of Companies or Registrar of Firms and Societies or Registrar of Public Trusts, as the case may be;

(d) self-certified copy of the documents evidencing adoption or modification of the objects, if any;

(e) where the trust or institution has been in existence during any year or years prior to the financial year in which the application for registration is made, self certified copies of the annual accounts of the trust or institution relating to such prior year or years (not being more than three years immediately preceding the year in which the said application is made) for which such accounts have been made up; note on the activities of the trust or institution;

(f) self-certified copy of existing order granting registration under section 12A or section 12AB, as the case may be; and

(g) self-certified copy of order of rejection of application for grant of registration under section 12A or section 12AB, as the case may be, if any.

In simple words, we can say the following is required for registration

Following documents are required from the client and annexed to FORM 10A while registration:-

1. Registration Certificate and MOA / Trust Deed (two copies- self attested by the Managing Trustee)

2. NOC from the Landlord where registered office is situated (if place is rented)

3. Copy of PAN card of Trust.

4. Electricity Bill/ House Tax/ Water Bill.

5. Evidence of welfare activities carried out and progress report of the same since 3 years or since inception.

6. Books of Accounts, Balance Sheet, ITR (if any) since inception or last 3 years.

7. List of Donors with their PAN and address.

8. List of Governing body or members of the trust/ Institution in the following format

| Sr. No. | Name | Address | Adhaar No. | PAN | Mobile No. | Email id |

9. Trust Deed for verification of Original Registration Certificate and MOA.

10. Any other information / document as may be asked by the Income Tax Department.

Conclusion:-

From 1st October 2020, the new provisions will come into effect, as a result of which every trust or Institution which are already in existence will have to mandatorily renew the certificate granted under section 12A, 12AA, 80G or section 35 within the time limit prescribed which is latest by 31st December 2020.

In case of new Trusts or Institutions they will have to apply for registration under section 12AB within the time limit prescribed.

We applied 12A registration form 10AB instead of 10A , after submitted 10AB , 10A also submitted for both 12A & 80G registration 80G approval received but 12A not yet received, 10AB how to surrendered and how to get 12A registrarion.

Whether AOP can register u/s 12 AB of Income tax Act?

Please update this article considering new changes in time limit announced by the Government.

Thank you.

Regards,

Still Form 10A is not showing section 12AB

Please see my other article on same topic for forms updated by CBDT for applying renewed registration. I hope your query will be anwered by that article.

Here’s the link https://taxguru.in/income-tax/form-application-registration-charitable-religious-trusts-institutions.html

Hello,

Whether Form-12AB is available on the site or not ??

When we has to start the procedure??

hello sir

80g And 12A Renewal Process For 12AB Has Started Or Not

while applying 12a registration mobile number and email id prefilled. but that mobile number and email are not managing trustee’s. we are unable to edit also. can you please explain why it is coming and what to do now?

Change Mobile number & Email in Efiling “Profile – Principal Contact details” and it will automatically reflect in your 12A Application.

That was very informative. Thank you for making it so clear! Best wishes.

We have recently been informed that the site for applying for12AB is not functional and we have to register from 1st April 2021,

We do not have to register NOW but FROM 1ST APRIL 2021.

Is this true???

Hello CA Chiragji,

today our NGO Has been granted 80G certification w.e.f from 04/10/20 & in order its not mentioned its provisional for 6 month or 3 year or 5 year.

And also We have to apply for renewal, as its already issue on 4/10/20.

Please help for the confuse for the above.

Thanks you in advance for your help,

Ramakant

When will portal open for registering trusts u/s 12AB

Dear All,

The earlier reply of mine was updated by one of my article as I was occupied in GST audit and was not keeping well with my health sue to pandemic and the was not completely updated for which grant me an apology.

But as far as renewals are concerned.

Government has not updated on how to proceed.

It is expected for a new form for the same or the existing forms will have amendments which allows for renewals and applications. Request all to kindly wait from any updates from the government side.

I will also reply to individual query soon and will keep everyone informed by updating my comments with respect to any updates by The Government.

I believe fresh form would replace Form 10A to meet the requisites of section 12AB and even the documents to be filed may be enlisted afresh. I am afraid, it may not require a compliance certificate or declaration under other Acts applicable to assessee trust/society.

According to rule all 12AA & 80 G registrations will be cancelled w,e,f,1/10/20 and trusts will have to apply for re-registration by 31/12/2020. My question is whether trust can issue receipts of 80 G during this period to doners

Our organization have FCRA and 12AA…should we renewal for 12AB

Dear sir,

In application form 10A,

1. Details of authors/founders- if not alive then ?

2. In point no 5 , The details of every registered trust 12A/12AA required or only those trust which have modified objects, has to be given ?

Thanks & regards

CA Kapil Bafna

Nobody has answered which is the amended application form in place of Form 10A, which does not mention about 12AB and existing Registration details required to be filled in case of application for fresh registration due to amendment in object. There should be a fresh application form u/s 12AB with relevant clauses/details.

Sir,

I have filed the applications via form 10A and 10G for renewal of 12AB and 80G on 25 Aug 2020.

Now I am told that the same can be filled wef 1 Oct.

Now what is rectification.. plz expedite your comments

Regards

Dear Sir,

Thank you for your detailed post. Very informative.

Also ours is a charitable trust with !2A, registered in 2000 with 80G registration valid till date.

Now that to re-register the same and moving to 12AB , I feel it is mandatory to enclose self attested 12A registration certificate copy.

Unfortunately 12A certificate is misplaced and not traceable. I do not have the registration number too. But have original 80G certificate,

In this situation how am I to proceed further. Pls guide.

Since 12A registration is 20 years old, it is not available for downloading from IT site.

Thanks for your immediate and valuable reply.

Rajan

Dear sir,

The article suggest to apply for registration u/s 12AB in FORM 10A. Perusal of Rule 17A, under which Form 10A has been prescribed, reveals that it is a form prescribed for “clause (aa) or clause (ab) of sub-section (1) of section 12A”. It nowhere specifies that it can be used u/s 12AB.

I am unable to find any authority say notification / press release etc. which allows the usage of Form 10A for the purpose of sec. 12AB registration.

I would be glad if you can share any such authority.

Thanks in advance.

Dear Madam,

We have Currently have registration under 12AA, Again we have to re register for exemption,

TO get Renewal of The trust , We should again file the Form 10A same as the previous time because it shows under 12A only but nowhere shown like 12AB could you clearly explain

Dear Chirag,

Form 10A for applying for registration is not updated on site?

Site nowhere shows form 10A for registration u/s 12AB as per clause 12A(i)(ac).

Can you pl revert for as to apply for registration