E-Tutorial on Important Information for 26QB Correction (Second Time), Brief steps for 26QB Correction (Second Time), 3. Description for Requested Status of 26QB Correction (Second Time), 4. Pictorial guide for 26QB Correction (Second Time) and Pictorial guide for Approval by Seller/Buyer for 26QB Correction (Second Time).

Page Contents

- 1. Important Information for “26QB Correction (Second Time)”.

- 2. Brief steps for “26QB Correction (Second Time)”.

- 3 . Description for “Requested Status of 26QB Correction (Second Time)”.

- 4 . Pictorial guide for “26QB Correction (Second Time)”.

- 5 . Pictorial guide for “Approval by Seller/Buyer for 26QB Correction (Second Time)”.

1. Important Information for “26QB Correction (Second Time)”.

♦ Only Buyers registered on TRACES can submit request for “26QB correction” under “Statements/Forms ” Tab.

♦ 26QB Correction applicable from Assessment Year 2014-15 onwards.

♦ Fields of 26QB in which Correction is allowed as follows :

1. PAN of Buyer

2. PAN of Seller

3. Financial Year

4. Amount Paid/Credited

5. Date of Payment/Credit

6. Date of Deduction

7. Property Details –(Complete Address of the Property)

8. Total Value of Consideration (Property Value)

♦ If Buyer files 26QB Correction (Second Time) and “Seller” is known , after approval of Seller the correction will directly Submitted to AO.

♦ If Buyer files 26QB Correction (Second Time) and Seller is non Traceable, the correction request can be submitted through AO Approval option for updating PAN details (Buyer/ Seller).

♦ If PAN of Seller requires to be updated, the taxguru.in correction request will require “Previous Seller’s” approval.

♦ If PAN of Buyer requires to be updated, the correction request will require Seller’s and intended (New) Buyer approval.

♦ If both PAN of Seller and Buyer requires to be updated, the correction request will require approval from Previous Seller and intended (New) Buyer.

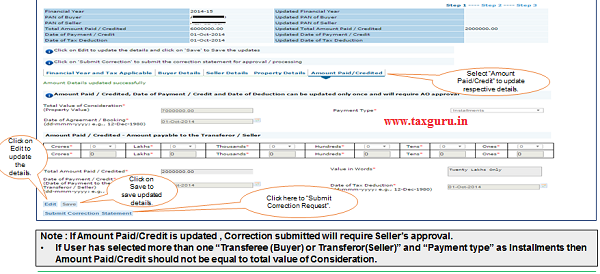

♦ If Amount Paid/Credited is updated, the correction submitted will require Seller’s Approval.

♦ Jurisdictional AO will be decided on the basis of Buyer’s PAN’s (PAN submitting the correction) Jurisdiction.

♦ If user is doing 26QB correction for the First Time Correction or Second time Correction in Seller PAN + Amount Paid /Credit, Correction request will be directly submitted for A.O. approval

♦ If user is doing 26QB correction for the taxguru.in First Time Correction or Second Time Correction in Buyer PAN + Seller PAN + Amount Paid/Credit, request will be directly submitted for A.O. approval.

2. Brief steps for “26QB Correction (Second Time)”.

♦ Step 1 : Login to TRACES website with your “User ID”, “Password” and the “Verification Code”. Landing page will be displayed on Screen.

♦ Step 2 : Select option “Request for Correction” under “Statements/ Forms” tab to initiate correction request. 26QB checklist will display on next screen. After clicking on “Proceed”.

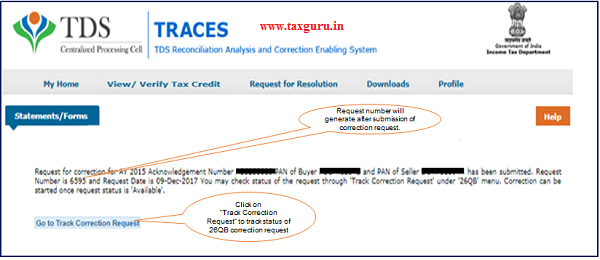

♦ Step 3 : Enter relevant “Assessment Year”, “Acknowledgement Number” and “PAN of Seller” according to filed 26QB, then Click on “File Correction” to submit request for correction. Request number will generate after submission of Correction

Request.

User can check Requested Status in “Track Correction Request” option under “Statements/ Forms” tab.

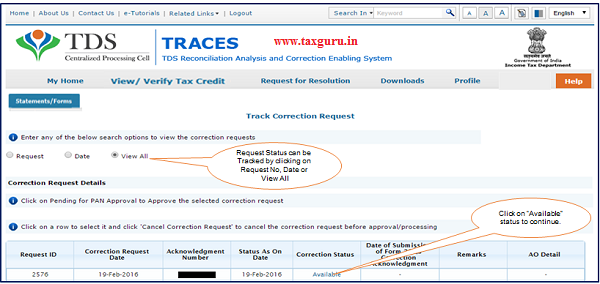

♦ Step 4 : Go to “Track Correction Request” option under “Statements/ Forms” tab and initiate correction once the status is

“Available”. Click on “Available” status to continue.

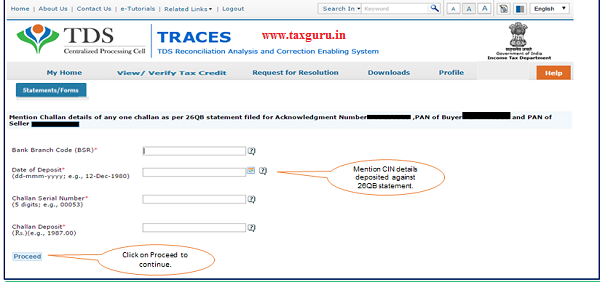

♦ Step 5 : Mention CIN details deposited against 26QB statement and click on “Proceed”.

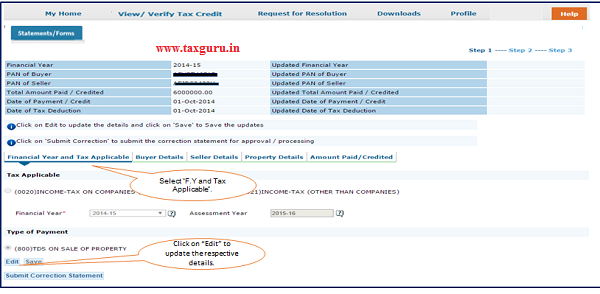

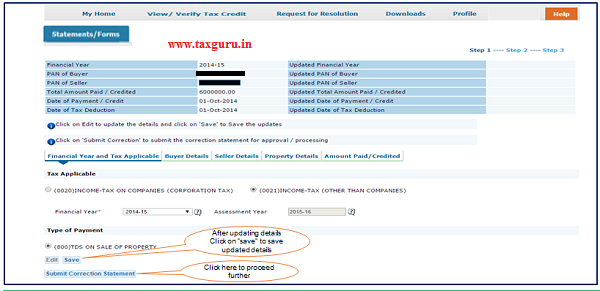

♦ Step 6 : User can select “Financial Year and Tax applicable” option to change F.Y in 26QB. After clicking on “Edit” button Message will pop up on the screen. Click on “Save” to save updated details then click on “Submit Correction Statement”

(Select tab accordingly in which user want to do edit details).

♦ Step 7 : Screen will display to “Confirm details” (Updated details will be highlighted in Yellow Colour).

♦ Step 8 : After confirming the details a message will pop-up on screen that is A.O. details will be available on “Track Request” screen under “26QB”, once the ”Correction Status” appears as “Pending for A.O. approval”.

♦ Step 9 : Profile details will be populated as per TRACES Profile. Click on “Submit Request” to Submit Correction Request.

♦ Step 10 : After submitting the Correction, a Correction ID will be generated through which status of correction can be tracked in “Track Correction Request” under “Statement/Forms”.

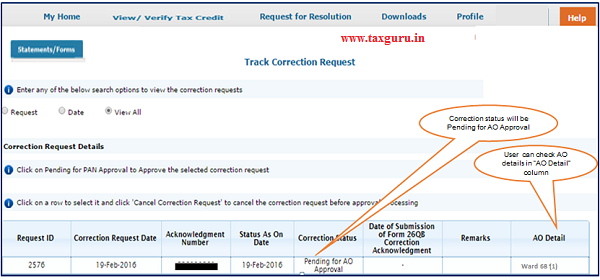

♦ Step 11 : Correction status will be “Pending for AO Approval”. User can check AO details in “AO Detail” column under “Track Correction Request” option.

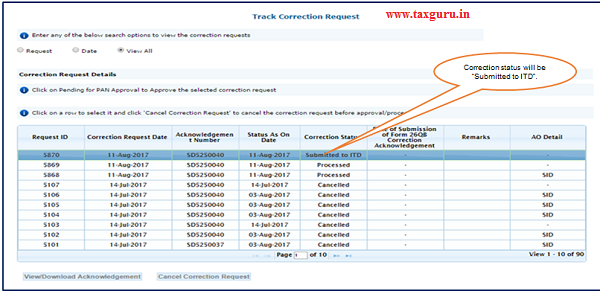

♦ Step 12: After Approval from A.O. correction will be “Submitted to ITD”.

♦ Step 13 : Final Correction status will be “Processed”.

NOTE :

1. Furnish hard copy of Acknowledgement of form 26QB correction along with Identity Proof.

2. PAN Card.

3. Documents related to Transfer of Property.

4. Proofs of payment made through Challan for 26QB to jurisdictional AO for verification.

3 . Description for “Requested Status of 26QB Correction (Second Time)”.

| Status | Description |

| Available | Once the request for correction is available for correction, status will be “Available”. |

| Pending for AO Approval | Status will be “Pending for A.O Approval” if correction is submitted for AO Approval. |

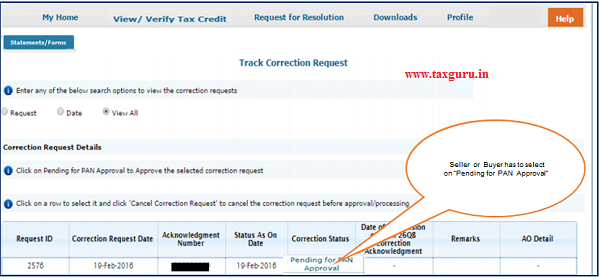

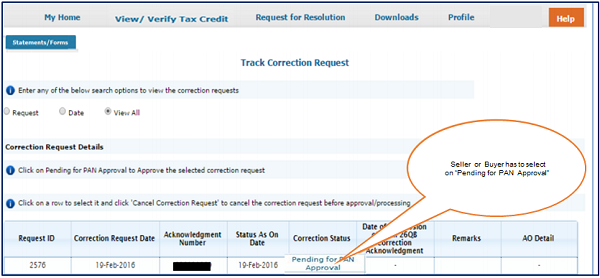

| Pending for PAN Approval | Status will be “Pending for PAN Approval” if Correction is submitted for second party’s (Seller or buyer) approval |

| Submitted to ITD | Status will be submitted to ITD if request is approved by AO or second party (Seller or Buyer). |

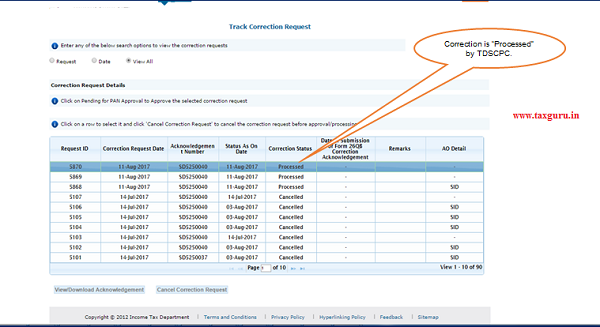

| Processed | Status will be processed if request is get processed by TDS CPC . |

| Cancelled | Status will be cancelled if request is cancelled by Buyer before Approval/Processing. |

4 . Pictorial guide for “26QB Correction (Second Time)”.

Step 1 : Login to TRACES website with your “User ID”, “Password” and the “Verification Code”.

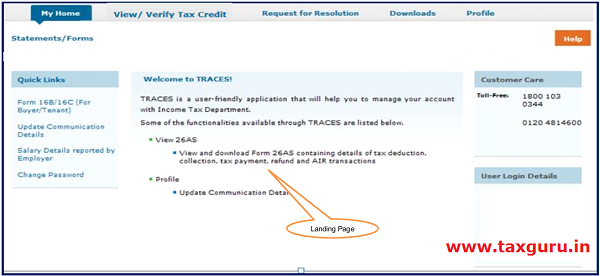

Step 1 (Contd.) : Landing page will be displayed on Screen.

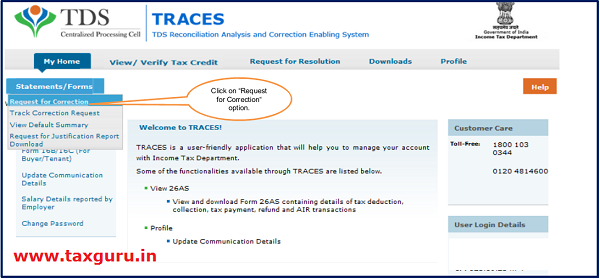

Step 2 : Select option “Request for Correction” under “Statements/Forms” tab to initiate correction request.

Step 2 (Contd.) : 26QB Correction Checklist will display.

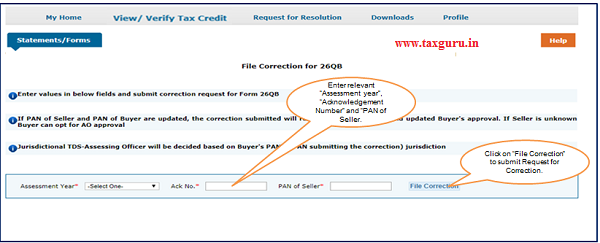

Step 3 : Enter relevant “Assessment year”, “Acknowledgement Number” and “PAN of Seller” according to filed 26QB, then Click on “File Correction”.

Note : Request number will be generated after submission of Request for Correction. User can check status in “Track Correction Request” option Under “Statements/ Forms” tab.

Step 3 (Contd.) : Request number will generate after submission of Correction Request.

Step 4 : Go to “Track Correction Request” option taxguru.in under “Statements/Forms” tab and initiate correction once the status is “ Available”. Click on “Available” status to continue.

Step 5 : Mention CIN details deposited against 26QB statement and click on “Proceed”.

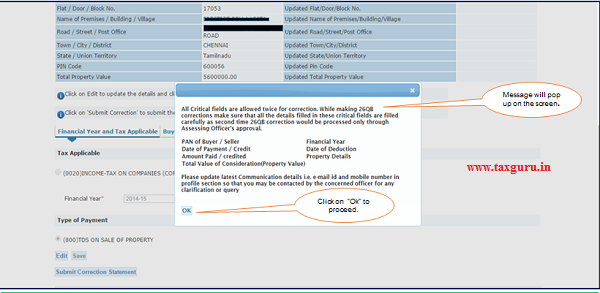

Step 6 : User can select “Financial Year and Tax applicable” option to change F.Y in 26QB.

Step 6 (Contd.) : After clicking on “Edit” option Message will pop up on the screen.

Step 6 (Contd.) : Click on “Save” to save updated details then click on “Submit Correction Statement”.

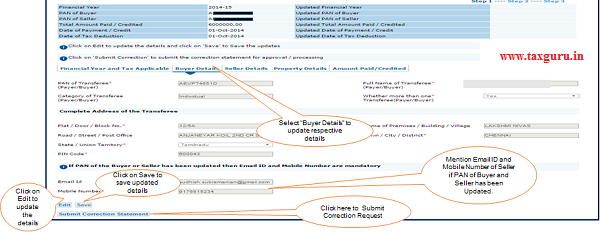

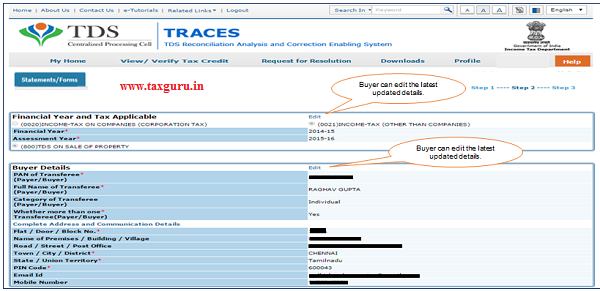

Step 6 (Contd.) : Select “Buyer Details” option to update respective details.

Note : On applying correction in taxguru.in PAN of Buyer or Seller or both, user will be asked to confirm if PAN of Seller is known or unknown.

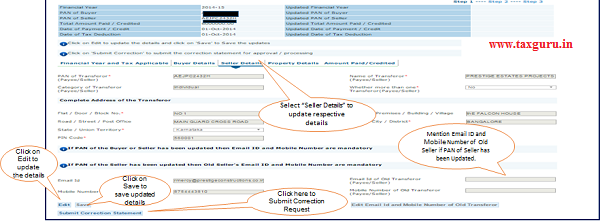

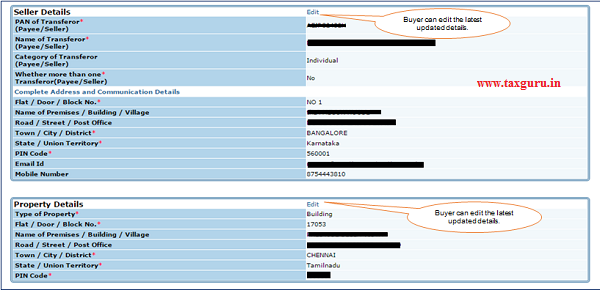

Step 6 (Contd.) : Select “Seller Details” option to update respective details.

Note : On applying correction in PAN of Buyer or Seller or both, user will be asked to confirm if PAN of Seller is known or unknown.

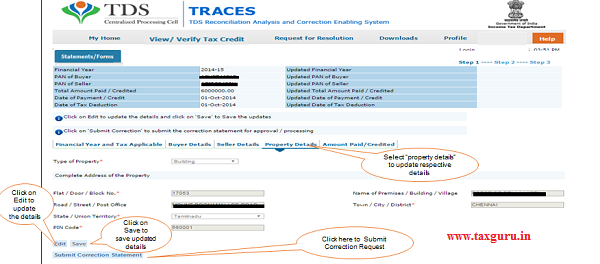

Step 6 (Contd.) : Select “Property Details” to update Property Address details.

–

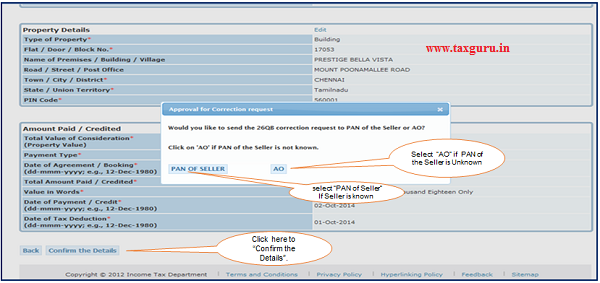

Step 6 (Contd.) : User will be asked to confirm if Seller is known or unknown.

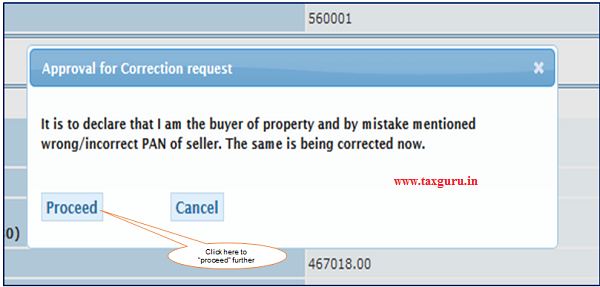

Step 6 (Contd.) : User is selecting “AO” tab if PAN of the Seller is Unknown then below dialogue box will pop up.

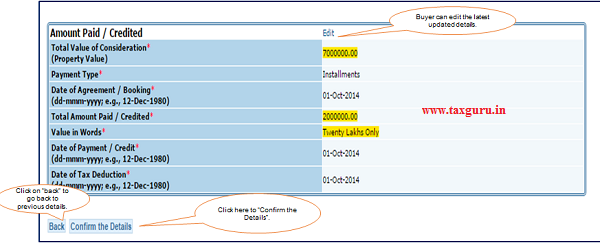

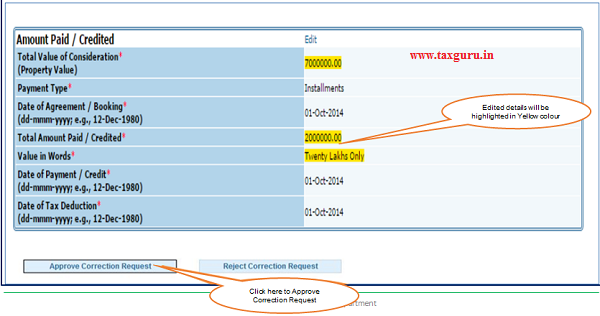

Step 7 :Screen will display to Confirm the details.

Step 7 ( Contd.) : Screen will display to Confirm the details of Correction Statement.

Step 7 ( Contd.) : Screen will display to Confirm the details.

Updated details will be highlighted in Yellow Colour.

Step 8 : After confirming the details a message will pop-up on screen.

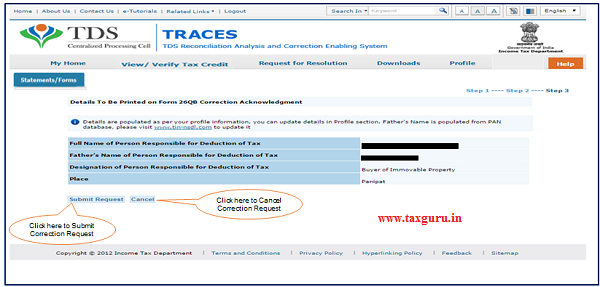

Step 9 : Profile details will be populated as per TRACES Profile. Click on “Submit Request” to Submit Correction Request.

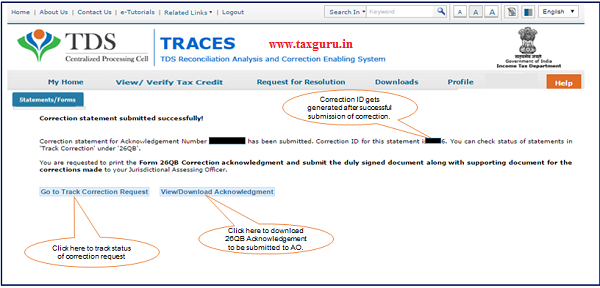

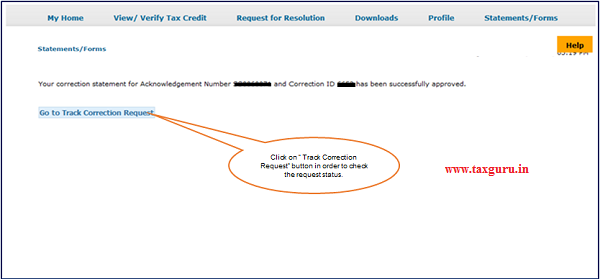

Step 10 : Correction ID gets generated after successful submission of correction.

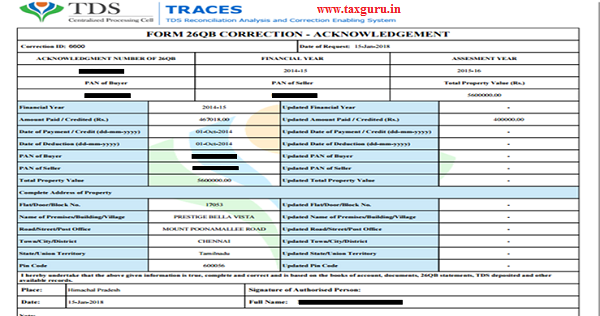

26QB Correction – Acknowledgement to be submitted to AO for approval.

Step 11: Correction status will be “Pending for AO Approval”. User can check AO details in “AO Detail” column under “Track Correction Request” option.

Step 12: After Approval from AO , Correction will be submitted to ITD.

Step 13 : Final Correction status will be “Processed”.

5 . Pictorial guide for “Approval by Seller/Buyer for 26QB Correction (Second Time)”.

Step 1 : Seller or Buyer has to select on “Pending for PAN Approval” status under “Track Correction” Option in “Statement /Forms Tab”.

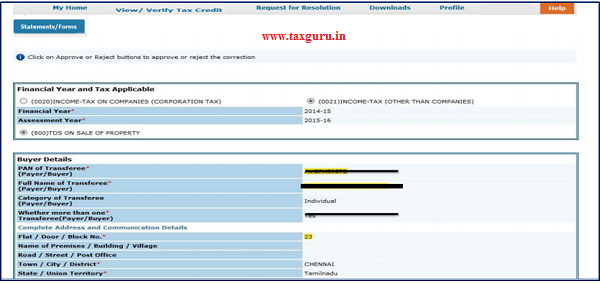

Step 2 : User can check the edited fields in “26QB Correction”.

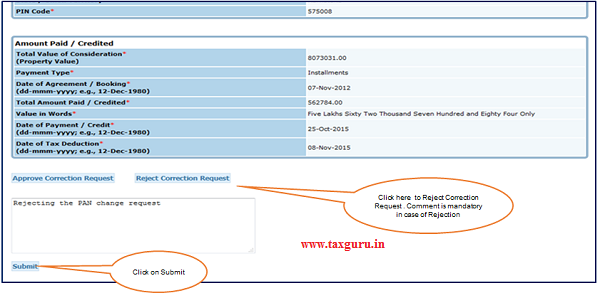

Step 2(Contd.) : User can check the edited fields in 26QB Correction”.

Step 2(Contd.) : Click on Approve button to Approve Correction Request.

Step 2(Contd.) : “Acknowledgement Number” and “Correction ID” has been successfully approved message will pop-up.

Step 2(Contd.) : Click on Reject button to Reject Correction Request.