Article explains Important Information for 26QB Correction, Brief steps for 26QB Correction, Description for Requested Status of 26QB Correction, Pictorial guide for 26QB Correction, Procedure for 26QB Correction with E- verified (Internet Banking), Pictorial guide for 26QB Correction with E-Verified (Internet Banking), Pictorial guide for 26QB Correction with DSC (Digital Signature Certificate), Pictorial guide for 26QB Correction with AO Approval and Pictorial guide for Approval by Seller/Buyer for 26QB Correction.

Page Contents

- 1. Important Information for “26QB Correction”.

- 2. Brief steps for “26QB Correction”.

- 3. Description for “Requested Status of 26QB Correction”.

- 4 . Pictorial guide for “26QB Correction”.

- 5 . Procedure for “26QB Correction with E- verification” (Internet Banking).

- 6 . Pictorial guide for “26QB Correction with E-Verified” option.

- 7 . Pictorial guide for “26QB Correction with DSC(Digital Signature Certificate)”.

- 8 . Pictorial guide for “26QB Correction with A.O Approval”.

- 9 . Pictorial guide for “Approval by Seller/Buyer for 26QB Correction”.

1. Important Information for “26QB Correction”.

- Only Buyers registered on TRACES can submit request for “26QB correction” under “Statements/Forms ” Tab.

- 26QB Correction applicable from Assessment Year 2014-15

- Fields of 26QB in which Correction is allowed as follows :

1. PAN of Buyer

2. PAN of Seller

3. Financial Year

4. Amount Paid/Credited

5. Date of Payment/Credit

6. Date of Deduction

7. Property Details –(Complete Address of the Property)

8. Total Value of Consideration (Property Value)

- If Buyer files 26QB Correction and “Seller” is known , correction can be submitted through E-Verified (Internet Banking) /AO Approval/DSC (If Buyers DSC is registered) for updating PAN details (Buyer /Seller).

- If Digital Signature is not registered and Buyer or Seller is non Traceable , the correction request can be submitted through AO Approval option for updating PAN details (Buyer/ Seller).

- If Digital Signature is not registered, Buyer or Seller is known , the correction request can be submitted through E-Verified (Internet Banking) /AO Approval option for updating PAN details (Buyer Seller).

- If PAN of Seller requires to be updated, the correction request will require “Previous Seller’s” approval.

- If PAN of Buyer requires to be updated, the correction request will require Seller’s” and intended (New) Buyer approval.

- If both PAN of Seller and Buyer require to be updated, the correction request will require approval from Previous Seller and intended (New) Buyer.

- If Amount Paid/Credited is updated, the correction submitted will require Seller’s

- Jurisdictional AO will be decided on the bases of Buyer’s PAN’s (PAN submitting the correction) Jurisdiction.

- If user is doing 26QB correction for the First Time or Second Time in Seller’s PAN +Amount Paid /Credit, Correction request will be directly submitted taxguru.in for A.O. Approval.

- If user is doing 26QB correction for the First Time or Second Time in Buyer’s PAN + Seller’s PAN + Amount Paid/ Credit request will be directly submitted for A.O. approval.

2. Brief steps for “26QB Correction”.

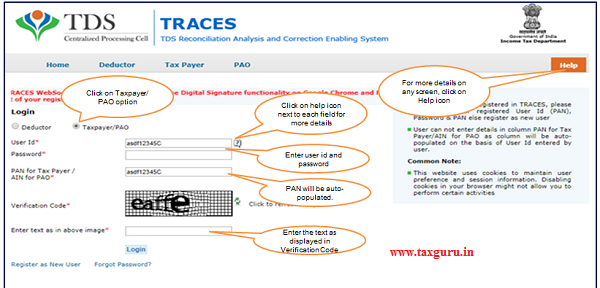

- Step 1 : Login to TRACES website with your “User ID”, “Password” and the “Verification Code”. Landing page will be displayed on Screen.

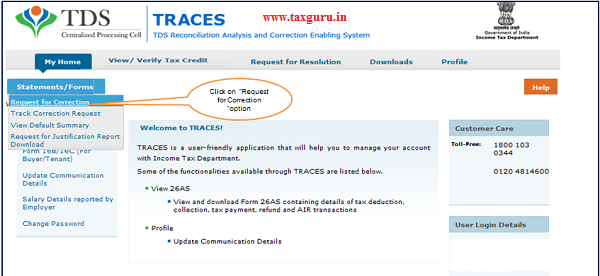

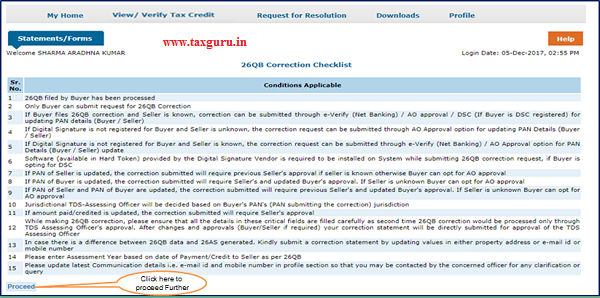

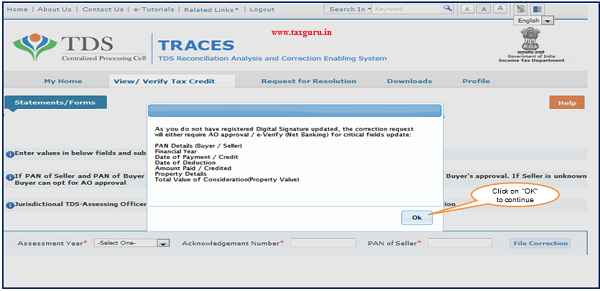

- Step 2 : Select option “ Request for Correction” under “Statements/ Forms” tab to initiate correction request. 26QB checklist will display on next screen. After clicking on “Proceed” Pop-Up window will display (If DSC is not registered).

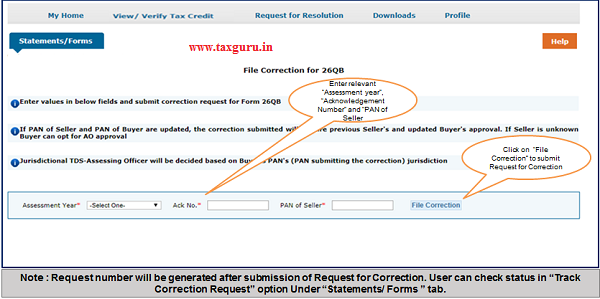

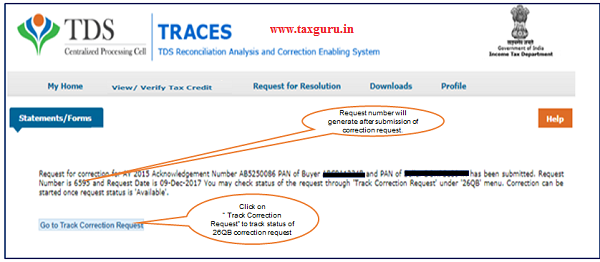

- Step 3 : Enter relevant “Assessment Year”, “Acknowledgement Number” and “PAN of Seller” according to filed Form 26QB, then Click on “File Correction” to submit request for correction. Request number will generate after submission of Correction Request.

- User can check Requested Status in “Track Correction Request” option under “Statements/ Forms” tab.

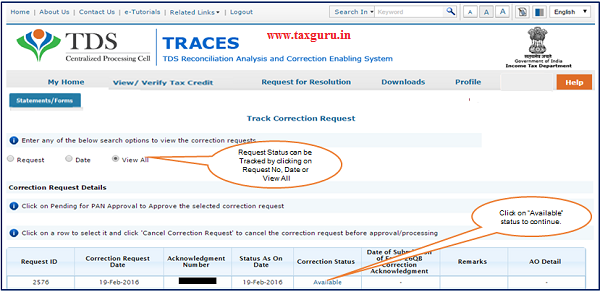

- Step 4 : Go to “ Track Correction Request” option under “Statements/ Forms” tab and initiate correction once the status is “ Available”. Click on “Available” status to continue.

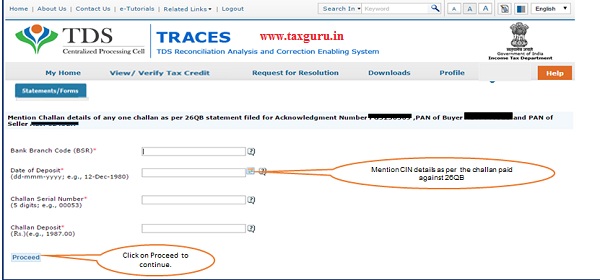

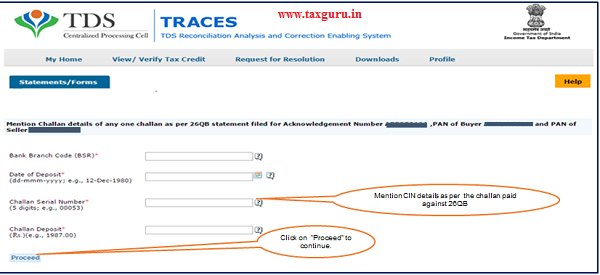

- Step 5 : Mention CIN details as per challan paid against 26QB then click on “Proceed” taxguru.in.

- Step 6 : User can select on “Financial Year and Tax applicable” option to change F.Y in 26QB. After clicking on “Edit” button. Message will pop up on the screen. Click on “Save” to save updated details then click on “Submit Correction Statement”(Select tab accordingly in which user want to do edit details).

- Step 7 :Screen will display to “Confirm details” after Submission of Correction Statement (Updated details will be highlighted in Yellow Colour).

- Step 8 : Profile details will be populated as updated on Traces. Click on “Submit Request” to Submit Correction Request.

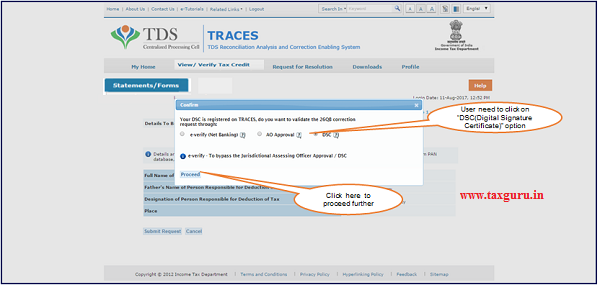

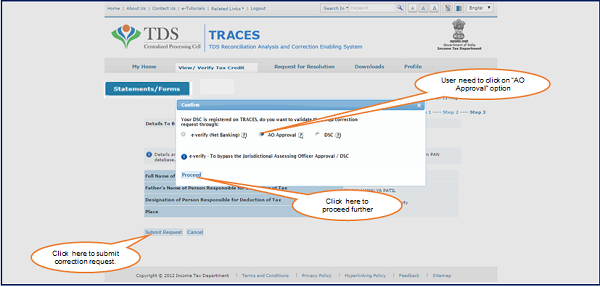

- Step 9 : After submission of Correction Request if DSC is not registered user gets the option to validate correction through E-Verified (Internet Banking) or AO Approval OR if DSC is registered user gets the option to validate correction through E-Verified (Internet Banking), AO Approval OR DSC.

NOTE :

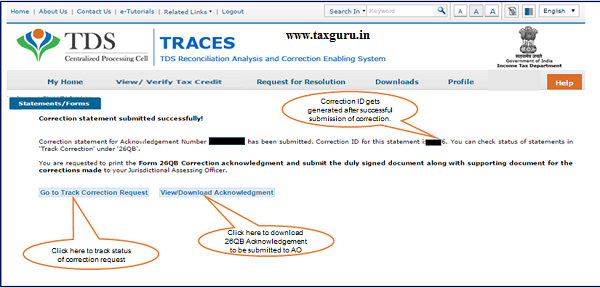

- After submitting the Correction, a Correction ID will be generated through which status of correction can be tracked.

- If DSC is not registered, user has to submit below mentioned documents to Jurisdictional AO for verification :

1. Furnish hard copy of Acknowledgement of form 26QB correction along with Identity Proof.

2. PAN Card.

3. Documents related to Transfer of Property.

4. Proofs of payment made through Challan for 26QB.

OR

With “E-Verified (Internet Banking) Service” user can submit 26 QB Correction statement without approval from Assessing Officer and without using DSC. (E-Verified Service option is not available for NRI Taxpayers ).

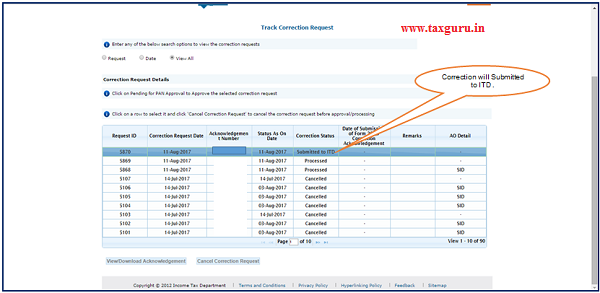

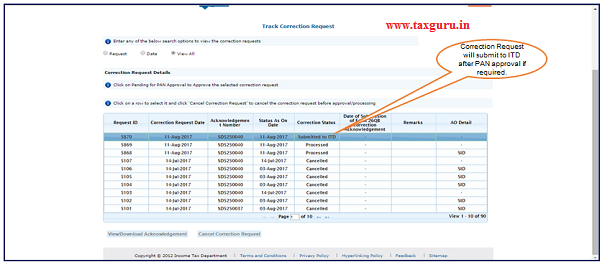

3. Description for “Requested Status of 26QB Correction”.

| Status | Description |

| Available | Once the request for correction is available for correction, status will be “Available”. |

| Pending for AO Approval | Once the correction is submitted and validated correction will be displayed with status as “ Pending for AO Approval”(If user has chosen AO approval option). |

| Pending for PAN Approval | Status will be “Pending for PAN Approval” if Correction is submitted for Seller or buyer approval. |

| Submitted to ITD | Status will be submitted to ITD if request is approved by AO or Seller/Buyer (if required) |

| Processed | Status will be processed if request is processed by TDS CPC . |

| Cancelled | Status will be cancelled if request is cancelled by Buyer before Approval/Processing . |

4 . Pictorial guide for “26QB Correction”.

Step 1 : Login to TRACES website with your “User ID”, “Password” and the “Verification Code”.

Step 1 (Contd.) : Landing page will be displayed on Screen.

Step 2 : Select option “ Request for Correction ” under “Statements/Forms” tab to initiate correction request.

Step 2 (Contd.) : 26QB Correction Checklist will display.

Step 2 (Contd.) : After clicking on Proceed, Pop-Up window will display in case DSC is not registered.

Step 3 : Enter relevant “Assessment year”, “Acknowledgement Number” and “PAN of Seller” according to filed 26QB, then Click on “File Correction”.

Step 3 (Contd.): Request number will generate after submission of Correction Request.

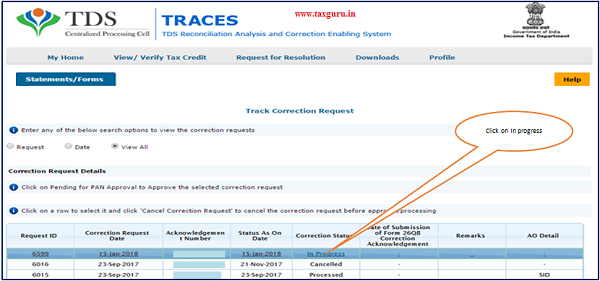

Step 4 : Go to “ Track Correction Request” option taxguru.in under “Statements/Forms” tab and initiate correction once the status is “ Available”. Click on “Available” status to continue.

Step 5 : Mention CIN details as per challan paid against 26QB then click on “Proceed”

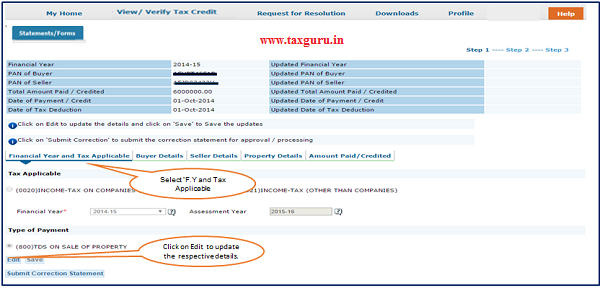

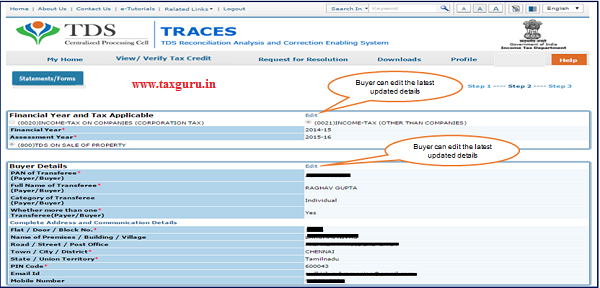

Step 6 : User can select on “Financial Year and Tax applicable” option to change F.Y in 26QB.

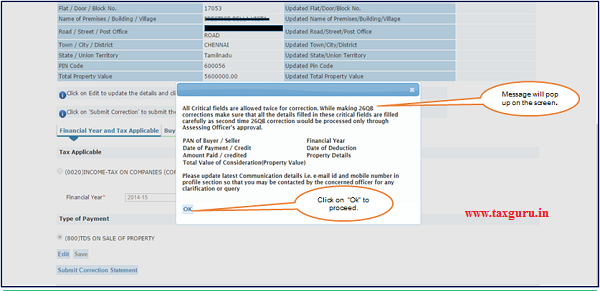

Step 6 (Contd.) : After clicking on “Edit” Button Message will pop up on the screen.

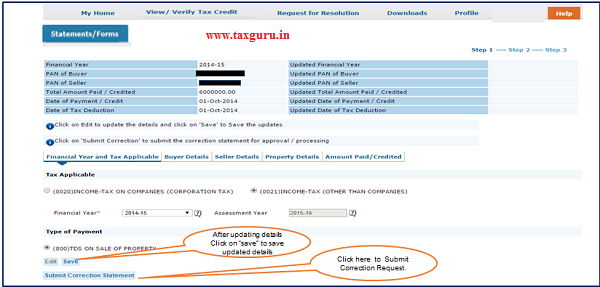

Step 6 (Contd.) : Click on “Save” to save updated details then click on “Submit Correction Statement”.

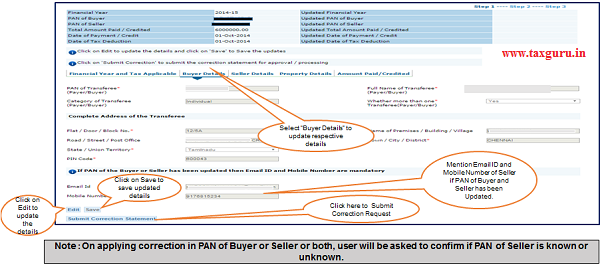

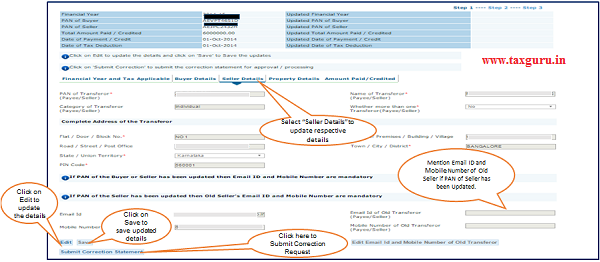

Step 6 (Contd.) : Select “Buyer Details” option to update respective details.

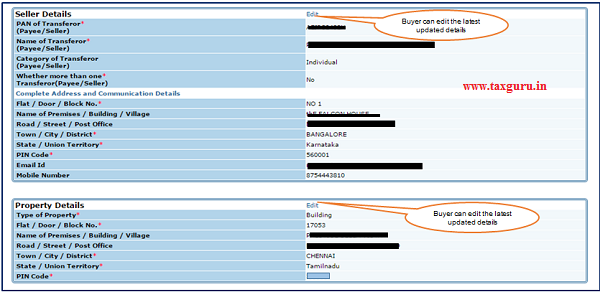

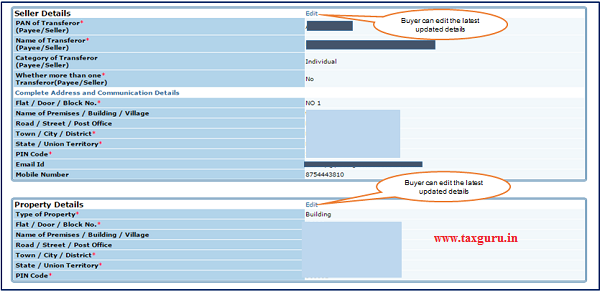

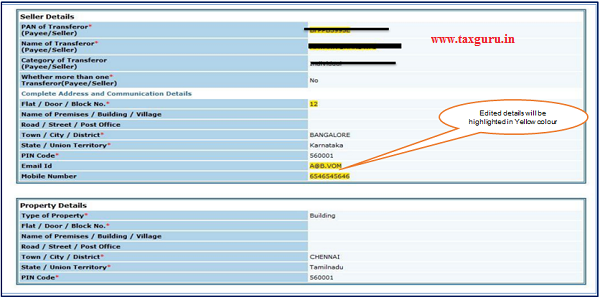

Step 6 (Contd.) : Select “Seller Details” Tab to update respective details.

Note : On applying correction of Buyer or Seller or both, user will be asked to confirm if PAN of seller is known or unknown.

Step 6 (Contd.) : User will be asked to confirm if PAN of the Seller is known or unknown.

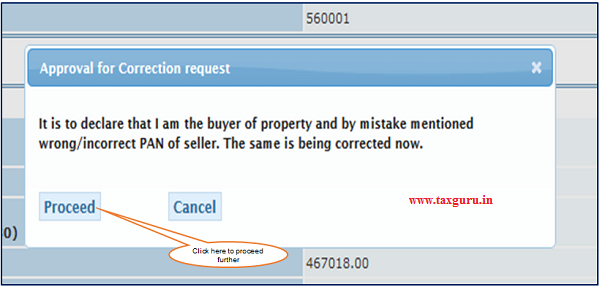

Step 6 (Contd.) : User is selecting “AO” tab if PAN of the Seller is Unknown then below dialogue box will pop up.

Step 6 (Contd.) : User is navigated to final submission page where buyer is prompted with the below dialogue box.

Note : The request gets submitted to AO for approval post PAN’s approval if needed.

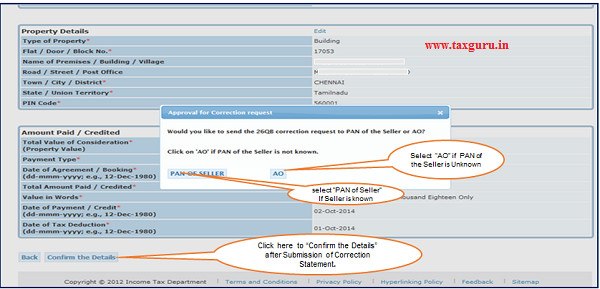

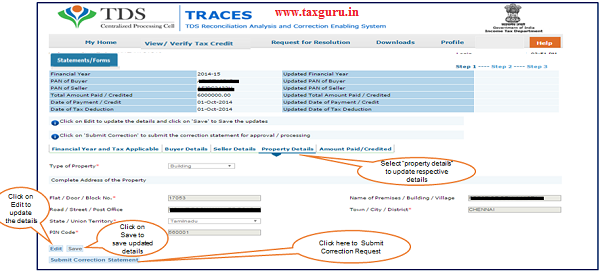

Step 6(Contd.) : Select “Property Details” to update Property Address details.

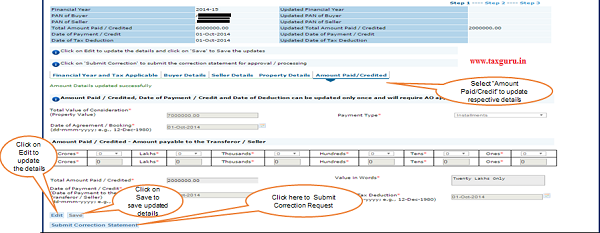

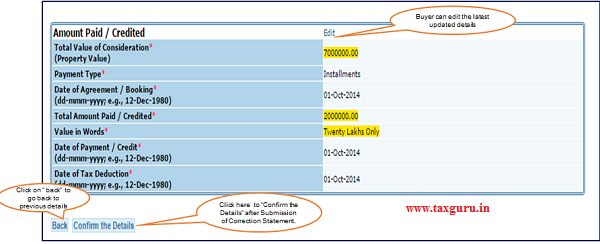

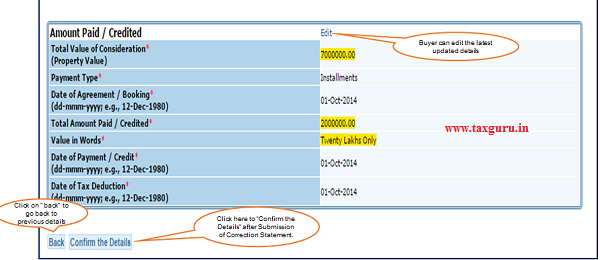

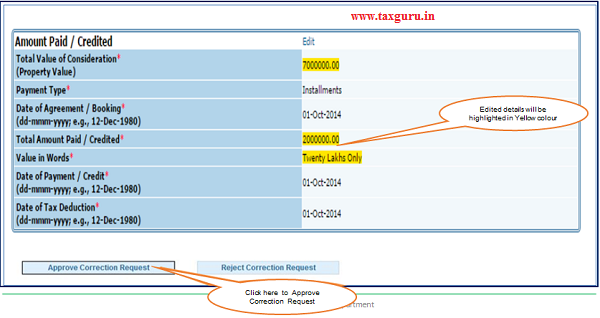

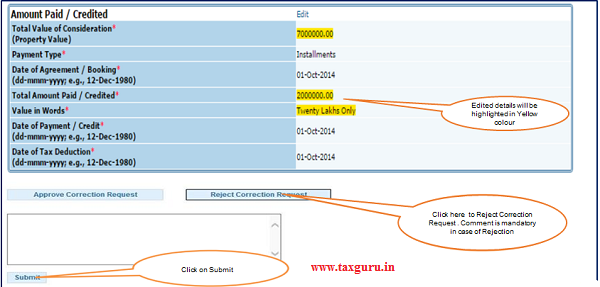

Step 6(Contd. ) : Select “Amount Paid/Credit” to update respective details.

Note : If Amount Paid/Credit is updated , Correction submitted will require Seller’s approval.

- If User has selected more than one “Transferee (Buyer) or Transferor(Seller)” and “Payment type” as Installments then Amount taxguru.in Paid/Credit should not be equal to total value of Consideration.

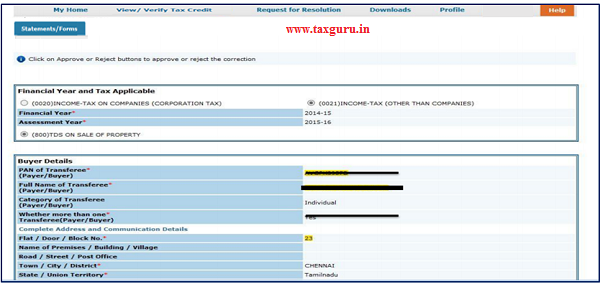

Step 7 :Screen will display to “Confirm details” after Submission of Correction Statement.

Step 7 ( Contd.) : Screen will display to “Confirm details” after Submission of Correction Statement

Step 7 ( Contd.) : Screen will display to “Confirm the details” after Submission of Correction Statement.

Updated details will be highlighted in Yellow Colour

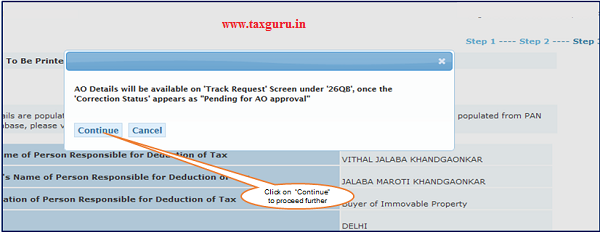

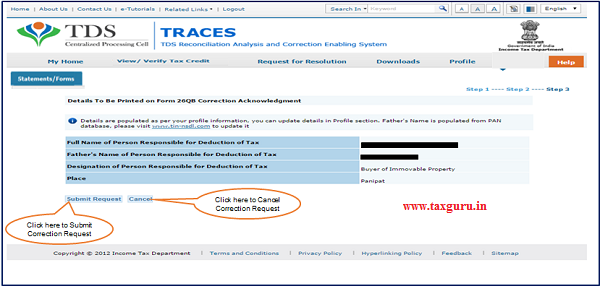

Step 8 : Profile details will be populated as updated on Traces. Click on “Submit Request” to Submit Correction Request.

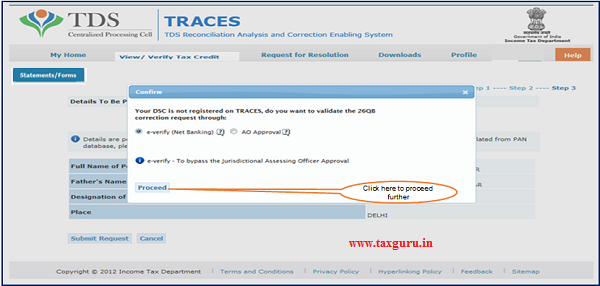

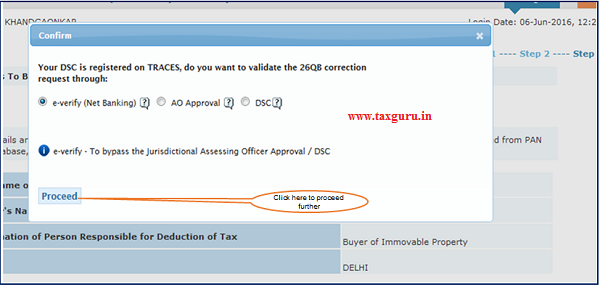

Step 9 : After submission of Correction Request if DSC(Digital Signature Certificate) is not registered user gets the option to validate correction through E-Verify (Internet Banking) or AO Approval .

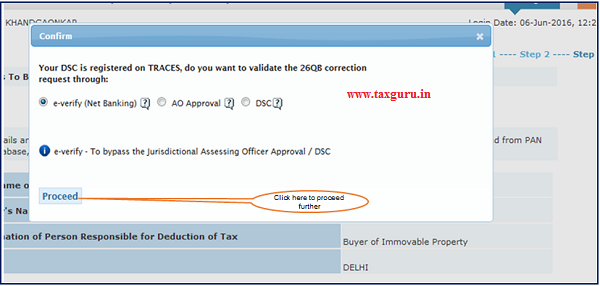

Step 9 ( Contd.) : After submission of Correction Request if DSC(Digital Signature Certificate) is registered user gets the option to validate correction through E-Verify (Internet Banking), AO Approval OR DSC(Digital Signature Certificate).

5 . Procedure for “26QB Correction with E- verification” (Internet Banking).

- E-Verified Service link is available at banks website:

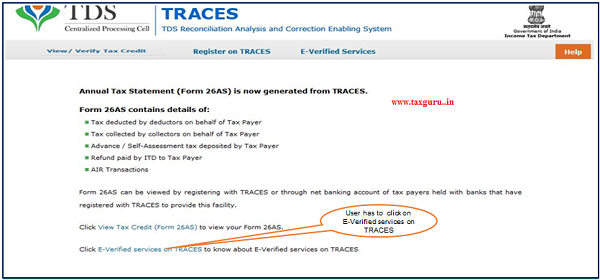

- User has to log in to Bank Website and select option “Click of view26AS”.

- It gets navigated to a new page which shows link “E-Verified services on TRACES”.

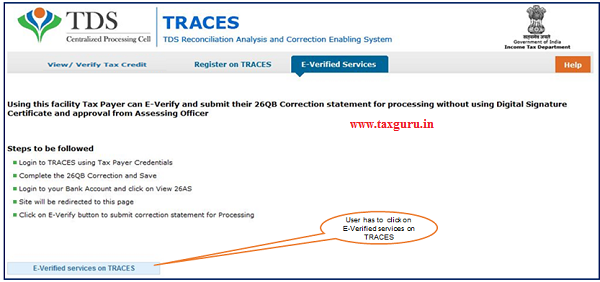

- Click on “E-Verified services on TRACES”, user gets navigated to the TRACES website with the pre populated User name and PAN of Taxpayer.

- This facility helps taxpayers to taxguru.in get Verified through Internet Banking.

- This can be used for “Submitting 26 QB Correction” request without Digital Signature and Approval from Assessing Officer.

- This Option is not available for NRI Taxpayers.

6 . Pictorial guide for “26QB Correction with E-Verified” option.

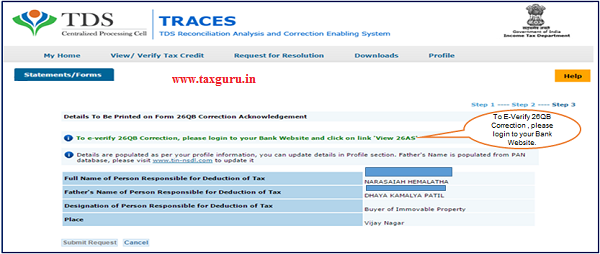

Step 1 : User need to Click on E-Verified (Internet Banking) option.

Step 2 : To E-Verify 26QB Correction , please login to your Bank Website and click on link “View 26AS”.

Step 3 : User will log in to Bank website and selects option “Click of view 26AS” then It gets navigated to a new page which shows link “E-Verified services on TRACES”.

Step 4 :User need to Click on “E-Verified Services on Traces” under “E- Verified Services Tab”.

Step 5 : After clicking on E-Verified Services on Traces, user gets navigated to the TRACES website with the Pre populated Username and PAN. User can login and continue 26QB correction.

Step 6 : Go to “ Track Correction Request” option under “Statements/Forms” tab and initiate correction once the status is “ In Progress”. Click on “in Progress” status to continue.

Step 7 : Mention CIN details as per the challan paid against 26QB.

Step 8 : Screen will display to “Confirm the details”.

Step 8 (Contd.) : Screen will display to “Confirm the details”.

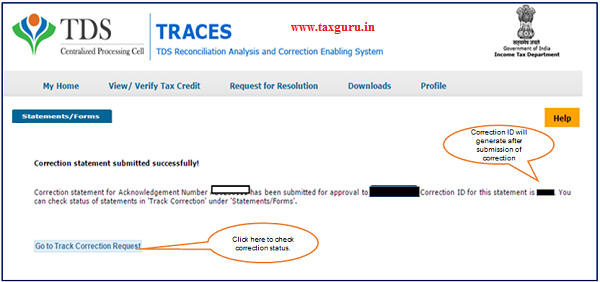

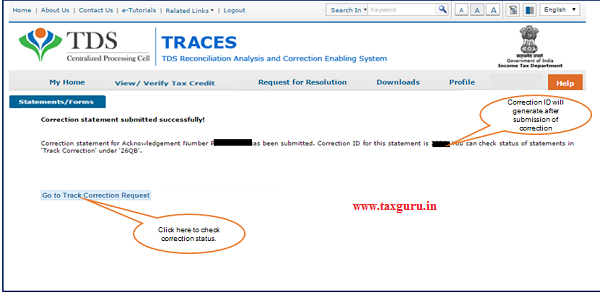

Step 9 : Correction Statement submitted successfully message will display on the screen.

Step 10 : User can check submitted correction status under “Track Correction Request” option under “Statement/Forms”.

7 . Pictorial guide for “26QB Correction with DSC(Digital Signature Certificate)”.

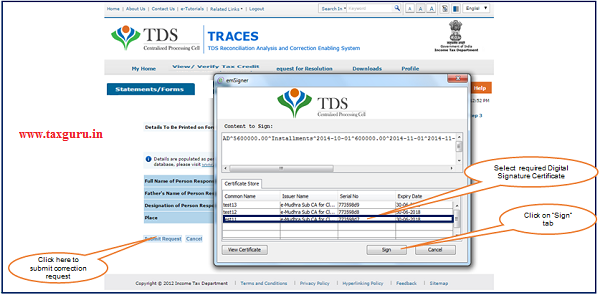

Step 1 : Click on “DSC(Digital Signature Certificate)” option If user want to validate “26QB Correction” with DSC

Step 2 : After validating DSC(Digital Signature Certificate), Click on “Submit Request”.

Step 3 : “Correction ID” will generate after successful submission of correction.

Step 3(Contd.) : User can check submitted correction status under “Track Correction Request” option under “Statements/Forms”.

8 . Pictorial guide for “26QB Correction with A.O Approval”.

Step 1 : Click on “AO Approval” option if user want to do 26QB Correction with “AO Approval”

Step 2 : Correction ID gets generated after successful submission of correction.

Step 3: 26QB Correction – Acknowledgement to be submitted to AO for approval.

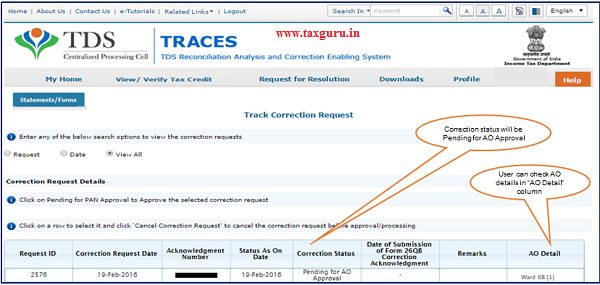

Step 4: Correction status will be “Pending for AO Approval”. User can check AO details in “AO Detail” column under Track Correction Request” option.

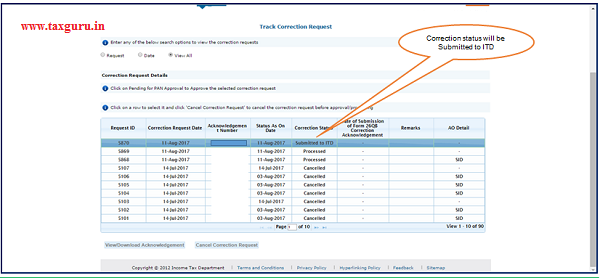

Step 5: After Approval from AO , Correction will be submitted to ITD.

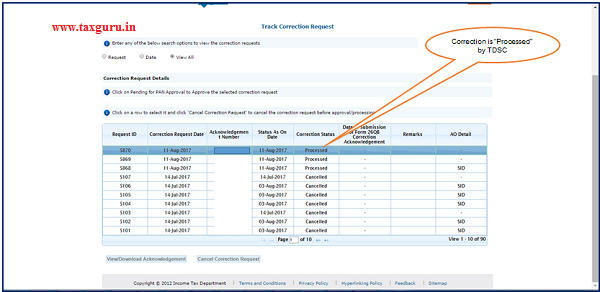

Step 6 : Final Correction status will be “Processed”.

9 . Pictorial guide for “Approval by Seller/Buyer for 26QB Correction”.

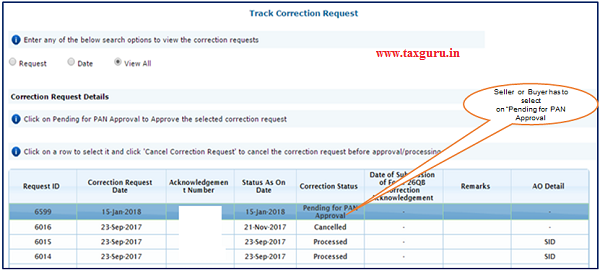

Step 1 : Seller or Buyer has to select on “Pending for PAN Approval” status under “Track Correction Request” Option in “Statements/Forms” Tab.

Step 2 : User can check the edited fields in “26QB Correction”

Step 2(Contd.) : User can check the edited fields in “26QB Correction”.

Step 2(Contd.) : Click on Approve button to Approve Correction Request.

Step 2(Contd.) : Click on Reject button to Reject Correction Request.

I have filed the correction in 26QB for Final Paid amount to seller. Now the status is showing Pending for PAN approval. Can you please advise me Who (seller OR buyer) will approve this and for this whether seller have to register his PAN at traces ? How to solve this status of Pan approval?

File Correction for 26QB

There is no data available for the specified search criteria

Reasons can be:

1. There is no statement filed for the searched criteria. Please verify Assessment Year, Acknowledgement Number and PAN Buyer and Seller

2. No challan has been deposited yet for the 26QB

I am getting this message, I searched with right values of AY, Ack#, and PAN of seller. Challan exists when I searched.

I am facing same issue .. whether you got the solution?

Now the status is showing Pending for PAN approval. Who (seller OR buyer) will approve this and for this whether seller have to register his PAN at traces ?

how to give approval?

Hi

Can correction of Buyer/seller name be done after two years?

With respect to correction in 26QB, the article explained nicely step by step procedure by Buyer and followed.

Now the status is showing Pending for PAN approval. Who (seller OR buyer) will approve this and for this whether seller have to register his PAN at TRACES ?

Please tell

Is your query is resolved?

I am facing the same issue

In Track Correction status

status is showing pending pan approval

What’s the next step to proceed further?

sri

i am also facing the same problem today as above questions

who to correction 26qb

in the 26qb buyers name and Pan number wrong seller name and pan is correct. how to correction the 26qb challan sir. please advice.

Hi Team,

I had raised a correction request for form26QB which was rejected by AO because there were some errors in the request. Can I file a new request with DSC so that it can be auto-approved?

The changes are in the date of payment

Hi Jatin,

Is your problem solved with DSC? I am also having same issue. Can you please help me with what you have done?

Thank you very much for the article. It’s much helpful.

I have purchased a property from a builder and deposit the 1% property tax according to my payment. I have submitted form 16 also in the same year but builder did not take the credit and after 4 years now builder is saying that he is not able to take the credit as the closer of financial year. Builder is saying to change the financial year in the form 16. Please advice.

I as (Buyer) cancel the deal and apply for a correction through Traces still it is pending for approval status shown, who will approve the request Buyer/Seller guide us.

I HAD PURCHASED PLOT IN YAMUNA EXPRESS WAY (YEIDA AREA) BUT WRONGLY ENTERED THE FOLLOWING INFORMATION INCORRECT IN 26QB FORM:-

1. MENTIONED PROPERTY TYPE AS BUILDING INSTEAD OF PLOT.

2. IN ADDRESS OF THE PROPERTY ENTERED AEROCITY, NOIDA – PIN 201301 INSTEAD OF AEROCITY, YAMUNA EXPRESS WAY (YIEDA) – PIN 203201.

3. I HAD PAID TOTAL COST OF THE PLOT BUT ENTERED IT AS INSTALLMENT.

ALL OTHER PARTICULARS ARE CORRECT.

CAN I MAKE THESE CORRECTIONS IN FORM 26AB NOW.

IS APPROVAL FROM SELLER OR AO REQUIRED FOR THESE CHANGES OR THESE CHANGES GET PROCESSED AUTOMATICALLY IF I E-VERIFY THE CHANGES THROUGH INTERNET BANKING.

I HAD PURCHASED PLOT IN YAMUNA EXPRESS WAY (YEIDA AREA) BUT WRONGLY ENTERED THE FOLLOWING INFORMATION INCORRECT IN 26QB FORM:-

1. MENTIONED PROPERTY TYPE AS BUILDING INSTEAD OF PLOT.

2. IN ADDRESS OF THE PROPERTY ENTERED AEROCITY, NOIDA – PIN 201301 INSTEAD OF AEROCITY, YAMUNA EXPRESS WAY (YIEDA) – PIN 203201.

3. I HAD PAID TOTAL COST OF THE PLOT BUT ENTERED IT AS INSTALLMENT.

ALL OTHER PARTICULARS ARE CORRECT.

CAN I MAKE THESE CORRECTIONS IN FORM 26AB NOW.

IS APPROVAL FROM SELLER OR AO REQUIRED FOR THESE CHANGES OR THESE CHANGES GET PROCESSED AUTOMATICALLY IF I E-VERIFY THE CHANGES THROUGH INTERNET BANKING.

MOB:9818468800

I HAD PURCHASED PLOT IN YAMUNA EXPRESS WAY (YEIDA AREA) BUT WRONGLY ENTERED THE FOLLOWING INFORMATION INCORRECT IN 26QB FORM:-

1. MENTIONED PROPERTY TYPE AS BUILDING INSTEAD OF PLOT.

2. IN ADDRESS OF THE PROPERTY ENTERED AEROCITY, NOIDA – PIN 201301 INSTEAD OF AEROCITY, YAMUNA EXPRESS WAY (YIEDA) – PIN 203201.

3. I HAD PAID TOTAL COST OF THE PLOT BUT ENTERED IT AS INSTALLMENT.

ALL OTHER PARTICULARS ARE CORRECT.

CAN I MAKE THESE CORRECTIONS IN FORM 26AB NOW.

IS APPROVAL FROM SELLER OR AO REQUIRED FOR THESE CHANGES OR THESE CHANGES GET PROCESSED AUTOMATICALLY IF I E-VERIFY THE CHANGES THROUGH INTERNET BANKING.

MOB:9810621295

As per steps mentioned I have raised the request for Form 26 QB correction for the seller name and PAN

Status of the rectification request is processed and same is reflected in mine Form 26 AS with new seller name n PAN

but now how can I get the revised 26QB with new seller name and PAN to give to seller?

Kindly help

I have try to 26QB Form seller details correction so they have shown error System has encountered some technical problem. Please try after some time .

Hello sir

I have purchase under construction property and I am pay the amount in installment basis but one 26QB Form total value amount filled wrong submitted. So kindly please help me.

Buy mistake total property value amount wrong full in 26qb. But tds challan amount submit properly. So how to change total property value in 26 QB

Buy mistake total property value amount wrong full in 26qb. So

hi,

I have paid 0.75%TDS on a property purchase on 3rd April’2021 on 9th of April’2021 I got default noticed from income tax.

I have paid to remain 0.25% through net banking.

Now in Correction Request Details, it is showing in the process status.

I try to update Chalan details but it is showing now Invalid details.

do I wait for the available status?

i have filed 26QB, but the pan of buyer was wrong. so after necessary corrections made as you explained above, then coming to e-verification through net banking it is unclear weather to logon to bank a/c of person who actually deducted tax or to logon to wrong deductor/buyers bank a/c. in which bank site i have to log in to e-verify. as in my case buyer pan was wrongly entered. please explain.

i have filed 26QB, but the pan of buyer was wrong. so after necessary corrections made as you explained above, then coming to e-verification through net banking it is unclear weather to logon to bank a/c of person who actually deducted tax or to logon to wrong deductor/buyers bank a/c. in which bank site i have to log in to e-verify. as in my case buyer pan was wrongly entered. please explain.

i have filed 26QB,

I have filed statement of correction for 26QB but when i am clicking on Pending for approval for the purpose of approving , No further steps/ action proceeds. I don’t understand its reason .

SIR I NEED HELP

CORRECTION IN ASSESSMENT YEAR IN 26QB CHALLAN. BUT I CAN NOT LOGIN IN TRACES

9722487348

The procedure is explained nicely. nevertheless one lacunae remains and that is when the correction request in form No. 26qb is approved, then what is the procedure to download corrected form No. 26 qb that is not explained.

kindly explain the procedure of how to download corrected Form No. 26QB.

By mistake TDS deposite withone seller pan , there are two seller , byer PAN NO ADQPA4163M ,SELLERS PAN NO,S BWDPS9204C and EYTPK 4699J , TDS deposite with one PAN i.e. BWDPS9204C ,amount of TDS Rs 103000/-ref no. AG9173684 , date of property purchase 06 FEB 2020 , and deposite of TDS date 11 FEB 2020 , with nett banking ICICI BANK ref no.BSR CODE 6390340 , tender date 11/02/2020 challan s.no. 00083, correction in 26QB required regards VEENA ARORA

I am also facing same issue Have u Solved the problem ? Can u help me if u have done so??

My Number is 9920864991

When I (Buyer) paid the TDS on sale of property through FORM 26QB, I paid excess amount. Later on I tried to correct form 26QB online and verified through e-banking, now it is showing “Pending for PAN approval” in correction status. However, the link is not active. What to do? Who will approve it buyer or seller? Shall I get back the excess amount paid as refund?

I have raised correction request on form 26QB, the correction request is approved. How to download the corrected Form 26QB?

I have the same issue ……. can you please help me to solve this issue