While filing Form 26QB, on last stage of payment the loading page shows error message? Because of which the payment got rejected or failed? Now in such scenario many people thought that how can we solve this issue? How can we make payment since we opt for the option as “Pay Immediately”, is subsequent payment accepted? If not what are the consequences and how it will resolve? I will try to solve all these questions in this article.

Option 1 – E-Tax Payment on Subsequent date of Demand for TDS on Property

While filing Form 26QB, either we can opt for this option or the another option is to pay immediately. In case, we choose to pay immediately and at the time of payment site will display an error page. So in such situation, don’t panic.

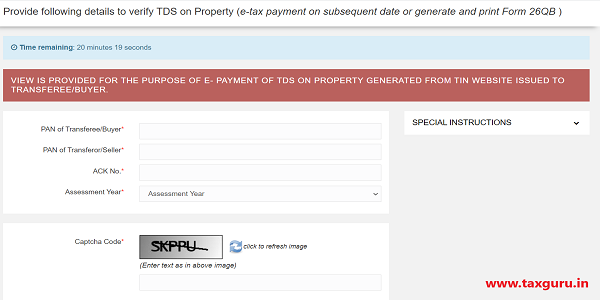

You can go to “TDS on Sale of Property” Tab and click on “E-Tax Payment on Subsequent date” it will lead you towards payment window as follows:

Now after entering all the details click on proceed and then it will re-direct you to your net banking page. Then follow the normal payment procedure as you usually do at the time of immediate payment.

Option 2 – Payment of Demand for TDS on property

Now, many times people make mistake in calculating tax u/s 194IA or make any default in payment and filing of Form 26QB. At that time TDS CPC will issue ypu the notice asking for payment against that notice.

Facility to make payment of demand raised by CPC-TDS against TDS on Sale of Property has been enabled by the department on www.tin-nsdl.com this website.

To Pay Such Demand Please click on the URL below

https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

Select / Click on “Demand Payment” (Payment against demand only for TDS on Sale of Property) as shown below –

Pay the Tax after filling the Particulars as shown in the screenshot below –

I hope the above article has cleared all your doubts regarding payment of tax for TDS on property.

All About TDS On Immovable Property Purchase (194IA)

(Republished with Amendments by Team Taxguru)

ACKNOWLEDGEMENT NUMBER (MANDATORY) accepts only 9 characters but in the challan generated for TDS it has 10 characters

no idea how to use this link to complete the demand payment raised by the government

kindly help

I have to pay tds on property buy.

So instead of paying in e tax payment on subsequent date I made payment in demand payment for TDs on property …

Did I made a mistake by paying in demand payment will form 16b will be generated

HI,

I have the exact same query which Anshuman has asked on May 1, 2015 at 12:33 pm.

the entire purpose of this article is only completed when you are able to define the mapping of various heads asked by the IT dept in the Banks Payment page. please respond

Sir I have received demand on payments for 26qb, but I paid the payment 26qd how can I correct this? Pls reply sir

Sir I have received demand on payments for 26qb, bulbt I paid the payment 26qd how can I correct this? Pls reply sir

WHICH CHALLAN NO TO BE FILLED to make payment against CPC (TDS) raised demand (only for TDS on Sale of Property)

Who do IT department, make this process so complicated even for paying penalty, its such a complicated process, it could be simplified.

I’m not asking for payment, here I’m paying, even than its complicated over and above you have hefty penalty charges.

I’m stuck at the point as mentioned by Anshuman, too many fields to fill and don’t know where to mention this amount.

Thanks. I have made the payment as per above details. Now what action do i need to take in Traces to update and confirm that i have made the payment?

Hi Guys,

I have also received Intimation says “Regular Statement for Acknowledgement Number XXXXXX is processed with defaults u/s 200A. The notice has below values

Short Deduction

Interest on Late payment

Late Levy

Rounding-Off amount

When i try to make payment via Demand Payment Link, it has below columns.

Principal Tax, Interest and Fee. Where should i enter Short Deduction and Rounding off amount?

Also in ICICI bank portal have below columns:

Income Tax:

Surcharge:

Education Cess:

Interest:

Penality:

Others:

Fee:

Please let me know where should i enter, Short Deduction and Rounding off amount in banking portal?

Appreciate Your Response..!

The client received INTIMATION U/S 200A AND NOTICE OF DEMAND U/S 156 FOR THE PAYMENT OF LEVY OF FEE U/S 234E OF INCOME TAX ACT, 1961. We accordingly paid the demand using the new facility on 04.05.2015 but the client received the mail on 02.05.2015. Order passed dated 30.04.2015. How to get the refund back?

Our client paid TDS on sale of property by using TDS challan U/s.94J.

How to rectify

Same comments like Debashis Saha Said.

Since payment of delay fees, have been writing to TDSCPC for confirmation of closing the demand-but there is no response. Wonder what is going to happen.

Ashok Deora

9840051184

i made the payment for this demand through form 26 qb. there was no clarity on how to remit this.

how can i retract the form 26 qb and get a refund?

Traces help desk has informed that no further interest would be levied when the delay is on account of the new window being made available for payment of demand raised as per the Notice of Demand issued by TDS CPC in case of defaults in remitting the TDS on sale of property.

In the window now made available, unfortunately on the bank’s site the slot provided for Fee payment u/s. 234E does not allow to enter the figure of late filing fees shown in the demand notice.

In case any one has succeeded in entering the figure under section 234E in the slot provided in the challan on the bank’s site please share the experience. In the instant case there is demand only for late payment interest and late filing fees.

Hi,

Thanks for your post.

I have a question about which fields to use in the online payment on the Bank (say SBI).

The demand note has three sections:

1) Short Deduction

2) Interest on late payment

3) Late fee u/s 234E

The SBI payment interface has:

a) Surcharge

b) Penalty

c) Edu Cess

d) Iterest

e) Others

f) Penalty Payment Code (11C or N11C)

Can you please match 1,2,3 to a-f?

Sounds like 2->b. What about 1->? and 3->? Is late fee penalty, surchate, or others? Penalty code N11C?

When from the said separate payment mode has come into effect ?

It was not there till April 10th.,2015.

TDSCPC informed me on 7/4/2015, against my query as follows and I have deposited the demand accordingly –

This mail is in reference to your query related to the procedure of demand closure against the interest on late payment/late filing fee against form 26QB filed. You are requested to deposit the demand amount under minor head 400 in Income-tax Challan No 280 by mentioning the Sum of Interest and Fee amount (if any) in ‘Interest’ column either through online payment mode or by visiting any authorized bank in order to settle the demand for Interest and/or Late filing Fee on sale of property. You are also requested to send the copy of the acknowledgement of the challan to our mail id contactus@tdscpc.gov.in.

Department has open this link at the end of 30th april 15(As I was keep checking for this link), Now many taxpayers are not aware of this link or waiting for this window to open. In case they will pay demand on or after 1st may 15, interest for another month will be applicable.

First of all, taxpayers were not aware how to pay this demand. Afterwards, they have open this link at the end of 30th April 15, Why taxpayers have to suffer for another month interest payment…

Thanks for the screen shots. One question I have is.

Do I enter the “Late Filing Fee u/s 234E” amount from the notice in “Fee” or “Other” column of the Bank Challan form? Please advice.

May be you can add the screen shot of the bank Challan form with highlighting the columns where we need to put the Fee.