Article explains Provisions of Section 194I related to TDS on Sale of Property with value exceeding or equal to Rs. 50 Lakhs. It explains When your are liable to deduct TDS on Sale of Property, When to deposit the TDS to Government after deduction, How to make payment of TDS to Government, Details required for filing the Form 26QB and how to Request for Form 16B [TDS Certificate for Sale of Property]

Page Contents

1. When your are liable to deduct TDS on Sale of Property?

As per provisions contain in sec 194-IA of Income Tax Act, if any buyer responsible for paying to a resident seller any amount exceeding or equal to Rs. 50 Lakhs for sale of immovable property other than agricultural land, then the buyer is required to deduct TDS @ 1% of consideration for transfer of immovable property.

As per Finance Act 2019, Consideration for transfer of immovable property shall include all charges of the nature of club membership fee, car parking fee, electricity or water facility fee, maintenance fee, advance fee or any other charges of similar nature, which are incidental to transfer of the immovable property.

Even when the amount is paid in installments, then even you are liable to deduct TDS @ 1% on the amount paid if the total amount paid is equal to or exceeds Rs. 50 Lakhs.

TDS is required to deduct irrespective of type of property whether it is land or building or vacant plot, residential or commercial or industrial property.

If GST is levied on transaction value for purchase of property, then TDS would be deducted on the amount excluding GST amount.

2. When to deposit the TDS to Government after deduction?

After deduction of TDS on the amount, it is to be deposited to Central Government within a period of 30 days from the end of the month in which deduction is made and it should be accompanied by a statement in Form 26QB. [Rule 30(2A)]

Also Form 26QB is to be filed within a period of 30 days from the end of the month in which deduction is made. [Rule 31A(4A)]

3. How to make payment of TDS to Government?

Following steps are involved while making the payment of TDS :-

- First go to the website tin-nsdl.com.

- Click on the tab Services and then click e-payment : Pay taxes Online.

- After that a new window will be open, that contains different challans for payment of TDS under different sections.

- Click on proceed on TDS on Property (Form 26QB) tab (in third row first column).

4. Details required for filing the Form 26QB

In the First Tab (Taxpayer Info) following details are required to be filled:

- Tax Applicable

- (0020) Corporation Tax (Companies)

- (0021) Income Tax (Other than Companies)

Select code 0020 if you are a company (person deducting TDS), otherwise select 0021 for persons other than company.

- Financial Year– It will be auto populated on the basis of Date of Payment / Credit filled in the form.

- Assessment Year– It will be auto populated on the basis of Date of Payment / Credit filled in the form.

- Type of Payment– It is auto selected as (800) TDS on Sale of Property.

- Status of Payee / Seller / Transferor– Select Resident or Non-Resident .

- Permanent Account No. (PAN) of Transferee (Payer/Buyer)– Enter the PAN of Buyer which is compulsory required to fill the form. After filling the PAN, it will automatically confirm the category of PAN of Transferee whether it is company, individual etc.

- Permanent Account No. (PAN) of Transferor (Payee/Seller)– Enter the PAN of Seller which is required so that it is reflected in Form 26AS of Seller and he/she can claim TDS on sale of property while filing Return of Income.

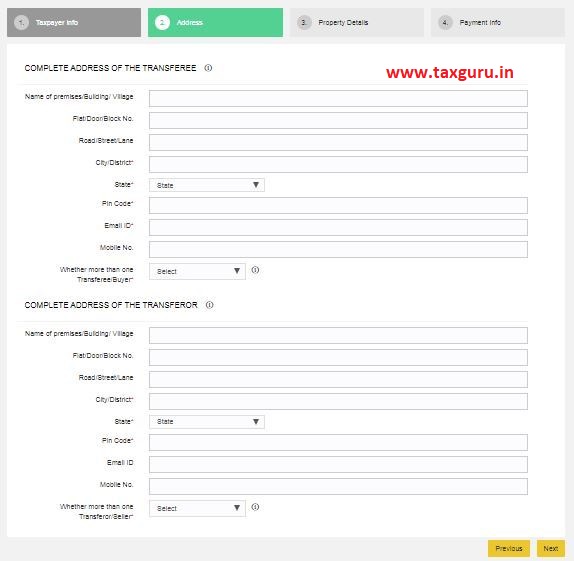

In the Second Tab (Address) following details are required to be filled:

- Complete Address of the Transferee (Buyer)– It also require whether there are more than one transferee / buyer.

- Complete Address of the Transferor (Seller)– It also require whether there are more than one transferor / seller.

In the Third Tab (Property Details) following details are required to be filled:

- Complete Address of the Property Transferred– It includes details like type of property whether it is land or building, Date of Agreement / booking, Total Value of Consideration, Payment Type (Lump sum or Installment).

- Amount paid / credited– Enter amount in figures and words.

- Tax Deposit Details– Provide details like Total Amount paid / credited, Basic Tax , Interest , Fee (if any).

In the Fourth Tab (Payment Info) following details are required to be filled:

- Mode of Payment– Select e-payment immediately or on subsequent date.

- Date of Payment / Credit

- Date of Tax Deduction

- Captcha Code

Date of Payment / Credit and Date of Tax Deduction is required to calculate the interest, fee if any which is required to be paid in case of late payment.

After payment of taxes, Challan is generated which is the proof of payment of TDS.

5. Request for Form 16B [TDS Certificate for Sale of Property]

- Request can be made at tdscpc.gov.in after creating New ID as Tax payer.

- Generally after payment of challan, it takes 4-5 working days for processing of challans, only after that you can request for Form 16B.

- Form 16B is itself an evidence that TDS deducted on payment to seller has been deposited to government.

If the price of property excluding GST is less than 50 lakhs but more than 50 lakhs including GST, do i need to do TDS from the transactions.

If price of property is less than INR 50 Lakhs excluding GST, then you are not required to deduct TDS on such amount.

If sale price of under-construction flat is 1 Crore (with 5% GST on top) then TDS is to be paid only on 1 Crore i.e. 1 Lakh, understood.

However here’s the million rupee question that NO site ever answers – Is the GST to be paid 5% of the full 1 Crore, or 5% of 99 Lakhs (after TDS deduction)? The former doesn’t make sense to me as it would mean paying GST on the TDS amount too (i.e. tax on tax), but maybe the govt. is just that greedy? Please do clarify!

As per my opinion, GST is to be paid 5% on full INR 1 crore as GST is paid on gross amount not after deduction of TDS as the value of supply under GST is INR 100 and it has no link with TDS. Further, for example – if you raise a professional services bill of INR 100 + 18% GST, then the service receiver will deduct TDS on INR 100 not INR 90 (100 – 10%TDS). Hope you understand.

As per your procedure, the same TIN-NSDL- TDS on sale property, web site is not accessible to from last 4 days. I had already did 5 times payment through this web site. Kindly suggest.

I booked a flat of ₹62,5000/- and as per demand of builder, payment is to be made in two instalments, 50% at the time of booking and 50% after 90 days. I have made 10% and 40% payment through self and my bank (Loan financed).

It may kindly confirm whether 1% TDS is to be deducted today or after completing of 100% payment.

Secondly… whether this amount (1% TDS is additional amount of my flat)

Thirdly, whether I should pay full amount of my flat including 1% TDS

1. In relation to your first query, TDS is to be deducted at the time of payment.

2. In relation to your second query, TDS amount is to be deducted from total amount of consideration payable to the seller. For Example- if you are paying Rs 100 to seller, then you pay Rs 99 to seller after deducting Rs 1 as TDS. Such TDS should be deposited with govt.

3. In relation to your third query, as mentioned in second query, TDS should be deducted from the full amount and not paid to the seller.

Total value of property is 1 core 10 lakhs. 1/4 share sold for 27.5 laks to A, 1/4 share sold to B, 1/4 share sold to C and 1/4 share sold to D by separate documents for 27.5 lakhs each and registered in same day. how TDS applicable for these transactions?

As the individual share sold is less than Rs. 50 lakhs per transaction and assuming separate sale deed is executed for each transaction, then TDS is not applicable on all 4 transactions.

the total value of property is 1 core 10 lakhs, 1/4 share sold to A, for 27.5 lakhs by one document, then 1/4 share sold to B, 1/4 share sold to C and 1/4 share sold by separate documents for 27.5 Lakhs each and registered same day. In this case Tds applicable or not?

The Sellers of joint property of worth 80Lakh, value is 80Lakh of three daughters as a legal heirs. Total mony is distributed each in equal parts. amount is received each daughters less than 50Lakh. In this case TDS should be deducted or not pls clarify.

In this case, as the sales value is less than Rs. 50 lakhs in the hands of each daughter, all the 3 daughters are shown as joint holders of the property in the sale deed executed and share of money is given in the bank account of all 3 daughters. Then, TDS will not applicable.

Hi, I have purchased a property and deducted 1% TDS every time while making payment to seller which included GST amount as well. Now the seller is saying that tds should be paid excluding gst amount. How can it be fixed for already paid amount to the government through 26QB. Kindly share a remedy.Thanks.

TDS ON SAE OF PROPERTY APPLICABL ON SALE OF AGREEMENT OR NOT . PLEASE REPLY

The sellers of a joint property of worth 70lakhs are mother, daughter and son as legal heirs. The total money is paid to the mother only. In that case, How many TDS Challans are to be made by the single buyer?

TDS to be deposited is on the basis of number of sellers not on the basis of to whom money was paid. Therefore, in your case TDS is to be deposited under 3 PAN in 3 Challans.