Why PAN of Foreign Companies having investment in India is mandatory & their ITR filing requirement?

WHY IS IT MANDATORY FOR FOREIGNERS INVESTING IN INDIA TO MANDATORILY HAVE A PAN & THEIR ITR FILING REQUIREMENT?

In this Article, we will understand why PAN of Foreign Companies are must and why the consultant & Indian Companies having foreign investment often insist Investors to apply PAN in India. Whenever a foreign company or non-resident invests in Indian Company or LLP, maximum compliances are related to RBI, FEMA or MCA (ROC) where PAN is not required. Requirement of PAN is mandated by Income Tax Act, 1961. Since reporting or filing in Income Tax is required at later stage, hence timely application of PAN often gets missed.

Let us understand which Income Tax provisions have mandated requirement of PAN of Foreign Companies directly or indirectly in such cases.

Page Contents

- 1. INCOME TAX PROVISIONS: SECTION 139A AND RULE 114B

- 2. PRACTICAL DIFFICULTIES IN FILING SFT (RULE 114E & FORM 61A)

- 3. REQUIREMENT OF PAN ON EXIT OR TRANSFER OF SHARES OR SECURITIES

- 4.RELAXATIONS FROM OBTAINING PAN IN CASE OF NON-RESIDENTS (RULE 114AAB).

- 5. REQUIREMENT OF FILING ITR IN CASE OF FOREIGN COMPANY

- 6. PENAL CONSEQUENCES OF NON-COMPLIANCE OF ABOVE PROVISIONS

1. INCOME TAX PROVISIONS: SECTION 139A AND RULE 114B

Section 139A of Income Tax Act, 1961 has mandated the requirement of Permanent Account Number (PAN). As per section 139A every person who has not been allotted a PAN and who is satisfying any of the following conditions will apply for allotment of PAN:

(i) if his total income or the total income of any other person in respect of which he is assessable under this Act during any previous year exceeded the maximum amount which is not chargeable to income-tax; or

(ii) carrying on any business or profession whose total sales, turnover or gross receipts are or is likely to exceed Rs 5,00,000 in any previous year; or

(iii) who is required to furnish a return of income under sub-section (4A) of section 139 (i.e. Charitable and Religious Trusts or Institutions); or

(iv) being an employer, who is required to furnish a return of fringe benefits under section 115WD, or

(v) being a resident, other than an individual, which enters into a financial transaction of an amount aggregating to Rs. 250,000 or more in a financial year; or

(vi) who is the managing director, director, partner, trustee, author, founder, karta, chief executive officer, principal officer or office bearer of the person referred to in clause (v) or any person competent to act or

(vii) who intends to enter into such transaction as may be prescribed by the Board in the interest of revenue

Further clause (c) of sub-section (5) of Section 139A mandates that every person shall quote PAN in all documents pertaining to such transactions as may be prescribed by the Board in the interests of the revenue, and entered into by him.

Rule 114B has prescribed such transactions (Extract from Rule 114B), accordingly PAN is required in following cases:

- As per Serial no. 8 of Rule 114B Table in case of Payment to a company or an institution for acquiring debentures or bonds issued by it where amount exceeds Rs. 50,000

- As per Serial no. 16 of Rule 114B Table in case of Sale or purchase, by any person, of shares of a company not listed in a recognised stock exchange where amount exceeds Rs. 100,000

- As per Serial no. 18 of Rule 114B Table in case of Sale or purchase, by any person, of goods or services of any nature other than those specified in this rule where amount exceeds Rs. 200,000

Accordingly when a foreign company invests in shares of Indian Company and investment amount exceeds Rs 100,000 PAN is required. In case of debentures this monetary limit is Rs. 50,000.

2. PRACTICAL DIFFICULTIES IN FILING SFT (RULE 114E & FORM 61A)

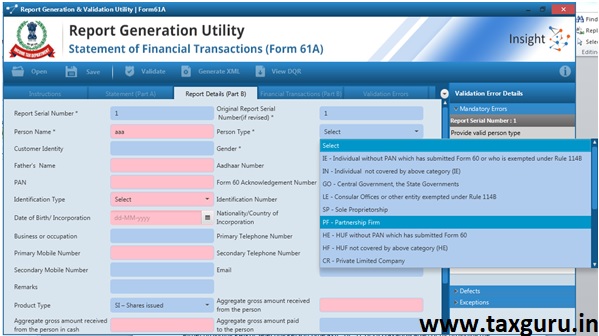

As per rule 114E of the IT rules 1962, a Reporting Entity is required to file a Statement of Financial Transaction (SFT) in Form 61A. A Reporting Entity has to report specified SFT reportable transactions of the nature specified in this rule for the relevant financial year on or before 31st of May immediately following the financial year. The late fee for filing this is ₹ 500 per day. Also, inaccurate filing may attract a penalty of ₹50,000 here.

A new reporting portal by the income tax department has been designated to ensure these filing under this provision. In case of Company, SFT filing is required in case of following three transactions:

| S.No | Reporting Entity | Nature and value of transaction |

| 1. | A company or institution issuing bonds or debentures. | Receipt from any person of an amount aggregating to 10 lakh rupees or more in a financial year for acquiring bonds or debentures issued by the company or institution (other than the amount received on account of renewal of the bond or debenture issued by that company). |

| 2. | A company issuing shares. | Receipt from any person of an amount aggregating to 10 lakh rupees or more in a financial year for acquiring shares (including share application money) issued by the company. |

| 3. | Any person who is liable for audit under section 44AB of the Act. | Receipt of cash payment exceeding 2 lakh rupees (per transaction) for sale, by any person, of goods or services of any nature.

|

The one of the primary requirement to file SFT is to mention PAN of investor. In case of no PAN, there will be validation error of form. This issue arises when PAN is not provided for person who has neither submitted Form 60 or who is exempted under Rule 114B. This defect can be resolved by either providing PAN or selecting Person Type as IE, HE, LE or GO (as applicable) or by providing the Form 60 Acknowledgement Number.

Screenshot from Form 61A is pasted below:

As we can see above, in case of Person Type other than IE (Individual without PAN who has submitted Form 60), HE (HUF without PAN, submitted Form 60), LE (Consular Offices) or GO (Government), mentioning PAN is mandatory to avoid validation error. Hence in case of Foreign Company, PAN is required.

3. REQUIREMENT OF PAN ON EXIT OR TRANSFER OF SHARES OR SECURITIES

Suppose a foreign company has acquired shares of Indian Company then on exit or transfer of shares it is required to compute Short Term or Long Term Capital Gain. Accordingly it will be required to pay its tax liability & file ITR in India.

Hence even if Foreign Company didn’t apply PAN initially, PAN will be required at later stage.

4.RELAXATIONS FROM OBTAINING PAN IN CASE OF NON-RESIDENTS (RULE 114AAB).

Rule 114AAB of Income Tax Rules, 1962 has provided certain relaxation. Accordingly person falling under this rule and satisfying conditions mentioned therein are not required to obtain PAN in India.

Following cases (A&B) have been provided in this rule:

1. Non-resident, have made investment in Specified Fund

Meaning of Specified Fund: Any fund established or incorporated in India in the form of a trust or a company or a limited liability partnership or a body corporate which has been granted a certificate of registration as a Category I or Category II Alternative Investment Fund and is regulated under the SEBI (Alternative Investment Funds) Regulations, 2012 made under the SEBI Act, 1992(15 of 1992) or International Financial Services Centres Authority Act, 2019 (50 of 2019) and which is located in any International Financial Services Centre or a specified fund referred to in sub-clause (i) of clause (c) of Explanation to clause (4D) of section 10.

Conditions to be fulfilled:

- the non-resident does not earn any income in India, other than the income from investment in the specified fund during the previous year

- any income-tax due on income of non-resident has been deducted at source and remitted to the Central Government by the specified fund at the rates specified in section 194LBB of the Act; and

- the non-resident furnishes the following details and documents to the specified fund, namely

1. name, e-mail id, contact number

2. address in the country or specified territory outside India of which he is a resident

3. a declaration that he is a resident of a country or specified territory outside India

4. Tax Identification Number in the country or specified territory of his residence and in case no such number is available, then a unique number on the basis of which the non-resident is identified by the Government of that country or the specified territory of which he claims to be a resident

Moreover specified fund is required here to furnish quarterly statement.

2. Non-resident being an eligible foreign investor

The provisions of section 139A shall also not apply to a non-resident, being an eligible foreign investor, who has made transaction only in a capital asset referred to in clause (viiab) of section 47 which are listed on a recognised stock exchange (RSE) located in any International Financial Services Centre (IFSC) and the consideration on transfer of such capital asset is paid or payable in foreign currency

Conditions to be fulfilled:

- the eligible foreign investor does not earn any income in India, other than the income from transfer of a capital asset referred to in clause (viiab) of section 47

- the eligible foreign investor furnishes the following details and documents to the stock broker through which the transaction is made namely

1. name, e-mail id, contact number

2. address in the country or specified territory outside India of which he is a resident

3. a declaration that he is a resident of a country or specified territory outside India

4. Tax Identification Number in the country or specified territory of his residence and in case no such number is available, then a unique number on the basis of which the non-resident is identified by the Government of that country or the specified territory of which he claims to be a resident.

Moreover stock broker is required here to furnish quarterly statement.

Here “eligible foreign investor” means a non-resident who operates in accordance with the SEBI, circular IMD/HO/FPIC/CIR/P/2017/003 dated 04th January, 2017

Here ”stock broker” means a person having trading rights in a RSE located in any IFSC and the member of such exchange.

3. Declaration in Form 60 (Proviso of Rule 114B)

The person entering into transactions specified in Rule 114B who does not have PAN may submit a declaration in Form 60. The form 60 is basically a declaration from a person who does not have PAN. However, the companies and firms cannot submit a declaration in Form 60.

The declarant submitting the Form 60 shall satisfy himself that the information furnished is true, correct and complete in all respects. Any person making a false statement in the declaration shall be liable to prosecution under section 277 of the Income-tax Act, 1961 and on conviction be punishable.

To read more about Form 60, Form 61 & Rule 114B please read my below article:

All About Permanent Account Number (PAN), Form 60 & Form 61

Link: https://taxguru.in/income-tax/permanent-account-number-pan-form-60-61.html

5. REQUIREMENT OF FILING ITR IN CASE OF FOREIGN COMPANY

Once foreign company having investment in India is allotted PAN in India. One of the issue which arises post PAN allotment is that whether it is required to file ITR in India or not. Suppose XYZ Inc. have made investment in Indian Company ABC Private Limited and have acquired shares of Rs. 20 lakhs. It is not earning dividend or any other income from India so question is whether it is required to file ITR in India or not since it has Indian PAN and it is a Foreign Company.

Section 139 deals with filing of ITR. As per section 139:

Every person-

- being a company or a firm; or

- being a person other than a company or a firm, if his total income or the total income of any other person in respect of which he is assessable under this Act during the previous year exceeded the maximum amount which is not chargeable to income-tax, shall, on or before the due date, furnish a return of his income or the income of such other person during the previous year, in the prescribed form and verified in the prescribed manner and setting forth such other particulars as may be prescribed.

The definition of “Company” provided in the Income Tax Act 1961 includes Foreign Company as well.

As we can see above, every company is required to file ITR whether total income exceeds maximum amount which is not chargeable to tax or not. Accordingly foreign company is required to file ITR in India if it has investment in India whether or not it has earned any income in India or it has exempt income. However it will be practically difficult to file ITR in India by foreign company, due to requirement of Directors’ DSC & PAN to file ITR (This Directors’ DSC & PAN issue can be avoided by adding Authorised Representative by uploading required POA etc).

In this case we have various conflicting rulings/judgement by AAR:

Case 1: Not required to file ITR in India [Venenburg Group B.V. 2007]

Ruling: Liability to pay tax is founded upon sections 4 and 5 of the Act, which are the charging sections. Section 139 and other sections are merely machinery sections to determine the amount of tax. There would be no occasion to call a machinery section in aid where there is no liability at all.

Case 2: Required to file ITR in India [VNU International B.V. v. DIT (International Taxation) (2011)]

Ruling: As far as filing of ITR is concerned, every company is required to file its ITR whether it has income or loss. Since the applicant is foreign company, it is covered within definition of “company” under the section 2(17) of the Act. While casting obligation on companies to file ITR, the legislature in its wisdom has omitted to include “exceeded the maximum amount which is not chargeable to tax”

Accordingly as per my understanding, foreign company must file ITR if it has exempt income (due to DTAA or any other provision) or it has any income in India. And department should clarify the cases and relaxed the ITR filing requirement where Foreign Company has only investment in Indian Company and has no income or exempt income.

6. PENAL CONSEQUENCES OF NON-COMPLIANCE OF ABOVE PROVISIONS

- The Penalty for failure to comply with the provisions of section 139A is leviable under Section 272B. If a person fails to comply with the provisions of section 139A (didn’t apply for PAN), the Assessing Officer may direct that such person shall pay, by way of penalty, a sum of Rs 10,000.

- The penalty for filing SFT Form 61A is ₹ 500 per day, in case if Form 61A is not filed later within time allowed under notice, penalty will be Rs. 1000/day. Also, inaccurate filing may attract a penalty of ₹50,000 here. However these penalties are imposable by department only.

- As per section 276CC, if a company (including Foreign Company) wilfully fails to furnish its ITR which he is required to furnish under section 139 he shall be punishable-

- in a case where the amount of tax, which would have been evaded if the failure had not been discovered, exceeds Rs 25 lakhs, with rigorous imprisonment for a term which shall not be less than 6 months but which may extend to 7 years and with fine;

- in any other case, with imprisonment for a term which shall not be less than 3 months but which may extend to 2 years and with fine

This article is written by Avinash Rao (consultant at Startup Movers Private Limited). In case of any query please feel free to write us at info@startup-movers.com or submit your query at our website www.startup-movers.com.

(Republished with Amendments)