DIRECTORATE OF INCOME TAX (SYSTEMS)

ARA Center, Ground Floor, E-2, Jhandewalan Extension,

New Delhi – 110055

F.No.System/ITBA/Instruction/Rect9ification/186/2018-19

Dated:19.04.2018

To

All Principal Chief Commissioners of Income-tax/ CCsIT,

All Principal Director Generals of Income-tax/DGsIT,

All Principal Commissioner of Income-tax/CsIT/CsIT(Admin & TPS),

All Principal Directors of Income Tax/DsIT,

Subject: Launch of functionality for Rectification u/s 154 of Intimation u/s 143(1) in Income Tax Business Application (ITBA) – Reg.

Sir/Madam,

This is in reference to the subject mentioned above. Functionality to rectify Intimation u/s 143(1) for all ITR forms is now available through the Rectification module of Income Tax Business Application for Asst. Yrs. 2014-15, 2015-16, 2016-17. For earlier AYs, rectification can be done using AST module for now. This functionality can be accessed through the Rectification module on the ITBA Portal and is meant for use by the AO and AO staff to carry out rectification of Intimation u/sec 143(1).

2. Rectification work flow can be initiated both suo-moto or on an application of the assessee received through ASK/ DAK.

i. Applications received through ASK/DAK will be displayed in the Rectification Control Register.

ii. User can initiate rectification from e-Nivaran module as well.

iii. In case any grievance application requires remedial action in form of rectification, same can be initiated from e-Nivaran work item by clicking on Initiate Action button.

iv. The E-nivaran petition will then be visible to the user in the Rectification Control Register.

v. The path for Rectification Control Register is: Rectification → Menu → Rectification Control Register.

vi. Facility to enter/update new/existing request will be available in the Rectification Control Register.

vii. On initiation, pendency will be created in the work list of AO for making rectification.

viii. User has the facility to view the status of all the rectification proceedings through Rectification control register.

ix. This screen provides a list of all the rectification proceedings and updated status of such proceedings.

x. While conducting Rectification proceedings, User has facility to generate Hearing Notice, Record Hearing, View/Upload Attachments and view Case History/Noting, in the workitem screen.

xi. Certain part of procedure can be delegated to staff as per their predefined role in ITBA by AO through delegate button.

3. The entire process of passing rectification orders is divided into 5 steps

i. Drafting of the rectification order.

ii. Steps for recomputation of income.

iii. Rectification order generation

iv. Steps for Digital signature.

v. Generation of refund intimation sheet.

4. There are marked differences in the approach of passing rectification order in ITBA from legacy AST system which are discussed as under. In ITBA the procedure is similar to passing Assessment Order (as may be referred to in ITBA- Assessment Instruction no 6):

i. In ITBA, any modification/additions/disallowances etc to the returned income are required to be made through various schedules provided in the income computation screen. However, ITR-1 & 4S do not have Schedules except 80G, hence, the AO can directly modify in income computation screen. This is different from AST legacy system where most of modification/additions/ disallowance for all ITRs can be made through income computation screen in AST.

ii. Based on the changes made by the AO in various schedules and income computation screen in ITBA, on submitting the income computation, the software will compute income in various heads that have been modified, and allow benefits of relevant deduction/exemption/reliefs/ adjustments on account of set off losses etc and determine the taxable income or refund due to the assessee. All the computation of Income and computation of tax calculation will be based on CPC-ITR processing software logic and rules.

iii. After receipt of system calculated computation from CPC, the AO has to check whether the results of computation are as per his expected values. If there is any difference in expected values of AO, then the AO has to click ” unfreeze button” and re-verify all the schedules and computation screen and make necessary changes if any required, and again submit for computation to CPC.

iv. The computation can be repeated multiple times after correcting any data entry errors in schedules

v. Similarly, inputs for TDS and Tax payments have to verified and can be corrected in Tax Computation screen (eg. Mistakes by taxpayer in TAN or CIN etc, mismatch in TDS etc after verification of 26AS/form 16 etc. can be rectified by AO) and submitted.

vi. Rectification proceedings already initiated in AST for A.Y. 2015-16 and earlier years can be completed in AST by making necessary modification in computation screen of AST. However if user wants to carry out rectification process in ITBA, than he has to cancel such rectification proceeding in AST and initiate fresh rectification proceedings in ITBA and proceed with passing rectification order in ITBA.

vii. The users are advised to familiarize themselves with the various ITRs and schedules thereof.

5. Rectification module of the ITBA can be accessed by entering the following URL in the browser : https://itba.incometax.gov.in

The path to access rectification module is:

ITBA Portal → Login → Modules → Rectification

6.Various steps to be employed for passing rectification order in ITBA are as per the process of passing Assessment Order in ITBA and the same are explained as under:

(A) Drafting Rectification order:

AO needs to navigate to ͞“Rectification order details” screen to draft the Rectification Order. The AO has two options while drafting text forming part of rectification order. One option is to type the text of order in the designated slot on the screen, which is fully equipped to create a rich text document. Alternatively, AO can get the rectification order typed offline in MS word and then copy and paste the word document in the ITBA screen (the document may be checked for any formatting errors). However, it is essential to note that in order to ensure that the formatting is correctly retained in ITBA, the instruction regarding font type, font size, line spacing etc are to be strictly followed as described in para 6(A) of the ITBA- Assessment Instruction no.-6, dated 3rd Oct.2017. The steps for drafting of order are as under:

- Click Enter Rectification order details

- Enter the text of order and click Save to save the text.

- Click Preview to view the draft order.

(B) Steps to recompute Income and Tax including interest after rectifying the mistake are as follows:

- Click Recompute Income

- Choose the Base as “Latest Return or Latest Order” for making additions/ disallowances. Based on the above selection, data is displayed in the column ‘As per Latest return/order’ in Part B TI and all schedules. Option of latest order may be selected only if the order sought to be rectified was passed in ITBA/ CPC-ITR

- Click Initiate computation.

- In respect of ITR-1 or 4S,which do not have any schedules, modify the income under the head salary, house property and Income from other sources on the Recompute Screen itself and click Save computation to save the details.

- For other ITR forms, click relevant schedules buttons/links placed at the bottom of the screen (available in the last panel in the Screen) to edit the data for entering rectified values and click Save to save the changes.

- Based on the changes done in the schedules, details in ‘Modifications’ and ‘Rectified Income’ column are displayed

- Click on Recompute Tax

- Edit the data related to Relief claimed; TDS/TCS/challans through Schedule TDS/TCS and Schedule IT (if required).

- Having completed the changes that are required to be made Click on Compute. Details will then be submitted to CPC-ITR for computation of income, tax and interest. Based on the computations received from CPC-ITR, system computed ‘Rectified Income’ is displayed and ‘Modifications’ column is also updated in Recompute Income

Screen. - On Recompute Tax Screen: System computed tax, interest for current order will be displayed. Review the computed values, click Unfreeze to edit the data (if required) and send the computation again to CPC-ITR through clicking Compute.

Note: computation can be done multiple times till User is satisfied with the correctness of computed figures.

(C) Once the user is satisfied with the computed values, rectification order is passed through following below steps:

- Click Preview to view the draft order.

- Select the other documents (i.e. demand notices, challans etc) if required to be issued along with the order and click Preview to view the draft of them.

- Enter the demand payment period (in days) allowed. If user enters the period less than 30 days then enter the approval details also.

- Select digital signature option as “Yes” or “No” and click Generate order to generate the order.

- Details will be shared with the CPC-ITR to run the computation and share the final computed figures. Based on the same, computation sheet and selected documents will be generated.

- All the process of accounting will be done by CPC-ITR.

- Workitem will be closed. User can view the orders and documents in “list of Notices, Order and Letters” Screen or ” View/ Dowland Notice/ Letter /Order ” Screen.

(D) In case user selected the digital signature option as “yes” then Go to “view/Enter Dispatch Detalis” Screen. Select the issue date and status as ‘Pending for signing’ and click Search

- Documents generated are displayed. Select them and click Sign Documents.

Note: Ensure DSC key is attached to the system while digitally signing

(E) For refund cases, following additional steps are to be followed:

- In case refund determined exceeds specified limit, the approval workflow will be initiated in Refund Banker module in the worklist of Range.

- Once the refund is approved by Range then refund will be issued by CPC-ITR after following adjustment process u/s 245 (if applicable)

- Once the refund is released by CPC –ITR, such order will be available in “List of demand/refund orders- Pending for Refund Adjustment cum Intimation Sheet” Screen.

- In case the refund amount is below specified limit not requiring Range approval the same will be issued by CPC-ITR after following adjustment process u/s 245 (if applicable).

- Select the order, DSC option and click Preview to view the draft Refund Intimation sheet and click on Generate Refund Intimation Sheet to generate the same.

Note: This Refund Intimation sheet is required to be generated and shared with assessee so that final Interest u/s 244A, adjustment details u/s 245 and final refund outgo are clear to assessee.

7. Rectification Module in ITBA will be expanded and following functionalities will also be made available soon:

i. Rectification on Assessment orders under 143(3)

ii. Re-rectification.

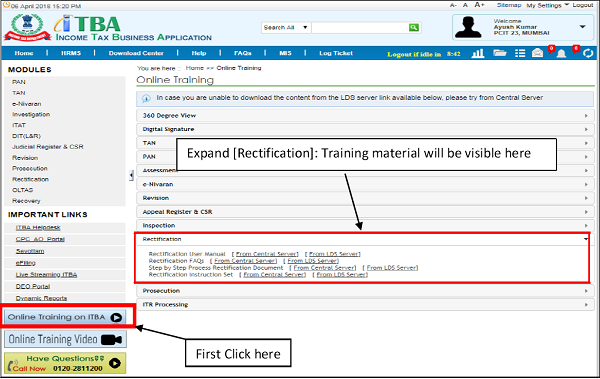

8. Training material including User manual, Step by step, FAQs and PPT are available on the Rectification Module Home Page and also on ITBA Portal → Online Training on ITBA. Users can refer to the same to understand as to how to use the rectification functionality.

Users are advised to contact helpdesk in case of any issues in respect of the ITBA.

a. URL of helpdesk – http://itbahelpdesk.incometax.net

b. Help desk number – 0120-2811200

c. E.mail ID – itba.helpdesk@incometax.gov.in

d. Help desk Timings – 8.30 A.M. – 7.30 P.M. (Monday to Friday)

The above Instruction may kindly be brought to the notice of all officers and staff for necessary compliance.

9. This instruction is issued with the prior approval of Pr DGIT (Systems).

Yours sincerely,

(Ramesh Krishnamurthi)

Addl.DG (S)-3, CBDT, New Delhi

Copy to:

1. The PPS to Chairman, Member(L)/Member(Inv.)/Member(IT&C)/Member(R)/ Member(A&J)/Member(Admin) CBDT for information

2. Pr. DGIT(Systems), New Delhi

3. The Database Cell with request to upload instruction on www.irsofficersonline.gov.in

4. ITBA Publisher with request to upload instruction on http://itba.incometax.gov.in

Ramesh Krishnamurthi)

Addl.DG (S)-3, CBDT, New Delhi