Article discusses changes in ITR 1, ITR 2, ITR 3 , ITR 4 Sugam, ITR 5 and ITR 6 as released by CBDT for Financial Year 2017-18 / Assessment Year 2018-19 vide these changes CBDT has ensured more disclosures from Assessee regarding GST, Financial Particulars, Depreciation, ICDS, Late Fees U/s. 234F, Income from Other Sources, Income from transfer of carbon credits u/s 115BBG ,Income chargeable at special rates under DTAA, Amounts not deductible u/s 58, Profits chargeable to tax u/s 59, IND-AS etc.

Page Contents

- 1. Changes in ITR-1 for Financial Year 2017-18 / Assessment Year 2018-19

- 2. Changes in ITR-2 for Financial Year 2017-18 / Assessment Year 2018-19

- 3. Changes in ITR-3 for Financial Year 2017-18 / Assessment Year 2018-19

- 4. Changes in ITR‐4 Sugam for Financial Year 2017-18 / Assessment Year 2018-19

- 5. Changes in ITR‐5 for Financial Year 2017-18 / Assessment Year 2018-19

- 6. Changes in ITR‐6 for Financial Year 2017-18 / Assessment Year 2018-19

1. Changes in ITR-1 for Financial Year 2017-18 / Assessment Year 2018-19

The most popular one pager return is continued by the CBDT this year also. But there are certain changes regarding eligibility to file this return as well contents of this return which are as under.

1. This year (AY 2018-19 FY 2017-18), only the individual who is “resident and ordinary resident” can file this return, so three categories of residential status are removed from the content of this return.

2. Resident Individual who has income to be apportioned in accordance with provisions of Section 5A (governed by Portuguese Civil Code) are no more eligible to file this return. Therefore in schedule-TDS of this ITR, column no. 7 is removed this year.

3. Individual who want to carry forward the loss under the head income from house property is not eligible to file this return.

4. Income under the head salary and house property are to be shown in detail as under instead of writing only net figure of income/loss under the head. (Same change in ITR-4 Sugam also).

5. Amount of late fees under newly introduced section 234F which is payable in case of late filing of ITR.(for more understanding of Section 234F refer to this video link : https://youtu.be/P-zH_uLq2wM

2. Changes in ITR-2 for Financial Year 2017-18 / Assessment Year 2018-19

In addition to changes discussed in above points

1. Income from Business or profession is no more reportable in this return. Consequently, from schedule-AL, Part-C regarding “interest held in assets of a firm or AOP as a partner or member thereof” is also removed.

2. Section 234F (Also in other ITRs)

3. In Schedule TDS, columns are added for TDS of others whose income are assessable in hands of assessee. (Also in ITR-3, ITR-4, ITR-5 & ITR-6).

4. Section 56(2)(x) income related information to be separately given as under. (Also in ITR3, ITR-5 & ITR-6)

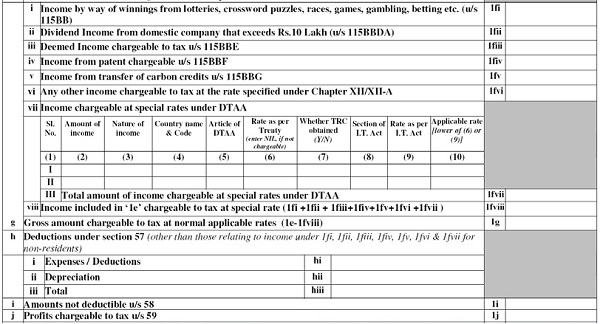

5. Income from transfer of carbon credits u/s 115BBG (Also in ITR-3, ITR-5 & ITR-6)

6. Income chargeable at special rates under DTAA to be shown in more detail as under. (Also in ITR-3, ITR-5 & ITR-6)

7. Amounts not deductible u/s 58 (Also in ITR-3, ITR-5 & ITR-6)

8. Profits chargeable to tax u/s 59(Also in ITR-3, ITR-5 & ITR-6)

9. In Schedule FSI, income from Business or profession is omitted to be removed.

3. Changes in ITR-3 for Financial Year 2017-18 / Assessment Year 2018-19

In addition to changes discussed in above points

1. GST details as under in Profit and Loss account. (Also in ITR-5 and ITR-6)

2. Part A-01 Point No. 4(a) and (b) are still not rectified this year. These points still refer to the market value, whereas ICDS says about Net Realizable Value (NRV). (Also in ITR-5 & ITR-6).

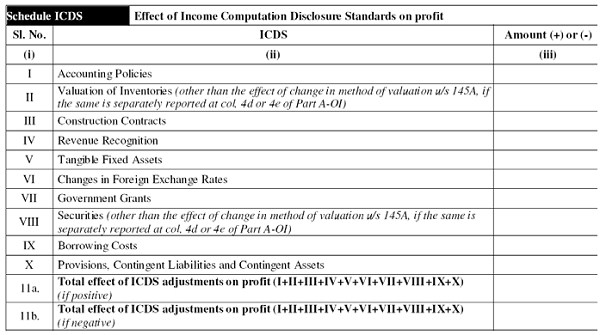

3. Specific head for ICDS effect in Schedule – Business Profession. (Also in ITR-5 & ITR-6)

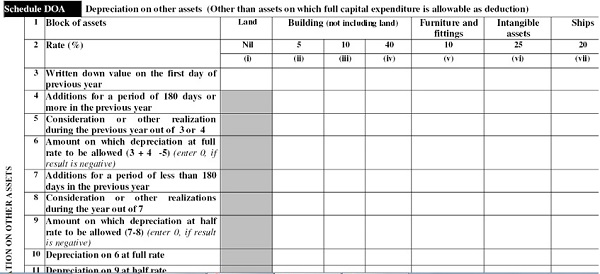

4. Restriction of maximum depreciation rate to 40% (Also in ITR-5 & ITR-6)

5. Place to report proportionate depreciation in cases of amalgamation, demerger etc. (Also in ITR-5 & ITR-6)

6. Column for land is also provided in schedule Depreciation on other assets. (Also in ITR‐5 & ITR‐6)

7. Rationalization of ICDS Schedule (Also in ITR‐5 & ITR‐6)

4. Changes in ITR‐4 Sugam for Financial Year 2017-18 / Assessment Year 2018-19

In addition to changes discussed in above points

1. GST details are introduced this year. And more financial particulars of business are asked for as under. (13 items in place of 4 items)

5. Changes in ITR‐5 for Financial Year 2017-18 / Assessment Year 2018-19

1. In addition to changes discussed in above points…nothing new

6. Changes in ITR‐6 for Financial Year 2017-18 / Assessment Year 2018-19

In addition to changes discussed in above points….

1. Whether total turnover/ gross receipts in the previous year 2015-16 exceeds 50 crore rupees? (Earlier it was ” previous year 2014-15 exceeds 5 crore rupees)

2. New schedule Balance sheet – Ind AS is introduced. In the same was P & L A/c. Ind AS

3. Schedule for Expenditure in respect of entities registered/not registered under GST and Break-up of payments/receipts in Foreign currency (to be filled up by the assessee who is not liable to get accounts audited u/s 44AB)

what to write in the verification node of PARTB of ITR 2 ??

ITR 1 (Sahaj) released for AY 2018-19 is flawed. Salaried employee without house property cannot use this form. House Property column is a must to be filled without which, one cannot validate the sheet. In the instant case, how can an employee use this form when he doesn’t have house property.

I have to file my return in form ITR -2 for assessment year

2018 – 2019 as my stay In India was less than 2 months.

Till last assessment years I was filing my IT return as resident and getting my IT refund creitted to my bank account in India.

I have no bank account in USA where I am currently staying as I am not employed and earn no Income in US.

Please clarify if I can get my IT refund for the current assessment year credited to my bank account in India or I should necessarily open a ban account in US to get my IT refund.

Thanks

I have retired from private service and donot have any taxable income.kindly tell me whether I am required to submit the It return or not

Regards

R.K.Hegde

Good , Keep it up.

Of course mis income is taxable and has tto be included by you in ITR. TDS will not be made by India Post.

what are the changes as regarding NRI tax payer.?

what about interest of MIS of Post Office Scheme.

Is it taxable or tax free

What about deduction u/s 80TTA for senior citizens and rebate u/s87A

In ITR 4S- if a person is not voluntarily register under GST Act than what to write under GST Turnover column?

Very Well Elaborated