Case Law Details

Catvision Ltd Vs ACIT (ITAT Delhi)

Introduction: In a significant turn of events, ITAT Delhi adjudicated a dispute involving Catvision Ltd and ACIT, highlighting an essential aspect of tax compliance and accuracy. The case revolved around a wrong demand of Dividend Distribution Tax (DDT) by the Assessing Officer (AO), despite the Assessee submitting proof of timely payment. This piece provides an insightful analysis of the court’s ruling and its implications.

Analysis: The crux of the issue was a clerical error in the challan where the assessment year was incorrectly mentioned. Despite providing all the facts, the Commissioner of Income Tax (Appeals) refused to grant any credit based on the challan’s details. The Assessee contended that taxes were appropriately paid, albeit mentioning the wrong assessment year, and hence credit should be granted.

ITAT Delhi, after considering the submissions, decided to restore the matter back to the AO for a re-examination, providing another opportunity to the Assessee. The Tribunal underscored that the AO should grant credit for the taxes paid, provided they are satisfied with the tax recovery and after ensuring safeguards against potential misuse of the e-challan.

FULL TEXT OF THE ORDER OF ITAT DELHI

The captioned appeal has been filed by the Assessee against the order of the Commissioner of Income Tax (Appeals)-NFAC, Delhi (‘CIT(A)’ in short) dated 27.07.2022 arising from the assessment order dated 16.04.2021 passed by the Assessing Officer (AO) under Section 143(3) of the Income Tax Act, 1961 (the Act) concerning AY 2018-19.

2. The grounds of appeal raised by the assessee read as under:

“1. The learned Assessing Officer has erred on facts and in law by raising a demand of Rs.15,87,620/- towards dividend distribution tax under section 115O for which the requisite payment was made on time and proof of payment was summited.

2. On the facts and circumstances of case and in law, ld . CIT(Appeal) through NFAC has erred in not allowing the payment of Dividend Distribution Tax u/s. 115O on the pretest of clerical error mentioned in the challan.”

3. When the matter was called for hearing, the assessee submitted that the demand has been raised by the Assessing Officer towards dividend distribution tax amounting to Rs.15,87,620/- for Assessment Year 2018-19 in question. In this context, the assessee submitted that the Assessing Officer has not given the credit towards dividend distribution tax paid to the extent of Rs.11,10,225/-. It is submitted on behalf of the assessee that the dividend distribution tax payable under Section 115O on dividend declared during the Financial Year 2017-18 was paid on 13.06.2017. However while making payment of such amount, the assessment year was wrongly mentioned in the challan is Assessment Year 2017-18 instead of correct Assessment Year 201819. The assessee submitted that all these facts were placed before the CIT(A) but however the CIT(A) strictly went by the details put in the challan reflecting Assessment Year 2017-18 and therefore, declined to give any credit for payment claimed against the challan in respect of Assessment Year 201819 in question. In the matter, the ld. counsel for the assessee submitted that the taxes to the extent of Rs.11,10,225/- has been duly paid to the coffers of the Government albeit mentioning incorrect assessment year in the challan and therefore, credit should be given for such payments in relation to Assessment Year 2018-19. The mistake committed by the Assessee towards incorrect mentioning of assessment year should be corrected by the Appellate Authorities.

4. On being inquired by the Bench, the ld. counsel submitted that the credit for such challan has not been taken in any other assessment year and the assessee is willing to file the affidavit and the indemnity bond in this regard and also such other declaration as may be called upon by the Revenue to assign credit in correct AY 2018-19.

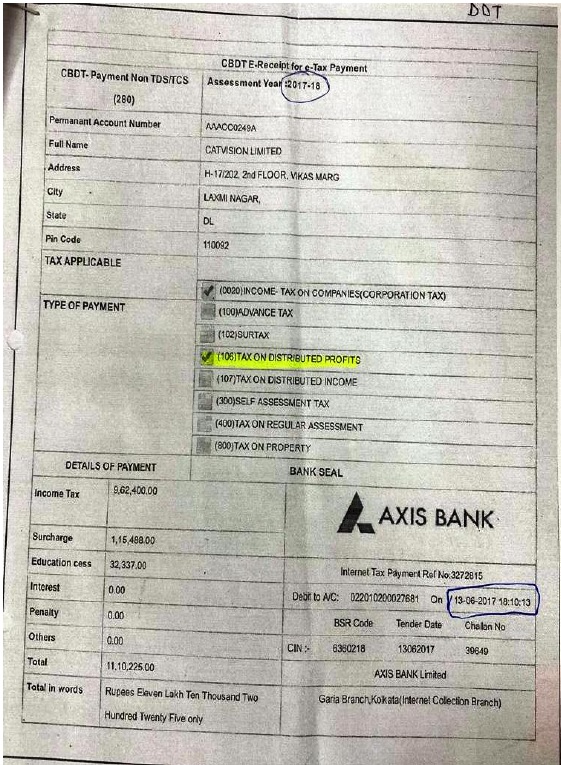

5. The copy of e-receipt for e-tax payment is reproduced hereunder:

6. In the light of the submissions made on behalf of the assessee, the matter is restored back to the file of the Assessing Officer to provide one more opportunity to Assessee and for re-examination of the issue by the Assessing Officer. The Assessing Officer shall grant credit for taxes paid, in accordance with provisions of law, where the authority concerned is duly satisfied about appropriate recovery of tax and after taking due safeguards on any possible misuse of the e-challan purportedly bearing incorrect assessment year. It shall be open to the Assessee to place relevant facts and position of law before the Assessing Officer to enable him to perform his quasi judicial function in accordance with law.

5. In the result, the appeal of the assessee is allowed for statistical purposes.

Order pronounced in the open Court on 23/05/2023.