Article explains How to download and extract an ITR excel utility, How to download and import the prefilled XML to prefill all the personal and tax details to the ITR excel utility, How to import tax details from the previous version of the excel utility and what to do if your are getting ‘invalid XML’ while trying to upload the xml?

Page Contents

- 1. How to download and extract an ITR excel utility?

- 2. How to download and import the prefilled XML to prefill all the personal and tax details to the ITR excel utility?

- 3. How to import tax details from the previous version of the excel utility?

- 4. I am getting ‘invalid XML’ while trying to upload the xml?

1. How to download and extract an ITR excel utility?

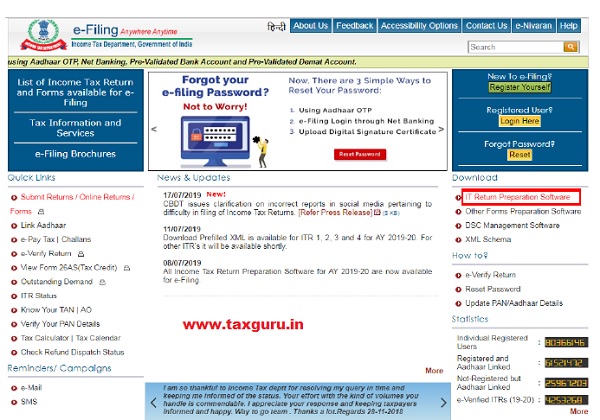

Step 1 : Go to Income Tax e-Filing Portal www.incometaxindiaefiling.gov.in

Step 2 : Click on ‘IT Return Preparation Software’ link under the ‘Downloads’ section.

Step 3 : Click on the appropriate ITR’s Excel utility hyperlink. The ITR excel utility zip file will be downloaded successfully.

download and extract an ITR excel utility

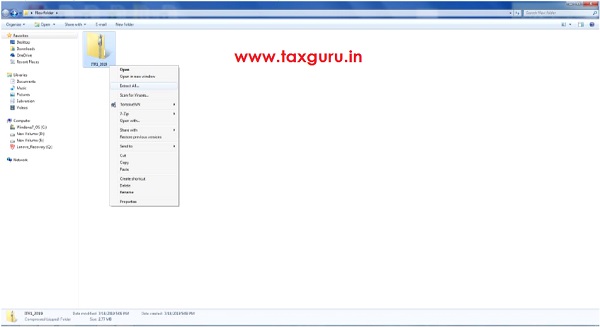

Step 4 : Open the location to which the zip file is downloaded.

Step 5 : Right click on the downloaded zip file and click on ‘Extract All’.

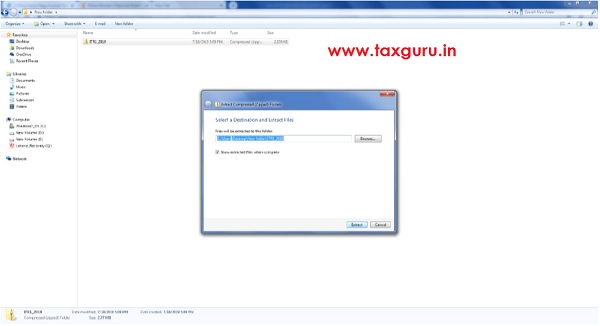

Step 6 : In the new dialogue box select the desired location and click on ‘Extract’.

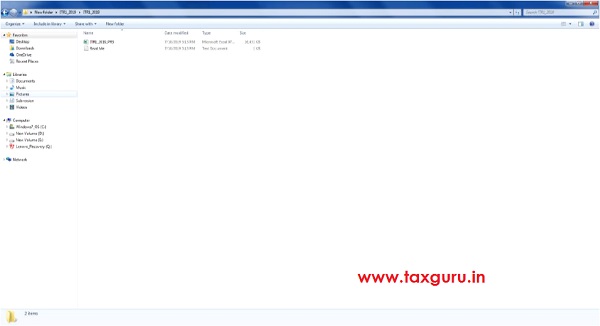

Step 7 : Open the folder to which the zip file is extracted. Double click on the ‘Excel File’ to open the excel utility.

2. How to download and import the prefilled XML to prefill all the personal and tax details to the ITR excel utility?

Step 1 : Go to Income Tax e-Filing Portal www.incometaxindiaefiling.gov.in

Step 2 : Login to the e-Filing portal by entering the User ID (PAN), Password and Captcha.

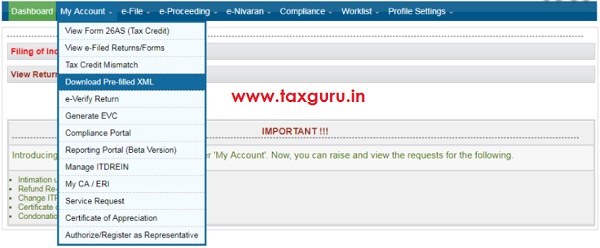

Step 3 : Post Login, Navigate to ‘My Account’ tab and select ‘Download Pre-filled XML’ link.

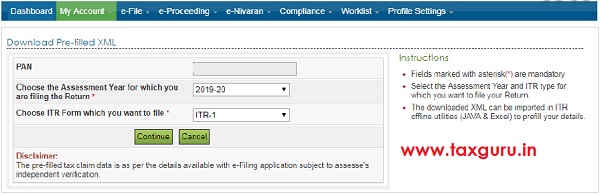

Step 4 : In the ‘Download Pre-filled XML’ page, the PAN will be auto populated, choose the Assessment Year for which you are filing the Return and the Income Tax Return Form which you want to file from the dropdown. Click ‘Continue’ button.

Step 5 : The details that will get prefilled to the ITR utility along with the bank account details that are available with e-Filing portal (if any) will be displayed to the user. Choose the bank account for refund credit.

Step 6 : Click on the ‘Download XML’ button to download the pre-filled XML.

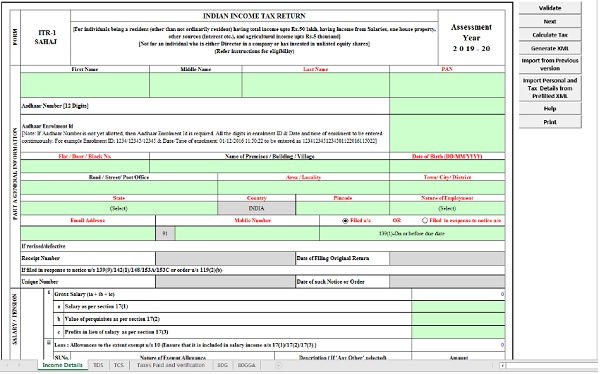

Step 7 : Open the ITR excel utility and click ‘Import Personal and Tax Details from Prefilled XML’ button from the right side panel.

Step 8 : Browse and select the downloaded pre-fill XML file and click on ‘Open’ button.

Step 9 : All the personal and tax details available with e-Filing portal will be prefilled into the ITR excel utility.

3. How to import tax details from the previous version of the excel utility?

Step 1 : Download and open the latest version of ITR excel utility from the e-filing portal.

Step 2 : Click ‘Import from Previous Version’ button from the right side panel.

Step 3 : Browse and select the saved excel file (previous version of the filled ITR excel utility) and click on ‘Open’ button.

Step 4 : All the information filled and saved into the previous version of the ITR excel utility will be imported to the latest version of the ITR excel utility successfully.

Step 5 : Thoroughly check the data in the newer version to ensure that all the data from previous version has been imported correctly. Fill in the additional fields, if any, in the new version so that the ITR is complete.

4. I am getting ‘invalid XML’ while trying to upload the xml?

Invalid XML error may arise due to the following reasons,

1. The taxpayer might have altered or edited the XML file generated from the ITR utility before uploading the same to the Portal.

2. The taxpayer might have generated the XML file from the older version of ITR utility.

3. In the case Excel utility, the PC used for generating the XML in which the .Net 3.5 frame work might have not installed or not enabled.

To install the .Net 3.5 Framework please visit the link provided

(https://www.microsoft.com/en-in/download/details.aspx?id=21)

To enable .Net Framework

Go to Control Panel ⇒ Programs ⇒ Programs and Features ⇒ Turn Windows features on or off ⇒ Select the .NET Framework 3.5 (includes .NET 2.0 and 3.0) check box, select OK and Restart the System and the generate the XML afresh.

The XML file uploaded to the portal must be generated from the latest version of ITR utility available in the e-Filing Portal.

On importing ITR2 data from previous version,

1. all TDS details are not imported fully.

Required details are to be re-entered.

2. Attention is to be paid to Schedule 112A (LTCG).

Before importing, add as many rows to latest version as there are in old version and then import.

If as many rows are not added, calculations in rows 5 and onwards may not take place even after re-entering details.

“Col 1a” is added in PR4, with one of two options to select. On selection of an option in “Col 1a”, the imported data in Col 4, 5, 6 and 10 gets deleted. So, deleted / required data is to be re-entered.