Double taxation can be a concern when a person residing in India earns income that is also taxable in a foreign country. To address this issue, individuals can claim credit for taxes paid outside India as Foreign Tax Credit (FTC). This article explores the rules and benefits of double taxation relief in India.

Page Contents

- Double Taxation Relief

- Document to be furnished to claim the benefit of DTAA

- In which year credit for foreign tax is allowed?

- How much amount can be claimed as a foreign tax credit?

- What is the conversion rate to be taken to convert the foreign tax?

- Documents required to claim the foreign tax credit

- How to file Form 67?

- What is the time limit to submit Form 67 with relevant documents?

- Steps to file Form 67

- Step 9: On clicking Yes, you will be taken to the e-Verify page. After successful e-Verification, a success message is displayed along with a Transaction ID and Acknowledgement Number. Please keep a note of the Transaction ID and Acknowledgement for future reference. You will also receive a confirmation message on the email ID registered on the e-Filing portal. Important Points on Double taxation relief

Double Taxation Relief

Where a person resident in India earns income which is also taxable in a foreign country, he may be liable to pay tax on such income in India as well. This results in a double taxation of the same income. To avoid such double taxation, the assessee can claim credit for the taxes paid outside India as Foreign Tax Credit (FTC).

Where an assessee has paid taxes in a country or specified territory with which India has entered into a Double Taxation Avoidance Agreement (DTAA), the relief in respect of such taxes shall be allowed in accordance with the provision of Section 90 and Section 90A. This relief is allowed under a bilateral treaty.

Unilateral relief is allowed in respect of taxes paid in the country or specified territory with which no DTAA exists. Such relief is allowed under Section 91.

Where the Central Government has entered into a DTAA with the government of any foreign country, then in relation to the assessee to whom such agreement applies, the provisions of the Income-tax Act shall apply only to the extent they are more beneficial to that assessee. In other words, if the provisions of the DTAAs are more beneficial to such assessee, such beneficial provisions supersede the provisions of the Income-tax Act and vice-versa.

Further, any term used in DTAA shall have the meaning as assigned to it under that agreement. However, if such a term is not defined in the DTAA, it shall be assigned the meaning as follows:

(a) Where such term is defined in the Act it shall have the meaning as assigned to it under Act and any explanation given by the government;

(b) Where such term is not defined in the Act unless the context otherwise requires, it shall have the same meaning as given by the notification issued by the Central Government. The meaning so assigned should not be inconsistent with the provision of the Act or the agreement. Such term shall be deemed to have effect from the date on which said agreement came into force.

Generally, a double taxation avoidance agreement includes the following articles:

Article 1: Personal Scope

Article 2: Taxes Covered

Article 3: General Definitions

Article 4: Resident

Article 5: Permanent Establishment

Article 6: Income from Immovable Property

Article 7: Business Profits

Article 8: Shipping and Air Transport

Article 9: Associated Enterprises

Article 10: Dividends

Article 11: Interest

Article 12: Royalties and Fees for Technical Services

Article 13: Capital Gains

Article 14: Independent Personal Services

Article 15: Dependent Personal Services

Article 16: Directors’ Fees

Article 17: Artistes and Sportspersons

Article 18: Non-Government Pensions

Article 19: Government Service

Article 20: Teachers, Students, and Trainees

Article 21: Other Income

Article 22: Capital

Article 23: Relief from Double Taxation

Article 24: Non-Discrimination

Article 25: Mutual Agreement Procedure

Article 26: Exchange of Information

Article 27: Diplomatic and Consular Privileges

Article 28: Entry into Force

Article 29: Termination

Document to be furnished to claim the benefit of DTAA

A non-resident to whom a DTAA applies shall be entitled to claim any relief under such DTAA only if he obtains a Tax Residency Certificate (TRC) of his being a resident of any foreign country from the government (tax authorities) of such country. Further, he shall be required to furnish some additional information in Form No. 10F electronically.

A resident person can make an application in Form No. 10FA to the assessing officer to obtain a Tax Residency Certificate to claim relief under a DTAA entered into with the source country. The tax residency certificate to a resident person is provided in Form No. 10FB.

In which year credit for foreign tax is allowed?

A resident shall be allowed to claim credit of the foreign tax paid by him in the foreign country in the year in which income earned in the foreign country (on which tax has been paid) is offered to tax or assessed to tax in India.

If the income to which such credit relates is offered to tax in more than one year, credit for the same shall be allowed in the proportion in which such income is offered to tax or assessed to tax in India in those years.

How much amount can be claimed as a foreign tax credit?

India generally follows the Ordinary Credit method to allow relief for the taxes paid in the foreign country (source state). In this method, the credit to be allowed shall be lower of the tax attributable in India to such income taxed in the foreign country and the taxes paid on such income in that country. If the amount of foreign tax exceeds the amount of tax payable as per the provisions of the DTAA, such excess shall be ignored while calculating the foreign tax credit.

The relief shall be allowed against the amount of income tax, surcharge, and cess payable under the Act except against any sum payable by way of interest, fee, and penalty.

However, no credit shall be allowed in respect of tax paid outside India which is disputed in any manner by the assessee.

What is the conversion rate to be taken to convert the foreign tax?

The amount of foreign tax credit shall be computed by converting the currency of foreign tax at the telegraphic transfer buying rate on the last date of the month immediately preceding the month in which such tax has been paid or deducted.

‘Telegraphic Transfer Buying Rate’ in relation to foreign currency means the rate or rates of exchange adopted by the SBI for buying such currency, having regard to the guidelines specified by RBI from time to time for buying such currency, where such currency is made available to that bank through a telegraphic transfer.

Documents required to claim the foreign tax credit

The assessee needs to furnish the following documents to claim the credit of foreign tax:

(a) A statement specifying income offered to tax in the foreign country for the previous year and foreign tax which has been deducted or paid on such income in Form No. 67;

(b) A certificate or statement specifying the nature of income and the amount of tax deducted therefrom or paid by the assessee from the tax authority of the foreign country or the person responsible for the deduction of such tax. It should be signed by the assessee and accompanied by the following:

- An acknowledgement of online payment or bank counterfoil or challan for payment of tax, where the payment has been made by the assessee;

- Proof of deduction, where tax has been deducted.

Countries with which no agreement exists [Section 91]

Where a resident person pays taxes in respect of the income accrued or arisen outside India, in any country with which no DTAA exists, unilateral relief on such doubly taxed income shall be allowed against income tax payable in India.

Relief under this provision shall be allowed, by way of deduction from the income-tax, at the following rates:

- Where rates are different in both countries – the Indian rate of tax or the rate of tax of the respective country, whichever is the lower.

- Where rates are the same in both countries – the Indian rate of tax

Meaning of Indian rate of tax

Indian rate of tax shall be determined in accordance with the following formulae:

Indian rate of tax = Indian income tax after relief under this provision but before relief under

Section 90 and Section 90A

Total Income

Meaning of the rate of tax of the foreign country

The rate of tax of foreign country shall be determined in accordance with the following formulae:

Rate of tax of the foreign country = Income tax and super-tax paid in that country after deduction of all

relief except relief in respect of double taxation

___________________________________________________

Total income assessed in that country

Meaning of “Income-tax”

Term Income-tax in relation to any country includes any excess profit tax or business profit tax charged on the profits by the government of any part of that country or local authority in that country.

How to file Form 67?

All assesses who are required to furnish a return of income electronically are required to prepare and submit Form No. 67 electronically.

What is the time limit to submit Form 67 with relevant documents?

Assessee is required to furnish Form 67 with relevant documents electronically on or before the end of the assessment year relevant to the previous year in which the income has been offered to tax or assessed to tax in India.

However, where an updated return has been furnished by the assessee under Section 139(8A), the documents (relating to income included in the updated return) shall be furnished on or before the date of filing of such an updated return.

Steps to file Form 67

Step 1: Visit https://www.incometax.gov.in/iec/foportal and log in to the e-Filing portal using your user ID and password.

Step 2: On your Dashboard, click ‘e-File > Income Tax Forms > File Income Tax Forms’.

Step 3: On the File Income Tax Forms page, select Form 67. Alternatively, enter Form 67 in the search box to find the form.

Step 4: On the Form 67 page, select the relevant Assessment Year (A.Y.) and click ‘Continue’.

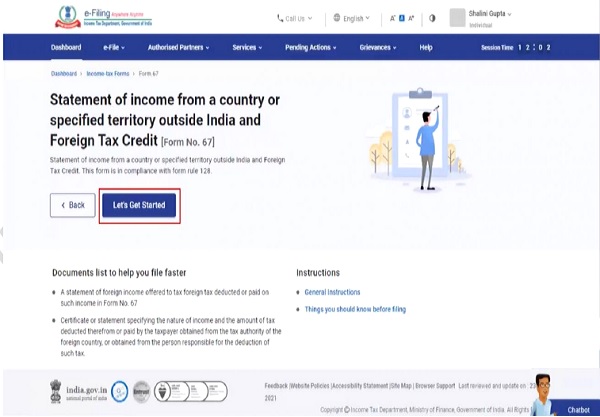

Step 5: On the Instruction page, click ‘Let’s Get Started’.

Step 6: On click of Let’s Get Started, Form 67 is displayed. Fill in all the required details and attach the required documents. It has the following 4 sections:

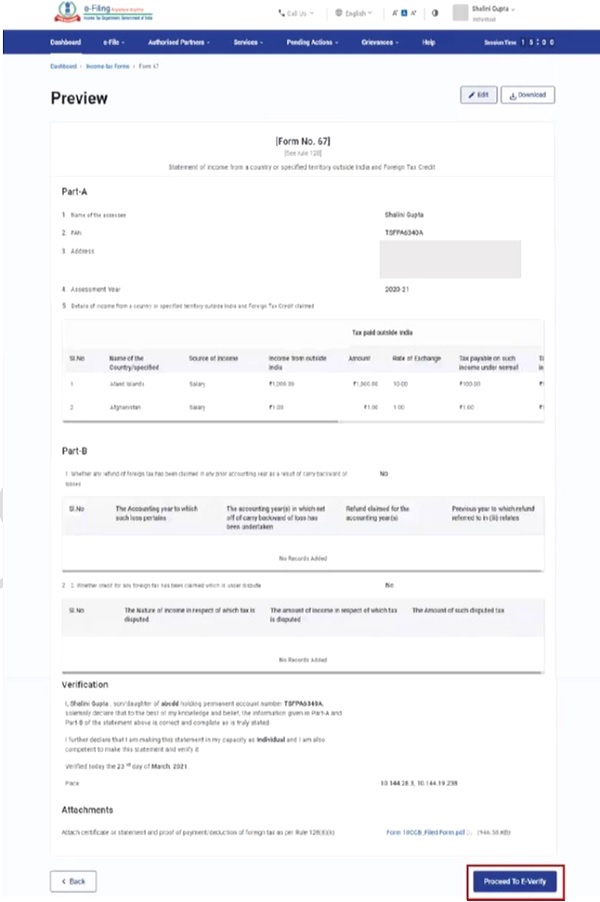

(a) Part A

Part A of the form entails basic information such as your Name, PAN, Address, and Assessment Year. Further, the taxpayer is required to provide details of his income from foreign countries and foreign tax credit claimed in respect thereof.

(b) Part-B

Under Part B, the taxpayer shall be required to specify if any refund of the foreign tax credit has been claimed in any prior accounting year as a result of carry backword of losses. Further, if credit has been claimed in respect of foreign tax which is under dispute, the taxpayer shall be required to specify the same.

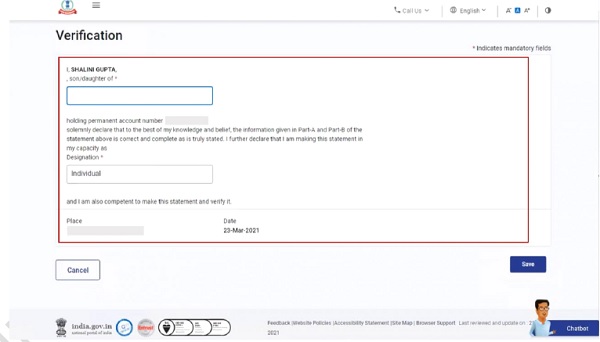

(c) Verification

On this page, the taxpayer is required to provide a self-declaration that all the information provided in the form is correct and complete.

(d) Attachments

The last section of Form 67 is ‘Attachments’, where you need to attach a copy of certificate or statement and proof of payment/deduction of foreign tax.

Step 7: After filling required details, preview the details and click on ‘Proceed to e-Verify.

Step 8: Click ‘Yes’ to submit.

Step 8: Click ‘Yes’ to submit.

Step 9: On clicking Yes, you will be taken to the e-Verify page. After successful e-Verification, a success message is displayed along with a Transaction ID and Acknowledgement Number. Please keep a note of the Transaction ID and Acknowledgement for future reference. You will also receive a confirmation message on the email ID registered on the e-Filing portal.

Important Points on Double taxation relief

1. Where an assessee has paid taxes in a country or specified territory with which India has entered into a Double Taxation Avoidance Agreement (DTAA), the relief in respect of such taxes shall be allowed in accordance with the provision of Section 90 and Section 90A. This relief is allowed under a bilateral treaty.

2. Unilateral relief is allowed in respect of taxes paid in the country or specified territory with which no DTAA exists. Such relief is allowed under Section 91

3. Where the Central Government has entered into a DTAA with the government of any foreign country, then in relation to the assessee to whom such agreement applies, the provisions of the Income-tax Act shall apply only to the extent they are more beneficial to that assessee.

4. A non-resident, to whom a DTAA applies, shall be entitled to claim any relief under such DTAA only if he obtains a Tax Residency Certificate (TRC) of his being a resident of any foreign country from the government of such country. Further, he shall be required to furnish some additional information in Form No. 10F electronically.

5. A resident person can make an application in Form No. 10FA to the assessing officer to obtain a Tax Residency Certificate to claim relief under a DTAA entered into with the source country.

6. A resident shall be allowed to claim credit of the foreign tax paid by him in the foreign country in the year in which income earned in a foreign country (on which tax has been paid) is offered to tax or assessed to tax in India.

7. The credit shall be lower of the tax payable on such income under the Income-tax Act and foreign tax paid on such income. If the amount of foreign tax exceeds the amount of tax payable as per the provisions of the DTAA, such excess shall be ignored while calculating the foreign tax credit.

8. The amount of foreign tax credit shall be computed by converting the currency of foreign tax at the telegraphic transfer buying rate on the last date of the month immediately preceding the month in which such tax has been paid or deducted.

9. The assessee needs to furnish the following documents to claim the credit of foreign tax:

(A) A statement specifying income offered to tax in the foreign country for the previous year and foreign tax which has been deducted or paid on such income in Form No. 67;

(B) A certificate or statement specifying the nature of income and the amount of tax deducted therefrom or paid by the assessee obtained from the tax authority of the foreign country or the person responsible for the deduction of such tax. It should be signed by the assessee and accompanied by:

-

- An acknowledgement of online payment or bank counterfoil or challan for payment of tax, where the payment has been made by the assessee;

- Proof of deduction, where tax has been deducted.

10. Where a resident person pays taxes in respect of the income accrued or arisen outside India, in any country with which no DTAA exists, relief shall be allowed, by way of deduction from the income-tax, at the following rates:

(a) Where rates are different in both countries – the Indian rate of tax or the rate of tax of the respective country, whichever is the lower.

(b) Where rates are the same in both countries – the Indian rate of tax