Case Law Details

SKF India Limited Vs DCIT (ITAT Mumbai)

ITAT Mumbai held that assessee is not entitled for concession rate of tax of 20% provided under section 112(1) of the Income Tax Act on the short term capital gain computed under section 50 of the Income Tax Act.

Facts- The assessee has offered capital gain at Rs. 2,62,63,582/-as short term capital gains computed as per section 50 of the Act. Assessee paid the tax on such capital gain at the rate of 20% as prescribed u/s 112 of the Act plus applicable surcharge. In response to the show cause notice by the AO as to why rate of 30% should not be applied which is applicable on short term capital gain, the assessee submitted that its claim was based on decision of ITAT Mumbai, Bench in the case of Ace Builders Pvt. Ltd vs. ACIT (76 ITD 389). However, the Ld. AO rejected the assessee’s contention. CIT(A) confirmed the order of AO.

Conclusion- In Ace Builders Pvt. Ltd. it is held that if the capital gain is computed as provided under section 50, then, the capital gain tax will be charged as if such capital gain has arisen out of short term capital asset.

Held that assessee is not entitled for concession rate of tax of 20% provided under section 112(1) of the Act on the short term capital gain computed under section 50 of the Act and included by the assessee in its total income, which arose on transfer of three residential properties forming part of block of asset and on which deprecation was availed by the assessee in earlier years. Thus, question of law referred to the special bench is liable to be answered against the assessee and in favour of the revenue.

FULL TEXT OF THE ORDER OF ITAT MUMBAI

In the aforesaid appeal, reference has been made by the Hon’ble President, Income-Tax Appellate Tribunal, to Special Bench to decide the following question:

“Whether, on the given facts and circumstances of the case and in law, the capital gains under section 50 of the Act arising out of sale of long term capital asset is chargeable at the rate applicable to short term capital gains or rates applicable to long term capital gains under section 112 of the Act?”

2. Brief facts qua the question referred are that, in the return of income, assessee has offered capital gain at Rs. 2,62,63,582/-as short term capital gains computed as per section 50 of the Act. Assessee paid the tax on such capital gain at the rate of 20% as prescribed u/s 112 of the Act plus applicable surcharge. In response to the show cause notice by the AO as to why rate of 30% should not be applied which is applicable on short term capital gain, the assessee submitted that its claim was based on decision of ITAT Mumbai, Bench in the case of Ace Builders Pvt. Ltd vs. ACIT (76 ITD 389). However, the Ld. AO rejected the assessee’s contention after holding as under:-

12.3 A plain reading of the provisions of section 50 shows that the provisions are applicable in respect of an asset forming part of block of assets on which depreciation has been claimed under this act. The gain resulting on account of transfer of such asset will be short term capital gain disregarding the provisions of Section 2(42A) of the I.T. Act, 1961 and the provisions of section 48 and 49 shall be subject to modifications as enumerated in clause 1 of section 50 of 1.T. Act, 1961. Since the instant case the assessee company has transferred immovable properties which formed part of block of assets on which the depreciation has been claimed by the assessee company, the capital gains on transfer of these assets shall naturally be taxed as short term capital gains. The transaction in question is squarely covered by the provisions of section 50(1) of I.T. Act, 1961)

12.4 The only reason for the assessee company treating the capital gain on transfer of the assets in question as Long Term Capital Gain is that it takes shelter behind the decision of Bombay Tribunal in the case of Ace Builders Pvt. Ltd. Vs. ACIT (76 ITD 389). I have gone through the decision of the Hon’ble Tribunal and feel that the said decision is not applicable in the instant case due to vast difference in facts of the two cases. The decision of the Bombay Tribunal has not been delivered in the context of applicability of provisions of section 54E. Therefore, it would amounts to stretching the said decision too far to apply it in the instant case, the facts of which have no similarity whatsoever with the facts in the case of Ace Builders Pvt. Ltd.

12.5 The assessee company has stretched the facts of the case as prevailing in Ace Builders Pvt. Ltd. to suit its convenience. It is a settled principle of interpretation of statutes that the judgment of a court has to be understood in the case of Ace Builders Pvt. Ltd. cannot be stretched to make it applicable to the facts present in the assessee’s case.

12.6 The assessee company has conveniently quoted certain portions of the decision which it has found suitable to its interest. It is again reiterated here that selective quoting of certain parts of decisions is not relevant and the ratio of a case is applicable only where the circumstances and the facts tally. This has been the well settled and consistent view of several High Courts and Supreme Court laid down in the following decisions:

1. CIT Vs. Sun Engineering Works (198 ITR 227, 297) (Supreme Court)

2. CWT Vs. Dr. Karan Singh & Others (200 ITR 614) (Supreme Court)

3. Chamber of Income Tax consultants Vs. CBDT (209 ITR 660) (Bombay)

4. SRF Finance Ltd. Vs. CBDT (211 ITR 861) (Delhi)

12.7 In view of the above, the contention of the assessee company is not acceptable and accordingly, the capital gains are taxed as short term capital gains as per the provisions of section 50(1) of I.T. Act, 1961.

3. The Ld. CIT (A) had confirmed the order of AO in the following manner:-

“The issue has already been decided in the appellant’s own case for A. Yrs 2001-02 and 2002-03 as has been pointed out by the appellant itself in its letter dated 07.02.2011. Following the same, the issue for the current year is decided against the appellant. As regards the appellant’s reliance on the decision in the case of Manali Investment, I find that it is not the contention of the appellant that the relevant facts in its case were similar to those in the case of Manali Investment. In the case of Manali Investment, the block of assets ceased to exists whereas it is not the contention of the appellant that the relevant block of assets that extinguished as a result of sale. The decision in the case of Manali Investment is, therefore, not applicable in the instant case. The appeal on this ground is, therefore, not allowed.

4. It has been pointed out that, the Tribunal in assessee’s own case for the assessment year 2001-02, had decided this issue against the assessee after holding as under:-

20. We have heard the rival contentions. Section 50 of the Act, reads as follows:-

SECTION 50

769 [Special provision for computation of capital gains in case of depreciable assets.

Notwithstanding anything contained in clause (42A) of section 2, where the capital asset is an asset forming part of a block of assets in respect of which depreciation has been allowed under this Act or under the Indian Income-tax Act, 1922 (11 of 1922), the provisions of sections 48 and 49 shall be subject to the following modifications:-

(1) where the full value of the consideration received or accruing as a result of the transfer of the asset together with the full value of such consideration received or accruing as a result of the transfer of any other capital asset falling within the block of assets during the previous year, exceeds the aggregate of the following amounts, namely:-

(i) expenditure incurred wholly and exclusively in connection with such transfer or transfers;

(ii) the written down value of the block of assets at the beginning of the previous year; and

(iii) the actual cost of any asset falling within the block of assets acquired during the previous year, such excess shall be deemed to be the capital gains arising from the transfer of short-term capital assets;

(2) where any block of assets ceases to exist as such, for the reason that all the assets in that block are transferred during the previous year, the cost of acquisition of the block of assets shall be the written down value of the block of assets at the beginning of the previous year, as increased by the actual cost of any asset falling within that block of assets acquired by the assessee during the previous year and the income received or accruing as a result of such transfer or transfers shall be deemed to be the capital gains arising from the transfer of short-term capital assets.]

769. Subs. by Taxation Laws (Amendment and Misc. Provisions) Act, 1986, s. 9 (w.e.f. 1-4-1986). Prior to that, it stood as under:

“50. Special provision for computing cost of acquisition in the case of depreciable assets.-Where the capital asset is an asset in respect of which a deduction on account of depreciation has been obtained by the assessee in any previous year either under this Act or under the Indian Income-tax Act, 1922 (11 of 1922), or any Act repealed by that Act or under executive orders issued when the Indian Income-tax Act, 1886 (2 of 1886), was in force, the provisions of sections 48 and 49 shall be subject to the following modifications:-

(1) The written down value, as defined in clause (6) of section 43, of the asset, as adjusted, shall be taken as the cost of acquisition of the asset.

(2) Where under any provision of section 49 read with sub-section (2) of section 55, the fair market value of the asset on the *[1st day of April, 1974,] is to be taken into account at the option of the assessee, then, the cost of acquisition of the asset shall, at the option of the assessee, be the fair market value of the asset on the said date, as reduced by the amount of depreciation, if any, allowed to the assessee after the said date, and as adjusted.”.

21. On plain reading of the above section shows that the excess in question shall be deemed to be the capital gains arising from the transfer of a short term capital asset. Both the section 54EC and section 74, do not speak about short term capital gain or long term capital gain. These sections deal with capita gains / loss arising from transfer of long term capital assets. Section 112, also deals with income arising from transfer of long term capital assets. Section 112(b)(i) and (ii) specifically mentions “long term capital gain”. When section 50 deems that income earned from a depreciable asset has to be deemed as short term capital gain, the question of applying the rate of tax specified in section 112(1) does not arise. This is what the Hon’ble Jurisdictional High Court stated at para-26 of its judgment in the case of Ace Builders (supra). We extract the same for ready reference:-

“26. It is true that s. 50 is enacted with the object of denying multiple benefits to the owners of depreciable asset. However, that restriction is limited to the computation of capital gains and not to the exemption provisions. In other words, where the long term capital asset has availed depreciation, then the capital gain has to be computed in the manner prescribed under section 50 and the capital gains tax will be charged as if such capital gain has arisen out of a short term capital asset but if such capital gain is invested in the manner prescribed in s. 54E, then the capital gain shall not be charged under section 45 of the Act. To put is simply, the benefit of s. 54E will be available to the assessee irrespective of the fact that the computation of capital gains is done either under section 48 and 49 or under section 50. The contention of the Revenue that by amendment to s. 50, the long term capital asset has been converted into a short term capital asset is also without any merit. As stated hereinabove, the legal fiction created by the statute is to deem the capital gain as short term capital gain and not to deem the asset as short term capital asset. Therefore, it cannot be said that s. 50 converts long term capital asset into a short term capital asset.” [emphasis own]

22. Respectfully following the aforesaid judgment of the Hon’ble Jurisdictional High Court, the ground raised by the assessee is dismissed.

5. While hearing this matter in the appeal for the A.Y. 2000-01, the Division Bench observed that decision of the Tribunal in the case of Smita Conductors Ltd vs. DCIT (2015) (152 ITD 417), this precise issue was decided in favour of the assessee. Apart from this judgment, there were various other judgments of the Tribunal in the favour of the assessee on this point following Bombay High Court in the case of CIT vs. Ace Builders Pvt. Ltd 281 ITR 210 (Bombay). Accordingly, the Bench after referring to the decision of the Bombay High Court in the case of CIT vs. Ace Builders Pvt. Ltd (supra), wherein the Hon’ble High Court has categorically held that deeming fiction of section 50 of the Act is restricted only to section 48 & 49 for the computation of capital gains and does not extend to other provisions or exemption provisions. Since the decision of the Tribunal in assessee’s own case was contradictory to various decisions of the Tribunal following the decision of the Hon’ble High Court, therefore, reference was made to the special bench to decide the aforesaid issue.

6. Before us the Ld. Counsel for the assessee submitted now the issue that, section 50 is limited to the scope of only computation of capital gains of section 48 and 49 and does not extend to the other provisions of the Act, has been settled by series of the judgments of Hon’ble jurisdictional High Court and other High Courts. Ld. Counsel relied upon the following judgments in her support of her arguments:-

| Sr.No | Particulars |

| 1. | Decision of the Bombay High Court in the case of CIT vs Ace Builders Pvt Ltd reported in [2005] 144 taxman 855. |

| 2. | Decision of the Mumbai Bench of the Income-Tax appellate Tribunal in the case of DCIT vs Voltas Ltd. Dated 06 October 2020 [ITA No. 7029, 6613/Mum/2018, 3307 & 2257/Mum/2019] |

| A | Section 50 of the Income-Tax Act, 1961 does not change character of the long term capital asset to short term capital asset and hence loss on long term capital asset (which is depreciable asset) can be set off against brought forward long term losses: |

| 3. | Decision of the jurisdictional Bombay High Court in the case of CIT vs Parrys (Eastern) Pvt Ltd reported in [2016] 66 taxmann.com 330 |

| 4. | Decision of the Bombay High Court in the Case of CIT vs Pursarth Trading Co. Pvt Ltd reported in [2013] 33 taxman.com 482 |

| 5. | Decision of the Bombay High Court in the case of CIT vs Manali Investment reported in [2013 39 taxmann.com 4 |

| B. | Deeming fiction of a long term capital gain to be treated as short- term capital gain is restricted only to section 50 and it would have no application to other provisions such as 54EC |

| Decision of the Bombay High Court in the case of CIT vs United Paper Industries reported in [2014] 42 taxmann.com 79 | |

| 7. | Decision of the Bombay High Court in the case of CIT vs Cadbury India Ltd reported in [2015] 53 taxmann.com 227 |

| 8. | Decision of the Gujarat High Court in the case of CIT vs Polestar Industries reported in [2014] 41 taxmann.com 237 |

| 9. | Decision of the Gujarat High Court in the case of CIT vs Aditya Medisales Ltd reported in [2013] 38 taxmann.com 244 |

| 10. | Decision of the Gujarat High Court in the Case of DCIT vs Himalaya Machinery Pvt Ltd reported in [2013] 29 taxmann.com 380 |

| 11. | Decision of the Gauhati High Court in the case of CIT vs Assam Petroleum Industries (P.) Ltd reported in [2003] 131 taxman 699 |

| C. | Decision of the High Court is a binding precedent only for the issue which was raised before the decided by it: |

| 12. | Decision of the Bombay High Court in the case of HDFC Bank Ltd vs. DCIT reported in [2016] 383 ITR 529 |

| 13. | Decision of the Apex Court in the case of CIT vs Sun Engineering Works Pvt Ltd reported in [1992] 198 ITR 297 |

| D. | Question as to whether gains computed on depreciable asset u/s 50 is to be given the benefit of lower tax rate u/s 112 of the Income Tax Act, 1961 admitted by the Bombay High Court: |

| 14. | In Rathi Brothers Madras Ltd. Vs ACIT (ITA No. 871 of 2015) arising out of the decision of the Pune Bench of the Tribunal in ITA No. 707/Mum/2013. |

7. Besides this she heavily relied upon the judgment of Hon’ble Supreme Court in the case of CIT vs. Dempo Company Ltd., 387 ITR 354 (SC),wherein the following decisions of the Hon’ble High Court have been approved;

i. CIT v. Ace Builders (P). Ltd [2006] 281 ITR 210 (Bom);

ii) CIT v. Polestar Industries [2014] 221 Taxman 423 (Guj); and

iii) CIT v. Assam Petroleum Industries (P.) Ltd [2003] 262 ITR 587 (Gau).

Thus, she submitted that once it has been categorically held that section 50 creates a deeming fiction only for the mode of computation of capital gains under sections 48 and 49 and not for other provisions, therefore, the rate of tax provided in section 112 of the Act which is applicable for transfer of a long term capital asset should be applied, even though the same is taxed as short term capital gain u/s 50 of the Act. Ld Counsel further submitted that, deeming fiction is about treatment of an asset appearing in the block of asset, is to be computed in the manner provided in section 50 and excess is to be taxed as capital gain arising from transfer of short term capital assets. Thus, asset forming part of block of asset, for the limited purpose is to be taxed (even if it is long term capital asset forming part of block of asset), as short term capital gain. This deeming fiction does not mean section 112 has no applicability when tax rate has been provided on transfer of long term capital asset. This aspect has been clarified now by series of judgment.

8. On the other hand the Ld. CIT DR on behalf of the Revenue submitted that the Tribunal in assessee’s own case for the immediately preceding year has interpreted judgment of Ace Builders Pvt. Ltd (supra) while holding that it is short term capital gain and rate of tax shall be same as is applicable for short term capital gain, that is 30% therefore, same should be followed. Apart from that, he submitted that section 50 is very clear that any asset which is part of the block of asset, whether held for a long term has to be treated as short term capital asset in terms of section 2 (42A) of the Act and it further provides mode of computation on such depreciable asset and if there is any excess, it is deemed to be capital gains arising from transfer of short term capital assets and once that is so, then tax should be levied at the rate on which a short team capital gains is charged, i.e., @ rate of 30% of the charge.

9. The ld. CIT-DR strongly relied upon the decision of the Hon’ble Supreme Court in the case of M/s. Shakti Metal Depot vs. CIT (2021) 436 ITR 1(SC). He submitted that in this case before the Hon’ble Supreme Court a flat was used by the assessee for business purposes and availed depreciation on this asset from the year of acquisition. However, assessee discontinued claim of depreciation for 2 years before the sale of the flat and showed capital gain out of transfer of this flat as Long-Term Capital Gain (in short LTCG).

Hon’ble Kerala High Court decided this issue referring the section 50 & 50A and held that character of the building can’t be changed and converts to an investment due to non-use as business asset. Finally, profit arising on sale of said flat would be assessed as a Short- Term capital gain fin short STCG) under section 50.

10. He further submitted that non obstante clause of section 50 makes an exception to the definition of short-term capital asset which means that even though the duration of holding of an asset is more than the period mentioned in section 2(42A), still the asset would be treated as short-term capital asset. The assets covered by section 50 are depreciable assets forming part of block of assets as per section 2(11). Once the capital asset that has been transferred is found to form of a block of assets in respect of which depreciation has been allowed, the surplus if any computed under section 50 will be treated as STCG. Use of asset is important for the purposes of depreciation, but not for application of section 50. Once it is brought to use, it enters the block and once it enters the block, its identity gets submerged in block identity so that it is not necessary or possible to infer that any particular asset in the block is being used or not, as long as block is used.

11. Hon’ble Apex Court also held that the description of the asset by the appellant in the balance sheet as an investment asset is meaningless and is only to avoid payment to tax on STCG on sale of building. So long as the appellant continued business, the building forming part of the block of assets will retain its’ character as such, no matter one or two of the assets in one or two years not used for business purposes disentitlement the appellant for depreciation for these years.

12. The decision in Sakthi Metal is applicable to this case also. Main extract of this decision is excess out of transfer of any depreciable assets would be STCG and to be computed as per section 50 of the I. T. Act. Since treatment of capital gain is STCG and not LTCG, therefore section 112 is not attracted at all. Tax rate applicable for STCG will be applicable.

13. CIT DR submitted that in the assessee’s case, the question before the Hon’ble Special Bench is already decided by the Hon’ble Co-ordinate Bench ITAT Mumbai in the assessee’s own case for the A/Yrs. 2001-02 to 2005-06 in favour of the revenue citing the decision of Hon’ble Jurisdictional High Court in the case of Ace Builders (P) Ltd vs ACIT (2001) 76 ITD 389. Details of the appeals are given in a tabular form.

| ITA No. | A/Yr | Date of order | Members of the Bench | Issue raised in Ground no | Decision in para no. |

| 616/M/2006 | 2001-02 | 29.12.2011 | Hon’ble Shri B. R. Mittal (JM) &.Hon’ble Shri J. Sudhakar Reddy (AM) | Gr-5 | 21 |

| 721/M/2006 | 2002-03 | 29.12.2011 | Do | Gr-3 | 49 |

| 2660/M/2007 | 2003-04 | 29.12.2011 | Do | Gr-3 | 71 |

| 4625/M/2008 | 2004-05 | 29.12.2011 | Do | Gr-1 | 91 |

| 6461/M/2009 | 2005-06 | 24.02.2012 | Hon’ble Shri Vijay Pal Rao (JM) & Hon’ble Shri Rajendra Singh (AM) | Gr-3 | 7&8 |

13. In all these years there was a common issue involved which was as under:-

“On the facts & in the circumstances of the case and in Saw the Id. CITA) erred in confirming Capital Gain under section 50 of the Act arising on sale of Long-term Capita! Asset is chargeable to tax at the rate applicable to STCG instead of the rate applicable to LTCG.”

Hon’ble Bench held as follows:

“On plain reading of the section 50 shows that the excess in question shall be deemed to be the capital gain arising from the transfer of a short-term capital asset. Both the sections 54 EC & Section 74 do not speak about STCG or LTCG. These sections deal with capital gain / loss arising from transfer of long-term gain. Section 112 deals with income arising from transfer of long-term capital asset. Section 112(b)(i) & (ii) specifically mention “LTCG”. When section 50 deems that income earned from a depreciable asset has to be deemed as STCG, the question of applying the rate of tax specified in section 112(1) doesn’t arise.”

14. Finally, he concluded that the decision of the Hon’ble Jurisdictional High Court in the case of Ace Builders in para 26, following points are relevant:-

“1. Section 50 is enacted with the object of denying multiple benefits to the owners of depreciable assets.

2. Restriction is limited to the computation of capital gain and not to the exemption provisions.

3. In other words, where the long-term capital asset has availed depreciation, then capital gain has to be computed in the manner prescribed u/s 50 and the capital gain tax will be charged as if such capital gain has arisen out of short-term capital asset.

Therefore, it is clear that excess earned from transfer of any depreciable assets will be treated as STCG and taxed as per rate applicable to STCG.”

15. In rejoinder, ld. Counsel for the assessee submitted that the decision of Shakti Metal Depot (supra) is not applicable and she gave the following facts for distinguishing the case:

1.1. The appellant used a flat for business purposes and claimed depreciation on the same for 21 years from the year of its acquisition.

1.2. Thereafter, the appellant discontinued the claim of depreciation for 2 years and subsequently sold the flat. The appellant returned the income on sale of such flat as longterm capital gain.

1.3. In the said case, the appellant contended that the asset ceased to be a business asset since the asset was not being used for business purpose and was held as investment (i.e. personal asset). In view of the same, the appellant offered the income on sale of the asset as long-term capital gains.

1.4. The Hon’ble Kerala High Court decided the matter by discussing section 50 and 50A of the Act. It concluded that the nature of building cannot change character and convert to an investment due to non-use as business asset. Accordingly, the Hon’ble High Court held the profit on sale of building to be as short-term capital gains. The Hon’ble Supreme Court affirmed the order of the Hon’ble Kerala High Court by reproducing the below extract of High Court order:

“In other words, in our view, the building which was acquired by the assessee in 1974and in respect of which depreciation was allowed to a as a business asset for 21 years, that is upto the assessment year 1995-96. still continued to be part of the business asset and depreciable asset, no matter the non-user disentitles the assessee for depreciation for two years prior to the date of sale. We do not know how a depreciable asset forming part of block of assets within the meaning Section 2(11) of the Act can cease to be part of block of assets. The description of the asset by the assessee in the Balance Sheet as an investment asset in our view is meaningless and is only to avoid payment to tax on short term capital gains on sale of the building. So long as the assessee continued business, the building forming part of the block of assets will retain it’s character as such, no matter one of two of the assets in one or two years not used for business purposes disentitles the assessee for depreciation for those years. In our view instead of selling the building, if the assessee started using the building after two years for business purposes the assessee can continue to claim depreciation based on the written down value available as on the date of ending of the previous year in which deprecation was allowed last.”

Decision

16. We have heard both the parties and also perused the various judgments relied upon. As noted above, the main issue to be adjudicated by this special bench is, whether the capital gains under section 50, arising out of sale of a long term capital assets is chargeable at the rate applicable to the short term capital gains or the rates applicable to the long term capital gains u/s 112 of the Act. Interestingly, this tribunal in the earlier year in the case of the assessee on same issue has quoted the judgment of Hon’ble Jurisdictional High Court in CIT v. Ace Builders (P). Ltd (supra), to decide against the assessee. Accordingly, we have to decide this referred question in light of this judgement and other judgments and also the true purport of section 50.

17. Section 50 is a special provision for computation of capital gains in the case of depreciable assets. Section reads as under:-

50. Notwithstanding anything contained in clause (42A) of section 2, where the capital asset is an asset forming part of a block of assets in respect of which depreciation has been allowed under this Act or under the Indian Income- tax Act, 1922 (11 of 1922), the provisions of sections 48 and 49 shall be subject to the following modifications:

(1) where the full value of the consideration received or accruing as a result of the transfer of the asset together with the full value of such consideration received or accruing as a result of the transfer of any other capital asset falling within the block of assets during the previous year, exceeds the aggregate of the following amounts, namely:-

(i) expenditure incurred wholly and exclusively in connection with such transfer or transfers;

(ii) the written down value of the block of assets at the beginning of the previous year; and

(iii) the actual cost of any asset falling within the block of assets acquired during the previous year,

such excess shall be deemed to be the capital gains arising from the transfer of short-term capital assets;

(2) where any block of assets ceases to exist as such, for the reason that all the assets in that block are transferred during the previous year, the cost of acquisition of the block of assets shall be the written down value of the block of assets at the beginning of the previous year, as increased by the actual cost of any asset falling within that block of assets, acquired by the assessee during the previous year and the income received or accruing as a result of such transfer or transfers shall be deemed to be the capital gains arising from the transfer of short-term capital assets:]

[Provided that in a case where goodwill of a business or profession forms part of a block of asset for the assessment year beginning on the 1st day of April, 2020 and depreciation thereon has been obtained by the assessee under the Act, the written down value of that block of asset and short-term capital gain, if any, shall be determined in such manner as may be prescribed.]

[Explanation.—For the purposes of this section, reduction of the amount of goodwill of a business or profession, from the block of asset in accordance with sub-item (B) of item (ii) of sub-clause (c) of clause (6) of section 43 shall be deemed to be transfer.]

18. The said section starts with non-obstante clause, that is, exception has been carved out to section 2(42A) of the Act, which provides definition for a short term capital asset. The said definition reads as under:-

(42A) “short-term capital asset” means a capital asset held by an assessee for not more than [Thirty Six] months immediately preceding the date of its transfer.

Ergo, if the capital asset which is an asset forming part of the block of asset, in respect of which depreciation has been allowed, then even if it is held for more than 36 months, the conditions of the 36 months will not be applicable and still it will be chargeable as capital gains arising from transfer of a short term capital asset.

19. The ‘long term capital asset’ and ‘long term capital gain’ has been defined in section 2 (29AA) and 29B which reads as under:-

(29AA). “long term capital asset” means a capital asset which is not a short term capital asset;

(29B). “long term capital gain” means capital gain arising from the transfer of a long term capital asset;

Thus, capital gain arising from transfer of a long term capital asset is taxed as a long term capital gain and long term capital assets means which is held for more than 36 months. So taxability is on transfer of long term capital asset.

20. Normally capital gain is required to be computed according to the provisions contain in sections 48 & 49 of the Act. But section 50 by deeming fiction amends the mode of computation of capital gain and cost with reference to certain modes of acquisition. Section provides that where the capital asset is forming part of the block of assets in respect on which depreciation has been allowed to the assessee has been transferred, then the provisions of sections 48 (mode of computation) and 49 (cost with reference to certain mode of acquisition) has been modified, that is, the computation of depreciable assets has to be done in the mechanism provided in sub section (1) and (2) of section 50. Since in this case sub section (1) is applicable, which provides that, where the full value of consideration received or accruing as a result of transfer of the assets together with the full value of such consideration received or accruing as a result of transfer from any other capital asset falling within the block of asset during the previous year, which exceeds the aggregate of the following amounts, that is; (i) expenditure incurred wholly and exclusively in connection with such transfer or transfers; ii) the written down value of the block of assets at the beginning of the previous year; and iii) the actual cost of any asset falling within the block of assets acquired during the previous year. In other words,

i) Where the consideration received as a result of transfer of an asset falling within the block of asset and such consideration received, exceeds the amount after making the computation provided in clauses (i), (ii) & (iii) of sub-Section 1, then such excess is deemed to be capital gains arising from transfer of short term capital assets.

ii) Where the block of asset cease to exist then the income received or accruing as a result of such transfer shall be deemed to be the capital gains arising from the transfer of short-term capital assets.

Thus, in a situation where because of transfer of a depreciable assets forming part of the block of the assets, any gain arising to the assessee shall always be deemed to be the capital gains from the transfer of a short-term capital asset.

21. Section 50 starts with a non-obstante clause and is a deeming provision which should be strictly limited to the purpose mentioned therein. The exclusion prescribed by the non-obstante clause is limited to the purpose of modification of Section 48 & 49 of the Act and such non-obstante clause cannot be applied to any other provisions contained in the Act. Here Section 50, firstly, deems that any capital asset which is held for a long term period, that is, beyond specified time limit as provided in section 2(42A) is transferred, and if there is excess after computation provided in sub clauses (i), (ii) and (iii) of sub section (1), then it is taxed as capital gains arising from transfer of a short term capital asset. Secondly, the deeming provisions has been confined only to the purpose of computation of sections 48 and 49 of the Act and the capital gains then arising is deemed to be from transfer of short term capital assets. The deeming provision does not extend for any other purpose. In other words provisions of section 50 of the Act changes the characteristic of the gain that in some cases a long term to a short term capital gain were assets are held beyond the specific term. However, the section does not change the characteristic of the capital asset held by the assessee, that is, the long term capital asset will remain a long term capital asset for all other purposes, but for the deeming fiction u/s 50 of the Act, capital gains is taxable as if it is gain arising from transfer of a short term capital asset and it does not extend beyond this fiction to convert long term capital asset into short term capital asset for other purposes of the Act.

22. Section 2(42B) of the Act defines short term capital gains, “a short term capital gains means capital gains arising from transfer of a short term capital asset”. Though the gain on transfer of a depreciable asset have been deemed to be in the nature of a short term capital gain in case of transfer, but that does not alter the characteristic of that capital asset, whether ‘long term capital asset’ or ‘short term capital asset’ for the purpose of other provisions of the Act. In order to apply Section 50 of the Act, the mode of computation on the transfer of the asset, only sections 48 & 49 has been modified to deem it as transfer of a short term capital asset. Here in this case, the assessee has computed the capital gains in alignment with the provision of section 50 despite holding the asset for a period longer than three years and offered it as STCG. Thus, there are two steps in arriving at the final tax liability; (a) Step 1 – computation of income; and (b) step 2-determining the tax rate. The tax rate of long term capital gain has been defined in Section 112.

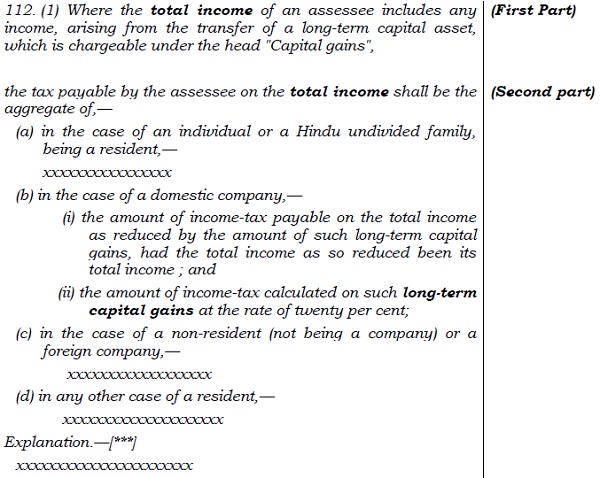

112. (1) Where the total income of an assessee includes any income, arising from the transfer of a long-term capital asset, which is chargeable under the head “Capital gains“, the tax payable by the assessee on the total income shall be the aggregate of,-

(a) in the case of an individual or a Hindu undivided family, [being a resident,]

(i) the amount of income-tax payable on the total income as reduced by the amount of such long-term capital gains, had the total income as so reduced been his total income; and that

(ii) the amount of income-tax calculated on such long-term capital gains at the rate of twenty per cent :

Provided that where the total income as reduced by such long-term capital gains is below the maximum amount which is not chargeable to income-tax, then, such long-term capital gains shall be reduced by the amount by which the total income as so reduced falls short of the maximum amount which is not chargeable to income-tax and the tax on the balance of such long-term capital gains shall be computed at the rate of twenty per cent;

(b) in the case of a 21[domestic] company,-

(i) the amount of income-tax payable on the total income as reduced by the amount of such long-term capital gains, had the total income as so reduced been its total income; and

(ii) the amount of income-tax calculated on such long-term capital gains at the rate of 20 [twenty] per cent :

The aforesaid section deals with tax rate on long term capital gains which clearly provides that, where the total income of the assessee includes any income arising from transfer of long term capital asset which is chargeable under the head Capital Gain, then tax is to be calculated at the rate of 20%.

23. Section 112 deals with the rate on which long term capital gain has to be taxed. The pre-requisite for applicability of 20% rate as per Section 112 of the Act for the domestic companies is that firstly, there must be long term capital asset and secondly, income must arise from transfer of long term capital asset. If the long term capital asset has been held for more than 36 months immediately preceding the date of transfer, then transfer of such long term capital asset has to be taxed at the rate of profit under the Act. In the present case it is not in dispute that the asset has been held for more than 36 months prior to its transfer. Hence, both the conditions prescribed in Section 112 of the Act stands satisfied.

24. Now various courts have held that the deeming fiction in section 50 has been brought out for differential treatment of depreciable asset which has limited application and is confined for the purpose of mode of computation of capital gains under sections 48 and 49 of the Act. In so far as the judgment of Hon’ble Bombay High Court in the case of CIT vs. Ace Builders, (supra), wherein the Hon’ble High Court in the context of claim of deduction under section 54E of the Act in respect of capital gain arising on transfer of a capital asset on which depreciation has been allowed, which is deemed to be short term capital gains under section 50 of the Act, had made the following observation:-

“21. On perusal of the aforesaid provisions, it is seen that Section 45 is a charging section and sections 48 and 49 are the machinery sections for computation of capital gains. However, Section 50 carves out an exception in respect of depreciable assets and provides that where depreciation has been claimed and allowed on the asset, then, the computation of capital gain on transfer of such asset under sections 48 and 49 shall be as modified under Section 50. In other words, Section 50 provides a different method for computation of capital gain in the case of capital assets on which depreciation has been allowed.

22. Under the machinery sections the capital gains are computed by deducting from the consideration received on transfer of a capital asset, the cost of acquisition, the cost of improvement and the expenditure incurred in connection with the transfer. The meaning of the expressions ‘cost of improvement’ and ‘cost of acquisition’ used in sections 48 and 49 are given in section 55. As the depreciable capital assets have also availed depreciation allowance under section 32, section 50 provides for a special procedure for computation of capital gains in the case of depreciable assets. Section 50(1) deals with the cases where any block of depreciable assets do not cease to exist on account of transfer and Section 50(2) deals with cases where the block of depreciable assets cease to exist in that block on account of transfer during the previous year. In the present case, on transfer of depreciable capital asset the entire block of assets has ceased to exist and, therefore, Section 50(2) is attracted. The effect of Section 50(2) is that where the consideration received on transfer of all the depreciable assets in the block exceeds the written down value of the block, then the excess is taxable as a deemed short term capital gains. In other words, even though the entire block of assets transferred are long term capital assets and the consideration received on such transfer exceeds the written down value, the said excess is liable to be treated as capital gain arising out of a short term capital asset and taxed accordingly.

23. The question required to be considered in the present case is, whether the deeming fiction created under Section 50 is restricted to section 50 only or is it applicable to section 54E of the Income Tax Act as well? In other words, the question is, where the long term capital gain arises on transfer of a depreciable long term capital asset, whether the assessee can be denied exemption under section 54E merely because, section 50 provides that the computation of such capital gains should be done as if arising from the transfer of short term capital asset?

24. Section 54E of the Income Tax Act grants exemption from payment of capital gains tax, where the whole or part of the net consideration received from the transfer of a long term capital asset is invested or deposited in a specified asset within a period of six months after the date of such transfer. In the present case it is not in dispute that the assessee fulfills all the conditions set out in section 54E to avail exemption, but the exemption is sought to be denied in view of fiction created under section 50.

25. In our opinion, the assessee cannot be denied exemption under section 54E, because, firstly, there is nothing in section 50 to suggest that the fiction created in Section 50 is not only restricted to sections 48 and 49 but also applies to other provisions. On the contrary, Section 50 makes it explicitly clear that the deemed fiction created in sub-section (1) & (2) of section 50 is restricted only to the mode of computation of capital gains contained in Section 48 and 49. Secondly, it is well established in law that a fiction created by the legislature has to be confined to the purpose for which it is created. In this connection, we may refer to the decision of the Apex Court in the case of State Bank of India V/s. D. Hanumantha Rao reported in 1998 (6) S.C.C.183. In that case, the Service Rules framed by the bank provided for granting extension of service to those appointed prior to 19/7/1969. The respondent therein who had joined the bank on 1/7/1972 claimed extension of service because he was deemed to be appointed in the bank with effect from 26/10/1965 for the purpose of seniority, pay and pension on account of his past service in the army as Short Service Commissioned Officer. In that context, the Apex Court has held that the legal fiction created for the limited purpose of seniority, pay and pension cannot be extended for other purposes. Applying the ratio of the said Judgment, we are of the opinion, that the fiction created under section 50 is confined to the computation of capital gains only and cannot be extended beyond that. Thirdly, section 54E does not make any distinction between depreciable asset and non depreciable asset and, therefore, the exemption available to the depreciable asset under section 54E cannot be denied by referring to the fiction created under section 50. Section 54E specifically provides that where capital gain arising on transfer of a long term capital asset is invested or deposited (whole or any part of the net consideration) in the specified assets, the assessee shall not be charged to capital gains. Therefore, the exemption under section 54E of the I.T. Act cannot be denied to the assessee on account of the fiction created in section 50.

26. It is true that section 50 is enacted with the object of denying multiple benefits to the owners of depreciable assets. However, that restriction is limited to the computation of capital gains and not to the exemption provisions. In other words, where the long term capital asset has availed depreciation, then the capital gain has to be computed in the manner prescribed under Section 50 and the capital gains tax will be charged as if such capital gain has arisen out of a short term capital asset but if such capital gain is invested in the manner prescribed in Section 54E, then the capital gain shall not be charged under Section 45 of the Income Tax Act. To put it simply, the benefit of section 54E will be available to the assessee irrespective of the fact that the computation of capital gains is done either under sections 48 & 49 or under section 50. The contention of the revenue that by amendment to section 50 the long term capital asset has been converted into to short term capital asset is also without any merit. As stated hereinabove, the legal fiction created by the statute is to deem the capital gain as short term capital gain and not to deem the asset as short term capital asset. Therefore, it cannot be said that section 50 converts long term capital asset into a short term capital asset.”

[Emphasis in bold is ours]

25. Thus, sequitur of aforesaid judgment is that the fiction created by the legislature in Section 50 of the Act has to be confined to the purpose for which it is created. Section 50 of the Act was enacted with the object of denying multiple benefits to the owners of a depreciable asset, however, that restriction is limited to the computation of capital gains and not to the exemption provision. If depreciation has been availed on long term capital asset, then, the capital gains has to be computed in the manner prescribed under Section 50 of the Act and the capital gains tax will be charged as if such capital gain is arising out of short term capital asset. In that case, the capital gains was invested in the manner prescribed in Section 54E of the Act wherein exemption is provided on transfer of a long term capital asset then Long term capital gains was subject to deduction. There also, the asset was a depreciable asset, however, while granting exemption under Section 54E of the Act, which is applicable for Long term capital gains, the jurisdictional High Court has held that for the purpose of exemption under Section 54E of the Act, it has to be treated as Long term capital gains.

26. In Para 26 of the aforesaid judgment as highlighted in bold above, Hon’ble High Court specifically rejected the contention of the revenue by amendment section 50 a long term capital asset has been converted into a short term capital asset is without any merit. The legal fiction created is deemed to the capital gain as a short term capital gain and not to deemed that asset as a short term capital asset and therefore cannot be said that section 50 converts the long term capital asset into a short term capital asset. This principle and ratio of the Hon’ble Jurisdictional High Court if is to be followed, then it is clear that the tax rate provided under section 112 which is applicable for a long term capital gains will prevail. Once the Hon’ble High Court has held that section 50 does not convert a ‘long term capital asset’ to a ‘short term capital asset’, then the rate of tax is applicable for the transfer of a long term capital asset has to be in accordance with section 112 of the Act. The deeming fiction of section 50 cannot be imported u/s 112 of the Act. Thus, our analysis is in line with the judgement of the Jurisdictional High Court.

27. In another decision the Hon’ble Bombay High Court in the case of CIT vs. Parrys (Eastern) Pvt. Ltd, reported in 384 ITR 264, wherein following question of law was admitted for consideration of Hon’ble High Court;

1) Whether on the facts and in the circumstances of the case and in law, the Tribunal was justified in law in holding that capital gain arising from transfer of depreciable assets was liable to be set off against brought forward Long Term Capital Loss without appreciating that under section 50 of the Income Tax Act, 1961 such capital gain is treated as Short Term Capital Gain?

(2) Whether on the facts and in the circumstances of the case and in law the Tribunal was justified in law in holding that capital gain arising from transfer of depreciable assets was liable to be set off against brought forward Long Term Capital Loss without appreciating that according to Section 74 of the Income Tax Act, 1961 Long Term Capital Loss cannot be set off against the Short Term Capital Gain?.

The Hon’ble High Court observed and held that-

6. We find that the issue stands concluded by the decision of this Court in ACE Builders (P.) Ltd’s case (supra) in favour of the Respondent-Assessee. Moreover, the impugned order relies upon the order of the Tribunal in Komac Investments & Finance (P.) Ltd’s case (supra) to dismiss the Revenue’s appeal before it. The deeming fiction under Section 50 is restricted only to the mode of computation of capital gains contained in Sections 48 and 49 of the Act. It does not change the character of the capital gain from that of being a long term capital gain into a short term capital gain for purpose other than Section 50 of the Act. Thus, the respondent – assessee was entitled to claim set off as the amount of Rs. 7.12 Crores arising out of sale of depreciable assets which are admittedly on sale of assets held for a period to which long term capital gain apply. Thus for purposes of Section 74 of the Act, the deemed short term capital gain continues to be long term capital gain. Moreover, it appears that the Revenue has accepted the decision of the Tribunal in Komac Investments and Finance (P.) Ltd.’s case (supra), as our attention has not been drawn to any appeal being filed from that order.

7. In view of the above, the questions of law as framed stand concluded against the Revenue-appellant and in favour of Respondent-assessee by the decision of this Court if ACE Builders (P.) Ltd’s case (supra). Therefore, no substantial questions of law arise for consideration.

28. Thus, in the context of set off against the brought forward of long term capital loss, the Hon’ble High Court held that the deeming fiction under section 50 is restricted only to mode of computation of capital gains contained in sections 48 and 49 of the Act and it does not change character of capital assets from of being a long term capital asset or a short term capital asset for purpose u/s 50 of the Act. Thus, the capital gain arisen in terms of section 50 was allowed to be set off against long term capital loss. This judgment again clarifies the interpretation of section 50 and concept of a long term capital asset.

29. Again in another judgment Hon’ble Bombay High Court in CIT vs Pursarth Trading Co. Pvt Ltd in Income Tax appeal no. 123 of 2013 judgment an order dated 13.03.2013,the Hon’ble High Court upheld the set off of a long term capital loss against gain arising from the depreciable assets u/s 50 of the Act. This principle was reiterated in CIT vs. Manali Investment reported in [2013] taxman 113, wherein following question of law was admitted for adjudication.

“Whether on the facts and in the circumstances of the case and in law, the Tribunal was correct in holding that the assessee is entitled to set-off under Section 74 in respect of capital gain arising on transfer of capital assets on which depreciation has been allowed in the first year itself and which is deemed as short term capital gain under Section 50 of the Income Tax Act relying upon the judgment of this Court in the case of CIT V/s. Ace Builders (P.) Limited(281 ITR 210) even though the said decision was rendered in the context of eligibility of deduction under Section 54E”.

The Hon’ble High Court again followed the principle laid in case of CIT vs Ace Builders Pvt Ltd (supra) and observed and held that under:-

3. On further appeal, the Tribunal by the impugned order has allowed the claim of the respondent – assessee to set-off its long term losses in terms of Section 74 of the Act against the long term capital gains on sale of transformers and meters. This was by following the decision of this Court in the matter of CIT v. Ace Builders (P) Ltd [2006] 281 ITR 210/120051 144 Taxman 855 (Bom). In the case of Ace Builders (P) Ltd (supra), this Court held that by virtue of Section 50 of the Act only the capital gains is to be computed in terms thereof and be deemed to be short-term capital gains. However, this deeming fiction is restricted only for the purposes of Section 50 of the Act and the benefit under Section 54E of the Act which is available only to long term capital gains was extended. In this case, the Tribunal held that the position is similar and the benefit of set-off against long term capital loss under Section 74 of the Act is to be allowed. Further, an identical issue with regard to set off against long term capital loss arose in an appeal filed by the Revenue in the matter of CIT V Hathway Investments (P.) Ltd, being Income Tax Appeal (L) No. 405 of 2012. This Court by its order dated 31 January 2013 refused to entertain the appeal filed by the Revenue. The Revenue has not been able to point out any distinguishing features in the present case warranting a departure from the principles laid down by this Court in the matter of Ace Builders (P.) Ltd. (supra) and in our order dated 31st January, 2013 in Income Tax Appeal (L) No.405 of 2012

30. Similar view has been taken in many other cases by the Hon’ble Bombay High Court, for instance, in the case of CIT vs. United Paper Industries reported in [2014] 42 com 79 and CIT vs. Cadbury India Ltd reported in [2015] 41 taxmann.com 227). For sake of repetition we are not reproducing the relevant judgment as in all these judgments, Ace Builders have been followed.

31. Now, finally this issue has been set at rest by the Hon’ble Supreme Court in the case of CIT vs. Dempo Company Ltd 387 ITR 354 (SC) wherein Hon’ble Supreme Court had the occasion to examine the eligibility of assessee to claim exemption under section 54E of the Act in respect of capital gains arising on transfer of a capital asset on which depreciation has been allowed. The Hon’ble Apex Court reiterated and affirmed the judgment of Hon’ble Bombay High Court in the case of Ace Builders (P.) Ltd. (supra). In the said appeal before Supreme Court, in the income-tax return filed by the respondent/assessee for the A.Y. 1989-90, the assessee had disclosed that it had sold its loading platform M.V. Priyadarshni for a sum of Rs. 1,37,25,000/- on which it had earned some capital gains. On the said capital gains the assessee had also claimed that it was entitled for exemption under Section 54E of the Act. Admittedly, the asset was purchased in the year 1972 and sold sometime in the year 1989. Thus, the asset was almost 17 years old. Going by the definition of long term capital asset contained in Section 2(29B) of the Act, it was admittedly a long- term capital asset. Further the Assessing Officer rejected the claim for exemption under Section 54E of the Act on the ground that the assessee had claimed depreciation on this asset and, therefore, provisions of Section 50 were applicable. Though this was upheld by the CIT (Appeals), the ITAT allowed the appeal of the assessee herein holding that the assessee shall be entitled for exemption under Section 54E of the Act. The Bombay High Court confirmed the view of the CIT (Appeals) and dismissed the appeal of the Revenue. While doing so, the Hon’ble High Court relied upon its own judgment in the case of CIT, Mumbai City-II, Mumbai vs. ACE Builders Pvt. Ltd. (supra). In the words of Hon’ble Supreme Court, “the High Court observed that Section 50 of the Act which is a special provision for computing the capital gains in the case of depreciable assets is not only restricted for the purposes of Section 48 or Section 49 of the Act as specifically stated therein and the said fiction created in sub-section (1) & (2) of Section 50 of the Act has limited application only in the context of mode of computation of capital gains contained in Sections 48 and 49 of the Act and would have nothing to do with the exemption that is provided in a totally different provision i.e. Section 54E of the Act. Section 48 of the Act deals with the mode of computation and Section 49 of the Act relates to cost with reference to certain mode of acquisition.” Their Lordships observed that, this aspect has been analysed in the judgment of the Bombay High Court in the case of CIT, Mumbai City-II, Mumbai vs. ACE Builders Pvt. Ltd. (supra), in the following manner:

“In our opinion, the assessee cannot be denied exemption under Section 54E, because, firstly, there is nothing in Section 50 to suggest that the fiction created in Section 50 is not only restricted to Sections 48 and 49 but also applies to other provisions. On the contrary, Section 50 makes it explicitly clear that the deemed fiction created in sub-section (1) & (2) of Section 50 is restricted only to the mode of computation of capital gains contained in Section 48 and 49. Secondly, it is well established in law that a fiction created by the legislature has to be confined to the purpose for which it is created. In this connection, we may refer to the decision of the Apex Court in the case of State Bank of India vs. D. Hanumantha Rao reported in 1998 (6) SCC 183. In that case, the Service Rules framed by the bank provided for granting extension of service to those appointed prior to 19.07.1969. The respondent therein who had joined the bank on 1.7.1972 claimed extension of service because he was deemed to be appointed in the bank with effect from 26.10.1965 for the purpose of seniority, pay and pension on account of his past service in the army as Short Service Commissioned Officer. In that context, the Apex Court has held that the legal fiction created for the limited purpose of seniority, pay and pension cannot be extended for other purposes. Applying the ratio of the said judgment, we are of the opinion that the fiction created under Section 50 is confined to the computation of capital gains only and cannot be extended beyond that. Thirdly, Section 54E does not make any distinction between depreciable asset and non-depreciable asset and, therefore, the exemption available to the depreciable asset under Section 54E cannot be denied by referring to the fiction created under Section 50. Section 54E specifically provides that where capital gain arising on transfer of a long term capital asset is invested or deposited (whole or any part of the net consideration) in the specified assets, the assessee shall not be charged to capital gains. Therefore, the exemption under Section 54E of the I.T. Act cannot be denied to the assessee on account of the fiction created Section in 50.”

32. Their Lordships dismissing the appeal filed by the Revenue held that, “we are in agreement with the aforesaid view taken by the Bombay High Court.” Thus, the judgment of Hon’ble Bombay High Court in the case of Ace Builders has been fully approved by the Hon’ble Supreme Court, thereby settling the issue that the fiction created in sub section (1) and sub section (2) of section 50 has limited application only in the context of mode of computation of capital gains contention of sections 48 and 49 of the Act and beyond that nothing should be imported to other sections of the Act.

33. Though most of the decisions have been rendered in the context of Section 54E but the principle laid down therein will apply mutatis mutandis on this issue also for the reason that Section 54E provides for exemption from capital gain where the capital gain arises from transfer of “long term capital asset” ————– . Thus, even if u/s.50, long term capital asset is taxed as short term capital gain because of the deeming fiction, but that does not lead to convert long term capital asset into short term capital asset for the purpose of other section. Similarly, u/s.112 uses the word “where the total income of an assessee includes any income, arising from the transfer of a long-term capital asset, which is chargeable under the head “Capital gains”, the tax payable by the assessee on the total income shall be the aggregate of ————————- . Thus, wherein the statute had used the word “long term capital asset, it has to be given the same meaning as defined in said provision of the Section. Thus, all these judgments of Jurisdictional High Court as well as Hon’ble Supreme Court in the context of Section 54E which is applicable on capital gain arising of long term capital asset will also apply here. Thus, respectfully following the aforesaid judgments, we hold that, the legal fiction created by the statute is to deem the capital gain as ‘short term capital gain’ and not to deem the ‘asset’ as ‘short term capital asset’. Therefore, it cannot be said that section 50 converts long term capital asset into a short term capital asset. This principle of law has been exactly held by the Hon’ble Jurisdictional High Court and approved by the Hon’ble Supreme Court.

34. Now coming to the judgment relied upon by the ld. CIT DR in the case of Shakti Metal (supra), first of all the Hon’ble Kerala High Court had passed the order in the context of asset on which assessee had discontinued the claim of depreciation immediately prior to its sale and re-classified the asset as an investment. The brief facts in that case were, the assessee-firm purchased a flat for business purposes in the financial year ending on 31-3-1974. Since then it was used as the branch office of the assessee and on the capitalised cost of the building the assessee was allowed depreciation until the assessment year 1995-96. However, the assessee discontinued claiming depreciation for the flat for the assessment years 1996-97 and 1997-98. The flat was sold during the assessment year 1998-99 and profit arising on such sale was claimed by the assessee as long-term capital gain. The Assessing Officer, however, held that profit arising on transfer of depreciable asset was assessable as short-term capital gain under section 50. He rejected the assessee’s contention that it stopped using the flat for business purposes after the assessment year 1995-96 and thereafter, the flat was treated as an investment and was so shown in the balance sheet. On appeal, the Commissioner (Appeals) concurred with the Assessing Officer. However, on second appeal, the Tribunal, solely relying on the entry in the balance sheet of the assessee wherein the flat was shown as an investment, held that since the item was purchased in 1974, sale of the flat was assessable as long-term capital gain.

35. The Hon’ble High Court after referring the provisions of Section 50 held as under:-

“4. While the contention of the revenue is that the asset in respect of which depreciation has been claimed when sold should always be assessed as short-term capital gains, the contention of the assessee is that unless the asset sold forms part of the block asset in the previous year in which sale took place, it cannot be assessed to short-term capital gains under section 50 of the Act. In our view section 50 has to be understood with reference to the general scheme of assessment on sale of capital assets. The scheme of the Act is to categorize assets between short-term capital assets and long-term capital assets. Section 2(42A) defines short-term capital asset as an asset held for not more than 36 months. The non obstante clause with which section 50 opens makes it clear that it is an exception to the definition of short-term capital asset which means that even though the duration of holding of an asset is more than the period mentioned in section 2(42A), still the asset referred to therein will be treated as short-term capital asset. No one can doubt that assets covered by section 50 are depreciable assets forming part of block assets as defined under section 2(11) of the Act. Section 50 has two components, one is as to the nature of treatment of an asset, the profit on sale of which has to be assessed to capital gains. The section mandates that a depreciable asset in respect of which depreciation has been allowed when sold should be assessed to tax as short-term capital asset. The other purpose of section 50 is to provide cost of acquisition and other items of expenditure which are otherwise allowable as deduction in the computation of capital gains and covered by sections 48 and 49 of the Act. Here again section 50 provides an exception for deduction of cost of acquisition and other items of expenditure otherwise allowable in the computation of capital gains under sections 48 and 49 of the Act. In other words, section 50 provides for assessment of a depreciable asset in respect of which depreciation has been allowed as short-term capital gains and the deductions available under sections 48 and 49 should be allowed subject to the provisions provided in sub-sections (1) and (2) of section 50. Section 50A also deals with assessment of depreciable asset that too as short-term capital gains and it actually supplements section 50. In our view, the purpose of section 50A is to enable the assessee to claim deduction of the written down value of the asset in respect of which depreciation was claimed in any year as defined under section 43(6) of the Act towards cost of acquisition within the meaning of sections 48 and 49 of the Act. The condition for computation of short-term capital gains in the way it is stated in section 50A is that assessee should have been allowed depreciation in respect of a depreciable asset sold in any previous year which obvious means that for the purpose of assessment of profit on the sale of a depreciable asset, the assessee need not have claimed depreciation continuously for the entire period up to the date of sale of the asset, in other words, our view, the building which was acquired by the assessee in 1974 and in respect of which depreciation was allowed to it as a business asset for 21 years, that is up to the assessment year 1995-96, still continued to be part of the business asset and depreciable asset, no matter the non-user disentitles the assessee for depreciation for two years prior to the date of sale. We do not know-how a depreciable asset forming part of block of assets within the meaning section 2(11) of the Act can cease to be part of block of assets. The description of the asset by the assessee in the Balance Sheet as an investment asset in our view is meaningless and is only to avoid payment of tax on short-term capital gains on sale of the building. So long as the assessee continued business, the building forming part of the block of assets will retain its character as such, no matter one or two of the assets in one or two years not used for business purposes disentitles the assessee for depreciation for those years. In our view, instead of selling the building, if the assessee started using the building after two years for business purposes the assessee can continue to claim depreciation based on the written down value available as on the date of ending of the previous year in which depreciation was allowed last.”

36. The decision of the Hon’ble High Court was confirmed by the Hon’ble Supreme Court in the following manner:-

2. In our view the High Court justly over-turned the opinion recorded by the Commissioner of Income Tax (Appeals) 11. Aayakar Bhavan North Block, Manachira, Calicut, vide Order dated 23-6-2004 in Appeal NO.ITA57/M/00-01, inter alia, on the following basis-

“In other words, in our view, the building which was acquired by the assessee in 1974 and in respect of which depreciation was allowed to it as a business asset for 21 years, that is upto the assessment year 1995-96, still continued to be part of the business asset and depreciable asset, no matter the non-user disentitles the assessee for depreciation for two years prior to the date of sale. We do not know how a depreciable asset forming part of block of assets within the meaning Section 2(11) of the Act can cease to be part of block of assets. The description of the asset by the assessee in the Balance Sheet as an investment asset in our view is meaningless and is only to avoid payment to tax on short term capital gains on sale of the building. So long as the assessee continued business, the building forming part of the block of assets will retain it’s character as such, no matter one of two of the assets in one or two years not used for business purposes disentitles the assessee for depreciation for those years. In our view instead of selling the building, if the assessee started using the building after two years for business purposes the assessee can continue to claim depreciation based on the written down value available as on the date of ending of the previous year in which deprecation was allowed last.”

(emphasis supplied)

3. The reasoning by the High Court in view of the facts on record commends to us.

4. The High Court has, therefore, rightly restored the findings and addition made in the assessment order. Hence, we find no merits in this appeal and it is dismissed.

37. The ratio of the aforesaid decision is that once depreciable asset forming part of block of assets within the meaning Section 2(11) of the Act it does not cease to be part of block of assets and description of the asset by the assessee in the balance sheet as an investment is meaningless to avoid payment of tax on short term capital on sale of building. As long as assessee continues business, the building forming part of the block of asset will retain its character, no matter one of the assets in one of the two years has not been used for business purpose this entitles the assessee for depreciation for those years. This view of the Hon’ble Kerala High Court has been upheld that instead of selling the building, the assessee starts using the building after two years for business purpose, the assessee can continue to claim the depreciation based on WDV available as on the date of ending the previous year in which depreciation was allowed.

38. Nowhere, in the judgment deals with the situation or question, which is before us in the present reference to this Special Bench. The Hon’ble High Court has only dealt with the controversy raised before it to a limited application u/s.50 / 50A of the Act. It was rendered in view of the background that assessee had reclassified the asset as a non-depreciable asset and held it as such at the time of sale. In contrast, in the present case the asset continued to be depreciable asset and assessee has neither challenged the applicability of Section 50 of the Act nor has it challenged the income determined in accordance with the Section 50. The issue before us is, whether the rate of tax which is to be determined u/s.112 of the Act shall be applicable if asset is a long term capital asset held for more than 36 months and due to deeming fiction, it is treated as short term capital gain for the purpose of Section 50 and such deeming fiction is with regard to applicability of Section 48 & 49. The decision of the Hon’ble Supreme Court cannot be a binding precedent on the issue which was not there at all. It is axiomatic that the decision cannot be relied upon which was not the issue or context in which it was decided and it is only the ratio decidendi, i.e., the principle of law that decides a dispute on a question is a precedence to be followed. In support of this proposition it would be relevant to refer to the following judgments:-

(i) Hon’ble Bombay High Court in the case of HDFC Bank Ltd. V. DCIT (2016) 383 ITR 529, wherein it has been held as under:

“…One more aspect which needs to be adverted to and that is that a decision would be considered to be a binding precedent only if it deals with or decides an issue which is the subject matter of consideration or decision before a coordinate or subordinate court. It is axiomatic that a decision cannot be relied upon in support of the proposition that it did not decide. (see Mittal Engineering Works P. Ltd. v. Collector of Central Excise [1997] 106 STC 201 (SC) ; (1997) 1 SCC 203. Therefore, it is only the ratio decidendi, i.e., the principle of law that decides the dispute which can be relied upon as precedent and not any obiter dictum or casual observations. (See Girnar Traders v. State of Maharashtra (2007) 7 SCC 555 and Shin-Etsu Chemical Co. Ltd. v. Aksh Optifibre Ltd. (2005) 127 Comp Cas 97 (SC) ; (2005) 7 SCC 234.”

(ii) Apex Court’s decision in the case of CIT v/s. Sun Engineering Works (P.) Ltd. reported in 198 ITR 297 (1992) where in it has been held that:

“It is neither desirable nor permissible to pick out a word or a sentence from the judgment of the Court, divorced from the context of the question under consideration and treat it to be the complete ‘law’ declared by the Court. The judgment must be read as a whole and the observations from the judgment have to be considered in the light of the questions which were before the Court. A decision of the Court takes its colour from the questions involved in the case in which it is rendered and while applying the decision to a latter case, the Courts must carefully try to ascertain the true principle laid down by the decision of the Court and not to pick out words or sentences from the judgment, divorced from the context of the questions under consideration by the Court, to support their proceedings.”

(iii) Apex Court’s decision in the case of Madhav Rao Jivaji Rao Scindia Bahadur v. Union of India [1971] reported in 3 SCR 9; AIR 1971 SC 530, where in it has been held that:

“It is difficult to regard a word, a clause or a sentence occurring in a judgment of this Court, divorced from its context, as containing a full exposition of the law on a question when the question did not even fall to be answered in that judgment.”

39. One of the arguments also raised by the ld. CIT DR was that, since Section 50 starts with non-obstante clause therefore, other provisions of that will not apply and once the Section itself is treated sale of long term capital asset as short term capital gain, then Section 112 would not apply. As we have already stated that non-obstante clause in Section 50 is only with regard to definition of a short term capital asset, i.e., an asset which is held by the assessee in not more than 36 months, preceding the date of its transfer. Thus, the exclusion prescribed by the non-obstante clause is limited to the purpose of modification of Section 48 & 49. In this regard, the decision of Hon’ble Gujarat High Court in the case of Amar Jewellers Ltd vs/ ACIT (2022) 444 ITR 97 would be relevant to quote wherein the scope of non-obstante clause has been discussed.

46. A non-obstante clause is generally appended to a section with a view to give the enacting part of the section, in case of conflict, an overriding effect over the provision in the same or other Act mentioned in the non-obstante clause. It is equivalent to saying that inspite of the provisions or Act mentioned in the non-obstante clause, the provision following it will have its full operation or the provisions embraced in the non-obstante clause will not be an impediment for the operation of the enactment or the provision in which the non-obstante clause occurs. (See: Principles of Statutory Interpretation, 9th Edition by Justice G.P. Singh Chapter V, Synopsis IV at pages 318 and 319]

47. Normally the use of the phrase by the Legislature in a statutory provision like notwithstanding anything to the contrary contained in this Act is equivalent to saying that the Act shall be no impediment to the measure [See: Law Lexicon words notwithstanding anything in this Act to the contrary]. Use of such expression is another way of saying that the provision in which the non-obstante clause occurs usually would prevail over the other provisions in the Act. Thus, the non- obstante clauses are not always to be regarded as repealing clauses nor as clauses which expressly or completely supersede any other provision of the law, but merely as clauses which remove all obstructions which might arise out of the provisions of any other law in the way of the operation of the principle enacting provision to which the non-obstante clause is attached. [See: Bipathumma v. Mariam Bibi 1966 1 MYSLJ 162]

48. A non obstante clause has two parts the non obstante clause and the enacting part. The purpose of enacting a non obstante clause is that in case of a conflict between the two parts, the enacting part will have full sway in spite of the contrary provisions contained in the non obstante clause. Therefore, the object and purpose of the enacting part should be first ascertained and then the assistance of the non obstante clause should be taken to nullify the effect of any contrary provision contained in the clause.”

40. Thus, non-obstante clause does not mean to completely supersede any other provisions of the Act. To remove the obstruction which might arise out of the provision of any other law in way of operation of the principle enacting provision to which the non-obstante clause is attached. If the non-obstante clause has been confined to Section 50 dealing with the mode of computation of Section 48 & 49 and that even if the asset appearing in the block of asset on which depreciation has been claimed is more than 36 months, then the gain of transfer of such asset is to be taxed as short term capital gain while computing the income. However, as held by the Hon’ble Jurisdictional High Court in several cases as noted above, Section 50 cannot convert the long term capital asset into a short term capital asset and therefore, the principle laid down by the Hon’ble Jurisdictional High Court in all the above quoted cases acts as a binding precedent.