Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

New Delhi, 10th August, 2019

PRESS RELEASE

CBDT simplifies the process of assessment in respect of Startups

The Finance Ministry has simplified the process of assessment in the case of Startup entities.

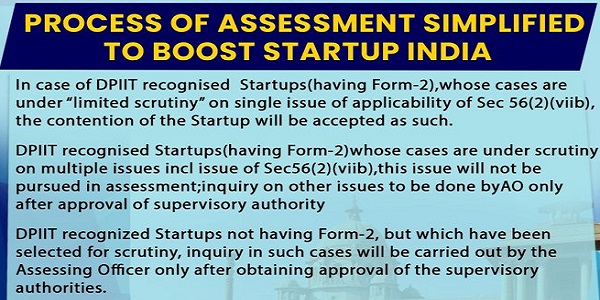

In cases where scrutiny assessments of Startup entities are pending, the CBDT has decided that:

i) In case of Startup Companies recognized by DPIIT which have filed Form No. 2 and whose cases are under “limited scrutiny” on the single issue of applicability of section 56(2)(viib),the contention of the assessee will be summarily accepted.

ii) In case of Startup Companies recognized by DPIIT which have filed Form No. 2 and whose cases have been selected under scrutiny to examine multiple issues including the issue of section 56(2)(viib),this issue will not be pursued during the assessment proceedings and inquiry on other issues will be carried out by the Assessing Officer only after obtaining approval of the supervisory authority.

iii) In case of Startup Companies recognized by the DPIIT, which have not filed Form No. 2, but have been selected for scrutiny, the inquiry in such cases also will be carried out by the Assessing Officer only after obtaining approval of the supervisory authorities.

In addition to the above, the Central Government has further decided to relax Para-6 of the DPIIT notification No.127 (E) dated 19.02.2019 and make it clear that this notification will also be applicable to Startup Companies where addition under section 56(2)(viib) has been made and the assessee has been recognized by DPIIT and subsequently filed Form No. 2. The Circular to this effect in F.No 173/149/2019-ITA-I of CBDT dated 7th August, 2019, has been placed on www.incometaxindia.gov.in.

(Surabhi Ahluwalia)

Commissioner of Income Tax

(Media & Technical Policy)

Official Spokesperson, CBDT.