MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 27th June, 2017

G.S.R. 642(E).—In exercise of the powers conferred by section 139A and section 139AA, read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:—

1. (1) These rules may be called the Income –tax (17th Amendment) Rules, 2017.

(2) They shall come into force from the 1st day of July, 2017.

2. In the Income-tax Rules, 1962,-

I. in rule 114, for sub-rule (5), following shall be substituted, namely:-

“(5) Every person who has been allotted permanent account number as on the 1st day of July, 2017 and who in accordance with the provisions of sub-section (2) of section 139AA is required to intimate his Aadhaar number, shall intimate his Aadhaar number to the Principal Director General of Income-tax (Systems) or Director- General of Income-tax (Systems) or the person authorized by the said authorities.

(6) The Principal Director General of Income-tax (Systems) or Director- General of Income-tax (Systems) shall specify the formats and standards along with procedure, for the verification of documents filed with the application under sub-rule (4) or intimation of Aadhaar number in sub-rule (5), for ensuring secure capture and transmission of data in such format and standards and shall also be responsible for evolving and implementing appropriate security, archival and retrieval policies in relation to furnishing of the application forms for allotment of permanent account number and intimation of Aadhaar number”;

II. in Appendix II, in Form No. 49A,-

(i) for Column number 12 and entries relating thereto, the following shall be substituted namely:-

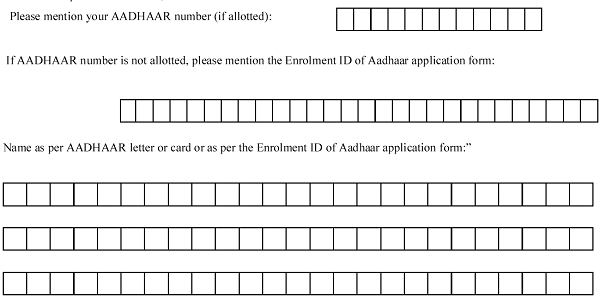

“12. In case of a person, who is required to quote Aadhaar number or the Enrollment ID of Aadhaar application form as per section 139AA,-

(ii) in column number 15, in heading, for the words, brackets and letters, “Documents submitted as Proof of Identity (POI) and Proof of Address (POA)”the words, brackets and letters “Documents submitted as Proof of Identity (POI), Proof of Address (POA) and Proof of date of Birth (POB)”shall be substituted.

[Notification No. 56/2017/F.No. 370142/40/2016-TPL]

ABHISHEK GAUTAM, Under Secy.

Note:- (1) The principal rules were published vide notification number S.O. 969 (E), dated the 26th March, 1962 and last amended by Income-tax (16th Amendment) Rules, 2017 vide notification number S.O. 1927(E), dated the 16th June, 2017.