Summary: The Income Tax updates in Budget 2025 bring changes to the New Tax Regime, with revised income slabs offering rates from 0% to 30% based on income brackets, with specific deductions like a standard deduction of Rs. 75,000, family pension relief, and rebates for certain incomes. Notably, deductions under Section 80CCD(1B) for pension contributions and Section 80IAC for startup benefits have been extended until 2030. A new presumptive scheme for NRIs has been introduced, benefiting businesses involved in electronic manufacturing or services. The TCS rate on forest produce is adjusted, and TDS threshold rationalization is proposed for various sections, including Section 194Q and Section 206C. There are amendments to provisions for search and requisition cases, adding virtual digital assets to the definition of undisclosed income. The deduction for municipal taxes on self-occupied houses has been expanded to include two houses. Further, the time limit for filing updated returns has been extended from 24 months to 48 months, and a provision to exempt prosecution for delayed TCS payments has been introduced. These changes aim to streamline tax processes, extend benefits to specific sectors, and encourage compliance.

Bullet Points from the Discussion & Analysis on Finance Bill, 2025 by Hon’ble Nirmala Sitharaman Dated 01.02.2025

No Changes are proposed in OLD TAX Regime for Standard Deduction and Slab Rates.

For New Tax Regime –

New Tax Slab Rates –

| 0 to 4,00,000 | – 0% |

| 4,00,001 – 8,00,000 | – 5% |

| 8,00,001 – 12,00,000 | – 10% |

| 12,00,001 – 16,00,000 | – 15% |

| 16,00,001 – 20,00,000 | – 20% |

| 20,00,001 – 24,00,000 | – 25% |

| 24,00,001 – above | – 30% |

*Note- No deduction available except mentioned below.

- Standard Deduction U/s 16(ia) upto Rs.75,000/-

- Family Pension U/s 57(iia) upto Rs.25,000/-

- Deposited in the Agniveer Corpus Fund u/s 80CCH(2)

Rebate U/s 87A = Rs 25000/- Rs 60,000/- such rebate of income-tax is not available on tax on incomes chargeable at special rates (for e.g.: capital gains u/s 111A, 112 etc.).

Deductions Allowable under New Regime –

Section 80 CCD(1B) – upto Rs 50,000/- for depositing in pension scheme in name of minor

Section 80 IAC – Startups Benefit date is extended from March, 2025 to March, 2030.

Small Trust or Institution – Whose Total Income is less than Rs 5 crores (without giving the effect of Section 11/12) in during each of the 2 previous years before the year in which application was made

Section 12 AB – Validity of Certificate Increased : 5 years 10 years

New Presumptive Scheme for NRI : Section 44 BBD Business Income = 25% Condition 1 : Transaction is between NRI and Resident Company

Condition 2 : engaged in business of providing services or technology for setting up an electronics manufacturing facility or in connection with manufacturing or producing electronic goods, article or thing in India

TCS On Forest Produce

Only such other forest produce (not being timber or tendu leaves) which is obtained under forest lease will be covered under TCS at 2% from 2.5%.

Applicability of Sec 194Q and 206C (1H)

Provisions of sub-section (1H) of section 206C of the Act will not be applicable from the 1st day of April, 2025.

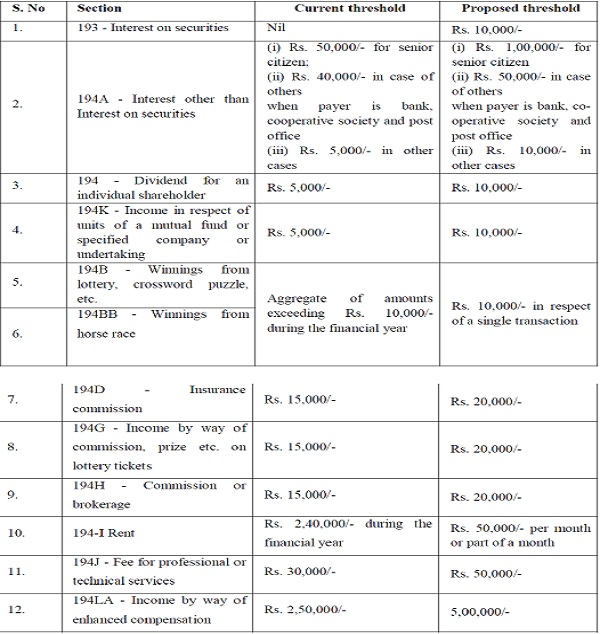

TDS Threshold Rationalisation

Amendments proposed in provisions of Block assessment for search and requisition cases under Chapter XIV-B

Section 158B of the Act defines “undisclosed income” for the purposes of Chapter XIV-B. It is proposed to add the term “virtual digital asset” to the said definition.

Non-applicability of Section 271AAB – relates to penalty for searches initiated

shall not be applicable to the assessee in whose case search has been initiated under section 132 on or after the 1st day of September, 2024

Section 23 : Deduction for Self Occupied Houses

Deduction of municipal taxes paid for 2 houses can be taken now.

Exemption from prosecution for delayed payment of TCS –

the prosecution shall not be instituted against a person covered under the section 276BB, if the payment of the tax collected at source has been made to the credit of the Central Government at any time on or before the time prescribed for filing the quarterly statement under proviso to sub-section (3) of section 206C of the Act in respect of such payment.

Extending the time-limit to file the updated return

Time-limit to file the updated return from existing 24 months to 48 months from the end of relevant assessment year.