Govt. introduces Additional Reporting by Auditors of Charitable Trusts under the Maharashtra Public Trusts Act, 1950 to check Income Tax Compliances/Evasion.

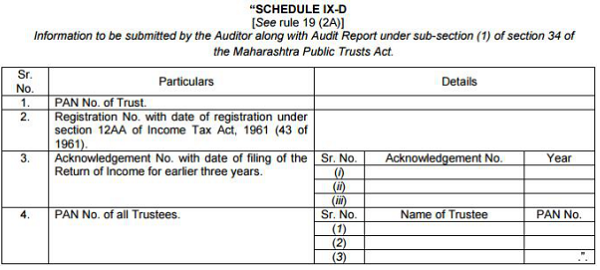

The Law and Judiciary Department, Maharashtra State, vide Notification Dated 15/05/2019, has framed the Bombay Public Trusts (Second Amendment) Rules, 2019, to introduce additional reporting by the Auditors of the Trust in Form IX-D, as under:

In addition to the reporting of the Auditor under sec. 33 and 34 and in Form IX-C, the above provisions are aimed at checking the Income Tax Compliances being made by the Charitable Trusts in the State.

As per the digitisation rules, The Audit Report of the Charitable Trusts have to be compulsory uploaded online. With the new data mining techniques of the Income Tax Department, the above shall serve as ready information to the Income Tax Department regarding the Information furnished in the Income Tax Return by the Trusts and as furnished under the Maharashtra Public Trusts Act, 1950 to the Charity Commissioner and any mismatch between the details shall be easily detectable.

It is pertinent to note that the Auditors have to also report the Registration No. u/s 12AA of the Trust in their Audit Report and hence the authenticity and genuineness and validity of the 12AA Certificate/Registration shall have to be attested by the Auditor. The same is not required even under the Income Tax Act, 1961 but is now required under the amended Maharashtra Public Trusts Act, 1950, which suggests how stringent the provisions for claiming the exemptions under the Income Tax Act, 1961 have become.

We, as authors, are of the firm belief that the Income of the charitable/religious trusts have to be reported in ITR-7, since the Header of the Form ITR-7 and Rule 12 of the Income Tax Rules, 1962, clearly mention that every person in receipt of income derived from property held under trust or other legal obligation wholly or partly for charitable or religious purposes or of income being voluntary contributions referred to in section 2(24) of the Income Tax Act, 1961 have to be file their Income Tax Return in ITR-7. It is common knowledge and understanding that all the charitable trusts registered under the Maharashtra Public Trusts Act, 1950 have to be compulsorily registered u/s 12AA of the Income Tax Act, 1961, in order to claim the necessary exemptions u/s 11 and 12, being the nature of income and expense of the public charitable trusts.

However, it was a general practice by Trusts/Professionals that the Trusts not registered u/s 12AA, used to file Form ITR-5, without considering the above provisions and not entering the Trustee Details and claiming the basic exemption limit and further claiming the charitable expenses as deductions, which is otherwise not permissible under the Act, without registration u/s 12AA.

With the above information of Registration u/s 12AA and the PAN Details of the Trustees, duly attested by the Auditor, it shall now become mandatory to obtain the Registration u/s 12AA of the Income Tax Act, 1961. Further, the Trusts not filing Income Tax Returns but having surplus Income as per the Audited Accounts filed with the Charity Commissioner, shall have to take immediate corrective actions and become fully compliant.

This additional reporting introduced in Form IX-D is a master stroke in curbing the exemptions/freebies being claimed improperly by the Trusts and shall act as stringent anti-evasion tool.

The additional reporting is now mandatory alongwith all the Audit Reports being filed with the Office of the Charity Commissioner online. The Auditors are required to take note of the same and plan the Audit work accordingly.

For copy of the Notification, please click here.

The Authors, CA Navinchandra Premji Dedhia and CA Rohan Navin Dedhia, are practicing members of the ICAI and can be reached on ca. navindedhia@gmail.com or on +91 – 9892678133

What is the present rule?

How long can we continue with the same auditor?

Is there any time limit?

Is it applicable for all audits completed on or after 15.5.2019 i.e, for the year ended 31.3.2019 onwards, or prospectively from 31.3.2020 ?

Good decision by the concerned authorities. It seems to be right step. still needs to take more actions to prevent corruption.

Nice informative article

Day by day compliance for auditor is increasing and is becoming very difficult to practice. Govt should bring regulation for minimum fee below which no Auditor can charge.

Great news and much needed step. In the name of exemption, income tax returns not filed by NGO. Fooling the authorities.