Case Law Details

Amit Vyas Vs ITO (ITAT Indore)

In the case of Amit Vyas Vs ITO, the Income Tax Appellate Tribunal (ITAT) Indore addressed an appeal filed against the Commissioner of Income Tax (Appeals) [CIT(A)] order dismissing the appeal due to a 669-day delay. The case originated from an assessment for the 2015-16 financial year where an addition of ₹40,00,000 was made for unexplained cash deposits. Vyas argued that the delay occurred due to incorrect service of the assessment order, as it was sent to an old address despite updating the details with the assessing officer. CIT(A) dismissed the appeal both on technical grounds of delayed filing and on the merits, which prompted Vyas to approach ITAT. The tribunal noted that crucial documents explaining the delay, such as the change of address and returned speed post, were not presented earlier. Consequently, ITAT remanded the case back to CIT(A) for fresh consideration, allowing Vyas to provide additional evidence and argue the case further. The appeal was allowed for statistical purposes, and no judgment was made on the merits of the addition.

Assessee was represented by Shri Milind Wadhwani

FULL TEXT OF THE ORDER OF ITAT INDORE

Feeling aggrieved by appeal-order dated 25.10.2023 passed by learned Commissioner of Income-Tax (Appeals)-NFAC, Delhi [“CIT(A)”] which in turn arises out of assessment-order dated 22.12.2017 passed by learned ITO-2(1), Ujjain [“AO”] u/s u/s 143(3) of Income-tax Act, 1961 [“the Act”] for Assessment-Year [“AY”] 2015-16, the assessee has filed this appeal on the grounds mentioned in Appeal Memo (Form No. 36).

2. The background facts leading to present appeal are such that the assessee-individual filed return of income of AY 2015-16 on 22.07.2016 declaring a total income of Rs. 6,12,360/-. The case of assessee was initially processed u/s 143(1) but later converted into scrutiny-assessment by issuing notices u/s 143(2)/142(1). Finally, the AO completed assessment vide order dated 22.12.2017 u/s 143(3) after making an addition of Rs. 40,00,000/- on account of unexplained cash deposit in bank a/c on 16.01.2015 and thereby determining total income at Rs. 46,12,360/-.

2.1 Aggrieved by AO’s order, the assessee filed first appeal to CIT(A) on 30.12.2019 with a huge delay of 669 days as calculated by CIT(A). The CIT(A) was not satisfied with the reasoning advanced by assessee for delayed filing, therefore he treated assessee’s appeal as invalid and dismissed on this technical ground. Simultaneously, the CIT(A) also decided merit of addition and dismissed appeal on merit as well. Thus, the assessee did not get any success in first-appeal.

2.2 Now, the assessee has come before us by way of next appeal.

3. At first, we extract the relevant paras in which the CIT(A) has rejected assessee’s first-appeal on technical ground of delayed filing:

“2. As per declaration in Form No. 35, the date of service of the impugned order and the demand notice is 30.01.2018. There was delay of 669 days in filing this appeal. Grounds for condonation of delay given by appellant :-

“That due to some unavoidable circumstances appeal could not be filed on time. Hence, it is requested that the appeal of the appellant may please be accepted and for this act of kindness appellant would be grateful to our Honour.”

6.1 In view of the above, the grounds of appeal, statement of facts, submissions of the appellant and records available have duly been considered. It is seen that there was delay of 669 days in filing this appeal. As per section 249(2) of the Act, any appeal before the Ld. CIT(A) is required to be filed in electronic mode within 30 days of receipt of the order and demand notice by the appellant. Further, section 249(3) provides that the Ld. CIT(A) may admit an appeal filed after the prescribed due date if he is satisfied that the appellant had sufficient cause for not filing the appeal within the prescribed time limit. As mentioned above, there was a delay of 669 days in filing this appeal. Therefore, the issue as to whether this delay in filing the appeal can be condoned needs to be examined first before going into the merits of the appeal.

6.2 For condoning the delay, it must be proved beyond the shadow of doubt that the appellant was diligent and was not guilty of negligence whatsoever. The sufficient cause within the contemplation of the limitation provision must be a cause which is beyond the control of the party invoking the aid of the provisions. The appellant submitted the reasons for the delay in filing the appeal as “unavoidable circumstances”, however not discussed anything else such as circumstances and the documentary evidence towards the same. The assessment u/s 143(3) was completed on 22.12.2017 and same along with demand notice was served to the appellant on 30.01.2018 as per information provided in Form 35. Thus, the appellant was very much aware about the assessment order since 30.01.2018. The appellant is supposed to explain a valid reason for delay so that this office could have considered condoning the delay. However, the reason provided by the appellant is not sufficient to condone the delay of 669 days. The Hon’ble Supreme Court in the case of Ramlal v. Rewa Coalfileds Ltd., AIR 1962 SC 361 has held that

“the cause for the delay in filing the appeal which by due care and attention – could have been avoided cannot be a sufficient cause within the meaning of the limitation provision. Where no negligence, nor inaction, or want of bona fides can be imputed to the assessee a liberal construction of the provisions has to be made in order to advance substantial justice. Seekers of justice must come with clean hands. At this point it is pertinent to mention that the provisions of Section 5 of the Limitation Act, 1961 are pari materia to the provisions of section 249 of the Act as both the provisions stipulate that after expiry of stipulated period of limitation as per provisions of the relevant Act, if the court satisfied that there was a “sufficient cause” for non-representing the appeal within prescribed period, then the appeal may be admitted for hearing on merits by condoning the delay.”

6.3 Further, the Hon’ble Supreme Court in the case of Chief Postmaster General and others vs. Living Media India Ltd in I.T.A. No. 3555/Del/2009 A.Y. 2002-03 and another (2012) 348 ITR 7 (SC) and in the case of Pundik Jalam Patil (dead) by LRS vs. Executive Engineer, Jalgaon Medium Project (2008) 17 S.C. 448 had held that

“when the conduct of the assessee and facts of the case clearly show the neglected of its own right in preferring appeals, then it is not expected from the judicial and quasi-judicial authorities to inquire into belated and state claims on the ground of equity.”

6.4 Considering above, the delay is not condoned. Since the delay is not condoned, the appeal becomes invalid and liable to be dismissed on technical ground. However, notwithstanding the dismissal on technical grounds, the merits of the case are also discussed in detail.

10. In the result, this appeal is dismissed on technical ground as discussed in Para no. 6 as well as on merits of the case.”

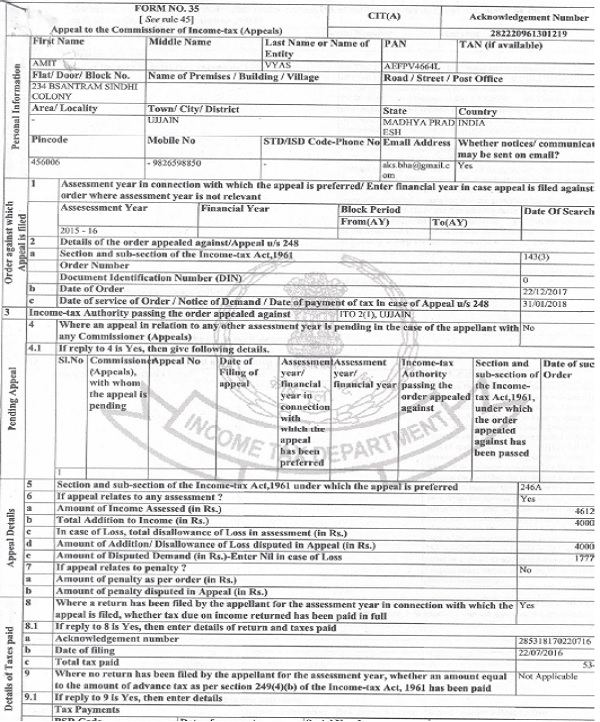

4. The Form No. 35 filed by assessee to CIT(A) is also scanned and reproduced below:

–

–

5. It can be seen that the assessee has provided following information in above Form No. 35 filed to CIT(A):

| Column No. | Details required | Information provided by assessee |

| 2(c) | Date of service of Order/Notice of demand | 31/01/2018 |

| 14 | Whether there is a delay in filing appeal? | Yes |

| 15 | If reply to 14 is Yes, enter the grounds for condonation of delay | That due to some unavoidable circumstances appeal could not be filed on time. Hence, it is requested that the appeal of the appellant may please be accepted and for this act of kindness appellant would be grateful to Your Honour. |

6. Thus, the CIT(A) considered above information filed by assessee in statutory Form No. 35 under verification and thereafter dismissed assesse’s appeal being not satisfied with the cause of delay.

7. However, during hearing before us, the assessee has filed following documents to explain the delay occurred in filing first-appeal:

Order-sheet of department:

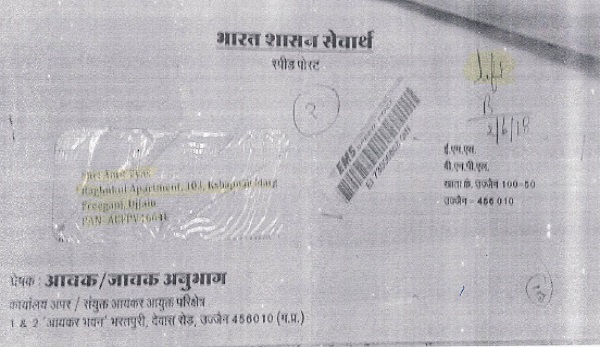

Envelope of Speed-Post:

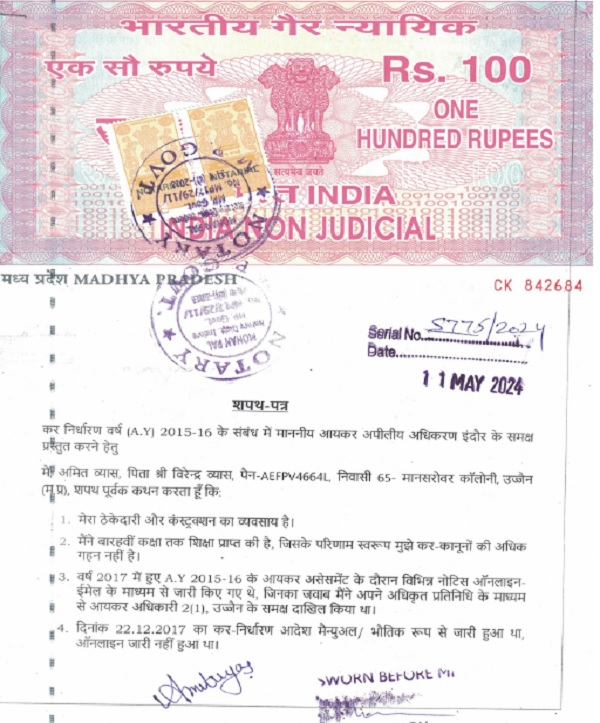

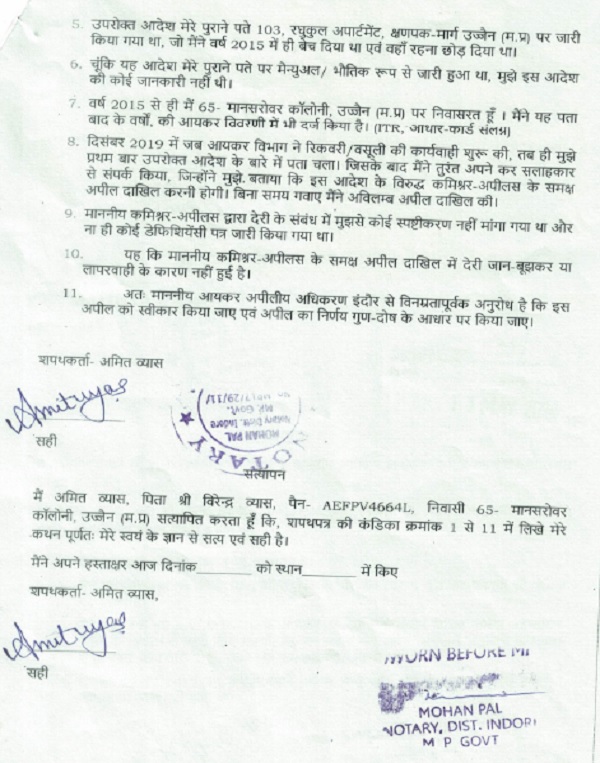

Affidavit of assessee:

–

8. On the basis of above documents, it is being claimed by assessee/Ld. AR that there was a change in address of assessee from “103, Raghukul Apartment, Kshapnak Marg, Freeganj, Ujjain” to “65, Mansarover Colony, Near Shri Ram Nagar, Freeganj Ujjain” which was intimated to AO during the course of assessment-proceeding on 30.08.2017 and the new address was taken on record by AO as is evident from Order-Sheet re-produced above. However, the AO still served the assessment-order by speed-post at the old address and the speed-post was returned back with the remark “left-02.06.2018” by postal authorities which is evident from envelope of speed-post re-produced above. Therefore, as per affidavit of assessee, the assessment-order passed by AO did not reach to assessee. Ultimately, the assessee came to know of assessment-order in December, 2019 when the department initiated recovery proceeding and immediately thereafter, the assessee arranged to file appeal to CIT(A) on 30.12.2019.

9. The above submission made by assessee was not at all before first-appellate authority i.e. CIT(A) who was concerned with condonation of delay in filing first-appeal. Admittedly, there was a huge delay of 669 days in filing first-appeal as noted by CIT(A). Therefore, without making any comment on the merit of submission, we remand this matter back to the file of CIT(A) for consideration afresh. The CIT(A) shall consider assessee’s submission and take an appropriate view firstly in the matter of invalidity/validity of first-appeal filed before him on the ground of delayed filing and thereafter on merit of the addition made by AO as considered necessary. The assessee shall be at liberty to make all submissions before CIT(A). Needless to mention that the CIT(A) shall consider assessee’s submissions judiciously without being influenced by his previous order.

10. Other pleadings made by both sides are not required to be adjudicated by us since we have remanded matter to CIT(A) for adjudication afresh.

11. Resultantly, this appeal is allowed for statistical purpose.

Order pronounced in open court on 09.09.2024