Introduction: This article attempts to simplify the miscellaneous transitional provisions under GST for better understanding.

Page Contents

- Q 1. What types of forms are required to filed in relation to Transition to GST from earlier laws?

- Q 2. What about carry forward of credit of Cess (Krishi Kalyan Cess, Swachch Bharat Cess) to GST Regime?

- Q 3. Will CENVAT credit (or VAT credit) carried forward in the last return prior to GST under existing law be available as ITC under GST?

- Q 4. What are those conditions?

- Q 5. What if I belong to Gujarat and I have sold goods worth Rs. 100,000 against “C” Form to a dealer in Mumbai however I have not received the “C” form Yet? Normal VAT rate for the goods sold is 5 %.

- Q 6. A registered person, say, purchases capital goods under the existing law (Central Excise) in the June quarter of 2017-18. Though the invoice has been received within 30th June but the capital goods are received on 5th July, 2017 (i.e. in GST regime). Will such a person get full credit of CENVAT in GST regime?

- Q 7. We are a manufacturer and we have purchased a machinery in April,2017 worth Rs. 1 crore on which we have paid Excise duty (ED) of Rs. 15,00,000. We have availed 50 % credit of such ED. 50% is still unavailed. What about carry forward of such credit?

- Q 8. CENVAT credit was not available on items ’X’ & ’Y’ being capital goods in the existing law (Central Excise). Now they are covered in GST, can the registered taxable person claim it now?

- Q 9. Assuming the registered person has wrongly enjoyed the credit (Refer to Q9) under the existing law, will the recovery be done under the GST Law or the existing law?

- Q 10. Give two examples of registered taxable persons who are not liable to be registered under the existing law (Central Excise/VAT) but are required to be registered under GST?

- Q 11. Will ITC be allowed to a service provider on VAT paid inputs held as stock on the appointed day?

- Q 12. We are VAT Registered dealer of “X Goods” in Gujarat. We do not have any other indirect tax registration. We purchase the “X Goods” Directly from Manufacturer who issues us excisable invoice however we cannot avail excise credit currently as the same we are not excise registered dealer. Now we are holding 1000 units of “X Goods” on the appointed day. We already have availed VAT credit for the same.

- Q 13. We are VAT Registered dealer of “Y Goods” in Gujarat. We do not have any other indirect tax registration. We purchase the “Y Goods” from wholesaler who issues us only VAT invoice. Now we are holding 1000 units of “Y Goods” (Selling price of Rs. 100 per unit) on the appointed day. We already have availed VAT credit for the same.

- Q 14. We are a dealer of “Goods X” in Gujarat. Our Supplier resides in Maharashtra. What if They send goods on 29thJune 2017 and We receive the same on 3rd Shall we be eligible to get the credit in respect of such goods?

- Q 15. We are Service Tax Registered entity. Is there any requirement under GST that my Service tax Return has to be filed within prescribed time to carry forward the credit of existing law to GST? Can I revise such return later on?

- Q 16. We have HO in Vadodara and branches in Delhi and Kolkata. We are currently having centralized registration under Service tax. We are having a credit balance of Rs. 10 Crores. Can we distribute such credit to our branches in Delhi and Kolkata as in GST we have to obtain separate registrations for Branches in different states? If Yes, In What proportion?

- Q 17. A registered person has excess ITC of Rs. 10,000/- in his last VAT return for the period immediately preceding the appointed day. Under GST he opts for composition scheme. Can he carry forward the aforesaid excess ITC to GST?

- Q 18. Sales return under CST (i.e. Central Sales Tax Act) is allowable as deduction from the turnover within six months? If, say, goods are returned in GST regime by a buyer within six months from appointed day, will it become taxable in GST?

- Q 19. Shall a manufacturer or a job worker become liable to pay tax if the inputs or semi finished goods sent for job work under the existing law are returned after completion of job work after the appointed day?

- Q 20. What happens if the job worker does not return the goods within the specified time?

- Q 21. Can a manufacturer transfer finished goods sent for testing purpose to the premise of any other taxable person?

- Q 22. If finished goods removed from a factory for carrying out certain processes under existing law are returned on or after the appointed day, whether GST would be payable?

- Q 23. When tax shall become payable in GST on manufactured goods sent to a job worker for carrying out tests or any other process not amounting to manufacture under the existing law?

- Q 24. Is extension of two months as discussed in section 141 automatic?

- Q 25. We are Jewelers. Some of our stock is lying with the job worker. Any formality on our part?

- Q 26. What is the time limit for issue of debit/credit note(s) for revision of prices?

- Q 27. What will be the fate of pending refund of tax/interest under the existing law?

- Q 28. What will be fate of any appeal or revision relating to a claim of CENVAT or ITC on VAT which is pending under the existing law? If say, it relates to output liability then?

- Q 29. If the appellate or revisional order goes in favor of the assessee, whether refund will be made in GST? What will happen if the decision goes against the assessee?

- Q 30. How shall the refund arising from revision of return(s) furnished under the existing law be dealt with in GST?

- Q 31. If any goods or services are supplied in GST, in pursuance of contract entered under existing law, which tax will be payable?

- Q 32. Tax on a particular supply of goods/services is leviable under the existing law. Will GST be also payable if the actual supply is made in GST regime?

- Q 33. In pursuance of any assessment or adjudication proceedings instituted, after the appointed day, under the existing law, an amount of tax, interest, fine or penalty becomes refundable. Shall such amount be refundable under the GST law?

- Q 34. If services are received by ISD under the earlier law, can the ITC relating to it be distributed in GST regime?

- Q 35. Where any goods are sold on which tax was required to be deducted at source under State VAT law and an invoice was also issued before the appointed day, shall deduction of tax at source shall be made under this Act if the payment is made after the appointed day?

- Q 36. Goods were sent on approval not earlier than six months before the appointed day but are returned to the seller after 6 months from the appointed day, will tax be payable under GST?

- Q 37. In order to avoid dispute later on, our company avail the credit only after payments have been made to the Input service provider.

Q 1. What types of forms are required to filed in relation to Transition to GST from earlier laws?

Ans. 2 different types of forms have prescribed in relation to GST transition. Summary of these forms is as below:

| Purpose | Form Number | Time Limit |

| Tax or duty credit carried forward under any existing law or on goods held in stock on the appointed day

The amount of credit specified in the application in FORM GST TRAN-1 shall be credited to the electronic credit ledger of the applicant maintained in FORM GST PMT-2 on the Common Portal. |

GSTR-Tran-1 |

Within 90 days from appointed date |

|

Credit in respect of a registered person who was not registered under the existing laws and also not in possession of any document evidencing payment of central excise duty. (subject to conditions) |

GSTR-Tran-2 |

At the end of each of the six tax periods during which the scheme is in operation indicating there in the details of supplies of such goods effected during the tax period. |

Q 2. What about carry forward of credit of Cess (Krishi Kalyan Cess, Swachch Bharat Cess) to GST Regime?

Ans. As specified in the proviso to Section 140 (1) of the Act, the taxable person is allowed to carry forward the credit to the extent admissible as INPUT TAX CREDIT under GST. Definition of Input tax as given in Section 2(62) does not include any cess. So apparently Krishi Kalyan Cess, Education and Secondary & Higher Secondary education cess will not be allowed to be carried forward.

Q 3. Will CENVAT credit (or VAT credit) carried forward in the last return prior to GST under existing law be available as ITC under GST?

Ans. As per section 140(1) of CGST / SGST Act, 2017, a registered person, other than a person opting to pay tax under composition scheme, shall be entitled to take credit in his electronic credit ledger the amount of CENVAT (or VAT credit) Credit carried forward in the return of the last period before the appointed day, subject to the conditions stated therein.

Q 4. What are those conditions?

Ans. The conditions are as below:

(i) the said amount of credit is admissible as input tax credit under this Act;

(ii) the registered person has furnished all the returns required under the existing law (i.e. Central Excise and VAT) for the period of six months immediately preceding the appointed date;

(iii) the said amount of credit does not relate to goods sold under exemption notifications as are notified by the Government.

But under SGST law, there will be one more condition as given below:

So much of the said credit as is attributable to any claim related to section 3, sub-section (3) of section 5, section 6, section 6A or sub-section (8) of section 8 of the Central Sales Tax Act, 1956 that is not substantiated in the manner, and within the period, prescribed in rule 12 of the Central Sales Tax (Registration and Turnover) Rules, 1957 shall not be eligible to be credited to the electronic credit ledger.

It means that credit against C’ form, H’ Form, F’ form, I’ form shall be allowed to carried forward only against the such forms received.

However, an amount equivalent to the credit specified above shall be refunded under the existing law when the said claims are substantiated in the manner prescribed in rule 12 of the Central Sales Tax (Registration and Turnover) Rules, 1957.

Q 5. What if I belong to Gujarat and I have sold goods worth Rs. 100,000 against “C” Form to a dealer in Mumbai however I have not received the “C” form Yet? Normal VAT rate for the goods sold is 5 %.

Ans. In Such cases, You are required to obtain “C” forms within 3 months as per rule 12 of the Central Sales Tax. If you could not receive the “C” forms within such 3 months then while filling the declaration (GST-Tran-1) for carry forward of credit you have to reduce your Input tax credit by Rs. 3,000 (5% of Rs. 100,000 Reduced by 2% of Rs. 100,000).

Q 6. A registered person, say, purchases capital goods under the existing law (Central Excise) in the June quarter of 2017-18. Though the invoice has been received within 30th June but the capital goods are received on 5th July, 2017 (i.e. in GST regime). Will such a person get full credit of CENVAT in GST regime?

Ans. Yes, he will be entitled to credit in 2017-18 provided such a credit was admissible as CENVAT credit in the existing law and is also admissible as credit in CGST section 140(2) of the CGST Act.

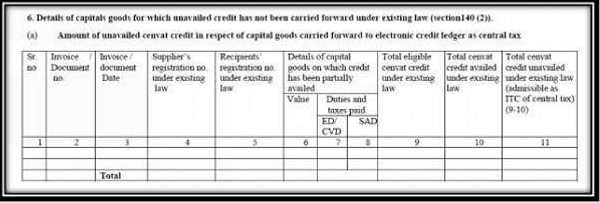

Ans. The proviso to Section 140(2) provides for availment of balance credit provided the credit was available under the existing law and is also available under the current law. (There is specific section in GST-TRN-1 as shown below form where you can avail such credit.)

Q 8. CENVAT credit was not available on items ’X’ & ’Y’ being capital goods in the existing law (Central Excise). Now they are covered in GST, can the registered taxable person claim it now?

Ans. He will be entitled to credit only when ITC on such goods are admissible under the existing law and is also admissible in GST. Since credit is not available under the existing law on such goods, the said person cannot claim it in GST proviso to section 140(2) of the CGST Act.

Q 9. Assuming the registered person has wrongly enjoyed the credit (Refer to Q9) under the existing law, will the recovery be done under the GST Law or the existing law?

Ans. The recovery relating to ITC wrongfully enjoyed, unless recovered under the existing law, will be recovered as arrears of tax under GST.

Q 10. Give two examples of registered taxable persons who are not liable to be registered under the existing law (Central Excise/VAT) but are required to be registered under GST?

Ans. Examples are as below:

1. A manufacturer having a turnover of say Rs. 60 lakh who is enjoying SSl exemption under the existing law will have to be registered under GST as the said turnover exceeds the basic threshold of Rs. 20 lakh under section 22 of CGST Act.

2. A trader having turnover below the threshold under VAT but, making sales through ecommerce operator will be required to be registered in GST. There will be no threshold for such person(s) under section 24 of CGST Act.

Q 11. Will ITC be allowed to a service provider on VAT paid inputs held as stock on the appointed day?

Ans. Yes, he will be entitled to input tax credit on inputs held in stock in accordance with the provisions of section 140(3) of CGST Act.

Q 12. We are VAT Registered dealer of “X Goods” in Gujarat. We do not have any other indirect tax registration. We purchase the “X Goods” Directly from Manufacturer who issues us excisable invoice however we cannot avail excise credit currently as the same we are not excise registered dealer. Now we are holding 1000 units of “X Goods” on the appointed day. We already have availed VAT credit for the same.

Ans. You will be entitled to take the 100 % credit of all eligible duties and taxes (Includes all excise duties and additional custom duties) in respect of inputs held in stock, inputs contained in semi finished or finished goods held in stock as on the immediately preceding the appointed date. The following conditions must be satisfied:

a. Such inputs are intended for making taxable supplies under GST

b. The registered person is eligible for input tax credit on such inputs under this act.

c. The said registered person is in possession of Invoice evidencing payment of duty under the existing law in respect of such inputs.

d. Such invoice should not be older than 12

e. The supplier of service is not eligible for any abatement under GST.

Q 13. We are VAT Registered dealer of “Y Goods” in Gujarat. We do not have any other indirect tax registration. We purchase the “Y Goods” from wholesaler who issues us only VAT invoice. Now we are holding 1000 units of “Y Goods” (Selling price of Rs. 100 per unit) on the appointed day. We already have availed VAT credit for the same.

Ans. This case falls under the provisions of Deemed Credit.

As per Proviso to Section 140(3) read with Rule 1(3)(a) In case where the person does not have duty paid document with him in such case he will be eligible for the credit at the rate of:

a. 60% of CGST where CGST RATE is 9% or more and

b. 40% in all other

So now if “Y Goods” are rated at 18% GST (9% CGST and 9% SGST) you will be eligible for credit at the rate of 60% x 9% x (1000 units x Rs. 100)= Rs. 5400. However first you will have to pay the tax and then avail the credit by filling Form GST TRN 2.

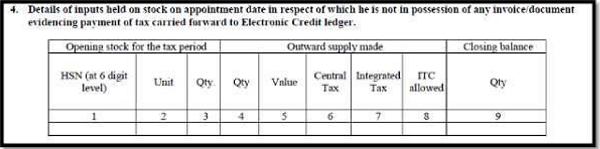

You will have to file GST TRN 2 at the end of every month (Extract of GST TRN -2 is as follows:

Q 14. We are a dealer of “Goods X” in Gujarat. Our Supplier resides in Maharashtra. What if They send goods on 29thJune 2017 and We receive the same on 3rd Shall we be eligible to get the credit in respect of such goods?

Ans. As per Section 140(5) – Yes, Provided Following Conditions are satisfied:

a. Tax on such goods are paid before appointed date, i.e. on or before 30thJune 2017

b. Receipt of such goods/Services are recorded in the books of recipient within 30 days of appointed date, i.e. on or before 30th July

c. Furnish GST TRAN 1 within 90 days.

Note: Section 140(5) of speaks about Inputs and Inputs Services in transit, however It does not make any provisions for Capital Goods in Transit. Therefore The availment of Credit of capital Goods may be disputed by department so suggested that the manufacturer should try to ensure that no capital goods are in transit as on 30th June 2017.

Q 15. We are Service Tax Registered entity. Is there any requirement under GST that my Service tax Return has to be filed within prescribed time to carry forward the credit of existing law to GST? Can I revise such return later on?

Ans. Yes, as per provision to section 140(8), you will have to file your Service tax return or for that matter any other return within 3 months from the appointed date subject to penalty.

I mentioned penalty because as per Service tax provisions you will have to file your return within 25 days however you can file your return late subject to Penalty.

As far as revision is concerned you can definitely revise your return but only within 3 months from the appointed date (1st July 2017). Further, the credit balance shown in the revise return should be same or less than original return.

So the credit amount as per revise return cannot be more than original return. So be careful while filling your original Return.

Q 16. We have HO in Vadodara and branches in Delhi and Kolkata. We are currently having centralized registration under Service tax. We are having a credit balance of Rs. 10 Crores. Can we distribute such credit to our branches in Delhi and Kolkata as in GST we have to obtain separate registrations for Branches in different states? If Yes, In What proportion?

Ans. Yes, as per Third proviso to Section 140(8), the credit can be transferred to any registered person having same PAN for which centralized registration has been obtained. So you can transfer the credit to your branches. Now It is not necessary to distribute the same in any proportion. You can distribute it as per your wish. Nothing with respect to proportion has been specified in the law.

Q 17. A registered person has excess ITC of Rs. 10,000/- in his last VAT return for the period immediately preceding the appointed day. Under GST he opts for composition scheme. Can he carry forward the aforesaid excess ITC to GST?

Ans. The registered person will not be able to carry forward the excess ITC of VAT to GST if he opts for composition scheme Section 140(1) of CGST Act.

Q 18. Sales return under CST (i.e. Central Sales Tax Act) is allowable as deduction from the turnover within six months? If, say, goods are returned in GST regime by a buyer within six months from appointed day, will it become taxable in GST?

Ans. Where tax has been paid under the existing law (CST, in this case) on any goods at the time of sale, not being earlier than six months prior to the appointed day, and such goods are returned by the buyer after the appointed day, the sales return will be considered as a supply of the said buyer in GST and tax has to be paid on such supply, if:

(i) the goods are taxable under the GST Law; and

(ii) the buyer is registered under the GST Law.

However, if the aforesaid buyer is an unregistered person under GST and the goods are returned within 06 (six) months (or within the extended period of maximum two months as per proviso to Section 142(12) of CGST Act) from the appointed day and the goods are identifiable, then the seller is entitled to refund of such tax (CST, in this case) paid under the existing law Section 142(1) of CGST Act.

Q 19. Shall a manufacturer or a job worker become liable to pay tax if the inputs or semi finished goods sent for job work under the existing law are returned after completion of job work after the appointed day?

Ans. No tax will be payable by the manufacturer or the job worker under the following circumstances:

(i) Inputs / semi-finished goods are sent to the job worker in accordance with the provisions of the existing law before the appointed day. The relevant sections are 141(1) & 141(2) of CGST Act.

(ii) The job worker returns the same within six months from the appointed day (or within the extended period of maximum two months). The relevant sections are 141(1) & 141(2) of CGST Act.

(iii) However as per section 142(8) of CGST Act, if the said inputs/semi-finished goods are not returned within six months (or within the extended period of maximum two months), the input tax credit availed is liable to be recovered.

(iv) However as per section 141(4) of CGST Act, If both the manufacturer and the job worker declare the details of inputs held in stock by the job worker on the appointed day in the prescribed form i.e. GST Form Tran-1, then above 3 conditions shall not apply.

Q 20. What happens if the job worker does not return the goods within the specified time?

Ans. Tax will be payable by the job worker on the said goods if they are not returned to the place of business of the manufacturer within six months (or within the extended period of time) from the appointed day. The relevant sections are 141(1) & 141(2) of CGST Act.

Q 21. Can a manufacturer transfer finished goods sent for testing purpose to the premise of any other taxable person?

Ans. Yes. As per section 141(3) of CGST Act, a manufacturer can transfer finished goods sent for testing purpose to the premise any other registered person on payment of tax in India or without payment of tax for exports within Six months (or within the extended period of maximum two months).

Q 22. If finished goods removed from a factory for carrying out certain processes under existing law are returned on or after the appointed day, whether GST would be payable?

Ans. No tax under GST will be payable if finished goods removed from factory prior to the appointed day to any other premise for carrying out certain processes are returned to the said factory after undergoing test or any other process within six months (or within the extended period of maximum two months) from the appointed day section 141 (3).

Q 23. When tax shall become payable in GST on manufactured goods sent to a job worker for carrying out tests or any other process not amounting to manufacture under the existing law?

Ans. Tax will be payable in CST on manufactured goods sent to a job worker prior to the appointed day for carrying out tests or any process not amounting to manufacture under the existing law if such goods are not returned to the manufacturer within six months (or within the extended period of maximum two months) from the appointed day.

Further, as per section 141 (3), the input tax credit enjoyed by the manufacturer will liable to be recovered if the aforesaid goods are not returned within six months from the appointed day.

Q 24. Is extension of two months as discussed in section 141 automatic?

Ans. No, it is not automatic. It may be extended by the Commissioner on sufficient cause being shown.

Q 25. We are Jewelers. Some of our stock is lying with the job worker. Any formality on our part?

Ans. Yes, you will have to file a declaration in Form GST TRAN 1 within 90 days about the stock lying with your Job worker.

Q 26. What is the time limit for issue of debit/credit note(s) for revision of prices?

Ans. The taxable person may issue the debit / credit note(s) or a supplementary invoice within 30 days of the price revision.

As per section 142(2), in case where the price is revised downwards the taxable person will be allowed to reduce his tax liability only if the recipient of the invoice or credit note has reduced his ITC corresponding to such reduction of tax liability.

Q 27. What will be the fate of pending refund of tax/interest under the existing law?

Ans. As per section 142(3), the pending refund claims will be disposed of in accordance with the provisions of the existing law section & shall be paid in cash.

Q 28. What will be fate of any appeal or revision relating to a claim of CENVAT or ITC on VAT which is pending under the existing law? If say, it relates to output liability then?

Ans. As per section 142(6) / 142(7), every proceeding of appeal, revision, review or reference relating to a claim for CENVAT/ input tax credit or any output tax liability initiated whether before, on or after the appointed day, will be disposed of in accordance with the existing law and any amount of credit of CENVAT/ input tax credit or output tax found admissible for refund will have to be refunded in cash in accordance with the existing law.

Q 29. If the appellate or revisional order goes in favor of the assessee, whether refund will be made in GST? What will happen if the decision goes against the assessee?

Ans. As per section 142(6) / 142(7), the refund will be made in accordance with the provisions of the existing law in cash only. In case any recovery is to be made then, unless recovered under existing law, it will be recovered as an arrear of tax under GST.

Q 30. How shall the refund arising from revision of return(s) furnished under the existing law be dealt with in GST?

Ans. As per section 142(9)(b), any amount found to be refundable as a consequence of revision of any return under the existing law after the appointed day will be refunded in cash in accordance with the provisions of the existing law section 142(9)(b).

Q 31. If any goods or services are supplied in GST, in pursuance of contract entered under existing law, which tax will be payable?

Ans. GST will be payable on such supplies as per section 142(10) of the CGST Act.

Q 32. Tax on a particular supply of goods/services is leviable under the existing law. Will GST be also payable if the actual supply is made in GST regime?

Ans. As per section 142(11), no tax will be payable on such supply of goods / services under GST to the extent the tax is leviable under the existing law.

Q 33. In pursuance of any assessment or adjudication proceedings instituted, after the appointed day, under the existing law, an amount of tax, interest, fine or penalty becomes refundable. Shall such amount be refundable under the GST law?

Ans. As per section 142(8)(b), refund of such amount will be made in cash under the existing law.

Q 34. If services are received by ISD under the earlier law, can the ITC relating to it be distributed in GST regime?

Ans. Yes, it can be distributed as section 140(7) of CSGT Act, irrespective of whether the invoice(s) relating to such services is received on or after the appointed day section 140(7) of the CGST Act.

Q 35. Where any goods are sold on which tax was required to be deducted at source under State VAT law and an invoice was also issued before the appointed day, shall deduction of tax at source shall be made under this Act if the payment is made after the appointed day?

Ans. No, as per section 142(13) of CGST Act, in such case no deduction of tax at source shall be made under GST.

Q 36. Goods were sent on approval not earlier than six months before the appointed day but are returned to the seller after 6 months from the appointed day, will tax be payable under GST?

Ans. Yes, as per section 142(12) of CGST Act, if such goods are liable to tax under GST and the person who has rejected or has not approved the goods, returns it after 6 months (or within the extended period of maximum two months) from the appointed day, then in that case tax shall also be payable by the person who has sent the goods on approval basis.

Q 37. In order to avoid dispute later on, our company avail the credit only after payments have been made to the Input service provider.

Ans. As far as transition period is concerned, please avail the credit prior to 30-06-2017. If you have avail the credit, then it may be considered otherwise You will lose the credit forever.

So better to receive a show cause notice and then reverse the credit. Let the department find their way out.

The author is a practicing CA based in Delhi and is registered Insolvency Professional. He can be reached at cavinodchaurasia@gmail.com , Mob. +91 9953587496.

Disclaimer: The views expressed in this article are strictly personal. The content of this document are solely for informational purpose. It doesn’t constitute professional advice or recommendation. The Author does not accept any liabilities for any loss or damage of any kind arising out of information in this article and for any actions taken in reliance thereon.