1. Introduction :

Submission of details of transaction that the business was indulged in for a given period , in prescribed period can be termed as ‘Return’. It can also be described as periodic statement of transactions carried out by organization. Every Act has certain returns prescribed which has to be filed with certain departments / authorities etc. Even before GST, if we take service tax law there was ST-3 return which was filed half – yearly and due date was within 25 days from the end of half year. We now proceed further for understanding returns under GST.

2. Types of returns or reports and periodicity:

| Return Form | What to file? | By Whom? | By When? |

| GSTR-1 | Details of outward supplies of taxable goods and/or services effected (other than compounding taxpayer and ISD ) | Registered Taxable Supplier | 10th of the next month |

| GSTR-2 | Details of inward supplies of taxable goods and/or services effected claiming input tax credit. (other than compounding taxpayer and ISD ) | Registered Taxable Recipient | 15th of the next month |

| GSTR-3 | Monthly return on the basis of finalization of details of outward supplies and inward supplies along with the payment of amount of tax. (other than compounding taxpayer and ISD ) | Registered Taxable Person | 20th of the next month |

| GSTR-4 | Quarterly return for compounding taxpayer u/s 9. | Composition Supplier | 18th of the month next to quarter |

| GSTR-5 | Return for Non-Resident foreign taxable person | Non-Resident Taxable Person | Within 20 days after the end of a tax period or within 7 days after the last day of the validity period of registration, whichever is earlier |

| GSTR-6 | Return for Input Service Distributor | Input Service Distributor | 13th of the next month |

| GSTR-7 | Return for person deducting tax at source. | Tax Deductor | 10th of the next month |

| GSTR-8 | Details of supplies effected through e-commerce operator and the amount of tax collected u/s 56(1) | E-commerce Operator/Tax Collector | 10th of the next month |

| GSTR-9 | Annual Return | Registered Taxable Person | 31st December of next financial year |

| GSTR-10 | Final Return | Taxable person whose registration has been surrendered or cancelled. | Within three months of the date of cancellation or date of cancellation order, whichever is later. |

| GSTR-11 | Details of inward supplies to be furnished by a person having UIN | Person having UIN and claiming refund | 28th of the month following the month for which statement is filed |

Apart from above, following returns will be auto – generated at common portal.

| Sr.No | Return | Nature of Return |

| 1 | GSTR 1A | Details of outward supplies as added, corrected or deleted by the recipient |

| 2 | GSTR 2A | Details of inward supplies made available to the recipient on the basis of FORM GSTR-1 furnished by the supplier |

| 3 | GSTR 4A | Details of inward supplies made available to the recipient registered under composition scheme on the basis of FORM GSTR-1 furnished by the supplier |

| 4 | GSTR 6A | Details of inward supplies made available to the ISD recipient on the basis of FORM GSTR-1 furnished by the supplier |

| 5 | GSTR 7A | TDS Certificate |

| 6 | GSTR 9A | Simplified Annual return by Compounding taxable persons registered under section 8 |

| 7 | GSTR 9B | Reconciliation Statement |

Other features of returns :

⇒ The filing of returns shall be only through online mode.

⇒ Facility of offline generation and preparation of returns shall be available but offline returns shall have to be uploaded before the due date.

Return without payment of self-assessed tax :

⇒ The return may be filed; however such return shall be treated as an invalid return;

⇒ Not to be taken into consideration for matching of invoices and for inter-governmental fund settlement among states and centre.

3) GSTR-1 – Returns for outward supplies : ( Refer format)

♦ Persons liable to furnish GSTR -1 :

Every registered taxable person other than –

⇒ An input service distributor

⇒ A non-resident taxable person

⇒ Person paying tax under the composition scheme u/s 9

⇒ TDS deductor u/s 46

⇒ Electronic commerce operator u/s 56

4) GSTR-1A – Return of outward supplies as added, corrected or deleted by the recipient : (Refer format )

It will be auto generated at common portal.

5) GSTR-2 – Returns for Inward supplies : (Refer format)

♦ Persons liable to furnish GSTR -2 :

Every registered taxable person other than –

⇒ An input service distributor

⇒ A non-resident taxable person

⇒ Person paying tax under the composition scheme u/s 9

⇒ TDS deductor u/s 46

⇒ Electronic commerce operator u/s 56

Other key points :

⇒ Even if supplier has not uploaded invoices , recipient is permitted to add invoices if he is in possession of invoices and has received the goods or services.

⇒ It may be possible that outward supplies covered under one invoice but received in more than one instance / lot. In that case ITC ( Input tax credit) shall be given in the return period in which last purchase is recorded.

e.g. Mr.A purchased 100 units of telephone @ Rs.500/ unit from Mr.B (seller) and Mr.B issued one invoice for those 100 units of telephone and accordingly raised bill as follows :

| Particulars | Quantity | Rate | Amount |

| Telephone | 100 units | 500/ unit | 50000 |

| Add : SGST @ 15% (assumed) | 7500 | ||

| Add: CGST@ 15% (assumed) | 7500 | ||

| Total | 65000 |

Now Mr.B supplies 50 units on 31st May and rest on 2nd June. In this case credit will be available in the month of June as last purchases is made in that month.

6) GSTR-2A – Return of inward supplies made available to the recipient on the basis of Form GSTR -1 furnished by supplier : (Refer format )

It will be auto generated at common portal. It is divided into four parts as follows :

| Sr.No | Part | Particulars |

| 1 | A | Inward supplies received from Registered Taxable person |

| 2 | B | ISD Credit received |

| 3 | C | TDS credit received |

| 4 | D | TCS credit received |

7) GSTR-3 – Monthly Return : (Refer format)

It is filed monthly and completely auto generated from the information furnished in GSTR-1 and GSTR-2. Additional information furnished in the return relates to

⇒ Utilization of ITC

⇒ Debit of cash ledger for payment of taxes.

In case if any excess payment is made it may be carried forward to the next return period or alternatively refund can be claimed in the selected bank account.

8) GSTR -4- Quarterly return by composition taxpayers : (Refer format )

⇒ If supplier is making inter-state supply in that case he shall not be allowed composition benefit.

⇒ If receipts are from unregistered dealers it shall attract tax on reverse charge basis.

9) GSTR – 4A- Details of inward supplies made available to the recipient registered under composition scheme on the basis of FORM GSTR-1 furnished by the supplier :(Refer fromat)

⇒ GSTR 4A will be auto populated on the basis of GSTR -1 furnished by supplier.

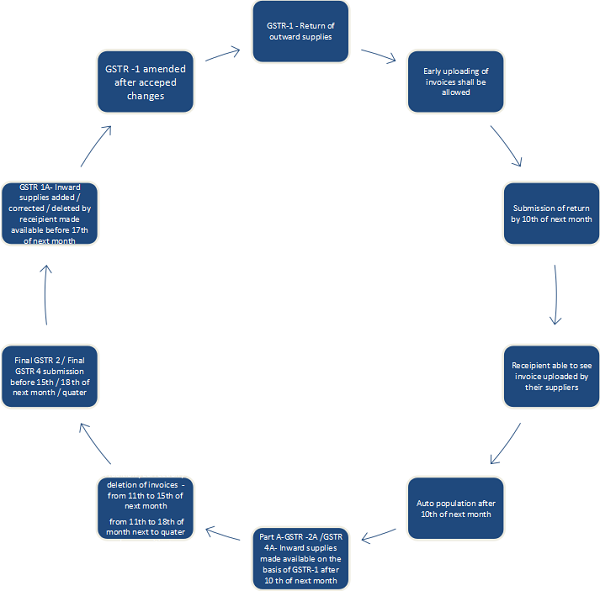

10) Time flow for ( GSTR – 1/ 2 ) :

11) GSTR-5- Non-resident foreign Taxpayer (Refer Format)

Non-resident foreign taxpayers are those suppliers who do not have a business establishment in India and have come for a short period to make supplies in India [sec.2(68)]

12) GSTR-6-ISD Return (Refer format )

As per sec.2(54) Input Service Distributor distributes credit of tax invoices received centrally on services to units that actually use those services in the course of their business. Inward supplies from registered taxable person ( to be auto-populated from counter party GSTR -1 and GSTR-5. Also in this details regarding Input service distribution has to be furnished.

13) GSTR-6A- Details of inward supplies made available to ISD recipient on the basis of Form GSTR-1 furnished by supplier .(Refer format )

Auto generated at common portal.

14) GSTR-7- TDS Return and GSTR-7A-Certificate – (Refer format )

⇒ The details furnished in Form GSTR-7 shall be made available electronically to each suppliers in Part C of Form GSTR-2A on the common portal after the due date of filing of Form GSTR-7.

⇒ TDS Certificate to be given in Form GSTR-7A by deductee to deductor.

⇒ TDS Certificates are not required to be uploaded. Only for the purpose of record keeping of the taxpayer is to kept and can be downloaded from GSTN portal.

15) GSTR-8- Return by e-commerce operator (Refer Format)

⇒ Required to be filed only by e-commerce operator (s) providing facility of supplying goods and / or services of other suppliersthrough his portal .(Thus if an e-commerce portal is supplying goods through his own portal in that case not required to file this return)

16) GSTR-9- /9A/9B :

a) Annual return shall be filed by every registered taxable person, other than –

⇒ An input service distributor

⇒ A non-resident taxable person

⇒ TDS deductor u/s 46

⇒ Electronic commerce operator u/s 56

⇒ Casual Taxable Person

b) Moreover if aggregate turnover in a financial year exceeds Rs.1 Cr., in that taxable person is required to get his accounts audited u/s 53(4) and shall submit :

⇒ Audited copy of annual accounts

⇒ Reconciliation statement duly certified, reconciling the value of supplies declared in the return furnished for the year with the audited annual financial statement in Form GSTR-9B and

⇒ Such other particulars as may be prescribed.

c) In case of composition dealers GSTR-9A has to be filed and reconciliation statement in Form GSTR-9B.

17) Acknowledgement :

| In case of offline Tools | In case of Online Tools |

| ⇒ For generation of acknowledgement it will take some time as GSTN system needs to verify certain details such as personal ledger,ITC,tax payment details, etc.

⇒ A Transaction ID confirming receipt of data will be generated initially and once data validation is complete final acknowledgement will be generated |

⇒ Acknowledgement will be generated instantly |

18) Other Points :

⇒ As GST is transaction based if any changes are required they must be made at transaction level rather than at aggregate level of return. Thus no revision of returns is allowed.

⇒ GSTN system shall generate defaulters list by comparing the return filers with the registrant database within 15 days and accordingly notices will be auto –generated in Form GSTR-3A and sent to all non-filers in the form of e-mail and SMS.

⇒ GST returns can be signed used DSC for validation. Alternatively e-verification can also be done using Aadhar card / net banking credentials.

Sir kindly issue article on reverse charge and service like transportation of goods via individual own carrier and through GTA . If possible with multiple of eg. Please include word magic also

Sir , Very detailed information. Very useful.

Please also provide format and their availability. At which site these are available.