JCCI has requested Hon Union Finance Minister of India to extend due date of GSTR-9 / GSTR-9C report for year 2017-18 to atleast up to 31.3.2020 as due to system problem Taxpayers are unable to file / upload GSTR-9 and GSTR-9C.

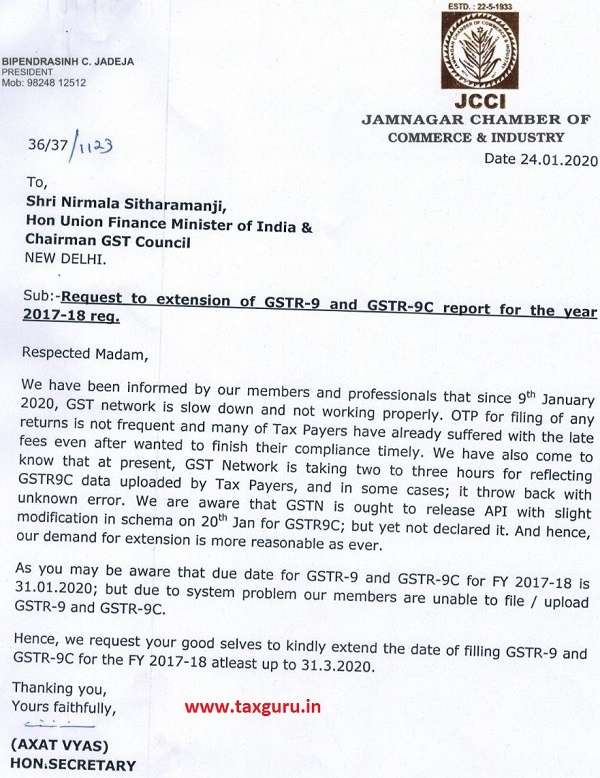

JCCI (JAMNAGAR CHAMBER OF COMMERCE & INDUSTRY)

36/37/1123

Date 24.01.2020

To,

Smt. Nirmala Sitharamanji,

Hon Union Finance Minister of India &

Chairman GST Council

NEW DELHI.

Sub:-Request to extension of GSTR-9 and GSTR-9C report for the year 2017-18 reg.

Respected Madam,

We have been informed by our members and professionals that since 9th January 2020, GST network is slow down and not working properly. OTP for filing of any returns is not frequent and many of Tax Payers have already suffered with the late fees even after wanted to finish their compliance timely. We have also come to know that at present, GST Network is taking two to three hours for reflecting GSTR9C data uploaded by Tax Payers, and in some cases; it throw back with unknown error. We are aware that GSTN is ought to release API with slight modification in schema on 20th Jan for GSTR9C; but yet not declared it. And hence, our demand for extension is more reasonable as ever.

As you may be aware that due date for GSTR-9 and GSTR-9C for FY 2017-18 is 31.01.2020; but due to system problem our members are unable to file / upload GSTR-9 and GSTR-9C.

Hence, we request your good selves to kindly extend the date of filling GSTR-9 and GSTR-9C for the FY 2017-18 atleast up to 31.3.2020.

Thanking you,

Yours faithfully,

(AXAT VYAS)

HON:SECRETARY

Recent Representation on GSTR-9 & GSTR 9C due date extension Published till date on Taxguru

| S. N. | Date | Association | Link |

| 15 | 30/01/2020 | 1) The Gujarat Sales Tax Bar Association 2) National Action Committee 3) All Gujarat Federation of Tax Consultant 4) Chartered Accountants Association, Ahmedabad 5) Income Tax Bar Association, Ahmedabad 6) Tax Advocates Association Gujarat |

Request to extend due date of GSTR-9, 9A & 9C for F.Y. 2017-18 |

| 14 | NA | Taxation Bar Association, Modinagar | Letter for GST Portal issues and GSTR 9 & GSTR 9C Date extension |

| 13 | 26/01/2020 | Central Gujarat Chamber of Commerce and Baroda Tax Bar Association | Extend due date of GSTR 9 & GSTR 9C to 31.03.2020 for FY 2017-18 |

| 12 | 27/01/2020 | The Goods and Services Tax Practitioners’ Association of Maharashtra | Extend dates for filing Form GSTR-9 and Form GSTR-9C for FY 2017-18 |

| 11 | 27/01/2020 | Tax Bar Association, Guwahati | Request to extend due date of GST Annual Returns for year 2017-18 |

| 10 | 27/01/2020 | Sales Tax Bar Association, New Delhi | Extend date of filing of Form GSTR 9, GSTR 9A and GSTR 9C |

| 9 | 27/01/2020 | Association Of Tax Practitioners, Ernakulam | Extension of due date for filing GSTR-9/9A & GSTR-9C for F.Y. 2017-18 |

| 8 | 27/01/2020 | Haryana Chamber Of Commerce & Industry | Extend GSTR 9 & GSTR 9C Return Filing due Date For Year 2017-18 |

| 7 | 22/01/2020 | Ahilya Chamber of Commerce and Industry | GST Portal Issues | Problems in Forms | GSTR 9/9C due date extension |

| 6 | 27/01/2020 | Kerala Tax Practitioners’ Association (KTPA), Kochi | Extend due date of GSTR-9 & 9C for further one month |

| 5 | 27/01/2020 | District Tax Bar Association Sonipat. | Extend due date of GSTR-9 & GSTR-9C for FY 2017-18 |

| 4 | 26/01/2020 | Central Gujarat Chamber of Commerce and Baroda Tax Bar Association | Extend due date of GSTR 9 & GSTR 9C to 31.03.2020 for FY 2017-18 |

| 3 | 24/01/2020 | Jamnagar Chamber Of Commerce & Industry | Request for extension of GSTR-9 / GSTR-9C report for year 2017-18 |

| 2 | 24/01/2020 | The Southern Gujarat Commercial Tax Bar Association, Surat | Extend due date of GST Annual returns / Audit of 2017-18 to 31/3/2020 |

| 1 | 24/01/2020 | Tax Bar Association, Jammu | Extend due date of GSTR-9 / GSTR-9C for year 2017-18 for UT of J&K |

Please extend the GST Annual Returns for the year 2017-18 till 31.03.2020.

Thanking you

PL EXTEND TH GST ANNUAL RETURNS FOR THE YEAR 2017-18

Mrs.shri NIRMALA SEETHARAM JI DONT GIVE ANT EXTENSIONS BCAZ U LL GIVE ANY TIME ALL R REQUEST ANOTHER DUE DATE

PLEASE EDIT OPTION IN GSTR 3B RETURN FINANCIAL YEAR 2017-18

Madam,

Please arrange to extend the Last Opportunity fior GST Annual Returns for the year 2017-18 till 31.03.2020.

LET THE ANNUAL RETURN TO BE CLOSED FOR THE YEAR 2017-18WITH IN 31.01.2020. DISGUSTED WITH THE GST NETWORK

Kindly waive off late filing fees if not extend the due date of Annual return for FY 2017-18.

Madam,

Most respectfully we hereby submit that with lot of efforts we are unable to file the the GSTR-9C. system is not accepting the digital signature of auditor.Even on GST portal this issue was also mentioned, till date the same has not been resolved.Hence we request before your goodself to resolve the said problem and extend the date for filing of annual return for the year 2017-2018.

Respected Madam

We all knows, the implementation of GST in transition stage and will take few years to settled down. We, all professional are working hard and are and will always supports the effords of present Govt. But, we are facing problems with the fillings, due ignorance by our client to this systems resulting teething problems and your own official are making changing in the system. However,Every coming day is better that previous one. Extension of time shall be great strep towards efforts of the Govt. Moreover the Govt is not loosing much for annual return. Kindly consider in good sprit.

Not to extend.please

GST Annual Return for the year 2017-18 filling date should be extend upto 31/03/2020 or exempted for the year 2017-18 who turnover less than 5000 lac

Please use SMT. instead of SHRI before her name of our Honourable Union Finance Minister of India.

Please use SMT. Instead of Shri before her name of current Honourable Finance Minister of India.

Madam,

Most respectfully,due to system problems we could not file GST Annual Return for the year 2017-18.Kindly extend the same upto 31.03.2020.

Thanking you,