QRMP Scheme (Quarterly Return Monthly Payment Scheme) – New GST Return System w.e.f. 01-Jan-2021

In the recent World Bank’s ease of doing business 2020 report, the country jumped to 63rd position, among 190 nations. India also figured among the top 10 performers on the list for the third time in a row. On the same path, GOI time to time ease the compliance, lesser paperwork, transparency and controlling system under GST. Further, all compliances will be done so that supplier continuous upload the invoices, file his returns and pay the taxes thereby the credit comes to the recipient.

In the current system, If the credit of GST (Input tax credit) is not reflected on portal in Form GSTR-2A/2B, the credit is denied to the recipient prima facie. Many of the SME’s are filing their returns quarterly (Supplier invoice data) hence the credit is not reflected timely (monthly) to the recipient thereby defeat the purpose of new rule introduced popularly called as Rule 36(4) under the GST.

In order to further ease the process of doing business and the industry demands for lesser compliance under GST, the government has now introduce new scheme under GST, popularly will call as QRMP Scheme (Quarterly Return Monthly Payment Scheme). This the option is to furnish quarterly return with monthly payment of taxes along with monthly uploading of invoices under Invoice furnishing facility (IFF). This new scheme will be effective from 1st Jan, 2020. The CBIC on 10th of Nov, 2020 issued four notifications and one circular regarding the scheme.

The Notification No. 81/2020-Central Tax, dated 10-11-2020, Notifies amendment carried out in sub-section (1), (2) and (7) of section 39 of the CGST Act vide Finance (No.2) Act, 2019.

The Notification No. 82/2020-Central Tax, dated 10-11-2020, Makes the Thirteenth amendment (2020) to the CGST Rules 2017.

The Notification No. 84/2020-Central Tax, dated 10-11-2020, Notifies class of persons under proviso to section 39(1) of the CGST Act.

The Notification No. 85/2020-Central Tax, dated 10-11-2020, Notifies special procedure for making payment of tax liability in the first two months of a quarter.

And the Circular No. 143/13/2020-GST dated 10.11.2020, Explain the scheme in simple terms.

Key Highlights of the QRMP Scheme:

1. Eligibility for QRMP Scheme

- A registered person who is required to furnish a return in Form GSTR-3B, and who has an aggregate turnover of upto Rs. 5 crore in the preceding financial year, is eligible for the QRMP Scheme.

- Clarification 1: The aggregate annual turnover for the preceding financial year shall be calculated in the common portal taking into account the details furnished in the returns by the taxpayer for the tax periods in the preceding financial year. And it should be PAN wise. If a taxpayer having 2 or more GSTIN’s then the aggregate turnover of all should be taken for eligibility.

- Clarification 2: In case the aggregate turnover exceeds 5 crore rupees during any quarter in the current financial year, the registered person shall not be eligible for the Scheme from the next quarter.

- Clarification 3: The option to avail the QRMP Scheme is GSTIN wise and therefore, distinct persons as defined in Section 25 of the CGST Act (different GSTINs on same PAN) have the option to avail the QRMP Scheme for one or more GSTINs. In other words, some GSTINs for that PAN can opt for the QRMP Scheme and remaining GSTINs may not opt for the Scheme.

2. When & How to Exercise the QRMPS Option

- Facility to avail the Scheme on the common portal would be available throughout the year. In terms of rule 61A of the Central Goods and Services Tax Rules, 2017, a registered person can opt in for any quarter from first day of second month of preceding quarter to the last day of the first month of the quarter.

- In order to exercise this option, the registered person must have furnished the last return, as due on the date of exercising such option.

- For example: A registered person intending to avail of the Scheme for the quarter ‘July to September’ can exercise his option during 1st of May to 31st of July. If he is exercising his option on 31st July for the quarter (July to September), in such case, he must have furnished the return for the month of June which was due on 22/24th July.

- Similarly, for the quarter ‘Oct to Dec’ can exercise his option during 1st of Aug to 31st of Oct.

- Similarly, for the quarter ‘Jan to Mar’ can exercise his option during 1st of Nov to 31st of Jan.

- Similarly, for the quarter ‘Apr to Jun’ can exercise his option during 1st of Feb to 30th of Apr.

- Registered persons are not required to exercise the option every quarter. Where such option has been exercised once, they shall continue to furnish the return as per the selected option for future tax periods, unless they revise the said option.

3. Default Migration

- For the first quarter of the Scheme i.e. for the quarter January, 2021 to March, 2021, all the registered persons, whose aggregate turnover for the FY 2019-20 is up to 5 crore rupees and who have furnished the return in FORM GSTR-3B for the month of October, 2020 by 30th November, 2020, shall be migrated on the common portal as below.

| S. No. | Class of Registered Person | Default Option |

| 1. | Registered persons having aggregate turnover of up to 1.5 crore rupees who have furnished FORM GSTR-1 on quarterly basis in the current financial year | Quarterly Return |

| 2. | Registered persons having aggregate turnover of up to 1.5 crore rupees who have furnished FORM GSTR-1 on monthly basis in the current financial year | Monthly Return |

| 3. | Registered persons having aggregate turnover more than 1.5 crore rupees and up to 5 crore rupees in the preceding financial year | Quarterly Return |

- The taxpayers who have not filed their return for October, 2020 on or before 30th November, 2020 will not be migrated to the Scheme. They will be able to opt for the Scheme once the FORM GSTR-3B as due on the date of exercising option has been filed.

- The registered persons are free to change the option as above, if they so desire, from 5th of December, 2020 to 31st of January, 2021.

4. When to Opt-Out and How Op-out from the Scheme?

- Any taxpayer whose aggregate turnover has exceeded 5 crore rupees in the financial year 2020-21, shall opt out of the Scheme. The registered person shall not be eligible for the scheme from the next quarter.

- Similarly, the facility for opting out of the Scheme for a quarter will be available from first day of second month of preceding quarter to the last day of the first month of the quarter.

- All persons who have obtained registration during any quarter or the registered persons opting out from paying tax under Section 10 of the CGST Act during any quarter shall be able to opt for the Scheme for the quarter for which the opting facility is available on the date of exercising option.

5. Furnishing of details of Outward Supplies IFF and Form GSTR-1

- The registered persons opting for the Scheme would be required to furnish the details of outward supply in FORM GSTR-1 quarterly as per the rule 59 of the CGST Rule.

- For each of the first and second months of a quarter, such a registered person will have the facility (Invoice Furnishing Facility- IFF) to furnish the details of such outward supplies to a registered person, as he may consider necessary, between the 1st day of the succeeding month till the 13th day of the succeeding month.

- The said details of outward supplies shall, however, not exceed the Rs. 50 Lakhs in each month. It may be noted that after 13th of the month, this facility for furnishing IFF for previous month would not be available.

- The continuous upload of invoices would also be provided for the registered persons wherein they can save the invoices in IFF from the 1st day of the month till 13th day of the succeeding month.

- The facility of furnishing details of invoices in IFF has been provided so as to allow details of such supplies to be duly reflected in the FORM GSTR-2A and FORM GSTR-2B of the concerned recipient.

- For example, a registered person who has availed the Scheme wants to declare two invoices out of the total ten invoices issued in the first month of quarter since the recipient of supplies covered by those two invoices desires to avail ITC in that month itself. Details of these two invoices may be furnished using IFF. The details of the remaining 8 invoices shall be furnished in FORM GSTR-1 of the said quarter. The two invoices furnished in IFF shall be reflected in FORM GSTR-2B of the concerned recipient of the first month of the quarter and remaining eight invoices furnished in FORM GSTR-1 shall be reflected in FORM GSTR-2B of the concerned recipient of the last month of the quarter. The said facility would however be available, say for the month of July, from 1st August till 13th August. Similarly, for the month of August, the said facility will be available from 1st September till 13th September.

- The said facility is not mandatory and is only an optional facility made available to the registered persons under the QRMP Scheme.

- The details of invoices furnished using the said facility in the first two months are not required to be furnished again in FORM GSTR-1. Accordingly, the details of outward supplies made by such a registered person during a quarter shall consist of details of invoices furnished using IFF for each of the first two months and the details of invoices furnished in FORM GSTR-1 for the quarter. At his option, a registered person may choose to furnish the details of outward supplies made during a quarter in FORM GSTR-1 only, without using the IFF.

6. Monthly Payment

- The registered person under the QRMP Scheme would be required to pay the tax due in each of the first two months of the quarter by depositing the due amount in FORM GST PMT-06, by the twenty fifth day of the month succeeding such month.

- While generating the challan, taxpayers should select “Monthly payment for quarterly taxpayer” as reason for generating the challan.

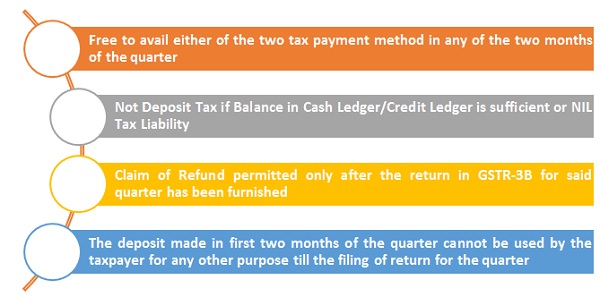

- In case the balance in the electronic cash ledger and/or electronic credit ledger is adequate for the tax due for the first month of the quarter or where there is nil tax liability, the registered person may not deposit any amount for the said month.

- Similarly, for the second month of the quarter, in case the balance in the electronic cash ledger and/or electronic credit ledger is adequate for the cumulative tax due for the first and the second month of the quarter or where there is nil tax liability, the registered person may not deposit any amount.

- Any claim of refund in respect of the amount deposited for the first two months of a quarter for payment of tax shall be permitted only after the return in FORM GSTR-3B for the said quarter has been furnished. Further, this deposit cannot be used by the taxpayer for any other purpose till the filing of return for the quarter.

- The said person can use any of the following two options provided below for monthly payment of tax during the first two months. The said registered person is free to avail either of the two tax payment method above in any of the two months of the quarter.

(a) FIXED SUM METHOD: An amount equal to 35% of the tax paid in cash in the preceding quarter where the return was furnished quarterly,

Or

Equal to the tax paid in cash in the last month of the immediately preceding quarter where the return was furnished monthly.

For easy understanding, the same is explained by way of illustration in table below:

(b) SELF ASSESSMENT METHOD: The said persons, in any case, can pay the tax due by considering the tax liability on inward and outward supplies and the input tax credit available, in FORM GST PMT-06. In order to facilitate ascertainment of the ITC available for the month, an auto-drafted input tax credit statement has been made available in FORM GSTR-2B, for every month.

7. Quarterly Return

- Such registered persons would be required to furnish FORM GSTR-3B, for each quarter, on or before 22nd or 24th day of the month succeeding such quarter.

- In FORM GSTR-3B, they shall declare the supplies made during the quarter, ITC availed during the quarter and all other details required to be furnished therein.

- The amount deposited by the registered person in the first two months shall be debited solely for the purposes of offsetting the liability furnished in that quarter’s FORM GSTR-3B.

- However, any amount left after filing of that quarter’s FORM GSTR-3B may either be claimed as refund or may be used for any other purpose in subsequent quarters.

- In case of cancellation of registration of such person during any of the first two months of the quarter, he is still required to furnish return in FORM GSTR-3B for the relevant tax period.

8. Applicability of Interest

- Interest payable, if any, shall be paid through FORM GSTR-3B.

| For registered person making payment of tax by opting Fixed Sum Method | For registered person making payment of tax by opting Self-Assessment Method |

| No interest would be payable in case the tax due is paid in the first two months of the quarter by way of depositing auto-calculated fixed sum amount by the due date.* | Interest amount would be payable as per the provision of Section 50 of the CGST Act for tax or any part thereof (net of ITC) which remains unpaid / paid beyond the due date for the first two months of the quarter. |

| In case such payment of tax by depositing the system calculated amount in FORM GST PMT-06 is not done by due date, interest would be payable at the applicable rate, from the due date of furnishing FORM GST PMT-06 till the date of making such payment. |

*If while furnishing return in FORM GSTR-3B, it is found that in any or both of the first two months of the quarter, the tax liability net of available credit on the supplies made /received was higher than the amount paid in challan, then, no interest would be charged provided they deposit system calculated amount for each of the first two months and discharge their entire liability for the quarter in the FORM GSTR-3B of the quarter by the due date.

Further, in case FORM GSTR-3B for the quarter is furnished beyond the due date, interest would be payable as per the provisions of Section 50 of the CGST Act for the tax liability net of ITC.

Illustration 1 –

A registered person, who has opted for the Scheme, had paid a total amount of Rs. 100/- in cash as tax liability in the previous quarter of October to December. He opts to pay tax under fixed sum method. He therefore pays Rs. 35/- each on 25th February and 25th March for discharging tax liability for the first two months of quarter viz. January and February. In his return for the quarter, it is found that liability, based on the outward and inward supplies, for January was Rs. 40/- and for February it was Rs. 42/-. No interest would be payable for the lesser amount of tax (i.e. Rs. 5 and Rs. 7 respectively) discharged in these two months provided that he discharges his entire liability for the quarter in the FORM GSTR-3B of the quarter by the due date.

Illustration 2 –

A registered person, who has opted for the Scheme, had paid a total amount of Rs. 100/- in cash as tax liability in the previous quarter of October to December. He opts to pay tax under fixed sum method. He therefore pays Rs. 35/- each on 25th February and 25th March for discharging tax liability for the first two months of quarter viz. January and February. In his return for the quarter, it is found that total liability for the quarter net of available credit was Rs. 125 but he files the return on 30th April. Interest would be payable at applicable rate on Rs. 55 [Rs. 125 – Rs. 70 (deposit made in cash ledger in M1 and M2)] for the period between due date of quarterly GSTR 3B and 30th April.

9. Late Fee

Late fee would be the applicable for delay in furnishing of the said quarterly return / details of outward supply. No late fee is applicable for delay in payment of tax in first two months of the quarter.

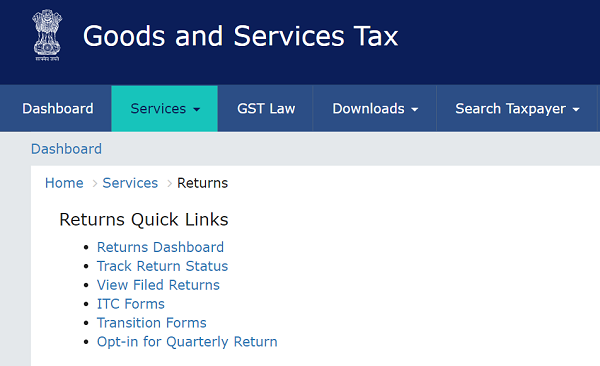

10. Travel through GSTN Portal

Login>Services>Returns>Opt-in for Quarterly Return

Opt-in for Quarterly Return before 5-Dec-2020

Opt-in for Quarterly Return w.e.f. 5-Dec-2020

After Clicking Search>Select Quarterly> GSTR-1 and GSTR-3B showing Quarterly and their respective due dates

After Clicking Search>Select Monthly> GSTR-1 and GSTR-3B showing Monthly and their respective due dates

11. Summarized Due Dates

| AT upto Rs. 5Cr | PMT-06 | GSTR-3B | IFF | GSTR-1 |

| April | 25th | 1st-13th | ||

| May | 25th | 1st-13th | ||

| June | 22nd/24th | 13th | ||

| July | 25th | 1st-13th | ||

| August | 25th | 1st-13th | ||

| September | 22nd/24th | 13th | ||

| October | 25th | 1st-13th | ||

| November | 25th | 1st-13th | ||

| December | 22nd/24th | 13th | ||

| January | 25th | 1st-13th | ||

| February | 25th | 1st-13th | ||

| March | 22nd/24th | 13th |

Disclaimer: The information in this document is for educational purposes only and nothing conveyed or provided should be considered as legal, accounting, or tax advice.

Very nicely explained , thank you