What is Input Tax?

Input tax in relation to a registered person means, the CGST, SGST/UTGST or IGST charged on any supply of goods or services or both made to him and includes-

⇒ IGST charged on import of goods.

⇒ Tax payable under the provision of RCM.

{INPUT TAX CREDIT IS A BENIFIT GIVEN BY STATUTE, IT IS NOT A RIGHT}

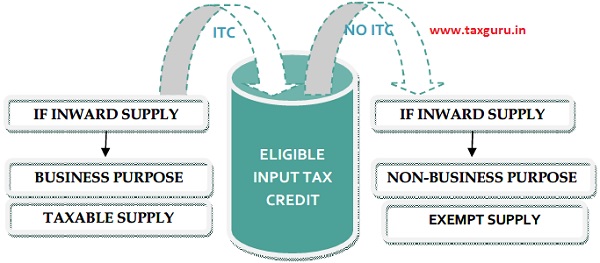

Every Registered person entitled to take credit of on supply of goods or services or both to him in the course of furtherance of business subject to such conditions as follow:

GST RETURN IS FILED BY SUPPLIER

TAX INVOICE IS IN THE POSSESSION

GST ON SUCH SUPPLY PAID BY SUPPLIER

GOODS OR SERVICES OR BOTH SHOULD BE RECEIVED

PAYMENT MADE TO SUPPLIER WITH IN 180 DAYS (ONLY NCM)

IMPORTANT POINT

1. In case of goods or services or both received in installment then ITC can be claimed only after receipt of last installment

2. Post sale discount shall not be deemed as payment to supplier hence no ITC claim on such amount.

3. In case of manufacturing unit entire ITC available even if part of input goes in by-product, waste, process loss, handling loss, natural loss, loss in transit due to natural causes and atmospheric changes are allowed and ITC need not to be reversed even if waste is not returned by job worker. (But no ITC on short supply of input received)

4. No ITC if Depreciation charge on such tax amount.

TIME LIMIT TO CLAIM INPUT TAX CREDIT

EXEMPT SUPPLY INCLUDES:

* Supply taxable under RCM

* Telecommunication Tower

* Sale of Land

* Services given in sub item (b) of item 5 of Schedule II

CONDITIONS WHERE A PERSON CAN NOT CLAIM INPUT TAX CREDIT

|

Block Credits:

|

Exceptions: ITC ALLOWED

|

Other:

* No ITC on advance payment

* No ITC on short supply of input received

* No ITC if GST paid in terms of section 74(Fraud), 129(Detention) and 130(Confiscation)

* No ITC on post sale discount

* No ITC for motor vehicle used for transportation of cash. (Cash in not goods)

* Shed to protect plan and machinery is civil structure, no ITC allowed

Some eligibility/ ineligibility:

- Expenses related to guest house, transit house and training hostels-Eligible for ITC

- Input services for CSR activity- Eligible for ITC

- Brokerage services related to renting of building- Eligible for ITC

- Lease rent for pre operative period- Not eligible for ITC

- Gardening expenses, hospital expenses- Not eligible for ITC

Plant and Machinery:

- Apparatus, equipment and machinery

- Fixed to earth by foundation or structural support

- That are used for making outward supply of goods or services or both And include such foundation and structural support.

But exclude:

- Land, building or other civil structures

- Telecommunication tower

- Pipeline laid outside the factory

Construction Includes:

- Reconstruction

- Renovation

- Repair

- Addition

- Alteration

- Warehouse constructed using pre-fabrication structure is immovable property

Section 18(1)

Availability of credit

Provided that the ITC on capital goods shall be claimed after reducing the tax paid on such capital goods by 5% per quarter or part thereof from the date of invoice. Immediately preceding the date

- For claiming ITC U/s 18 taxable shall within 30 days from the date when he become eligible shall make an declaration in form GST ITC-01. Extension can be provided by commissioner.

- Above declaration shall be duly certified by Practicing CA/ CMA if aggregate value of ITC exceeds Rs. 2,00,000.

Section 18(3)

When change in constitution of a registered person due to sale, merger, demerger, amalgamation, lease or transfer of business with the specific provision of transfer of liabilities then such registered person allowed to transfer ITC available in electronic credit ledger to transferee.

[In case of demerger ITC shall be apportioned in the ration of value of asset]

Notes:

- For capital goods held in stock ITC involved in remaining useful life in month shall be computed on prorate basis, assuming useful life as 60 months i.e. 5 years.

- If invoice not available the registered person estimate the amount based on prevailing market value.

- Such amount shall be added to output tax liability of registered person, such details shall be furnished in form GST ITC-03 and also furnished details certified by practicing CA/ CMA.

- Remaining balance of ITC in electronic credit ledger shall be laps.

- IGST, CGST and SGST/UTGST shall be determined separately.

- Reversal of ITC if payment not made to supplier.

Section 18(6)

Supply of capital goods or plant and machinery on which ITC

⇓

Supply of capital goods or plant and machinery on which ITC taken the registered person shall pay an amount equal to HIGHER of following:

ITC on such capital goods or plant and machinery reduced by 5% per quarter or part thereof from the date of invoice.

OR

Tax on transaction value of capital goods or plant and machinery determined as per section 15.

In case of refractory bricks, moulds and dies, jigs, and fixtures are supplied as SCRAP, the taxable person may pay tax on the transaction value of such goods determined as per section 15.

Suppose X has procured material from Y. Y has supplied the material with payment of GST.

The material got destroyed en route. Y has made good of the material by sending replacement material. Now X cannot claim input credit as per section 17(5) of CGST Act,

But at the e_ledger the tax invoice against the first consignment (which got destroyed) is still open? What X has to do so that the invoice against the destroyed does not appear at his e_ledger. Pl help

In second point you have wrote that in case of post sales discount , ITC shall not be allowed , however as per circular no. 92/11/2019 heading secondary discount it is written that commercial credit note can be issue , and it has no impact in the value of supplies ,means no reversal of ITC.

Kindly correct your point.