I. Input Tax Credit

CGST Act 2017 sec16. Eligibility and conditions for taking input tax credit.—

1.Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.

Conditions

(a) he is in possession of a tax invoice or debit note issued by a supplier registered under this Act, or such other tax paying documents as may be prescribed;

The details of the invoice or debit note referred to in clause (a) has been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note in the manner specified under section 37.

(b) he has received the goods or services or both.

(c) subject to the provisions of section 41, the tax charged in respect of such supply has been actually paid to the Government, either in cash or through utilization of input tax credit admissible in respect of the said supply

(d) he has furnished the return under section 39

(e) Where the registered person has claimed depreciation on the tax component of the cost of capital goods and plant and machinery under the provisions of the Income tax Act, 1961, the input tax credit on the said tax component shall not be allowed.

(f) A registered person shall not be entitled to take input tax credit in respect of any invoice or debit note for supply of goods or services or both after the 30 th day of November following the end of financial year to which such invoice or debit note pertains or furnishing of the relevant annual return, whichever is earlier.

II. How will I know if my ITC has been unblocked?

You will receive an email message as well as an SMS – “Please visit your Credit ledger to see the amount of credit unblocked by the jurisdictional officer.”.

Navigate to Services > Ledgers > Electronic Credit Ledger. You will notice the ITC has been unblocked.

(Source: https://tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t=Receiving_Intimation_of_ITC_Blocked_by_Tax_Official.htm)

(Source: https://tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t=Receiving_Intimation_of_ITC_Blocked_by_Tax_Official.htm)

III. Eligibility to Claim Input Tax Credit

A consignment of coal is to be dispatched from Kolkata to Mumbai using 5 trucks. An invoice was issued to the recipient on March 10, 2022. Three trucks reached the claimant by March 30, 2022 but the trucks carrying the final lot of the consignment reached the recipient only on April 2, 2022. In this case, input tax credit for the entire consignment can be availed only in the month of April 2022.

IV. Ineligible to claim ITC

ITC cannot be claimed in the following cases.

a. Purchase of capital goods used for non-business purposes.

b. Composition dealers

c. Purchase of capital goods used for manufacturing exempted goods.

d. Blocked credits (Section17(5)

(Source: https://icmai.in/upload/Students/Syllabus2022/Inter_Stdy_Mtrl/P7_B.pdf)

V. Documents required for claiming ITC

Documentary requirements and conditions for claiming input tax credit [Rule 36]

1. The input tax credit shall be availed by a registered person, including the Input Service Distributor, on the basis of any of the following documents, namely,-

a. an invoice issued by the supplier of goods or services or both in accordance with the provisions of sec. 31;

b. an invoice issued in accordance with the provisions of s. 31(3)(f), subject to the payment of tax;

c. a debit note issued by a supplier in accordance with the provisions of sec. 34;

d. a bill of entry or any similar document prescribed under the Customs Act, 1962 or rules made thereunder for the assessment of integrated tax on imports;

e. an Input Service Distributor invoice or Input Service Distributor credit note or any document issued by an Input Service Distributor in accordance with the provisions of rule 54(1).

(https://icmai.in/upload/Students/Syllabus2022/Inter_Stdy_Mtrl/P7_B.pdf)

VI. Questions

Apportionment of Credit

1.Mr X registered person provides the following information for the month of May 2022 :

|

Input tax credit in respect of inward supply |

₹4,00,000 |

| Taxable supply (Excluding zero rated supply) | ₹20,00,000 |

| Export i.e., zero-rated supply | ₹ 5,00,000 |

| Exempt supplies | ₹ 5,00,000. |

| Inward supplies on which he is liable to pay tax on reverse charge basis | ₹ 5,00,000 |

Compute of ITC available to Mr. X

Answer

|

Taxable supply (Excluding zero rated supply) |

₹20,00,000 |

| Exempt supplies | ₹ 5,00,000 |

| Export i.e., zero-rated supply | ₹ 5,00,000 |

| Inward supplies on which he is liable to pay tax on reverse charge basis | ₹ 5,00,000 |

| Total Supply A | ₹ 35,00,000 |

| Total Supply Out of this taxable supply including zero rated supplies | [₹ 20,00,000 + ₹ 5,00,000] B ₹ 25,00,000 |

Input tax credit in respect of inward supply C ₹4,00,000 ITC available [C x B/A] for the month of May 2022 ₹ 2,85,714

VII. Inverted Tax Structure

The term inverted Tax structure refers to a situation where the rate of tax on inputs purchased (i.e GST rate paid on inputs received) is more than the rate of tax (GST rate payable on outward supplies) on outward supplies.

VIII.Refund of Tax

Situations leading to refund claims: The relevant date provision embodied in Section 54 of the CGST Act, 2017, provision contained in Section 77 of the CGST Act, 2017 and the requirement of submission of relevant documents as listed in Rule 89(2) of CGST Rules, 2017 is an indicator of the various situations that may necessitate a refund claim.

A claim for refund may arise on account of:

(a) export of goods or services;

(b) supplies to SEZs units and developers;

(c) supply of goods regarded as Deemed Exports;

(d) refund of taxes on purchase made by UN or embassies etc. under Section 55 of CGST Act, 2017;

(e) refund arising on account of judgment, decree, order or direction of the Appellate Authority, Appellate Tribunal or any court;

(f) refund of accumulated Input Tax Credit on account of inverted rate structure;

(g) finalization of provisional assessment;

(h) refund of pre-deposit;

(i) tax paid in excess/by mistake;

(j) Refunds to International tourists of GST paid on goods in India and carried abroad at the time of their departure from India (not notified yet);

(k) refund of tax paid in wrong head under Section 77 of CGST Act, 2017 & Section 19 of IGST Act, 2017 (treating the supply as intra-State supply which is subsequently held as inter-State supply and vice versa);

(l) refund on account of any other reasons. Thus, practically every situation is covered. The GST law requires that every claim for refund is to be filed within 2 years from the relevant date.

(Source: https://taxguru.in/goods-and-service-tax/gst-refunds-what-you-should-know.html)

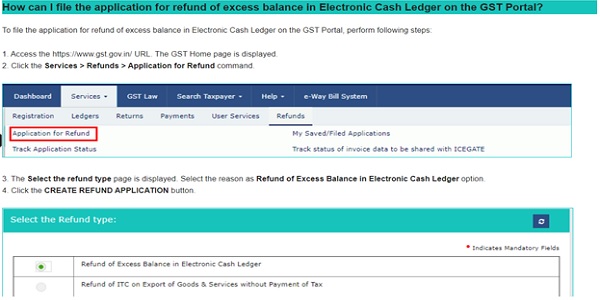

(Source:https://tutorial.gst.gov.in/userguide/refund/index.htm#t=Application_for_Refund_manual.htm)

IX. Standardization of procedure:

The GST laws contains standardised provisions for making a refund claim.

A. Refund pre-application

Refund pre-application is a form that taxpayers must fill out to offer information about their business, Aadhaar number, income tax details, export data, expenditure and investment, and so on. Taxpayers must file this pre-application form for all types of GST refund.

B. FORM GST RFD-01

Every claim, except for claim on account of integrated tax paid on export of goods and refund under section 55 of the CGST Act, 2017, has to be filed online in FORM GST RFD-01. The application will be assigned by the system to the proper officer who shall, within a period of fifteen days of filing of the said application, scrutinize the application for its completeness and where the application is found to be complete in all terms, an acknowledgement in FORM GST RFD-02 is made available to the applicant through the common portal electronically. The proper officer has to convey deficiencies, if any, in the refund claimed within 15 days and in such cases the claim will be sent back to the applicant along with the notified deficiencies. The refund claim filed post rectification of deficiencies shall be treated as fresh refund claim. The time period from the date of filing ofrefund claim to the date ofissuance of deficiency memo in Form GST RFD-03 would be excluded for computation of time period of 2 years for filing of refund claim under sub-section (1) of section 54 of the CGST Act, 2017. The claim, if in order, is sanctioned in FORM GST RFD-06 within a period of 60 days from the date of receipt of the application if claim is complete in all respects. If this mandatory period is exceeded, interest at the rate of 6% (9% in case of refund made on order passed by an adjudicating authority or Appellate Tribunal or court which has attained finality) becomes payable along with refund from the expiry of 60 days till the date of payment of refund. However, if the refund claim is on account of pre-deposit made before any appellate authority, the interest becomes payable from the date of making such payment.

(Source: https://www.cbic.gov.in/resources//htdocs-cbec/gst/refund-in-gst.pdf).

X. References.

2. https://icmai.in/upload/Students/Syllabus2022/Inter_Stdy_Mtrl/P7_B.pdf.

3. https://icmai.in/upload/Students/Syllabus2022/Inter_Stdy_Mtrl/P7_B.pdf.

4. https://www.cbic.gov.in/resources//htdocs-cbec/gst/refund-in-gst.pdf