Case Law Details

In re Varachha Co-op. Bank Ltd (GST AAAR Gujrat)

Introduction: In the legal case of Varachha Co-op. Bank Ltd. before the GST AAAR Gujarat, a pivotal query arises concerning the availability of Input Tax Credit (ITC) in the context of a construction project. The appellant has embarked on the construction of their new administrative office and seeks clarity regarding their ITC entitlement for various items, including the Central Air Conditioning Plant, Lift, Electrical Fittings (excluding those used in civil construction), Solar Plant, Fire Safety Extinguishers, Architect Service Fees, and Interior Designing Fees.

Detailed Analysis:

1. Central Air Conditioning Plant:

- Appellant’s Claim: The Central Air Conditioning System is not an immovable property, and thus, not subject to ITC restrictions.

- Authority’s Decision: The Central Air Conditioning Plant was classified as an immovable property, rendering it ineligible for ITC.

2. Lift:

- Appellant’s Claim: The Lift/Elevator installation process and components should not categorize it as an immovable property.

- Authority’s Decision: The installation of Lifts was categorized as a works contract service for immovable property construction, making it ineligible for ITC.

3. Electrical Fittings:

- Appellant’s Claim: Most Electrical Fittings are concealed within the building and should not be categorized as immovable property.

- Authority’s Decision: Electrical Fittings are considered a works contract service, integrated into the building structure, and thus, ineligible for ITC.

4. Roof Solar Plant:

- Appellant’s Claim: The Roof Solar Plant, designed for in-house consumption and flexibility in installation angles, should not be classified as immovable property.

- Authority’s Decision: The Roof Solar Plant was considered plant and machinery, hence eligible for ITC.

5. Fire Safety Extinguishers:

- Appellant’s Claim: Fire Safety Extinguishers, as mandated by law, should not be classified as immovable property.

- Authority’s Decision: Fire Safety Extinguishers, integral to the building, are considered immovable property and are ineligible for ITC.

6. Architect Service Fees and Interior Designer Fees:

- Appellant’s Claim: Architect Service Fees and Interior Designer Fees should be eligible for ITC as capital expenses.

- Authority’s Decision: Both services are related to the construction of immovable property, classifying them as works contract services and making ITC disallowed.

Conclusion: In summary, ITC eligibility in a construction project hinges on whether the supplied items or services become part of the immovable property. Items such as Central Air Conditioning Plant, Lift, Electrical Fittings, and Fire Safety Extinguishers were classified as immovable property, rendering them ineligible for ITC. Conversely, the Roof Solar Plant was deemed to be plant and machinery, making it eligible for ITC. Architect Service Fees and Interior Designer Fees were also ineligible due to their connection with the construction of immovable property. This case underscores the critical importance of accurately categorizing items and services when seeking ITC in construction projects

Read AAR Order : Admissibility of ITC on Central AC Plant, Lift, New Locker Cabinet installed during Construction of New office

FULL TEXT OF THE ORDER OF AUTHORITY FOR ADVANCE RULING, GUJARAT

At the outset we would like to make it clear that the provisions of the Central Goods and Services Tax Act, 2017 and Gujarat Goods and Services Tax Act, 2017 (hereinafter referred to as the ‘CGST Act, 2017‘ and the ‘GGST Act, 2017’) arc in pall materia and have the same provisions in like matter and differ from each other only on a few specific provisions. Therefore, unless a mention is particularly made to such dissimilar provisions, a reference to the CGST Act, 2017 would also mean reference to the corresponding similar provisions in the GGSTs Act, 2017.

2. The present appeal has been filed under Section 100 of the CGST Act, 2017 and the GGST Act, 2017 by M/s The Varachha Co-op. Bank Ltd.. against the Advance Ruling No. GURGAAR/R/37/2021 dated 30.07.2021.

3. Briefly the facts are enumerated below for ease of understanding.

4. M/s. The Varachha Co-Op. Bank Ltd., 1 to 10, Anil Tower, 1.H. Road, Surat-395006, Gujarat (hereinafter referred to as ‘the appellant’) , holding, GSTIN., 24AABAT4356N1Z6, submitted that they are constructing a new administrative building and incurring cost on various services. The appellant. further submitted that they were eligible for Input Tax Credit [ITC] on the below mentioned goods and services in view of the foregoing viz:

|

Sr. No. |

Nature of Cost/ Expenses | Head under which expense will be booked | Capitali zed or not | Remark |

| 1. | Central Air Conditioning Plant | Plant & Machinery | Yes | Being plant Not covered under Immovable Property & hence ITC available. |

| 2. | New Locker Cabinet | Locker Cabinets | Yes | Being Furniture Not covered under Immovable Property & hence ITC available. |

| 3. | Lift | Plant & Machinery | Yes | Being Plant Not covered under Immovable Property & hence ITC available. |

| 4. | Electrical fittings, such as Cables , Switches, NCB and other Electrical Consumables material | Electrical fittings | Yes | Being Electrical Fittings Not covered under Immovable Property & hence ITC available. |

| 5. | Roof Solar Plant | Plant & Machinery | Yes | Being Plant Not covered under Immovable Property & hence ITC available. |

| 6. | Generator | Plant & Machinery | Yes | Being Plant Not covered under Immovable Property & hence ITC available. |

| 7. | Fire Safety Extinguishers | Plant & Machinery | Yes | Being Plant Not covered under Immovable Property & hence ITC available. |

| 8. | Architect Service Fees | Profit & Loss Account | No | Not being capitalized and charged to P&L A/C no restriction on ITC |

| 9. | Interior Designing Fees | Profit & Loss Account | No | Not being capitalized and charged to P&L A/C no restriction on ITC |

5 Before the Gujarat Authority for Advance Ruling [GAAR], the appellant sought advance ruling on the following question:

Whether the appellant, having undertaken the construction of their new administrative office, will be eligible for the ITC of following:

i) Central Air Conditioning Plant (Classified & Grouped under ‘Plant & Machinery’ )

ii) New Locker Cabinet (Classified & Grouped under ‘Locker Cabinets)

iii) Lift (Classified & Grouped under ‘Plant & Machinery’)

iv) Electrical Fittings, such as Cables, Switches, NCB and other Electrical Consumables Materials (Classified & Grouped under Separate Block namely ‘Electrical Fittings)

v) Roof Solar (Classified & Grouped under ‘Plant & Machinery)

vi) Generator (Classified & Grouped under ‘Plant & Machinery’)

vii) Fire Safety Extinguishers (Classified & Grouped under Plant & Machinery’)

viii) Architect Service Fees (Charged to Profit & Loss Account)

ix) Interior Designing Fees (Charged to Profit & Loss Account)

6. The GAAR, vide its order No. GUJ/GAAR/R/37/2021 dated 30.07.2021, gave its ruling as under:

i) Input Tax Credit is admissible on New Locker Cabinet and Generator;

ii) Input Tax Credit is blocked under Section 17(5)(c) CGST Act for Central ; Air Conditioning Plant, Lift. Electrical Fittings. Fire Safety Extinguishers, Roof Solar Plant;

iii) Input Tax Credit is blocked under Section 17 (5) (d) CGST Act for Architect Service and Interior Decorator Fees.

7. Feeling aggrieved with the ruling in respect of (ii) & (iii) supra, the appellant has preferred the present appeal raising the following plea:

a) GAAR has erred in interpreting section 17(5) of the CGST Act, 2017 whereby the ITC which was otherwise eligible to the appellant. is denied. The appellant submitted reasons and justification for each item on which ITC was claimed as follows:

Central Air Conditioning System

The appellant had entered into a contract for ‘supply & erection’ of ‘Central Air Conditioning System’. Section 2(119) of the CGST Act, defines ‘Works Contract’. The expression ‘works contract’ is limited to contracts to do with immovable property, which is defined in clause 3(26) of the General Clauses Act. 1897. Section 3 of the Transfer of Property Act 1882, further defines the phrase ‘attached to earth’.

The supply received by the appellant does not involve assimilation with the property and the work carried out by the supplier is only to make the plant ready for a ‘wobble free operation’. Thus, the activity undertaken by the supplier cannot be considered as an ‘Immovable Property’ by applying the permanency test. The appellant also relied upon the decision of AAAR of Maharashtra in the case of Nikhil Comforts 1202001gISTL 417(AAAR-GST-Mah.)I and the ruling in the case of M/s. BAHL Paper Mills Ltd., [2018(14)GSTL. 306(AAR-GST)].

Lift

The supply of Lift will he booked under the head of ‘Plant & Machinery’ in the books of accounts. The purpose behind attaching Lift to a concrete base was to prevent wobbling of the lift, to secure maximum operational efficiency and also for safety. The lift as per the appellant, will be saleable if somebody wants to purchase it could he dismantled and sold. Thus, it would not he prudent to hold the lilt. assembled and erected at the premises, to be an immovable property. Further. the Apex court in the case of M/s. Sirpur Paper Mills 11998 (97) ELT 3 (SC)1 held that where Plant & Machinery are capable of being dismantled and sold without being destroyed and are only embedded to the earth because of operational efficiency, it is not an immovable property. Even by this analogy also, ITC is available in their case.

Electrical Fittings

The appellant will install ‘Electrical Fittings’ both at the exterior and the interior. The appellant does not intend to avail ITC on Electrical Fittings used in civil construction as it is being blocked via section 17(5). However, for rest of the ‘Electrical Fittings’. there is no specific barring provisions. The appellant also wishes to rely on the ruling of M/s. Nipro India Corporation P. Ltd., [2018(18) GSTL 289 (AAR-GST)].

Roof Solar Plant

The solar equipment can be qualified as ‘Plant and Machinery’ will be used for furtherance of business i.e. in its business of supplying taxable service. Even though generation of electricity is an exempt supply, the appellant will he using electricity solely & consuming it captively for the purpose of supplying taxable services. From the above it is inferred that the ‘Roof Solar Pant’ will be attached to earth for operational efficiency. The whole purpose behind attaching it to a concrete base will be to secure maximum operational efficiency and for safety purpose. Further, it is also seen that the ‘roof solar plant’ is saleable and that if’ somebody wants to purchase, it can be dismantled and sold. Further, it would not he correct to hold that the ‘Roof Solar Plant’ assembled and erected at the premises of the appellant is an immovable property.

Fire Safety Extinguishers

Fire Safety Extinguishers is nothing but ‘Plant and Machinery attached to earth which is movable as well as marketable also. They further also relied on the case of M/s. Sirpur Paper Mills, supra. Further as per the Gujarat Fire Prevention and Life Safety Measures Act, 2013. the appellant is duty bound to install lire safety instruments/system at their premises. Further credit restriction is only in so far as inputs/input services ‘ for construction of an immovable property’ is concerned and does not apply to capital goods. The restriction provided under section 17(5)(c ) & (d) does not apply to procurement of various inputs which arc installed in their administrative building. I hence. ITC should be available to the appellant on these goods.

Architect Service Fees

The appellant appointed architect i.e. Mr. Jignesh Moradiya and M/s. Keystone Consultants, for structural design of building. The explanation under section 17(5) defines the expression ‘construction’. In the instant case the said expenses is not capitalized and is charged to ‘Profit & Loss Account’ and hence ITC is admissible.

Interior Designing Fees

The appellant has appointed the Interior Designer i.e. M/s. Pankaj Dhakhar & Associates for ‘Interior Design Development’ of building which will be ultimately used for provision of supply of service. In the instant case, the said expenses is not capitalized and is charged to ‘Profit & Loss Account’ and hence the ITC is admissible.

The appellant on the basis of above submissions requested to set aside the ruling issued by the GAAR (to the extent ITC is disallowed) and allow ITC on the inward supply of the goods/ services as mentioned in the appeal.

8. During the course of virtual personal hearing held on 06.01.2023 and 26.7.2023, the authorized representative for the appellant, Shri Hardik P Shah reiterated the submissions made in their appeal and submitted that they were eligible for ITC on the following:

i) Central Air-conditioning Plant

ii) Lift

iii) Electrical fittings not for civil construction

iv) Solar Plant

v) Fire Safety Extinguishers

vi) Architect Service Fees

vii) Interior Designing Fees

Further, the appellant forwarded the copies of following orders/article in support of their contentions:

b) Order No. KAR ADRG 25/2019 dated 12.09.2019 passed by the Authority for Advance Ruling, Karnataka in the case of M/s. Shri Keshav Cement and Infra Limited.

c) Article from the portal TaxGuru with reference to order dated 13.09.2021 passed by Authority for Advance Ruling, Rajasthan in the case of M/s. Pristine Industries Ltd

Discussions and Findings:

9. We have gone through the facts of the case as mentioned in the Appeal papers, the Ruling of the GAAR, documents on record and oral as well as all the written submissions made by the appellant.

10. We find that the appellant had sought ruling on the questions mentioned in para 5 above which was decided vide the impugned order dated 30.7.2021.

11. As is already mentioned, the GAAR allowed ITC on New Locker Cabinet and Generator. However, it held that ITC is blocked under Section 17 (5)(c) of the CGST Act, 2017 for Central Air Conditioning Plant; Lift; Electrical Fittings; Fire Safety Extinguishers and Roof Solar Plant. Further, it held that ITC is blocked under Section 17(5)(d), ibid in respect of Architect Service and Interior Decorator Fees. The appellant has filed the present appeal against the order of GAAR rejecting ITC on the aforementioned items, wherein ITC stands blocked/disallowed.

12. The provisions of ITC and blocked credit provided under sections 16 & 17 of the CGST Act, 2017, states as under: [relevant extracts]

Section 16. Eligibility and conditions fbr taking input tax credit.-

(1) Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49. be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall he credited to the electronic credit ledger of such person.

“Section 17: Apportionment of credit and blocked credits

(1) Where the goods or services or both are used by the registered person partly for the purpose of any business and partly for other purposes, the amount of credit shall be restricted to so much of the input tax as is attributable to the purposes of business.

(2) Where the goods or services or both are used by the registered person partly for effecting taxable supplies including zero-rated supplies under this Act or under the Integrated Goods and Services Mx Act and partly for effecting exempt supplies under the said Acts, the amount of credit shall be restricted to so much of the input tax as is attributable to the said taxable supplies including zero-rated supplies.

………..

…………

(5) Notwithstanding anything contained in sub-section (1) of section 16 and subsection (1) of section 18. input tax credit shall not he available in respect of the following, namely:-

(c) works contract services when supplied for construction of an immovable property (other than plant and machinery) except where it is an input service for further supply of works contract service:

(d) goods or services or both received by a taxable person for construction of an immovable property (other than plant or machinery) on his own account including when such goods or services or both are used in the course or furtherance of business .

Explanation. “For the purposes of clauses (c) and (d). the expression ‘construction’ includes re-construction, renovation. additions or alterations or repairs, to the extent of capitalization. to the said immovable properly:

Explanation.- For the purposes of this Chapter and Chapter VI. the expression “plant and machine’).”means apparatus. equipment. and machinery fixed to earth by foundation or structural support that are used for making outward supply of goods or services or both and includes such foundation and structural supports but excludes-

(i) land, building or any other civil structures:

(ii) telecommunication towers: and

(iii) pipelines laid outside the .factory premises.

13. ‘Immovable property’ is not defined under GST. However, its defined under section 3(26) of the General Clauses Act, 1897 to include land, benefits to arising out of land and things attached to the earth, or permanently fastened to anything attached to the earth. Likewise, section 3(36) of General Clauses Act, 1897, defines “movable property” to mean property of every description, except immovable property. Further, section 3 of the Transfer of Property Act, 1882 stipulates that unless there is something repugnant in the subject or context, “immovable property” does not include standing timber, growing crops or grass. Section 3, further, defines the term “attached to the earth” to mean (a) rooted in the earth, as in the case of trees and shrubs. (b) embedded to earth, as in the case of walls or buildings and (c) attached to what is so embedded for permanent beneficial enjoyment of that to which it is attached. Thus, on a conjoint reading. “immovable property”, essentially means something which is attached to the earth, or permanently fastened to anything attached to the earth, or forming part of the land and not agreed to be severed before supply or under a contract of supply.

14. We now move on to examine the seven disputed supplies for which this appeal is preferred.

15. Central Air Conditioning Plant

15.1. The appellant states that they had entered into a contract for ‘supply & erection’ of ‘Central Air Conditioning System’. Relying on section 2(119) of the CGST Act, which defines a ‘Works Contract’, the appellant states that works contract is limited to immovable property; that the supply does not involve assimilation With the property; that the work carried out by the supplier is to make the plant ‘wobble free for operation’ and hence it cannot be considered as an `Immovable Property’ by applying the permanency test.

15.2. A conjoint reading of sections 16(1) and 17(5)(c), ibid, shows that ITC can be availed by a registered person subject to conditions and restrictions prescribed on any supply of goods or services or both, which are used or intended to be used in the course of furtherance of his business. The restrictions imposed las far as the present context is concerned is that ITC is not eligible for works contract services when supplied for construction of any immovable property except when it is an input service for further supply of works contract service. The only exception being when the works contract service is supplied for construction of’ plant and machinery. The section further goes on to define plant and machinery.

15.3. Now, as per www.electricalworkbook.com in a central air-conditioning system, all the components of the system are grouped together in one central room and conditioned air is distributed from the central room to the required places through extensive duct work. The whole system can be divided into three parts.

i) Plant room, which includes compressor, condenser and motor

ii) Air handling unit (AHU room)

iii) Air distribution system (Ducting)

15.4 The plant room is located away from the room to be air conditioned. Other components are grouped together in a AHU and conditioned air is circulated through air distribution system i.e. ducting with the help of fan or blower to the room to be air-conditioned. The air, which is to be conditioned, is directly allowed to flow over the evaporator coil. Low pressure and temperature refrigerant passing through evaporator coil absorbs heat from the air. Thus the air gets cooled.

15.5 appellant has not submitted the details of supply of Central Air Conditioning Plant, its installation and functioning. However, from the general details of installation and functioning of a central air conditioning plant mentioned above, we find that the contention of the appellant that the supply does not involve assimilation with the property and the work carried out by the supplier is only towards making the plant ready for a ‘wobble free operation’ is not true representation of facts. As is evident the Central Air Conditioning Plant becomes a part of the building once it is installed and thereby an immovable property.

15.5 It is in this context that we would like to refer to CBEC’s [now CBIC] Order No. 58/1/2002-CX dated 15.01.2002, wherein under Para 5(iii), with regards to Refrigeration/ Air-Conditioning Plants, it is mentioned as follows:

“5(iii) Refrigeration/Air conditioning plants. “These are basically systems comprising of compressors, ducting. pipings. insulators and sometimes cooling towers etc. They are in the nature of systems and are not machines as a whole. They come into existence only by assembly and connection of various components and parts. ‘Though each component is dutiable, the refrigeration/air conditioning system as a whole cannot he considered to be excisable goods. Air conditioning units, however. would continue to remain dutiable as per the Central Excise Thrift:”

Taking inference from the above Board’s circular we find that the supply of Central Air Conditioning Plant falls under the category of works contract service supplied for construction of an immovable property. We would also like to rely on the judgement of the Hon’ble Supreme Court in the case of Globus Stores P. Ltd., [2011 (267) ELT 435 (S.C.)] wherein it was held that air-conditioning plant is an immovable property.

3. In the present appeals also, we are concerned with the air-conditioning plant which is the same good us that of Brothers (supra).1he learned counsel appearing fir the appellant, however, has drawn our attention to the decision of this court in Commissioner of Central Excise, Ahmedabad v. Solid & Correct Engineering Works 2010 (252) E.L. T. 481. In the said decision, this court had considered the case of setting up of Asphalt Drum/I lot Mix plant. Apart from the _fact that the aforesaid good is different from the good in question, even the circular which is referred to and relied upon by this Court in the case of Virdi Brothers (Supra) was not considered in the said decision as the subject matter was totally different. Besides, the air-conditioning was an immovable article whereas Asphalt drum/Hot mix plant is a movable article Therefore, in our considered opinion. the facts of both the cases are different and therefore, distinguishable. For what is required to he decided in the present case stands already decided by this court in Virdi Brothers (supra). which applies to the case in hand with full force.

[emphasis supplied]

15.6 As the construction of central air conditioning plant via a works contract service as pointed out above, makes it an immovable property, it ceases to be a plant and machinery.

15.7. In view of the foregoing, we hold that the ITC on the supply of Central Air Conditioning Plant, ceases to be a plant and machinery & hence, is blocked under Section 17(5)(c) of CGST Act, 2017 as the same is works contract services for construction of an immovable property.

16. Lift

16.1. The appellant has entered into an agreement with M/s. Schindler India Private Ltd., for supply and installation of Lift/Elevator. The components of a lift include – the elevator car, elevator doors, hoist way or shaft, elevator control system, safety systems, counterweights, guide rails, call buttons, emergency communication system, lighting, and ventilation. In the agreement for supply, M/s. Schindler India Private Ltd., had mentioned the following installation steps viz:

i) Installing of hoisting equipment and testing hitch point

ii) Template fixing

iii) Installing of mechanical pit components

iv) Installing of car structure for use as working platform

v) Installing of brackets and guide rails

vi) Installing of cabin door and landing doors

vii) Installing of headroom components and commissioning of machine

viii) Wiring in hoist way and pit

ix) Completion of cabin

x) Installation of belt

xi) Commissioning

xii) Quality inspection & handover to customer

On examining the above agreement for supply of lift, we find that the same falls under the category of ‘works contract’ service as defined under section 2(119) of CGST Act, 2017, as it fulfills the description of the works contract service.

16.2. We find that in the case of M/s. Otis Elevator Company (India)[2003 (151) ELT 499] the Hon’ble Bombay High Court, held that lift/elevator is an integral part of immovable property, viz [relevant extract]:

“9.Having; heard the rival contentions and having examined all the citations referred to hereinabove, we are clearly of the opinion that the same shall apply to the Acts of this case in All force and item in question being immovable property cannot he subjected to excise under the tariff heading claimed by the Revenue. The case sought to be made out by the petitioner is also covered by the decision of the Government of India in reference, Otis Elevator Company (India) Ltd., 1981 (3) E.L.T 720 (G01), wherein it was clearly held that if an article does not come into existence until it is fully erected or installed, adjusted, tested and commissioned in a building, and on complete erection and installation of such article when it becomes part of immovable property, ………………..

[emphasis supplied]

In view of the foregoing, we find that the lift would become an immovable property after being erected and installed, as it is attached to the building itself.

16.3. As the erection, installation and commissioning of lift via a works contract service as pointed out above, makes it an immovable property, it ceases to be a plant and machinery.

16.4. In view of the above discussions in terms of section 17 of the CGST Act, the appellant is not entitled to ITC of GST paid on supply of Lift/Elevator.

17. Electrical fittings such as Cables, Switches, NCB and other Electrical consumables materials

17.1. The appellant states that they will install ‘Electrical Fittings’ in both exterior and interior and further concedes that they do not intend to avail 1–1.0 on Electric Fittings used in civil construction. However, for the rest of the ‘Electrical Fittings’, they intend to avail ITC on the premise that there is no specific barring provisions.

17.2. The electrical fittings are mostly concealed into the wall/floor of the building. They are concealed or fitted on to the building through pipes as it serves the dual purpose of safety and aesthetics. The supply of electrical fittings involves its installation also. The supply therefore falls under the category of Works Contract Service’. Further on installation of the electrical fittings it becomes part of the building and thereby an immovable property.

17.3. In view of the foregoing, we find that the supply of electrical fittings after installation and commissioning becomes part of the building i.e. immovable property and thus in terms of section 17 of the CGST Act, we hold that the appellant is not entitled to ITC of GST paid on Electrical fittings.

18. Roof Solar Plant

18.1. As per the appellant they will be installing a Roof Solar Plant atop their building to generate electricity which will ultimately be used for provision of supply of service. They further stated that they will enter into comprehensive SITC contract (supply, installation, testing and commissioning) with the vendor.

18.2. We find that the appellant has enclosed as Annexure VII to the appeal papers ‘Proposal for solar Project by M/s. Raj Electricals’. The relevant portion, is scanned below for ease of reference viz

–

–

–

–

–

–

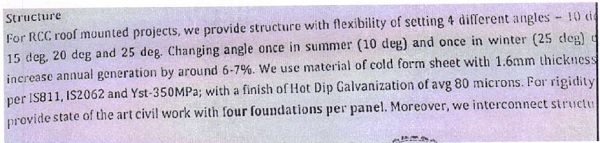

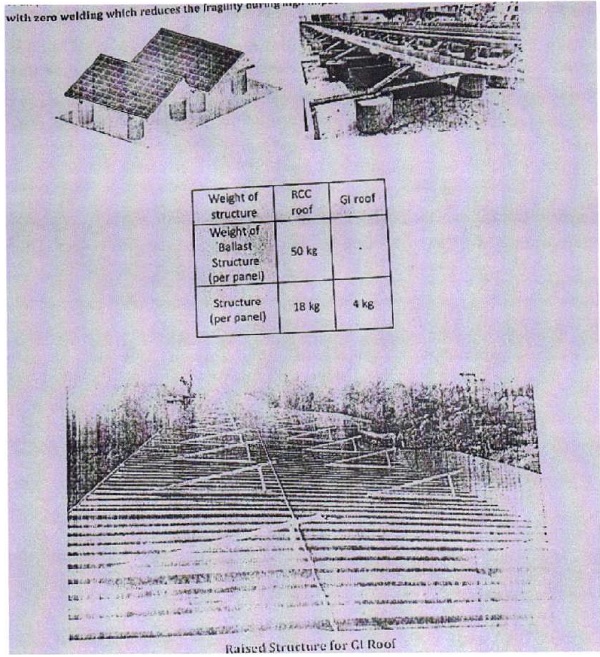

18.3. On going through the above, what is forthcoming is as under:

- that the solar PV plant is for captive consumption as the energy generated is to be used in-house & only in case the available energy exceeds the demand, it would be ‘exported’ to the DGVCL grid via Net Metering System;

- that it will have work with four foundations per panel;

- that the entire structure is supported by nuts and bolts with zero welding which reduces the fragility during high impacts;

- that it will have flexibility of setting 4 different angles 10″ , 150, 200, 25° ; that changing the angle once in summer 100 & once in winter 250 , can increase annual generation by around 6-7%.

18.4. In view of the foregoing, it is abundantly clear that the roof solar plant, affixed to foundation via nuts and bolts and which has the flexibility of 4 different angles is not an immovable property but a plant and machinery. The applicant has further stated that they have capitalized the roof solar plant in their books of accounts. The Roof Solar Plant, as is evident is not permanently fastened to the building. Thus, it qualifies as a plant and machinery and is not an immovable property, hence, it is not covered under blocked credit as mentioned in 17(5)(d) of the CGST Act, 2017. Therefore we hold that the applicant is eligible for input tax on roof solar plant.

19. Fire Safety Extinguishers

19.1. The appellant has entered into agreement for supply and installation of `Fire Safety Extinguishers’ in their building premises. The appellant has submitted that in terms of sections 18, 19, 20 & 21 of The Gujarat Fire Prevention and Life Safety Measures Act, 2013, it is mandatory to install lire safety instruments/ systems at their premises. We find that while section 18 of the said Act ibid makes installation of firefighting and life safety installations mandatory, section 19 mandates that the occupancy certificate can be issued only after compliance of the provisions of section 18. Thus, it can be inferred that Fire Safety Extinguishers are integral part of any building. A building is only complete and can be occupied only when Fire Safety Extinguishers are i n place. Fire Safety Extinguishers however are permanently attached to the building and are in place during the entire life time of the building.

19.2. The Hon’ble Supreme Court of India in the case of Commissioner of Central Excise, Ahmedabad Vs. Solid & Correct Engineering Works 12010 (252) E.L.T. 481 (S.C.)] held at Para 33 as under:

“33. It is noteworthy that in none of the cases relied upon by the assessee referred to above was there any element of installation of the machine for a given period ()lame as is the position in the instant case. The machines in question were by their very nature intended to be fixed permanently to the structures which were embedded in the earth. The structures were also custom made for the fixing of such machines without which the same could not become functional. The machines thus becoming a part and parcel of the structures in which they were fitted were no longer moveable goods. It was in those peculiar circumstances that the installation and erection of machines at site were held to he by this Court, to he immovable property that ceased to remain moveable or marketable cis they were at iii time of their purchase. Once such a machine is fixed, embedded or assimilated in a permanent structure, the movable character of the machine becomes extinct….”

[emphasis supplied]

19.3. In the present case too we find that there is an intention to install the `Fire Safety Extinguishers’ permanently to the building. The Fire Safety Extinguishers once fitted, no longer remains movable goods as it gets assimilated in a permanent structure i.e. the administrative building of the appellant.

19.4. As the supply and installation of fire safety extinguishers as pointed out above, makes it an immovable property, it ceases to be a plant and machinery.

19.5. Hence, in view of the above discussions we find that the appellant is not entitled to ITC of GST paid on Fire Safety Extinguishers in view of the provisions of section 17(5)(c) of the CGST Act, 2017.

20. Architect Service Fees and Interior Designer Fees

20.1 The appellant has appointed Architect who will carry out the structural design of their new administrative building. Further they have also hired the services of Interior Designer who will carry out the interior design of their new administrative building.

20.2 We find that it is undisputed that the services of an Architect and Interior Designer availed is with regard to construction of an immovable property i.e. the new administrative/office building of the appellant.

20.3. The appellant, we find has contended that the expenses related to Architect services and Interior Designing fees is not being capitalized and is charged to Profit & Loss Account, to further substantiate their claim for availment of ITC. We find that Accounting Standards IASI 10 issued in terms of Section 133 of the Companies Act, 2013, prescribe the accounting treatment for property, plant and equipment. AS 10, states as follows: [htlps://www.icai.org/wwvr’.icai.org/post/accounting- standards-as-on- 1st Feb. 2022]

Elements of cost

17. The cost of an item of properly, plant and equipment comprises:

(a) its purchase price, including import duties and non refundable purchase taxes.. after deducting trade discounts and rebates.

(b) any costs directly attributable to bringing the asset to the location and condition necessary Or it to he capable (Operating in the manner intended by management.

(c) the initial estimate of the costs of dismantling, removing the item and restoring the site on which it is located, referred to as ‘decommissioning, restoration and .similar liabilities’, the obligation fin- which an enterprise incurs either when the item is acquired or as a consequence having used the item during a particular period .for purposes other than to produce inventories during that period.

18. Examples of directly attributable costs are:

(a) costs of employee benefits (as defined in AS 15, Employee Benefits) arising directly from the construction or acquisition of the item q /properly, plant and equipment,.

(b) costs of site preparation:

(c) initial delivery and handling costs:

(d) installation and assembly costs:

(e) costs of testing whether the asset is functioning properly, after deducting the net proceeds .from selling any items produced while bringing the asset to that location and condition (such as samples produced when testing equipment): and

(f) professional fees.

20.4. As is evident, AS 10, prescribes capitalization of professional lees, meaning thereby that in this case both these services viz architect service fees and interior designer fees, should in terms of the accounting standards be capitalized. The averment therefore that since they are booking a capital expense under Profit and Loss account will make them eligible for ITC, is not a legally tenable argument.

20.5 In view of the above discussions we find that the appellant is not entitled to ITC of GST paid on Architect Service Fees and Interior Designing Fees in view of the provisions of Section 17(5)(d) of the CGST Act, 2017.

21. As far as reliance on rulings of various AARs is concerned, we find that same are not binding on us in terms of section 103 of the CGST Act, 2017.

22. In view of the foregoing, we reject the appeal filed by appellant M/s. “the Varachha Co-op. I3ank I and uphold the Advance Ruling No. GUI/GAAR/R/ 37/2021 dated 30.07.2021 of the Gujarat Authority for Advance Ruling except in respect of roof solar plant, wherein in paragraph 18.1 to 18.4 we have held that ITC is admissible on roof solar plant.