Page Contents

- 1. Inward Side- Input Tax Credit (ITC) of / In Respect of Motor Vehicles

- 2.1 GST Rates on Motor Vehicles ( updated till 30-11-17)

- 2.2 Compensation Cess on Motor Vehicles (updated till 30–11–17)

- 2.3 GST Tax Rate on Sale of Old and Vehicles:

- 2.4 Valuation of Old or Used car for GST Calculation

- 2.5 GST Tax Rates for Services Related to Motor Vehicles Business

- 3. Various Scenarios to Determine Who is Liable to pay GST in case of a GTA

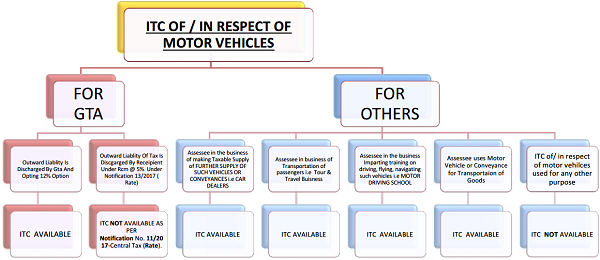

1. Inward Side- Input Tax Credit (ITC) of / In Respect of Motor Vehicles

SECTION 17(5) OF CGST ACT – Under section 17(5) of CGST Act, there are certain supplies on which input tax credit under GST is not available. These supplies can also be said as blocked credit.

Section 17(5) of the Central Goods and Services Act, 2017 provides that input tax credit in respect of the following shall not be available-

(a) Motor vehicles and other conveyances except when they are used-

(i) For making the following taxable supplies, namely-

(A) Further supply of such vehicles or conveyances; or

(B) Transportation of passengers; or

(C) Imparting training on driving, flying, navigating such vehicles or conveyances;

(ii) For transportation of goods;

Examples where credit of motor vehicles can be availed: Dealer of vehicles, cab providers, trucks/vehicles used by factories for transportation of goods.

It is important to understand that there is nothing mentioned about whether the credit would be available on purchase of motor vehicle. Since, the act provides that the credit is not available on motor vehicles it can be concluded that all input tax credit in relation to motor vehicle cannot be claimed except used in the supplies as mentioned above.

Part 2 – Outward Side

2.1 GST Rates on Motor Vehicles ( updated till 30-11-17)

| 5% | ||

| 8713 | Carriages for disabled persons, whether or not motorised or otherwise mechanically propelled | 2.5% |

| 12% | ||

| 87 | Electrically operated vehicles, including two and three wheeled electric motor vehicles | 6% |

| 8701 | Tractors (except road tractors for semi-trailers of engine capacity more than 1800 cc) | 6% |

| 8710 | Tanks and other armoured fighting vehicles, motorised, whether or not fitted with weapons, and parts of such vehicles. | 6% |

| 8712 | Bicycles and other cycles (including delivery tricycles), not motorised | 6% |

| 8714 | Parts and accessories of bicycles and other cycles (including delivery tricycles), not motorised, of 8712 | 6% |

| 8716 20 00 | Self-loading or self-unloading trailers for agricultural purposes | 6% |

| 8716 80 | Hand propelled vehicles (e.g. hand carts, rickshaws and the like); animal drawn vehicles | 6% |

| 18% | ||

| 8703 | Cars for physically handicapped persons, subject to the following conditions:

a) an officer not below the rank of Deputy Secretary to the Government of India in the Department of Heavy Industries certifies that the said goods are capable of being used by the physically handicapped persons; and b) the buyer of the car gives an affidavit that he shall not dispose of the car for a period of five years after its purchase. |

9% |

| 8704 | Refrigerated motor vehicles | 9% |

| 8708 | Following parts of tractors namely:

a. Rear Tractor wheel rim, b. tractor centre housing, c. tractor housing transmission, d. tractor support front axle |

9% |

| 8715 | Baby carriages and parts thereof | 9% |

| 8708 10 10 | Bumpers and parts thereof for tractors | 9% |

| 8708 30 00 | Brakes assembly and its parts thereof for tractors | 9% |

| 8708 40 00 | Gear boxes and parts thereof for tractors | 9% |

| 8708 50 00 | Transaxles and its parts thereof for tractors | 9% |

| 8708 70 00 | Road wheels and parts and accessories thereof for tractors | 9% |

| 8708 91 00 | (i) Radiator assembly for tractors and parts thereof

(ii) Cooling system for tractor engine and parts |

9% |

| 8708 92 00 | Silencer assembly for tractors and parts thereof | 9% |

| 8708 93 00 | Clutch assembly and its parts thereof for tractors | 9% |

| 8708 94 00 | Steering wheels and its parts thereof for tractor | 9% |

| 8708 99 00 | Hydraulic and its parts thereof for tractors | 9% |

| 8708 99 00 | Fender, Hood, wrapper, Grill, Side Panel, Extension Plates, Fuel Tank and parts thereof for tractors | 9% |

| 28% | ||

| 8701 | Road tractors for semi-trailers of engine capacity more than 1800 cc | 14% |

| 8702 | Motor vehicles for the transport of ten or more persons, including the driver | 14% |

| 8703 | Motor cars and other motor vehicles principally designed for the transport of persons (other than those of heading 8702), including station wagons and racing cars [other than Cars for physically handicapped persons] | 14% |

| 8704 | Motor vehicles for the transport of goods [other than Refrigerated motor vehicles] | 14% |

| 8705 | Special purpose motor vehicles, other than those principally designed for the transport of persons or goods (for example, breakdown lorries, crane lorries, fire fighting vehicles, concrete-mixer lorries, road sweeper lorries, spraying lorries, mobile workshops, mobile radiological unit) | 14% |

| 8706 | Chassis fitted with engines, for the motor vehicles of headings 8701 to 8705 | 14% |

| 8707 | Bodies (including cabs), for the motor vehicles of headings 8701 to 8705 | 14% |

| 8708 | Parts and accessories of the motor vehicles of headings 8701 to 8705 [other than specified parts of tractors] | 14% |

| 8709 | Works trucks, self-propelled, not fitted with lifting or handling equipment, of the type used in factories, warehouses, dock areas or airports for short distance transport of goods; tractors of the type used on railway station platforms; parts of the foregoing vehicles | 14% |

| Omitted | ||

| 8711 | Motorcycles (including mopeds) and cycles fitted with an auxiliary motor, with or without side-cars; side-cars | 14% |

| 8714 | Parts and accessories of vehicles of headings 8711 and 8713 | 14% |

| 8716 | Trailers and semi-trailers; other vehicles, not mechanically propelled; parts thereof [other than Self-loading or self-unloading trailers for agricultural purposes, and Hand propelled vehicles (e.g. hand carts, rickshaws and the like); animal drawn vehicles] | 14% |

| 8802 | Aircrafts for personal use | 14% |

| 8903 | Yachts and other vessels for pleasure or sports; rowing boats and canoes | 14% |

2.2 Compensation Cess on Motor Vehicles (updated till 30–11–17)

| 8702 10,

8702 20, 8702 30, 8702 90 |

Motor vehicles for the transport of not more than 13 persons, including the driver | 15% |

| 8703 | Motor vehicles cleared as ambulances duly fitted with all the fitments, furniture and accessories necessary for an ambulance from the factory manufacturing such motor vehicles | NIL |

| 8703 10 10, 8703 80 | Electrically operated vehicles, including three wheeled electric motor vehicles. | NIL |

| 8703 | Three wheeled vehicles | NIL |

| 8703 | Cars for physically handicapped persons, subject to the following conditions:

a) an officer not below the rank of Deputy Secretary to the Government of India in the Department of Heavy Industries certifies that the said goods are capable of being used by the physically handicapped persons; and b) the buyer of the car gives an affidavit that he shall not dispose of the car for a period of five years after its purchase. |

NIL |

| 8703 40,

8703 60 |

Following Vehicles, with both spark-ignition internal combustion reciprocating piston engine and electric motor as motors for propulsion; | |

| (a) Motor vehicles cleared as ambulances duly fitted with all the fitments, furniture and accessories necessary for an ambulance from the factory manufacturing such motor vehicles | NIL | |

| (b) Three wheeled vehicles | NIL | |

| (c) Motor vehicles of engine capacity not exceeding 1200cc and of length not exceeding 4000 mm | NIL | |

| (d) Motor vehicles other than those mentioned at (a), (b) and (c) above. | 15% | |

| Explanation.- For the purposes of this entry, the specification of the motor vehicle shall be determined as per the Motor Vehicles Act, 1988 (59 of 1988) and the rules made there under. | ||

| 8703 50,

8703 70 |

Following Vehicles, with both compression-ignition internal combustion piston engine [diesel-or semi diesel] and electric motor as motors for propulsion; | |

| (a) Motor vehicles cleared as ambulances duly fitted with all the fitments, furniture and accessories necessary for an ambulance from the factory manufacturing such motor vehicles | NIL | |

| (b) Three wheeled vehicles | NIL | |

| (c) Motor vehicles of engine capacity not exceeding 1500 cc and of length not exceeding 4000 mm | NIL | |

| (d) Motor vehicles other than those mentioned at (a), (b) and (c) above. | 15% | |

| Explanation.- For the purposes of this entry, the specification of the motor vehicle shall be determined as per the Motor Vehicles Act, 1988 (59 of 1988) and the rules made there under. | ||

| 8703 | Hydrogen vehicles based on fuel cell tech and of length not exceeding 4000 mm.

Explanation.- For the purposes of this entry, the specification of the motor vehicle shall be determined as per the Motor Vehicles Act, 1988 (59 of 1988) and the rules made there under. |

NIL |

| 8703 21 or 8703 22 | Petrol, Liquefied petroleum gases (LPG) or compressed natural gas (CNG) driven motor vehicles of engine capacity not exceeding 1200cc and of length not exceeding 4000 mm.

Explanation.- For the purposes of this entry, the specification of the motor vehicle shall be determined as per the Motor Vehicles Act, 1988 (59 of 1988) and the rules made there under. |

1% |

| 8703 31 | Diesel driven motor vehicles of engine capacity not exceeding 1500 cc and of length not exceeding 4000 mm.

Explanation.- For the purposes of this entry, the specification of the motor vehicle shall be determined as per the Motor Vehicles Act, 1988 (59 of 1988) and the rules made there under |

3% |

| 8703 | Motor vehicles of engine capacity not exceeding 1500 cc | 17% |

| 8703 | Motor vehicles of engine capacity exceeding 1500 cc other than motor vehicles specified against entry at S. No 52B | 20% |

| 8703 | Motor vehicles of engine capacity exceeding 1500 cc, popularly known as Sports Utility Vehicles (SUVs) including utility vehicles.

Explanation. – For the purposes of this entry, SUV includes a motor vehicle of length exceeding 4000 mm and having ground clearance of 170 mm. and above. |

22% |

| 8711 | Motorcycles of engine capacity exceeding 350 cc. | 3% |

| 8802 | Other aircraft (for example, helicopters, aeroplanes), for personal use. | 3% |

| 8903 | Yacht and other vessels for pleasure or sports | 3% |

2.3 GST Tax Rate on Sale of Old and Vehicles:

Government by issuing the Notification No. 8/2018 Central Tax Rate read with state Tax Notification, reduced the Rate of GST on old and used vehicle as follows:

| S. No. |

Chapter, Heading, Sub- heading or Tariff item | Description of Goods | Rate |

| (1) | (2) | (3) | (4) |

| 1. | 8703 | Old and used, petrol Liquefied petroleum gases (LPG) or compressed natural gas (CNG) driven motor vehicles of engine capacity of 1200 cc or more and of length of 4000 mm or more.

Explanation. – For the purposes of this entry, the specification of the motor vehicle shall be determined as per the Motor Vehicles Act, 1988 (59 of 1988) and the rules made there under. |

18% |

| 2. | 8703 | Old and used, diesel driven motor vehicles of engine capacity of 1500 cc or more and of length of 4000 mm Explanation. – For the purposes of this entry, the specification of the motor vehicle shall be determined as per the Motor Vehicles Act, 1988 (59 of 1988) and the rules made there under. | 18% |

| 3 | 8703 | Old and used motor vehicles of engine capacity exceeding 1500 cc, popularly known as Sports Utility Vehicles (SUVs) including utility vehicles.

Explanation. – For the purposes of this entry, SUV includes a motor vehicle of length exceeding 4000 mm and having ground clearance of 170 mm. and above. |

18% |

| 4. | 87 | All Old and used Vehicles other than those mentioned from S. No. 1 to S.No.3 | 12% |

Note: Government also exempted the Cess applicable on sale of Used vehicle through Notification 1/2018 Compensation Cess Rate

2.4 Valuation of Old or Used car for GST Calculation

Value on which GST at above rates to be calculated shall be Margin of Supply which is to be calculated in the manner as mentioned in Notification which is given below:

1. In Case Depreciation under Income Tax Act Availed:

Margin of supply shall be difference between Sale consideration and Written down Value and tax to be calculated on such Margin, and where the margin of such supply is negative, it shall be ignored.

2. In other cases:

Margin of Supply shall be difference between sale price and purchase price Tax to be calculated on such Margin, and where the margin of such supply is negative, it shall be ignored;

2.5 GST Tax Rates for Services Related to Motor Vehicles Business

2.5.1 For Passenger Transport

Transport of passengers by any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient. – RATE OF TAX 5%

Provided that credit of input tax charged on goods and services used in supplying the service, other than the input tax credit of input service in the same line of business (i.e. service procured from another service provider of transporting passengers in a motor vehicle or renting of a motor vehicle), has not been taken. [Please refer to Explanation no. (iv)]

Provided that the Assessee opting to pay tax @ 12% under this entry shall, thenceforth, be liable to pay central tax @ 12% on all the services of Pessenger Transport supplied by it., if Assessee wish to take full ITC

Passenger transport services other than above. – . – RATE OF TAX 18%

2.5.2 For Goods Transport

Q 1. What service of transportation of goods is exempt under GST?

Services by way of transportation of goods are exempted:

(a) by road except the services of:

(i) a goods transportation agency;

(ii) a courier agency

(b) by inland waterways.

Therefore, the service of transportation of goods by road continue to be exempt even under the GST regime. GST is applicable only on goods transport agency, GTA.

Q2. What is the rate of GST on GTA?

| Service by a GTA | GST rate |

Carrying-

|

0% |

| Carrying-

goods, where consideration charged for the transportation of goods on a consignment transported in a single carriage is less than Rs. 1,500 |

0% |

| Carrying-

goods, where consideration charged for transportation of all such goods for a single consignee does not exceed Rs. 750 |

0% |

| Any other goods | 5% No ITC OR 12% with ITC |

| Used household goods for personal use | 0% ** |

| Transporting goods of unregistered persons | 0% ** |

| Transporting goods of unregistered casual taxable persons | 0% ** |

| Transporting goods (GST paid by GTA)* | 5% No ITC or 12% with ITC |

| Transporting goods of 7 specified recipients* | 12% with ITC (paid by RCM 5% GTA) Or with ITC |

| Hiring out vehicle to a GTA | 0% |

*As per Notification No. 20/2017-Central Tax (Rate) 22nd August, 2017

** As per Notification No. 32/2017- Central Tax (Rate) dated 13th October, 2017

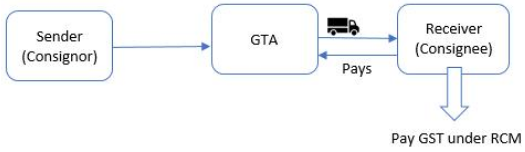

Q 3 What is RCM in case GTA ?

Normally Tax is charged & collected by Supplier of Service provider But in case of GTA , Recipient is liable to discharge TAX LIABLITY UNDER RCM. Pursuant to the enabling provision stated above, on 28 June 2017 the government specified categories of persons responsible for paying GST under the reverse charge mechanism.

These categories include:

(a) any factory registered under or governed by the Factories Act, 1948 (63 of 1948)

(b) any society registered under the Societies Registration Act, 1860 (21 of 1860) or under any other law for the time being in force in any part of India

(c) any co-operative society established by or under any law

(d) any person registered under the CGST Act, the Integrated GST (IGST) Act, the State GST (SGST) Act, or the Union Territory GST (UTGST) Act

(e) anybody corporate established, by or under any law

(f) any partnership firm whether registered or not under any law including association of persons

(g) any casual taxable person

Q 4. Who will pay under Reverse Charge?

As per Notification No. 13/2017- Central Tax dated 28/06/2017 the person who pays or is liable to pay freight for the transportation of goods by road in goods carriage, located in the taxable territory shall be treated as the receiver of service.

Payment is by sender

If the supplier of goods (consignor) pays the GTA, then the sender will be treated as the recipient. If he belongs to the category of persons above then he will pay GST on reverse charge basis.

Payment by Receiver

If the liability of freight payment lies with the receiver (Consignee), then the receiver of goods will be treated as a receiver of transportation services. If he belongs to any of the above category of persons, then he will pay GST on reverse charge basis.

3. Various Scenarios to Determine Who is Liable to pay GST in case of a GTA

| Service Provider | Supplier/ Consignor | Receiver of goods/ Consignee | Person paying Freight |

Person liable to pay GST |

| GTA | A company (Whether or not registered under GST) | Partnership Firm (Whether or not registered under GST) | Company | Company |

| GTA | Partnership Firm (Whether or not registered under GST) | Registered Dealer MR. X | MR. X | MR. X |

| GTA | Partnership Firm (Whether or not registered under GST) | Registered Dealer MR. X | Firm | Firm |

| GTA | A Co-Op Society Ltd (Whether or not registered under GST) | Registered Dealer MR. X | MR. X | MR. X |

| GTA | A Co-Op Society Ltd (Whether or not registered under GST) | Registered Dealer MR. X | A Co-Op Society Ltd | A Co-Op Society Ltd |

| GTA | Company A Ltd. (Whether or not registered under GST) | Company B Ltd. (Whether or not registered under GST) | B Ltd | B Ltd |

| GTA | URD A | Registered Dealer MR. X | A | MR. X |

| GTA | URD A | Registered Dealer MR. X | MR. X | MR. X |

| GTA | URD A | URD F | F | Exempted** |

** GTA services to an unregistered person is exempted as per Notification No. 32/2017- Central Tax (Rate) dated 13th October 2017

Please suggest, that we provide taxable outwards supplies of goods & services and claim ITC as per GST rules.

My query is we have to purchase a diesel fuel dispenser vehicle for businesses, which will we use for our machinery and vehicles can we claim ITC.

Thanks

Dear Sir,

A Partnership firm can avail GST refund against credit purchase a commercial truck for transportation purpose ( Not personal use).