Return being the documentary evidence and a mode of communication between the government department and registered taxable person. With digitalization playing an important role in the GST regime the return system and formats need to be perfectly built for smooth transition from current scheme to the new scheme. The matching concept of taking credit and the importance of returns that would now hold to avail benefit of credit. Here we would be throwing light on how the return system would function and the sync of returns with other provisions of GST.

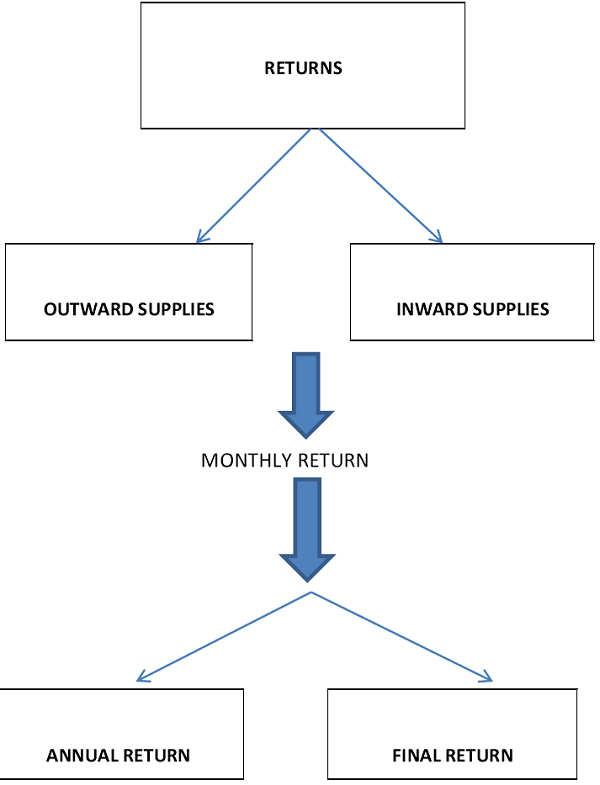

Different types of return:-

Outward

GSTR-1- Every registered taxable person other than Input Service Distributor (ISD)/Compound levy u/s-8/TDS u/s-37 person shall file by 10th of succeeding month.

Inward

GSTR-2- Every registered taxable person other than ISD/Section-8/Section-37 person shall file by 15th of succeeding month.

Monthly

GSTR-3- Every registered taxable person other than ISD/Section-8/Section-37 person shall file by 20th of succeeding month.

GSTR-4 – Quarterly return for compounding taxpayer u/s 8 by 18th of the month next to quarter.

GSTR-5 – Periodic return by Non-Resident Foreign taxpayer by last day of registration.

GSTR-6 – Return for Input Service Distributor(ISD) by 15th of the next month.

GSTR-7 – Return for Tax Deducted at Source u/s 37 by 10thof the next month.

Annual Return

GSTR-8 Annual return needs to be filed by 31st December following the end of financial year.

Final Return

Every registered taxable person who applies for cancellation of registration shall furnish a final return with 3months of the date of cancellation or date of cancellation order.

Matching concept

This is the most interesting part of GST where returns would be matched by both ends before the credit is passed. It would ensure that both parties keep their invoices updated on the portal to avail credit.

Firstly, GSTR-1 return where outward supplies would be filed by 10th of the succeeding month.

⇓

Secondly, while filing GSTR-2 return for inward supplies the taxable person would get to verify the details which were filed in GSTR-1 return by the seller.

⇓

Now, if the details of the both the parties do not tally u/s 29 of matching, reversal and reclaim of input credit then the defaulter would be liable to pay additional tax with interest.

⇓

No rectification after filing the return u/s 27 for the month of September following the end of financial year OR annual return whichever is earlier.

Different types of Ledger:-

- ITC Ledger of taxpayer continuous

- Cash Ledger of taxpayer continuous

- Tax Ledger of taxpayer continuous

Important Points

- Registered taxable person shall not be allowed to file monthly return if previous return is not filed.

- Notice would be issued to defaulting parties.

- Default in filing GSTR-1/2 or final return would result in levy of late fee 100 per day from the day of default to maximum 5000.

- Default in filing GSTR-8 would result in levy of late fee of 100 per day from the day of default subject to maximum of ¼% of aggregate turnover.

Thus, GST system of filing return would help to avoid the last minute rush to file the return with regular update for claiming credit. It would also encourage taxpayer to not default as the defaulting parties would not be able to pass on credit which would guard their customer/clients to not work with them. Also with technology playing an important role here all the work would be done from the desk of the tax payer it would avoid the futile wastage of time and energy which can be utilized in advancing the business.

The GST registration is good, but needs updation

This is not an updated article. You are requested to please update this article.

Note: GST Return Filing default charges are different from as mentioned in this article.

I just came across ONE comment in a seminar that we will have to fill the data of entire FY2016-17 in the new GST compliant software to get credit of the closing balances of Excise Duty & VAT for FY 2017-18.

Please clarify.

Regards

Sanjay Jain

Is revision of return under gst is allowed or not?