The matter of input tax credit in the world of GST has never been free of controversies and litigations. Whether we speak of restrictions in section 16 and section 17 or provisional credit in Rule 36, the ACT has never been in favour of the taxpayer in terms of taking the input tax credit. The Finance Act 2022 through its Finance Bill is now completely ready to put an additional burden on the taxpayer through amendment in section 16 of the CGST Act. The amendment carried out has been as follows-

In the Central Goods and Services Tax Act, 2017 (hereinafter referred to as the Central Goods and Services Tax Act), in section 16,

(a) in sub-section (2),––

(i) after clause (b), the following clause shall be inserted, namely:––

“(ba) the details of input tax credit in respect of the said supply communicated to such registered person under section 38 has not been restricted”;

If to be put in simple words then input tax credit with respect to a supply can be availed only when such credit has not been restricted under section 38, subject to fulfilment of other clauses of sub section 2 of section 16 of the Act, which means it is the recipient has to make sure that the input tax credit availed can’t be restricted under the provisions of section 38 of the Act.

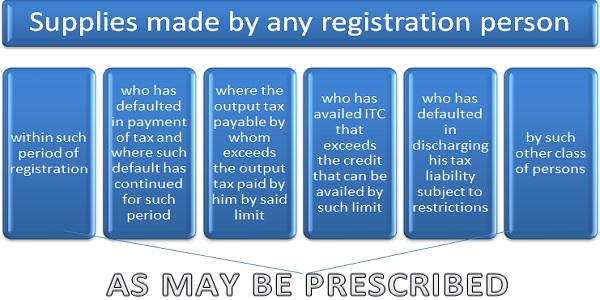

Now the Finance Bill has also put in table the amendment in section 38 where six clauses have been listed which will deny credit to the recipient through the powers given by section 16 of the Act. The six clauses, when put in simple words, where input tax credit cannot be availed, whether wholly or partly, by the recipient are as follows-:

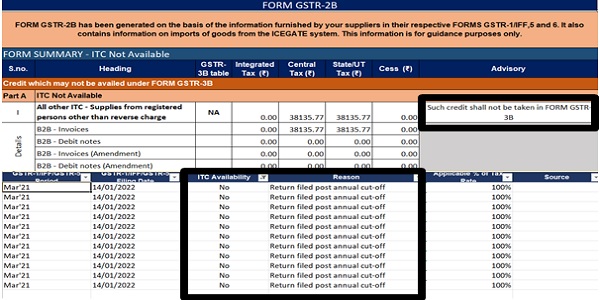

There are two important points to be noted in the above amendment of section 38 done via Finance Bill, 2022. The first being the starting lines of the sub-section 2 of section 38 which says “The auto-generated statement under sub-section (1) shall consist of–“. This necessary implies that the taxpayer will not have to bear this responsibility on his shoulder of checking the compliances related to above six clauses by the supplier. In fact it is the auto-generated form which would specify if the input tax credit is restricted as per the newly provisions of section 38. The auto-generated Form 2B already at present specifies the input tax credit which is not available to the recipient as per the provisions of the GST Act.

As it can be seen how as per the current provisions of the GST Act, the auto generated statement in the Form of GSTR-2B guides the taxpayers of the ITC which cannot be availed along with the reasons thereof. Since the new amendment already starts with the mention of the words “The auto generated statement shall consist of”. Hence it can be very well concluded that the taxpayer will not have to carry out this huge responsibility of checking the eligibility of the ITC as per the newly amended section.

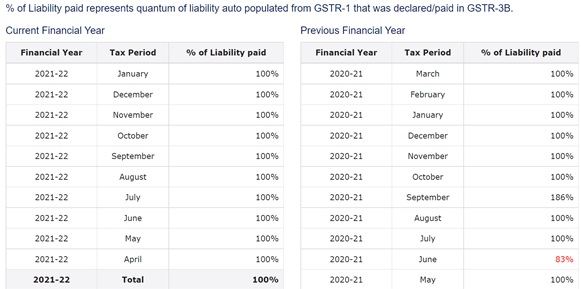

The second important point to be noted is the word “as may be prescribed” which has taken its place after each and every clause of the newly inserted section 38. This necessarily gives an indication that even if the supplier has defaulted in the tax payment or has been in non-compliance with any other clause of the newly inserted section 38; the restrictions will not come in place unless and until it exceeds the limit or the period as may be prescribed. The rules are yet to be prescribed by the council and it will be very interesting to see that how much limit relaxation will been showered on the taxpayer for the smooth flow of the input tax credit. The portal has however been already very active in the matter of the tax liability declared in the Form GSTR-1 and tax liability paid through Form GSTR-3B. The “Search Taxpayer” option in the GST portal already shows the percentage of liability that was declared/paid in GSTR 3B as compared to the quantum of liability auto populated from GSTR-1.

The current clause (c) of sub-section (2) of section 16 of the GST Act already imposes a burden on the recipient to check whether the tax charged in respect of such supply has been actually paid to the Government, either in cash or through utilisation of input tax credit admissible in respect of the said supply. And insertion of such an option in the GST portal will give the proper officer a weapon to put the onus on the taxpayer to check the compliance made by the supplier in respect of payment of tax in accordance with already existing section 16 and newly inserted section 38.

Thus it can be very well said that the newly introduced amendment in section 38 is definitely not something taxpayers will love, looking at the already over burden complexities in the roadway to GST compliances. The section though placed in Finance Bill is yet to be notified and will be applicable only after the date of the notification or as per the date specified in the notification. The rules pertaining to this peculiar section 38 are also yet to come in picture. However as and when this newly amended section and rules thereon comes into force, it would definitely turn out to be a nightmare for the recipient.

Good time for startup GSTR-2 implementation.