1. Registration

Registration Issue No. 1

Sub-Category / Form:

1.1. New Registration

Issue/Error Message:

1.1.1. Status of ARN generated against new registration is showing ‘Pending for Clarification’.

When this issue/error comes: When SCN has been issued.

Suggested solution: Please note that SCN (Show Cause Notice) has been issued by the tax official against your application for registration. Kindly review and submit the desired information which is stated in the respective notice. Please refer the link of manual to file clarification:

https://tutorial.gst.gov.in/userguide/registration/index.htm#t=Application_for_Filing_Clarification.htm

Note: You are requested to submit the clarification within 7 days of the receipt of SCN.

Registration Issue No. 2

Sub-Category / Form: New registration

Issue/Error Message:

1.1.2. System Error occurred while trying to submit application through DSC.

When this issue/error comes: At the time of submission.

Suggested solution: You are advised to Register/Update the DSC which you are using to sign the application. Kindly follow the below mentioned path to know the tab of “Register / Update DSC”:

Login through TRN > Services > User Services > Register / Update DSC.

Registration Issue No. 3

Sub-Category / Form: New registration

Issue/Error Message:

1.1.3. Updating Jurisdiction in application.

When this issue/error comes: While updating Jurisdiction

Suggested solution: You are informed that Jurisdiction can be changed only when it has been assigned wrongly. In such a case, please contact your Jurisdictional Authority for changing the same.

In order to search contact details of Jurisdictional Officer, please follow the below mentioned path on GST portal:

Dashboard> Services> User Services > Contact.

Registration Issue No. 4

Sub-Category / Form: New Registration

Issue/Error Message:

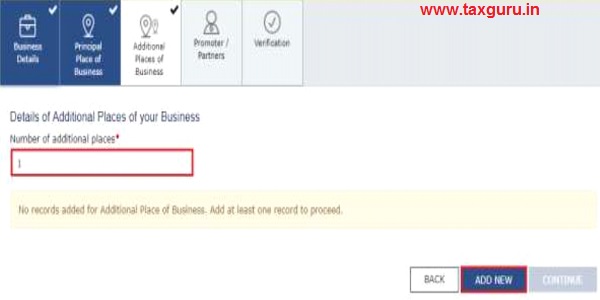

1.1.4. Unable to add additional place of business as “ADD NEW” option is disabled.

When this issue/error comes: While trying to add new place of business.

Suggested solution: In part-B of the registration, please increase the “number of places” in the text box first, then the option to add additional place of business will become enabled as shown below:

For further clarification while doing core-amendment and taking new registration, kindly follow the below mentioned link:

https://tutorial.gst.gov.in/userguide/registration/index.htm#t=Core_Fields_Manual.htm

https://tutorial.gst.gov.in/userguide/registration/index.htm#t=Apply_for_Registration_Normal_Taxpayer.htm

Registration Issue No. 5

Sub-Category/Form: New Registration

Issue/Error Message:

1.1.5. E-Commerce users or Inter State Suppliers cannot opt for composition scheme.

When this issue/error comes: At the time of applying for registration.

Suggested solution: Persons making use of e-commerce platform and/or making inter-state supply cannot opt for composition scheme. (exception-supply of restaurant services over e-commerce platform)

Registration Issue No. 6

Sub-Category/Form: New registration

Issue/Error Message:

1.1.6. Access denied at the time of login.

When this issue/error comes: At the time of login.

Suggested solution: You are advised to check your registration status, without login, in the Search taxpayer bar. If it is showing as ‘active’ and you are still unable to login, then raise a ticket. If the status is ‘cancelled’, then also raise a ticket.

If the status is ‘inactive’, please contact your Jurisdictional Officer for clarification/guidance. In order to search contact details of Jurisdictional Officer, please follow the below mentioned path on GST portal:

Dashboard> Services> User Services > Contact.

Registration Issue No. 7

Sub-Category / Form: New Registration

Issue/Error Message:

1.1.7. Unable to download Order/SCN/New Registration RC/Amended RC or getting page not found.

When this issue/error comes: At the time of downloading order.

Suggested solution: You are advised to download your registration certification from GST portal. Post login go to Services> User Services > View/Download Certificates command.

Upon approval of registration application, registration certificate gets updated on portal within 24 hours.

If you are still unable to find your registration certificate, try again after clearing cookies and history of browser or change the browser.

Registration Issue No. 8

Sub-Category / Form: New Registration

Issue/Error Message:

1.1.8. GST Practitioner applications for registration showing 105% profile complete.

When this issue/error comes: When applying for registration.

Suggested solution: This issue has been resolved and practitioners applying for fresh registration will not face this problem. However, if you are already registered and face this issue, please re-register at the GST portal.

Registration Issue No. 9

Sub-Category / Form: New Registration

Issue/Error Message:

When this issue/error comes: When tracking the registration application Suggested solution: This is in reference to your pending registration application. You are informed that the status against your submitted application is showing “Pending for Processing” which indicates that the application has been successfully filed and decision on your application is pending with the concerned tax official.

Registration Issue No. 10

Sub-Category/Form: New Registration

Issue/Error Message:

1.1.10. Unable to file clarification as page for filling clarification does not open and shows access denied.

When this issue/error comes: When you are trying to file clarification for obtaining new registration.

Suggested solution: You are requested to contact your Jurisdictional Officer and clarify the same against the clarification raised by the tax official.

In order to search contact details of Jurisdictional Officer, please follow the below mentioned path on GST portal

Sub-Category/Form: New Registration

Issue/Error Message:

1.1. 11.When Applying for registration – Clarification filed – Pending for Order

When this issue/error comes: When applying for New Registration

Suggested solution: This implies that your application is pending with the respective tax officer for further action. In this regard, kindly note that it takes 7 working days from the end of the respective tax official to process your application further after submission of clarification. In case 7 working days have already passed, please contact your Jurisdictional officer and clarify the same.

Note: Working days exclude all Gazetted holidays and weekend (Saturday and Sunday).

In order to search contact details of Jurisdictional Officer, please follow the below mentioned path on GST portal: Dashboard> Services> User Services > Contact.

Registration Issue No. 12

Sub-Category / Form: New Registration

Issue/Error Message:

1.1.12. Reason for Rejection not known

When this issue/error comes: When registration application has been rejected.

Suggested solution: The application may have been rejected from the end of the Jurisdictional Officer due to certain inconsistencies in the details furnished while applying for the new registration. In order to seek clarification regarding the rejection of the submitted application for new registration, kindly follow the below mentioned steps:

Log-in with TRN > Services > User services > View Notices and orders.

If you are unable to view the rejection reason, please contact your Jurisdictional officer. System offers an option to search the details of Jurisdictional Officer using the path specified below:

Dash board> Services> User Services > Contact

Further, you can also file another application for new registration in order to make the desired changes in the registration details.

Registration Issue No. 13

Sub-Category / Form:

1.2. Amendment of core fields

Issue/Error Message:

1.2.1. The users complain that the core amendment application is in pending for processing status even after 15 days.

When this issue/error comes: After filing application for core amendment.

Suggested solution: You are informed that the due date will be 15 days after the submission date excluding the Saturdays, Sundays and public Holidays. As core amendment application requires approval of Jurisdictional Officer, if the application has not been disposed of even after 15 working days, contact your Jurisdictional Officer.

System offers an option to search the details of Jurisdictional Officer using the path specified below:

Dash board>Services>User Services>Contact

Registration Issue No. 14

Sub-Category/Form: Amendment of core fields

Issue/Error Message:

1.2.2. Unable to add the authorized signatory on the portal and getting the error as “Duplicate mobile numbers are Passed in partner/promoter details” while filing the application.

When this issue/error comes: At the time of filing Application.

Suggested solution: You are informed that as per GST Functionality, the mobile No and email ID for Every Partner/promoter or Authorized Signatory should be unique.

- The warning message “Duplicate mobile numbers are Passed in partner/promoter details” will be displayed by GST Portal if e Mail ID and Mobile Number are common between Partner/Promoter/Authorized Signatory.

- This warning will not come if same person is registering in more than one capacity. For e.g. if same person registers as Partner and Authorized Signatory, the GST System will not give this warning message.

Registration Issue No. 15

Sub-Category / Form: Amendment of core fields

Issue/Error Message:

1.2.3. Validation Error after filing core amendment application as “Name/ Date of Birth does not match for Promoter for PAN (of partner/promoter)”

When this issue/error comes: When amending core fields.

Suggested solution: You are requested to do non-core amendment to make the changes in the Name/DOB of Promoter. Once the application is auto approved, then file a fresh core amendment where the Name/DOB of Promoter will be updated automatically, and you will be able to submit the application.

Note: If you have already initiated core amendment then delete the core amendment application from “My Saved application” and file a fresh core amendment.

Registration Issue No. 16

Sub-Category / Form: Amendment of core fields

Issue/Error Message:

1.2.4. Not saving the change, when trying to make other signatory as primary authorized signatory.

When this issue/error comes: While making core field amendment.

Suggested solution: This error comes when any document or detail is missing for the already added authorized signatory who is being made primary authorized signatory. Kindly go to the partners/promoters tab and please check the details added already. Save the page and then go to authorized signatory tab and then try to submit the form.

Registration Issue No. 17

Sub-Category/Form: Amendment of core fields.

Issue/Error Message:

1.2.5. Unable to make amendment as page redirects to Partner/promoters tab, Business details tab, Principle/Additional Places of business tab while submitting the amendment application through Submit with DSC/EVC.

When this issue/error comes: At the time of submitting application with DSC/EVC.

Suggested solution: Please check if all mandatory fields with (*) are filled and documents are present. If documents are missing in Partner/Promoters tab, then first file a non-core amendment to upload the document and after that file a new core amendment.

Registration Issue No. 18

Sub-Category/Form: Amendment of core fields.

Issue/Error Message:

1.2.6. Issue/Error Message on verification tab “Some required fields are not filled in partner/promoter tab” while making amendment or submitting with DSC-EVC

When this issue/error comes: At the time of amendment of core fields.

Suggested solution: You are requested to follow the below mentioned steps to resolve the said error:

1. You will be required to file non-core amendment first.

2. Go to partner/promoter tab and click edit on each partner and check all the mandatory fields are filled there. If some fields are blank, please add value. If no fields are blank, then just save the data. You have to do this cycle for each partner and promoter.

3. After that submit the non-core amendment.

4. After Approval of non-core amendment, you need to file fresh core amendment application.

Registration Issue No. 19

Sub-Category / Form: Amendment of core fields

Issue/Error Message:

1.2.7. Updated registration certificate not received after core amendment.

When this issue/error comes: After amendment of core fields.

Suggested solution: Amendment to Core fields requires approval by the Tax Official. Once the amendment application is approved or rejected, you will receive a notification through SMS and e-mail. You can view/ download the approval order (REG 15) on the dashboard.

You can download the amended registration certificate from the dashboard by following steps:

Post login > Services > User Services > View/Download Certificates. Check the latest registration certificate, according to “Date of issue of certificate” present in the registration certificate for download.

Registration Issue No. 20

Sub-Category / Form: Amendment of core fields

Issue/Error Message:

1.2.8. The users complain that the Registration Certificate received after core amendment does not contain Digital signature

When this issue/error comes: While generating Registration Certificate. Suggested solution: Kindly note that a registration certificate is a digitally signed document. Moreover, if your registration is deemed approved, details of approving authority may not reflect in it. In such a case your registration certificate will indicate a message that it is issued based on the deemed approval.

Registration Issue No. 21

Sub-Category / Form:

1.3. Amendment of non-core fields

Issue/Error Message:

1.3.1. The photo of Partner/Promoter has been exchanged or not present in Registration Certificate.

When this issue/error comes: While downloading Registration Certificate.

Suggested solution: You are requested to do a non-core amendment to make changes in the photo of Promoter which will be auto-approved.

Note: In case you have filed an application for core amendment which is already under process, portal will not allow you to file a non- core amendment application before the core amendment process is completed. However, if you have any core amendment application which is in “My Saved application”, delete it before initiating non-core amendment.

Registration Issue No. 22

Sub-Category/Form: Amendment of non-core fields

Issue/Error Message:

1.3.2. Registration certificate not received after approval of Non-core amendment.

When this issue/error comes: After amendment of non-core fields.

Suggested solution: A fresh registration certificate is only generated if you have applied for any core field amendments and the same have been approved by the proper officer. Amendments in non-core field will not become a part of Registration Certificate.

Registration Issue No. 23

Sub-Category/Form:

Change in registration type

Issue/Error Message:

1.3.3. Concern related to conversion of the Registration Type (SEZ conversion-regular to SEZ or vice versa)

When this issue/error comes: While trying to change registration type.

Suggested solution: You are informed that if you are registered as SEZ Unit/ Developer, you can’t get the registration changed into a Normal taxpayer, or vice versa, by raising a ticket.

You are required to apply for a new registration on GST portal and cancel your previous registration obtained in wrong category.

If you have units in both SEZ and DTA, separate registrations are required to be obtained for both the units.

Registration Issue No. 24

Sub-Category / Form:

1.4. GSTN-MCA Integration

Issue/Error Message:

1.4.1. Application SRN status in “Pending with MCA”

When this issue/error comes: While applying for new registration.

Suggested solution: Your application status is showing Pending with MCA. As the data from MCA Portal has not been received by the GSTN common Portal for completing your registration with GST, you are required to contact MCA team for resolution.

Registration Issue No. 25

Sub-Category/Form:

1.5. Cancellation of registration.

Issue/Error Message:

1.5.1. Status of ARN generated against the application for cancellation is showing ‘Pending for Processing’.

When this issue/error comes: At the time of cancellation.

Suggested solution: If the application has been successfully filed and the status is showing as pending for processing by the concerned tax official, please contact your Jurisdictional Officer for further processing of the application. Note: System offers an option to search the details of Jurisdictional Officer using the path specified below:

Dash board> Services> User Services > Contact

Registration Issue No. 26

Sub-Category/Form: Cancellation

Issue/Error Message:

1.5.2. Status of ARN generated against the application for cancellation is displaying as ‘Clarification filed – Pending for Order’

When this issue/error comes: Clarification filed – Pending for Order

Suggested solution: Your application for cancellation has been successfully filed and the required processing by the concerned tax official. In order to further process your application, you are requested to contact the Jurisdictional Officer.

Note: System offers an option to search the details of Jurisdictional Officer using the path specified below: Dash board> Services> User Services > Contact.

Registration Issue No. 27

Sub-Category/Form: Cancellation

Issue/Error Message:

1.5.3. Please file all pending returns till cancellation date before submission of Application of Revocation of Cancellation” at the time of filing Revocation Application

When this issue/error comes: At the time of filing Revocation Application.

Suggested solution: This Issue/Error Message comes when you have not filed all returns till the date of cancellation, and you are trying to file an application for revocation of cancellation of registration. If your registration is cancelled for non-filing of the Returns, please file all the pending returns from the start of Registration till the Cancellation Date from Return dashboard and then file an application for revocation of cancellation.

Registration Issue No. 28

Sub-Category/Form: Cancellation of registration.

Issue/Error Message:

1.5.4. Status of ARN generated against the application for cancellation is displaying as ‘Pending for processing’, when taxpayer applied for cancellation by mistake.

When this issue/error comes: When taxpayer applied for cancellation by mistake

Suggested solution: If you have applied for cancellation by mistake, you cannot file for revocation of cancellation. In case you want to get your application for cancellation rejected, then contact your Jurisdictional Officer. Note: System offers an option to search the details of Jurisdictional Officer using the path specified below:

Dash board> Services> User Services > Contact

Registration Issue No. 29

Sub-Category / Form: revocation of cancellation of registration.

Issue/Error Message:

1.5.5. Status of ARN generated against the application for revocation of cancellation is showing ‘Pending for Processing’.

When this issue/error comes: When taxpayer is applying for revocation of cancellation

Suggested solution: Your application for revocation of cancellation has been successfully filed and this requires processing by the concerned tax official. In order to further process your application, please contact your Jurisdictional Officer.

Note: System offers an option to search the details of Jurisdictional Officer. Using the path specified below:

Dash board> Services> User Services > Contact

Registration Issue No. 30

Sub-Category/Form:

1.6. Register/Update DSC

Issue/Error Message:

1.6.1. DSC you are trying to affix does not match with that of selected authorized signatory.

When this issue/error comes: When PAN of Authorized signatory doesn’t match with the PAN they have selected.

Suggested solution: Please make sure that the name of the authorized signatory is as per the PAN in DSC and the PAN under “issued to” field in DSC certificate is same as that of the authorized signatory.

Registration Issue No. 31

Sub-Category/Form: DSC

Issue/Error Message:

1.6.2. “Certificate already registered with another authorized signatory” while doing “Register/Update DSC”.

When this issue/error comes: DSC expired and renewed DSC not able to register/update DSC.

Suggested solution: The DSC you are trying to register/update is already registered with our system and there is no need to register the same DSC again for completing Registration at the portal. You can continue submitting the applications further without registering the DSC.

Registration Issue No. 32

Sub-Category / Form:

1.7. Composition

Issue/Error Message:

1.7.1. Composition-Issue with composition start date and end date

When this issue/error comes: When change in taxpayer type from ‘Composition Scheme’ to ‘Normal Taxpayer’.

Suggested solution: There could be multiple reasons why the portal may automatically convert you to Normal taxpayer, such as:

- any supply of goods which are not liable to be taxed under the GST Act

- inter-state outward supplies of goods

- supplies through electronic commerce operators (exception- supply of Restaurant Services through E Com Portal)

- a manufacturer of notified goods such as ice cream, pan masala, tobacco products, aerated water

- If you have multiple registrations with same PAN and you choose to convert as normal taxpayer for any of these, then you will be automatically converted from composition to normal taxpayer for rest as well.

Registration Issue No. 33

Sub-Category/Form:

1.8. Registration

Issue/Error Message:

1.8.1. Invalid username or password while login. Please reset new email id & mobile no. and use new login id & password to submit pending GST returns.

When this issue/error comes: Untraceable primary authorized signatory

Suggested solution: In case the Primary Authorized Signatory is not traceable, kindly follow the below mentioned steps and proceed accordingly:-

1. You need to approach relevant jurisdictional Tax Officer to get the password for the GSTIN allotted to your business. You can check your jurisdiction in the Registration Certificate. Alternatively, you can check the Dashboard > My Profile section to check your Jurisdiction.

2. You need to provide valid documentation to validate the business details related to your GSTIN.

3. Tax officer will check if the said person is added as a Stakeholder or Authorized Signatory for that GSTIN in the system.

4. Tax officer will upload sufficient proof on the GST Portal in support to authenticate the activity.

5. Tax officer will enter the email address and mobile phone number provided by you.

6. After upload of document, Tax officer will reset the password for the GSTIN in the system.

7. Username and Temporary password reset will be communicated to the email address as entered by the Tax Officer in your jurisdiction (in the email which is provided to you).

8. Next you need to login to the GST Portal available at

https://www.gst.gov.in/ and login using the First time login link. You will be asked to change your username and password after first time login with the Username and Temporary password that was emailed on the updated e-mail address of the Primary Authorized Signatory.

Registration Issue No. 34

Sub-Category/Form:

Error Code:

1.9.1. LU-LUAC-9019

Issue/Error Message: Something seems to have gone wrong while processing your request. Please try again. If error persists quote error number {0} when you contact customer care for quick resolution no. and use new login id & password to submit pending GST returns.

When this issue/error comes: This error occurs in case of an issue with the application while processing the request of the taxpayer.

Suggested solution: For quick resolution, kindly raise a ticket along with screenshot and time stamp of the error occurrence.

Registration Issue No. 35

Sub-Category/Form:

Application Issue – LUT

Error Code:

1.9.2. LU-LUWS-9021

Issue/Error Message: Something seems to have gone wrong while processing your request. Please try again. If error persists quote error number {0} when you contact customer care for quick resolution

When this issue/error comes: This error occurs in case of an issue with the application while processing the request of the taxpayer.

Suggested solution: For quick resolution, kindly raise a ticket along with screenshot and time stamp of the error occurrence.

2. Returns

GSTR-1

Return Issue No. 1

Sub-Category/Form:

2.1 GSTR 1

Issue/Error Message:

2.1.1 You have records still under processing

When this issue/error comes: The error occurs when the user is unable to submit the form.

Suggested solution:

Dear Taxpayer,

If you are trying through “Online” mode, Records got error occurred due to process stuck in progress. Please click on edit button of Error Occurred record and try saving again.

If you are trying through “Off line” mode, If uploaded records got Error occurred, Please retry upload again, If it got processed then after Generating summary you can view in your portal,

If you get ‘Processed with error’ please download the error report and take action accordingly and upload JSON again. If you face any other issue, kindly log a new ticket along with the screenshot of the error visible to you. Also, please mention date and time – when this issue occurred.

Return Issue No. 2

Sub-Category / Form: GSTR 1

Issue/Error Message:

2.1.2. Summary generate

When this issue/error comes: The error occurs when the user has uploaded the invoices but it does not reflect on the portal.

Suggested solution: Dear Taxpayer, You are advised to clear history/cache of your browser and Generate Summary. After 15 minutes, please refresh your page, & proceed further to return filing. If you still face the issue, then kindly log a ticket to the helpdesk along with the screenshot of the error visible to you. Also mention date and time when this issue occurred. Thanks.

Return Issue No. 3

Category: Return

Sub-Category / Form: GSTR 1

Issue/Error Message:

2.1.3. Can not add/amend same invoice number

When this issue/error comes: User uploading/amending the same invoice that are uploaded/amended in previous return period or F.Y.

Suggested solution:

You can add an invoice bearing a particular number only once in a financial year and the said invoice can be amended in the subsequent period return , within the time period prescribed under law.

Return Issue No. 4

Category: Return

Sub-Category / Form: GSTR 1

Issue/Error Message:

2.1.4. No action taken on item

When this issue/error comes: User want to take action on invoice but not able to accept or reject.

Suggested solution: If the number of invoices is less than or equal to 500, use online portal and if it is more than 500 please use offline tool. And then follow the steps below:

a) For online portal, Kindly click on prepare online>open B2B invoices section>check the invoices (mentioned in error report) in all tabs i.e. uploaded by receiver/rejected by receiver/modified by receiver and make respective action (ACCEPT/REJECT) against that invoice. After action is taken, please try to submit your return.

b) For offline tool, kindly download the return file from the Prepare offline>Download tab and then open the downloaded file in the latest Offline tool clicking on Open Button under the tile “Open downloaded return file from portal”. Check the invoices (mentioned in error report) under tabs i.e. uploaded by receiver/rejected by receiver/modified by receiver and make respective action (ACCEPT/REJECT), generate the json and then upload the JSON again to the portal and the try to SUBMIT If you face any other issue, kindly contact the helpdesk along with the screenshot of the error visible to you. Also, please mention date and time – when this issue occurred.

Return Issue No. 5

Category: Return

Sub-Category / Form: GSTR 1

Issue/Error Message:

2.1.5. Revised date cannot be later than the last day of the tax period

When this issue/error comes: User want to amend/revised the invoice in same/different return period.

Suggested solution: Dear Taxpayer, Revised date cannot be later than the last day of the tax period, i.e. In case you are trying to amend an invoice for June

Month after 30th June, it won’t be accepted by the system.

Return Issue No. 6

Category: Return

Sub-Category / Form: GSTR 1

Issue/Error Message

2.1.6. You are not allowed to access Return

When this issue/error comes: The error occurs when the taxpayer has opted for a quarterly return and is trying to file it monthly.

Suggested solution: Dear Taxpayer,

In case you have opted to file a quarterly GSTR 1 return, then you can file it only quarterly and not monthly.

Return Issue No. 7

Category: Return

Sub-Category / Form: GSTR 1

Issue/Error Message:

2.1.7. Pending invoice

When this issue/error comes: This error occurs when user is having some issue in uploading of invoice and it is available in pending invoice section.

Suggested solution: Dear Taxpayer, Please check for pending invoices and if it shows an error, then kindly rectify the mentioned error by clicking on edit icon against such invoices and then proceed. Or you can delete those records (with error) in pending invoices and then try to add the details again.

Return Issue No. 8

Category: Return

Sub-Category / Form: GSTR 1

Issue/Error Message:

2.1.8. Invoice already filed by counter party

When this issue/error comes: The error occurs when counter party already uploaded the invoice in return

Suggested solution: As invoice is already filed by your counter party, you are requested to delete those in the details uploaded by you in “Uploaded by taxpayer” tab. Kindly retry using following steps to delete the unnecessary details:

1) Through Online Mode (If invoices are less than 500):

a) Delete the existing invoices one-by-one.

2) Through Offline Mode (If invoices are more than 500):

a) Download the GSTR1 zip from the download tab (prepare offline>Download>Generate File), this will contain the existing invoices.

b) Import the zip in the offline tool (second open button).

c) If you want to delete some particular invoices, please click the checkbox in first column against the invoice number and click on the delete button present in the bottom to mark it as delete.

d) If you want to delete all data, Mark the invoices to be deleted using delete section data button.

e) Generate the JSON and upload in the portal. After successful upload, click on generate summary in the portal to update the details

Once deleted from portal you can upload the file with the fresh details if you want.

Return Issue No.9

Category: Return

Sub-Category / Form: GSTR 1

Issue/Error Message:

2.1.9. DSC not working

When this issue/error comes: DSC not working while filing the return Suggested solution:

This particular error comes when PAN of Authorized signatory doesn’t match with the PAN you have selected .Kindly make sure that the name of the authorized signatory is as per the PAN in DSC and the PAN under “issued to” field in DSC certificate is same as of the authorized signatory.

Return Issue No.10

Category: Return

Sub-Category / Form: GSTR 1

Issue/Error Message:

2.1.10 JSON related

When this issue/error comes: User is not using latest json file

Suggested solution: Please download the latest version of Off line utility 2.3.2 for generation of file. Kindly clear your cache and browser history and then upload the latest json file.

Sub-Category / Form: GSTR 1

Issue/Error Message:

2.1.11. File could not be uploaded

When this issue/error comes: While filing offline

Suggested solution:

Download the latest version of Offline tool to generate the JSON file’ or ‘JSON Structure Validation’. Please follow the steps given below to understand the issue with the JSON if you are getting the error ‘File could not be uploaded! –

1. Go to https://developer.gst.gov.in/apiportal/taxpayer/returns

2. Click on View API List.

3. click on ‘GSTR1 – Save GSTR1 data’ and then version-v1.1 (On third page).

4. Click on Request Payload and then click on Download Schema.

5. Go to https://www.jsonschemavalidator.net

6. Copy the schema and paste in Select schema: on https://www.jsonschemavalidator.net/ (first tab)

7. copy the JSON which is throwing error and paste in Input JSON: (second tab) and Click on the format tab. The errors in the JSON will appear.

8. Correct the mentioned errors in the offline tool and generate the JSON again. (For example- In the generated JSON if in HSN section uqc i.e unit of measurement is missing which is required property. Kindly fill the required property and then try to upload the corrected json).

Return Issue No. 12

Category: Return

Sub-Category / Form: GSTR 1

Issue/Error Message:

2.1.13. Original Invoice cannot be tracked

When this issue/error comes: This error occurs when the user wants to amend the invoice but is not able to search that particular invoice.

Suggested solution: Please make sure that the invoice number mentioned in the Credit/Debit Note is already uploaded. If not uploaded, upload the invoice first and then proceed with the amendment.

Return Issue No. 13

Category: Return

Sub-Category / Form: GSTR 1

Issue/Error Message:

2.1.13. Document details pertaining to previous financial year cannot be added/amended now.

When this issue/error comes:

Suggested solution: The addition /amendment of Invoices pertaining to previous financial year is not allowed.

Return Issue No. 14

Category: Return

Sub-Category / Form: GSTR 1

Issue/Error Message:

2.1.14. Data mismatch

When this issue/error comes: The error occurs when user upload insufficient data/no data is uploaded by the user.

Suggested solution: You did not upload any data/ or the data is not complete in that return period. Please upload complete data.

Return Issue No. 15

Category: Return

Sub-Category/Form: GSTR 1

Issue/Error Message:

2.1.15. History not deleted from User’s browser.

When this issue/error comes:

Suggested solution: Kindly clear history/cache and refresh your page and try again.

Return Issue No. 16

Category: Return

Sub-Category / Form:

2.2. GSTR 2A

Issue/Error Message:

2.2.1. Mismatch in ITC from 2A and credit liability statement

When this issue/error comes: Auto generation of GSTR 2A

Suggested solution:

The reason for mismatch between ‘ITC as per GSTR-2A (ITC accrued)’ in Credit and Liability Statement and actual GSTR2A form is as below –

1) The ITC accrued as per report generated, is on monthly basis even if the receiver has opted for quarterly filing, whereas GSTR2A form displays a consolidated amount in last month of quarter for invoices uploaded by suppliers for receiver, incase receiver has opted for quarterly filing.

2) ITC as per GSTR-2A (ITC accrued)’ in Credit and Liability Statement considers only submitted invoices, whereas GSTR-2A form displays both saved and submitted invoices. Also any invoices added after report generation cutoff date will only be reflected in GSTR2A form.

It is suggested to please compare the sum of ITC accrued in quarter from report with the sum of SUBMITTED invoices of quarter in GSTR2A form.

Return Issue No. 17

Category: Return

Sub-Category/Form: GSTR 2A

Issue/Error Message:

2.2.2. Counter party submit status is reflecting as NO

When this issue/error comes: Auto generation of GSTR 2A

Suggested solution:

You are advised to follow the steps given below to find invoices:-

1) Invoices uploaded by receiver, rejected by receiver and modified by receiver will not be visible in GSTR 2A; these are visible in GSTR 1 of supplier.

2) Invoices saved but not filed/submitted by GSTR 1 Supplier will be visible in same month in GSTR 2A.

3) After Submission of GSTR 1, Invoices will be visible in GSTR 2A in same month if receiver has opted for monthly filing of GSTR 1 but if receiver has opted quarterly filing then invoice will be rolled over to last month of quarter.

4) For rolled over invoices counter party status will be ‘Yes’ only when supplier has Submitted last month of quarter also.

Return Issue No. 18

Category: Return

Sub-Category/Form: GSTR 2A

Issue/Error Message:

2.2.3. GSTR 2A shows Status ‘NO’ under Counter Party Submit Status

When this issue/error comes:

Suggested solution:

You are advised to follow the steps given below to find invoices:-

1. Invoices uploaded by receiver, Rejected by receiver and modified by receiver will not be visible in GSTR 2A, These are visible in GSTR 1 of supplier.

2. Invoices saved but not filed/submitted by GSTR 1 Supplier will be visible in same month in GSTR 2A.

3. After Submission of GSTR 1 , Invoices will be visible in GSTR 2A in same month if receiver has opted for monthly filing of GSTR 1 but if receiver has opted quarterly filing then invoice will be rolled over to last month of quarter.

4. For rolled over invoices counterparty status will be ‘Yes’ only when supplier has Submitted last month of quarter also.

Return Issue No. 19

Category: Return

Sub-Category / Form:

2.3 GSTR 3B

Issue/Error Message:

2.3.1. The information provided in the form earlier is not saved properly. Please save your form again in each section and then try to proceed with Payment.

When this issue/error comes: It occurs when data saved by taxpayer in a return period for GSTR3B has expired and now he is trying to offset after many days.

Suggested solution:

Please proceed with the following steps:

1. Go back to tiles page where all the data has been saved.

2. Verify the data and save again using ‘Save GSTR 3B’ button.

3. Once you see message saying ‘GSTR3B details saved successfully’, go to the payment page [6.1]

4. Press ‘Make Payment’ button to offset and complete the process and proceed for filing.

Return Issue No. 20

Category: Return

Sub-Category / Form: GSTR 3B

Issue/Error Message:

2.3.2. GSTR 3B is not filed for previous period <Return period>

Error Code: RT 3BAS1076

When this issue/error comes:

The error comes when the taxpayer is trying to file a new return without filing the previous return. GSTR 3B form should be filed sequentially, as the system does not allow to file the form in any random order.

Suggested solution:

You are advised to save, offset and file returns for all previous periods first i.e. Starting from the month of your registration approval in GST system. You are also advised to file GSTR 3B sequentially and not in any random order.

Return Issue No. 21

Category: RETURN

Sub-Category / Form: GSTR 3B

Issue/Error Message:

2.3.3. OTP is either expired or incorrect.

Error Code: RT 3BAS1043

When this issue/error comes:

The error occurs mainly due to two reasons :

a) If the OTP for EVC is not used for 10 minutes, it gets expired and the system shows it as incorrect.

b) If the taxpayer has entered a wrong OTP.

Suggested solution:

In case the OTP has expired, you are advised to re-generate the EVC OTP and fill in the latest OTP received through SMS or Email. While entering the OTP, please make sure that all the digits are entered correctly.

Return Issue No. 22

Category: RETURN

Sub-Category/Form: GSTR 3B

Issue/Error Message:

2.3.4. Your OTP is expired please try again.

Error Code: RT- 3BWC1007

When this issue/error comes: The error occurs during filing GSTR 3B and the OTP to file GSTR 3B form has expired, as there is an expiry time of 10 minutes for every EVC OTP.

Suggested solution:

As the EVC OTP is valid for only 10 minutes, you are advised to re-generate the OTP and fill the latest OTP received through SMS/E-Mail.

Return Issue No. 23

Category: RETURN

Sub-Category/Form: GSTR 3B

Issue/Error Message:

2.3.5. Your previous GSTR 3B filing request is still in progress. Please wait for the same to complete or raise another request after 10 minutes.

When this issue/error comes: The message occurs when taxpayer attempts to file a NIL GSTR 3B return within a span of 10 minutes. If we allow taxpayer to file the NIL return again when one request is already in progress, he might end up filing twice which is not acceptable by the system.

Suggested solution: You are advised to wait for at least 10 minutes and retry entire process of NIL filing of GSTR3B for the said return period.

1) Please go to select return period again from the return dashboard.

2) Go to questionnaire page and select first question as ‘Yes’. All other options will automatically be disabled.

3) Click on ‘Next’ button on questionnaire page, you will be directed to filing page as it is a nil return.

4) Choose signatory from dropdown and file with desired option to file either with ‘DSC’ or ‘EVC’ in one go.

Return Issue No. 24

Category: RETURN

Sub-Category/Form: GSTR 3B

Issue/Error Message:

2.3.6. Authentication has failed at emas.

Error Code: RT-3BAS1031

When this issue/error comes: This error is seen at filing page while filing with DSC. The error generally comes because taxpayer may be trying to sign the return filing with a signature associated to a PAN different than the PAN of selected signatory.

Suggested solution: You are advised to carefully select the correct signatory from drop down list of signatories and choose signature of same signatory on Emsigner tool while signing the return.

Return Issue No. 25

Category: RETURN

Sub-Category / Form: GSTR 3B

Issue/Error Message:

2.3.7. Offset the CGST credit first before cross utilization SGST credit against IGST tax liability.

Error Code: LG 9074

When this issue/error comes: This error is only seen when taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return, but is not following the rules defined by GSTN correctly.

Suggested solution: You are advised to follow the rules as mentioned in point 2 of the link given below to cross utilize Input Tax Credit (ITC):

https://tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t=Utilization_Principles.htm

Return Issue No. 26

Category: RETURN

Sub-Category / Form: GSTR 3B

Issue/Error Message:

2.3.8. Please offset the IGST credit against the IGST liability first before cross utilization

When this issue/error comes: This error is only seen when taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return, but is not following the rules defined by GSTN correctly.

Suggested solution: You are advised to cross utilize Input Tax Credit (ITC), strictly following rules mentioned in point 2 of below link:

https://tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t=Utilization_Principles.htm

Return Issue No. 27

Category: RETURN

Sub-Category / Form: GSTR 3B

Issue/Error Message:

2.3.9. Offset CGST or SGST/UTGST liability first with IGST credit before utilizing CGST credit

When this issue/error comes: This error is only seen when taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return, but is not following the rules defined by GSTN correctly.

Suggested solution: You are advised to cross utilize Input Tax Credit (ITC), strictly following rules mentioned in point 2 of below link:

https://tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t=Utilization_Principles.htm

Return Issue No. 28

Category: RETURN

Sub-Category / Form: GSTR 3B

Issue/Error Message:

2.3.10. Offset CGST liability with CGST credit before utilizing it for IGST liability When this issue/error comes: This error is only seen when taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return, but is not following the rules defined by GSTN correctly.

Suggested solution: You are advised to cross utilize Input Tax Credit (ITC), strictly following rules mentioned in point 2 of below link:

https://tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t=Utilization_Principles.htm

Return Issue No. 29

Category: RETURN

Sub-Category / Form: GSTR 3B

Issue/Error Message:

2.3.11. Please offset the CGST tax Liability before cross utilization of IGST credit against SGST tax liability

When this issue/error comes: This error is only seen when taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return, but is not following the rules defined by GSTN correctly.

Suggested solution: You are advised to cross utilize Input Tax Credit (ITC), strictly following rules mentioned in point 2 of below link:

https://tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t=Utilization_Principles.htm

Return Issue No. 30

Category: RETURN

Sub-Category / Form: GSTR 3B

Issue/Error Message:

2.3.12. Offset CGST liability first with IGST credit before utilizing it for SGST/UTGST liability.

When this issue/error comes: This error is only seen when taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return, but is not following the rules defined by GSTN correctly.

Suggested solution: You are advised to cross utilize Input Tax Credit (ITC), strictly following the rules mentioned in point 2 of the link given below :

https://tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t=Utilization_Principles.htm

Return Issue No. 31

Category: RETURN

Sub-Category / Form: GSTR 3B

Issue/Error Message:

2.3.14. Offset IGST liability with CGST credit before utilizing SGST/UTGST credit. When this issue/error comes: This error is only seen when taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return, but is not following the rules defined by GSTN correctly.

Suggested solution: You are advised to cross utilize Input Tax Credit (ITC), strictly following rules mentioned in point 2 of below link:

https://tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t=Utilization_Principles.htm

Return Issue No. 32

Category: RETURN

Sub-Category / Form: GSTR 3B

Issue/Error Message:

2.3.14. Something seems to have gone wrong while processing your request. Not a valid cross utilization Scenario. Please try again.

Error Code: LG 9072

When this issue/error comes: This error is only seen when taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return, but is not following the rules defined by GSTN correctly.

Suggested solution: You are advised to cross utilize Input Tax Credit (ITC), strictly following rules mentioned in point 2 of below link:

https://tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t=Utilization_Principles.htm

Return Issue No. 33

Category: RETURN

Sub-Category / Form: GSTR 3B

Issue/Error Message:

2.3.15. Please offset the IGST credit against the IGST liability first before cross-utilization.

When this issue/error comes: This error is only seen when taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return, but is not following the rules defined by GSTN correctly.

Suggested solution: You are advised to cross utilize Input Tax Credit (ITC), strictly following rules mentioned in point 2 of below link:

https://tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t=Utilization_Principles.htm

Return Issue No. 34

Category: RETURN

Sub-Category / Form: GSTR 3B

Issue/Error Message:

2.3.16. Please offset the SGST credit against the SGST liability first before cross-utilization

When this issue/error comes: This error is only seen when taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return, but is not following the rules defined by GSTN correctly.

Suggested solution: You are advised to cross utilize Input Tax Credit (ITC), strictly following rules mentioned in point 2 of below link:

https://tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t=Utilization_Principles.htm

Return Issue No. 35

Category: RETURN

Sub-Category / Form: GSTR 3B

Issue/Error Message:

2.3.17. Offset SGST/UTGST liability with SGST/UTGST credit before utilizing it for IGST liability.

When this issue/error comes: This error is only seen when taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return, but is not following the rules defined by GSTN correctly.

Suggested solution: Taxpayer must be advised to cross utilize Input Tax Credit (ITC), strictly following rules mentioned in point 2 of below link:

https://tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t=Utilization_Principles.htm

Return Issue No. 36

Category: RETURN

Sub-Category / Form: GSTR 3B

Issue/Error Message:

2.3.18. Please offset the SGST credit against the SGST liability first before cross-utilization

When this issue/error comes: This error is only seen when taxpayer is trying to utilize ITC (Input Tax Credit) to offset the said return, but is not following the rules defined by GSTN correctly.

Suggested solution: You are advised to cross utilize Input Tax Credit (ITC), strictly following rules mentioned in point 2 of below link:

https://tutorial.gst.gov.in/userguide/inputtaxcredit/index.htm#t=Utilization_Principles.htm

Return Issue No. 37

Category: RETURN

Sub-Category / Form: GSTR 3B

Issue/Error Message:

2.3.19. Your Save Request for GSTR 3B is already being processed for Current Return Period.

When this issue/error comes: This error is typically seen when a request to save data in a particular return period of GSTR3B return is already under process and taxpayer tries to send another save request. In such situations, taxpayer will not be allowed to save request and must wait until this existing request is processed successfully.

Suggested solution: You will not be able to send another save request into the system for same return period of GSTR3B return unless previous request has been processed successfully. Please wait till the existing request is successfully processed.

GSTR-6

Return Issue No. 38

Category: RETURN

Sub-Category/Form:

2.4. GSTR 6

Issue/Error Message:

2.4.1. “Your ITC available in table no. 4(a) for distribution and utilization of ITC for distribution in Distributed credit reconciliation table are not matching”

When this issue/error comes: This error occurs when ITC available in table no. 4(a) for distribution and utilization of ITC in Distributed credit reconciliation table are not matching.

Suggested solution:

There is a change in GSTR6 Table4 (ITC-Distribution), Please refer our GSTN portal https://tutorial.gst.gov.in/userguide/returns/index.htm#t=GSTR-6.htm and check the details in section-9(e) 4 – Total ITC available and Eligible ITC/Ineligible ITC distributed. If you are using offline Utility for uploading invoices on portal, please download new Offline utility for the same. If the issue persists, then you can contact us along with the screenshot of both the ITC table with visible amount of the tables.

Return Issue No. 39

Category: RETURN

Sub-Category / Form: GSTR 6

Issue/Error Message:

2.4.2. Error in Submission during GSTR6 NIL Return filing

When this issue/error comes: This error occurs when the taxpayer is trying to file a NIL return, without adding “0” value.

Suggested solution: In case you are trying to file NIL GSTR6, kindly add value 0 in ITC table and save the table. After that, you can proceed to submit your return.

Return Issue No. 40

Category: RETURN

Sub-Category / Form: GSTR 6

Issue/Error Message:

2.4.3. NA

When this issue/error comes: This error occurs when the taxpayer is not able to download GSTR 6A

Suggested solution: The functionality of downloading GSTR6A data is not available in the system.

Return Issue No. 41

Category: Return

Sub-Category/Form:

2.5. GSTR-9

Issue/Error Message:

2.5.1. Proceed to file had some error

When this issue/error comes:

When clicking on FILE GSTR-9 button, warning message comes to ask for Yes or No confirmation. When user clicks on Yes button, page is not going ahead. User gets stuck on same screen and “Proceed to File” button is disabled.

When user is going to file NIL return and clicks on NIL return as YES, however, as per system, he is not eligible to file NIL return Suggested solution:

You are advised to please click on “Nil” button option as ‘NO’ and click on “Next” button. Then follow below steps:

1. Click on ‘Compute Liabilities’; for computation of Late fee, if any.

2. ‘Proceed to File’ button would be enabled once late fee is calculated by system.

3. Click on “Proceed to File” to pay liabilities and file return.

Additional details can be added even after clicking on ‘Compute Liabilities’ or ‘Proceed to file’ button. However, in that case, you would be required to follow steps 1 to 3 again to file the return.

To enable ‘FILE-GSTR-9’ button, please follow below steps:

1. Click on ‘Download Filed GSTR-9 (pdf)’ button to view summary of filed details in PDF format.

2. Download all filed details as an excel file by clicking on ‘Download GSTR-9 details (Excel)’.

If you face any other issue please raise a new ticket with proper screenshot. For further assistance, please feel free to contact us at GST helpdesk number 1800-103-4786 or visit Grievance Redressal Portal https://selfservice.gstsystem.in/ to log a ticket.

Inconvenience caused is regretted.

Return Issue No. 42

Sub-Category / Form: GSTR-9

Issue/Error Message:

2.5.2. “FILE GSTR-9” button is disabled

When this issue/error comes:

When user attempts to file Form GSTR-09

Suggested solution:

You are advised to please follow below steps:

1. Click on ‘Download Filed GSTR-9 (pdf)’ button to view summary of filed details in PDF format.

2. Download all filed details as an excel file by clicking on ‘Download GSTR-9 details (Excel)’.

Return Issue No. 43

Sub-Category / Form: GSTR-9

Issue/Error Message:

2.5.3. GSTR-1 Summary and table 4 mismatch in GSTR-9 form

When this issue/error comes: While filing GSTR-9

Suggested solution:

You are advised to please follow below steps for calculation of GSTR1 data in

GSTR-9 Table 4 as below:

4(a) -> B2C : all data belonging to B2CS/B2CL/CDNUR-B2CS/CDNUR-B2CL and their amendments

(The aggregate value of supplies made to consumers and unregistered persons on which tax has been paid shall be declared here. This includes details of supplies made through E-Commerce operators and is to be declared net of credit notes or debit notes)

4(b) -> B2B : all data belonging to B2B except reverse-charge/Deemed/Sez-Without-Payment

(The aggregate value of supplies made to registered persons (including supplies made to UINs) on which tax has been paid shall be declared here. This includes supplies made through E-Commerce operators, but shall not include supplies on which tax is to be paid by the recipient on reverse charge basis. Details of debit and credit notes are to be mentioned separately)

4(c) -> EXPWP : all data belonging to Export-With Payment section, except SEZ

The aggregate value of exports on which tax has been paid shall be declared here. This excludes supplies to SEZs.

4(d) -> SEZWP : all data belonging to B2B section which is Sez-With- Payment

(The aggregate value of supplies to SEZs on which tax has been paid shall be declared here)

4(e) -> Deemed : all data belonging to B2B section which is Deemed

(The aggregate value of supplies in the nature of deemed exports on which tax has been paid shall be declared here)

4(f) -> AT/TXPD : all data belonging to AT/TXPD and their amendments

(Details of all unadjusted advances i.e. an advance that has been received, and tax has been paid but the invoice has not been issued in the current year shall be declared here)

4(i) -> Credit Notes: all data belonging to Credit-Notes of 4(b),4(c),4(d),4(e)

(The aggregate value of credit notes issued in respect of B2B supplies, exports, supplies made to an SEZ and deemed exports shall be declared here)

4(j) -> Debit Notes: all data belonging to Debit-Notes of 4(b),4(c),4(d),4(e)

(The aggregate value of debit notes issued in respect of B2B supplies, exports, supplies made to an SEZ and deemed exports shall be declared here)

4(k) -> Upward Amendments : all data belonging to Upward Amendments of 4(b),4(c),4(d),4(e),4(h),4(i)

4(l) -> Downward Amendments: all data belonging to Downward Amendments of 4(b),4(c),4(d),4(e),4(h),4(i)

(Details of amendments made to B2B supplies, exports, supplies made to an SEZ and deemed exports, credit notes, debit notes and refund vouchers shall be declared here)

5(a) -> EXPWOP : all data belonging to EXPWOP section

(The aggregate value of exports (except supplies to SEZs) on which tax has not been paid shall be declared here)

5(b) -> SEZWOP : all data belonging to B2B section that is Sez-Without-Pay

(The aggregate value of supplies to SEZs on which tax has not been paid shall be declared here)

5(c) -> B2B_REVERSE_CHARGE : all data belonging to B2B section that is reverse-charge

(The aggregate value of supplies made to registered persons on which tax is payable by the recipient on the reverse charge basis. Details of debit and credit notes are to be mentioned separately)

5(d) -> Exempted : Exempted in NIL section

(The aggregate value of exempted supplies shall be declared here)

5(e) -> Nil Rated : Nil Rated in NIL section

(The aggregate value Nil rated supplies shall be declared here)

5(f) -> Non-GST supply : Non GST Supply in NIL section

(The aggregate value of Non-GST supplies shall be declared here. This includes ‘no supply’)

5(h) -> CreditNotes : all data belonging to CreditNotes of 5(a),5(b),5(c)

(The aggregate value of credit notes issued in respect of supplies declared in 5A, 5B, 5C, 5D, 5E and 5F shall be declared here)

5(i) -> DebitNotes : all data belonging to DebitNotes of 5(a),5(b),5(c)

(The aggregate value of debit notes issued in respect of supplies declared in 5A, 5B, 5C, 5D, 5E and 5F shall be declared here)

5(j) -> Upward Amendments : all data belonging to Upward Amendments of 5(a),5(b),5(c),5(h),5(i)

5(k) -> Downward Amendments : all data belonging to Downward Amendments of 5(a),5(b),5(c),5(h),5(i)

(Details of amendments made to exports (except supplies to SEZs) and supplies to SEZs on which tax has not been paid shall be declared here)

Notes:

Summary of GSTR1 may not match with GSTR9 Table 4 Data

- B2B section summary in GSTR1 would include reverse-charge/sez-with-pay/sez-without-pay/deemed. But they are all separate in GSTR9.

- For calculation purpose, credit note amounts should be considered negative and debit notes should be considered as positive. It is correct in GSTR1 Summary now but for first few months of GST deployment, it was considering both as positive.

- Amendment section’s summary in GSTR1 would only include the revised amount while it would include differential amount in GSTR9

- Definition of differential amount for Amendments of AT/B2CS(4(a),4(f)) is not straight forward.

Return Issue No. 44

Sub-Category / Form: GSTR-9

Issue/Error Message:

2.5.4. Mismatch in ITC

When this issue/error comes:

Mismatch of ITC as per auto populated details in table 8A of annual return (Form GSTR-9) with ITC as shown in Form GSTR 2A

Suggested solution:

Please note that GSTR2A data will not always matches with GSTR-9 –> Table 8A data because of following reasons:

1) Figures in GSTR-2A are auto populated based on filed/ saved / submitted Form GSTR-1 of the supplier taxpayer. But figures in table 8A of Form GSTR-9 are auto-populated only on the basis of only ‘FILED’ Form GSTR-1 by the supplier taxpayer. In case, Form GSTR -1 is not filed by your supplier, then credit related to those invoices will not appear in table 8A of your Form GSTR-9.

2) For FY: 2017-18, Figures in table 8A of Form GSTR-9 are auto populated only for those of Form GSTR-1, which are filed by the supplier taxpayer by due date of its filing i.e. 31st May, 2019. Thus, ITC on supplies of the financial year 2017-18, if reported beyond 31st May, 2019, will not get auto-populated in table 8A of Form GSTR-9.

For FY: 2018-19, Figures in table 8A of Form GSTR-9 are auto populated only for those of Form GSTR-1, which are filed by the supplier taxpayer by due date of its filing i.e. 31 October, 2019. Thus, ITC on supplies of the financial year 2018-19, if reported beyond 31st October, 2019, will not get auto-populated in table 8A of Form GSTR-9.

3) In ITC values in form GSTR-9 –> Table 8 –> point A, if supplier is not having Reverse charges (values: “N”) is considered for ITC calculations shown here. And if supplier is having Reverse charges (values: “Y”) will not be considered for ITC calculations.

4) For FY: 2017-18, In table 8A of Form GSTR-9, only latest values have been auto-populated based on filed Form GSTR-1, taking into account all the amendments made till 31 May, 2019.

For FY: 2018-19, In table 8A of Form GSTR-9, only latest values have been auto-populated based on filed Form GSTR-1, taking into account all the amendments made till 31 October, 2019.

Suppose an invoice with taxable value of Rs 100/- with tax of Rs. 18/- was filed in Form GSTR-1 in the month of January, 2019 and same was amended to Rs 90 as taxable value in the month of March, 2019, then

i. the Form GSTR-2A of January, 2019 will show ITC of Rs. 18

ii. the Form GSTR-2A of March, 2019 will show ITC of Rs 16.20 &

iii. the table 8A of Form GSTR-9 will account for ITC of Rs 16.20.

5) If GSTIN of original recipient has been changed through amendment, then original recipient will not get ITC, but ITC will be accounted for in table 8A of new recipient

6) For FY: 2017-18, In table 8A of Form GSTR-9, ITC related to all such invoices have been excluded in which place of supply lies in supplier’s taxpayers State, instead of State of the receiver taxpayer. Place of Supply should be same as Receiver State Code. These figures will be shown in Form GSTR-2A of the recipient.

For FY: 2018-19, In table 8A of Form GSTR-9, ITC related to all such invoices have been included where:

a) Place of Supply should be same as Receiver State Code.

b) Supplier’s State Code is same as Receiver’s State Code and Place of Supply is different.

c) All three Supplier’s State Code, Receiver’s State Code and Place of Supply are different.

7) The Figures in table 8A of Form GSTR-9 do not contain ITC for the period during which the recipient taxpayer was under composition scheme.

8) For FY: 2017-18, The Figures in table 8A of Form GSTR-9 do not contain ITC if Taxpayer is SEZ user.

For FY: 2018-19, The Figures in table 8A of Form GSTR-9 will also contain ITC if Taxpayer is SEZ user.

You can check and try filing form now. Please raise another ticket if you face any other issue.

Return Issue No. 45

Sub-Category / Form: GSTR-9

Issue/Error Message:

2.5.5. Tax amount should be equal to the tax rate (concessional rate) multiplied by taxable value in Table 17 & 18

When this issue/error comes:

When user entered incorrect amount in concessional rate in tax columns

Suggested solution:

You are advised to please mention correct/exact value with exact decimal digits in tax field, you will get the exact value in IGST, CGST & SGST columns.

Return Issue No. 46

Sub-Category / Form: GSTR-9

Issue/Error Message:

2.5.6. All tables are disabled

When this issue/error comes:

When user is trying to file NIL return and clicks on NIL return as ‘YES’

Suggested solution:

If you are going to file form GSTR-9, you are advised to please click on “Nil” button option as ‘NO’ and click on “Next” button. Consequently, all tiles/tables will get enabled.

GSTR-9A

Sub-Category / Form:

2.6 GSTR-9A

Return Issue No. 47

Issue/Error Message:

2.6.1. Please save turnover in GSTR-9A

When this issue/error comes: When user proceeding without saving turnover

Suggested solution:

You are advised to please enter the Aggregate Turnover of Previous Financial Year and click the SAVE button. If you have any other issue kindly raise a new ticket anew ticket with proper screenshot.

Return Issue No. 48

Sub-Category/Form: GSTR-9 & 9A

Issue/Error Message:

2.6.2. GSTR9/GSTR9A tiles are disabled, greyed out, unable to file: “To file annual return, you need to file GSTR1, GSTR3B or GSTR4, please file all pending returns for the financial year.”

When this issue/error comes: While filing GSTR-9/9A

Suggested solution:

To file your annual return, filing of all applicable returns/statements (GSTR-1, GSTR-3B and GSTR-4) are mandatory, please file your application returns/statements and try again. We would like to inform you that before filing Annual Return, composition taxpayers are required to file Form GSTR- 4, for all the quarters of the period July 2017 to March 2018.

You can check composition start date and end date from below mentioned link:

https://services.gst.gov.in/services/listoftaxpayer

Registration start date from mentioned link:

https://services.gst.gov.in/services/searchtp

Return Issue No. 49

Sub-Category / Form: GSTR-9C

Issue/Error Message:

2.6.3. There was an error while signing the JSON. Please click on generate JSON again.

When this issue/error comes: User is facing this issue while signing JSON from Offline Utility

Suggested solution:

You are advised to please use upgraded version of Microsoft office i.e. 2010, 2013 or 2016. Please download and use the latest GSTR-9C Offline Utility V_1.6 from the portal and follow the below steps:

1) Please close all the applications on your system

2) open your Internet Explorer

3) Go to Tool–>Internet Option–>Security–>Custom level,

4) Please ‘Enable’ all the option under ‘Activex controls and plug-ins’ click on

OK.

5) Now download the Notepad++ from google and follow the following process.

a) Install the Notepad++,

b) Go to the utility folder right click on ‘wsweb.html’—> click on ‘Edit with Notepad++’

c) Click after ‘<html>’ tag, give a space after ‘<html>’ tag and then press the backspace.

Save the file using ‘ctrl+S’ key and close the file and stop the Emsigner Service if started.

Now start emSigner again

Open the utility and try to generate the JSON file again

Internet explorer pop-up will come, inside that you’ll get one more pop-up asking for ‘Allow Blocked content’, click on it then click on ‘Initiate signing’, then ‘Open emSigner’.

If you face any other issue kindly raise another ticket with issue proper description and screen shot.

Return Issue No. 50

Sub-Category / Form: GSTR-6

Issue/Error Message:

2.6.4. Your ITC available in table no. 4(a) for distribution and utilisation of ITC in Distributed credit reconciliation table are not matching

When this issue/error comes: When user is filing GSTR-6

Suggested solution:

There is a change in GSTR-6 Table 4 (ITC-Distribution). Please refer to GSTN portal at – https://tutorial.gst. gov. in/userguide/returns/index.htm#t=GSTR-6.htm and check the details in Section-9(e) 4 – “Total ITC available and Eligible ITC/Ineligible ITC distributed”. If you are using offline Utility for uploading invoices on portal, please download new offline utility for the same. If you still face any issue, kindly log another ticket along with the screenshot of the ITC table along with the amounts showing in the tables

Return Issue No. 51

Issue/Error Message:

2.6.5. Error in submission during GSTR-6 NIL Return filing

When this issue/error comes: When user is filing NIL GSTR-6 Return

Suggested solution:

In case you are filing ‘NIL’ GSTR-6, you are advised to Kindly add value 0 in ITC table and save the table. Thereafter, you can proceed to submit return.

If you face any other issue, then kindly log another ticket along with the screenshot of the error visible to you. Also mention date and time when this issue occurred.

Return Issue No. 52

Category: Return

Sub-Category / Form:

2.7. ITC

Issue/Error Message:

2.7.1. JSON Structure Validation error in ITC forms.

When this issue/error comes: while generating json file

Suggested solution: Kindly download the latest offline tool from the portal, upload the data in offline utility and then generate the JSON file to upload online.

Return Issue No. 53

Category: Return

Sub-Category / Form: ITC

Issue/Error Message:

2.7.2. Error occurred while filing ITC-01/ ITC-04

When this issue/error comes: While filing ITC 01 & 04

Suggested solution:

Kindly download the error report from the upload JSON page and make corrections in the Off line tool. After making corrections, upload the JSON again.

3. Payment

Payment Issue No. 1

Category: Payment

Sub-Category:

3.1. Payment of GST

Issue/Error Message:

3.1.1. Taxpayer is unable to make payment on GST portal. After clicking “Make Payment” button, it’s not connecting to corresponding bank site.

When this issue/error comes: If there is any issue with a bank’s site, taxpayer may not be able to access it to make payment with that bank.

Suggested solution:

You are informed that there might be an issue with your bank’s site; if it persists, please inform your bank for resolution. The ticket is being closed as no further action is pending from our end.

Suggestion: You may also request Bank to escalate the matter to their IT Team.

Payment Issue No. 2

Sub-Category:Payment of GST

Issue/Error Message:

3.1.2. Unable to see Challan History option in GST portal.

When this issue/error comes: In cases of Cancelled GSTIN, user will not be able to view challan History.

Suggested solution:

If your GSTIN status is cancelled and therefore “Challan History” option won’t be available until Cancellation of GSTIN is revoked. However, you can use “Create Challan” “Make Payment” and “Track Payment Status” options.

Payment Issue No. 3

Sub-Category: Payment of GST

Issue/Error Message:

3.1.3. Showing error “access denied” on clicking “Make payment/post credit to ledger”.

When this issue/error comes: While accessing Generate Challan option which is not available for Inactive/Expired GSTN users.

Suggested solution:

You are informed that if your GSTIN status has expired, then “Generate Challan” option will not be available.

Payment Issue No. 4

Sub-Category: Payment of GST

Issue/Error Message:

3.1.4. while attempting to download the electronic credit ledger, GSTN portal is showing up System error.

When this issue/error comes: Most of the time, the reason for this issue is intermittent System error

Suggested solution:

Kindly clear the cache and try again. If error persists, kindly raise new ticket with recent screenshots.

4. Refund

Refund Issue No. 1

Issue faced:

4.1. While filing refund application, following massage pops up on screen.

Issue/Error Message:

4.1.1. “Refund has been already applied for this month. Kindly exclude”

Suggested solution: Once file, User can’t file Refund for a category for the same period again. In such case, please check if you have already file application for refund under the same category for this period. In case , deficiency Memo (RFD-03) has been issued by the officer, the user can file a fresh refund application covering the same period.

However, if a person has in advertantly file a NIL refund claim (RFD01A/RFD1) for a given period under a particular category, may again apply for refund for the said period under the same category only if he satisfies the following two conditions:

a. The registered person must have file a NIL refund claim in FORM GST RFD-01A/RFD-01 for a certain period under a particular category; and

b. No refund claims in FORM GST RFD-01A/RFD-01 must have been file by the registered person under the same category for any subsequent period.

It may be noted that condition (b) shall apply only for refund claims falling under the following categories:

i. Refund of unutilized input tax credit (ITC) on account of exports without payment of tax;

ii. Refund of unutilized ITC on account of supplies made to SEZ Unit/SEZ Developer without payment of tax;

iii. Refund of unutilized ITC on account of accumulation due to inverted tax structure;

In all other cases, registered persons shall be allowed to re-apply even if the condition (b) is not satisfied Registered persons satisfying the above conditions may file the refund claim under “Any Other” category instead of the category under which the NIL refund claim has already been file. For details refer GST Circular No. 110/20/2019 dated 03/10/2019.

Refund Issue No. 2:

4.2. While creating refund application, this message pops up at screen

Issue/Error Message:

4.2.1. A draft saved/submitted application already exists for the tax period`

Suggested solution: It means that a draft application is available under saved application, which can be worked further for filing the application. You should check for the save application in path Services – > Refunds -> My saved/file application. If the application is in saved status, it may be filled up and file. If it is in submitted stage, you can proceed to file such application.

Refund Issue No. 3: While creating refund application, this message pops up at screen.

Issue/Error Message:

4.2.2. ‘No Outward Supply tax file for the selected return period’

Suggested solution: It means no tax (IGST) has been shown to be paid on the outward export supply (zero rated supply) in GSTR-3B under 3.1(b) column in Outward taxable supplies, for the period , for which refund claim is being file.

Refund Issue No. 4: While creating refund application , this message pops up at screen.

Issue/Error Message:

4.2.3. ” Kindly file refund for periods… before filing …”

Suggested solution: Please note that refund to file any refund application, you have to file refund for previous return periods under same refund type for which you are filing now. Refund applications are file sequentially period wise except when the refund is applied in the category (i) Excess cash balance in ledger (ii) Tax paid wrongly/excess (iii) subsequent to any order/appeal/ finalization of provisional refund (iv) tax paid as interstate supply which is later held to be intra-state or vice versa (v) Refund applied in “any other category”.

Hence, if you are applying for refund in a category not mentioned above, you are requested to file for the mentioned periods or do NIL filing for the return period to which you don’t need to claim refunds.

Refund Issue No. 5:

4.3. Unable to Save/Submit/File new refund application , this message pops up at screen

Issue/Error Message:

4.3.1. Compile error in hidden module “

Suggested solution: Please do not try to click on greyed area and any other cell where user inputs are not required. If the error persists , download the fresh offline utility sheet and try again.

Refund Issue No. 6: Unable to Save/Submit/File new refund application, this message pops up at screen

Issue/Error Message:

4.3.2. The cell or chart that you are trying to change is protected and therefore read only.

Suggested solution: Once this error appears then you should delete the existing sheet and download the statement sheet and fill the data afresh. Try opening the utility with a latest version(Recommended : Version above than 2007) of Microsoft office and you will get click Enable editing and enable content in offline utility on the top. Click “Enable editing” and “enable content button” in order to make it editable file.

Refund Issue No. 7: Unable to Save/Submit/File new refund application, this message pops up at screen .

Issue/Error Message:

4.3.3. “Invalid GSTIN” when user is trying to create offline utility file to claim Refund.