CA Umesh Sharma

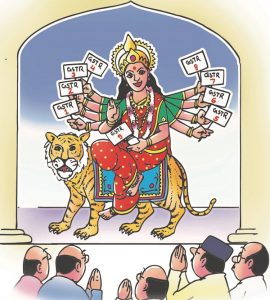

Arjuna (Fictional Character): Krishna, Navaratri will be starting from 21st September of this month. 9 days we worship the Goddess, just like that there is mess of returns everywhere. So tell the information regarding returns.

Krishna (Fictional Character): Arjuna, because the GST has been applicable from 1st July, 2017, every taxpayer has to file monthly return. As 9 days we worship the Goddess likewise the returns are to be filed along with correct information. Up till now the government has not made available utility for filing certain returns. There is mess due to returns. So in accordance with Navaratri, let’s take the information about important GST returns.

Arjuna: Krishna, which are the important returns in GST?

Krishna: Arjuna, The important returns under GST are as follows:

1. Form 3B and GSTR– 1: Every taxpayer should file summary return in Form 3B for July 2017 to December 2017, on 20th of the next month after payment of tax. Invoice wise information of outward supplies for the month is to be furnished in GSTR – 1 up to 10th of the next month. But for some initial months the date is extended.

2. GSTR– 2: Every taxpayer should check the information relating to purchases in form GSTR- 2A and return is to be furnished in form GSTR – 2 up to 15th of the next month.

3. GSTR– 3: Every taxpayer should furnish the monthly return i.e. calculation of tax liability in form GSTR- 3 up to 15th of the next month.

3. GSTR– 3: Every taxpayer should furnish the monthly return i.e. calculation of tax liability in form GSTR- 3 up to 15th of the next month.

4. GSTR – 4: The taxpayers, who have opted for composition scheme, should file quarterly return. Composition taxpayer should furnish the quarterly return in form GSTR- 4 after payment of tax up to 18thof the next month after quarter completed.

5. GSTR– 5: Nonresident taxable person should file return in form GSTR– 5 up to 20th of the month succeeding of the tax period or within 7 days from the expiry of the valid registration period whichever is earlier.

6. GSTR– 6: Input service distributor distributes the credit to their branches. For that they should file the return in form GSTR – 6 after distributing the credit up to 13th of the next month.

7. GSTR– 7 and GSTR- 8: The return relating to TDS is to be filed by tax deductor. It is to be filed in form GSTR– 7 up to the 10th of next month. The statement relating to TCS is to be filed by e commerce operator. It is to be filed in form GSTR – 8 up to the 10th of next month. But the government does not give the permission to file these returns.

8. GSTR– 9: The annual return is to be filed by every registered person in form GSTR– 9 before the 31st December of the next year.

9. GSTR– 10: The taxable person whose registration is cancelled or surrendered, then the final return is to be furnished in form GSTR – 10 within three months of the registration cancelled or surrendered.

Arjuna: Krishna, What taxpayers should learn from above?

Krishna: Arjuna, now there are so many difficulties to file returns. There is hassle bustle on the GST Network. To file the GST returns, taxpayers have to worship goddess. As we worship the goddess with full devotion, like that after compliance with the provisions of the act, corrected returns are to be filed. Because GST returns cannot be revised.

Very Nice Krishna….

so what will you advise us? wait and see till the GST online system stabilized?

RCM on expenses claimed for re-imbursement by employees is a big mess. Govt. should increase limit of exemption from Rs.5000 per day to Rs. 20000 per day.