Sponsored

MINISTRY OF FINANCE

Directorate of Systems, Chennai

Updating Mobile Number & Email Authorized Signatory-

Article explains Process flow and steps involved for Updating Mobile Number & Email of Authorized Signatory on GST portal www.gst.gov.in of Registered Taxpayer.

Process flow- Updating Mobile Number & Email Authorized Signatory

Steps involved

- Login using the provided credentials

- Select GST Application

- Activate Registration Menu

- Select “Active Registration”

- View the list of Tax payers active for the given formation

- Search for the “Tax payer”who requested the modification

- Activate “ACTION” button. It changes to Update AS (Authorised Signatory)

- View the current email id and mobile no.

- Change the required information

- Attach the request letter received from the Tax payer

- Submit, Confirm to view success message.

- Modification will be communicated to Tax payer through Common portal

View the Registration details

Current Authorized Signatory

Update Email/ Mobile No.

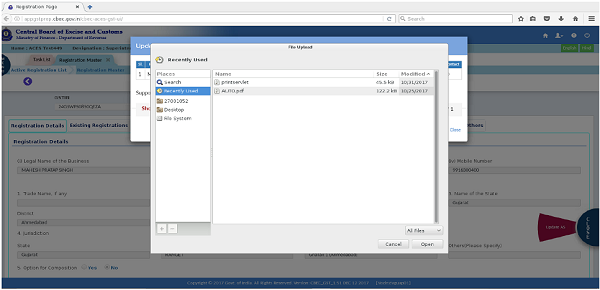

Upload request letter received

Document stored in AIO/Server

Document attached

Confirmation Message for updating the changes

Successful modification

Presentation by

CBEC-GST Team

DG System

Chennai

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.

do we have to login on CBEC site ? I tried but could not get the login window can you share the website link for login and correction