Abhinava Bhavani Prasad

Auditor shall design and perform audit procedures in such a way as to enable the auditor to obtain sufficient (quantity of audit evidence) and appropriate (quality of audit evidence) audit evidence to be able to draw reasonable conclusions on which to base the auditor’s opinion.

If Audit evidence obtained –from one source is inconsistent with that obtained from another or the auditor has doubts over the reliability of information to be sued as audit evidence –auditor shall determine what modifications or additional to audit procedures are necessary to resolve the matter, and shall consider the effect of the matter if an, on other aspects of the audit.

The procedures to obtain audit evidence can include Inspection, Observation, Confirmation, Recalculation, Re-performance, Analytical procedures and Inquiry.

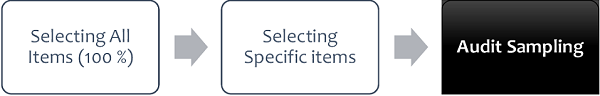

Hence the means available to the auditor to select items for testing are –

Audit Sampling (SA 530)

Application of audit procedures to less than 100 % of items within a population of audit

relevance such that all sampling units have a chance of selection in order to provide the auditor with a reasonable basis on which to draw conclusions about the entire population.

Scope of this SA

This SA will applies when the auditor has decided to use audit sampling in performing audit

procedures. It deals with the auditor’s use of statistical and non-statistical sampling when

designing & selecting the audit sample, performing test of controls and test of details, and

evaluating the results from the sample.

Objective of auditor

The objective of auditor when using audit sampling is to provide a reasonable basis for auditor to draw conclusions about the population from which the sample is selected.

Requirements of SA

Stratification may be appropriate in effective & efficient design of sample.

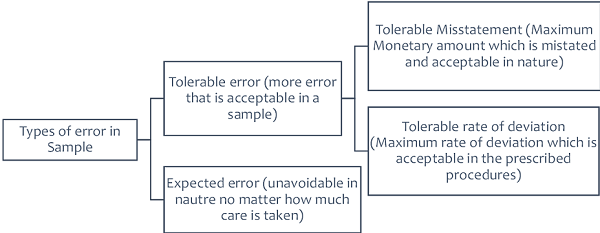

“When determining sample size, auditor should consider Sampling Risk, Tolerable error & Expected error”

1. Statistical Sampling

An approach to sampling that has the following characteristics –

1. Random Selection of the sample items &

2. The use of probability theory to evaluate sample results, including the measurement of sampling risk.

Examples –Random Selection Technique, Cluster Sampling Technique & Monetary Unit Sampling Technique. (Refer Glossary)

2. Non – Statistical Sampling

A sampling approach that doesn’t have the characteristics 1 & 2 is considered non statistical sampling.

Examples –Haphazard Selection Sampling Technique & Block Selection Technique. (Refer Glossary)

“The decision whether to use a statistical or non-statistical sampling approach is a matter for the auditor’s judgement. However, sample size is not a valid criterion to distinguish between statistical and non-statistical approaches”

Performing Audit Procedures

Auditor shall perform the procedure on a replacement item.

Auditor shall treat that item as a deviation from prescribed control (in case of test of controls) or a misstatement (in case of test of detail).

“Audit sample is to be analyzed to conclude that a misstatement or deviation is an anomaly”

Types of error in sample

Evaluating the results of Audit Sampling

Auditor shall evaluate:

1. The result of the sample &

2. Whether the use of audit sampling has provided a reasonable basis for conclusions about the population that has been tested.

Advantages and disadvantages of audit sampling

1. Advantages of Audit sampling

a. To sketch conclusions about a population without testing all of the transactions or

balances in the population as a whole.

b. To focus on high risk or high value items, and to distinguish between elements of a population which may be subject to differing internal controls.

2. Disadvantages of Audit sampling

a. There is always a risk that the auditor’s sample is not representative of the population as a whole. Auditor’s determine and accept the risk, and carry out other procedures to recompense for it, but it always remains as a risk.

b. Sampling relies on the use of judgement in relation to exceptions, materiality and in drawing conclusions.

Audit Risk

Audit Risk includes both uncertainties due to sampling and uncertainties due to factors other than sampling. These aspects of audit risk are sampling risk and non-sampling, respectively.

1. Sampling Risk

Arises from the possibility that, when a test of controls or a substantive test is restricted to a sample, the auditor’s conclusion may be different from the conclusions he would reach if the test were applied in the same way to all items in the account balance or class of transaction.

That is, a particular sample may contain proportionately more or less monetary misstatements or deviations from prescribed controls that exist in the balance or class as a whole.

“Auditor’s conclusion based on a sample may be different from the conclusion if entire population were subjected to same audit procedure”

Sampling risk can lead to two types of erroneous conclusions (Risk of Incorrect Acceptance / Risk of Incorrect Rejections)

2. Non –Sampling Risk

That risk that auditor reaches an erroneous conclusions for any reason not related to sampling risk.

The risk of incorrect rejection and risk of incorrect acceptance too high relate to the efficiency of the audit.

The risk of incorrect rejection and risk of incorrect acceptance too low relate to the effectiveness of an audit in detecting an existing material misstatement.

Computer assisted Audit Techniques

The practice of using computers to automate or simplify the audit process. Ms-Excel, Access,

Audit Command Language (ACL), Statistical Analysis Software (SAS) and etc.., are few examples.

Due to CAAT’s the audit process can be automated, easily sample can be targeted, 100% of the data sample can be done, less time & more productive & more precise error rate.

Documentation

1. Working papers

2. Records of planning and performance of work

3. Demonstrates that the work was actually performed

4. Evidential support for conclusions reached

5. Assessment of quality and compliance.

Conclusion

The use of sampling is widely adopted in auditing because it offers the opportunity for the auditor to obtain the minimum amount of audit evidence, which is both sufficient and appropriate, in order to form valid conclusions on the population.

“Audit sampling is also widely known to reduce the risk of ‘over-auditing’ in certain areas, and enables a much more efficient review of the working papers at the review stage of the audit.”

Glossary

1. Population

The entire set of data from which a sample is selected and about which the auditor wishes to draw conclusions.

2. Sampling Unit

The individual items constituting a population.

3. Stratification

The process of dividing a population into sub populations, each of which is a group of sampling units which have similar characteristic’s (often monetary value)

4. Anomaly

A misstatement or deviation that is demonstrably not representative of misstatements or deviations in a population.

5. Statistical Sampling Technique

6. Non –Statistical Sampling Technique

Perfection is not attainable, but if we chase perfection we can catch excellence.

(Author Abhinava Bhavani Prasad is a CA-Final Student, currently serving as an Article Trainee at Ganesh Prasad Chartered Accountants, Chennai & serving as an executive committee member of Chennai SICASA.)