GST ON PAYMENT OF NPV FOR FOREST CLEARANCE.

A. Use of forests and circumstances that may require diversion of forest:

1. The forests are generally used for the lifestyle, well-being of the forest dwellers, villagers and other people/ species wholly or partly dependent on forests. These are also used for nature reserve, national park, wildlife sanctuary, biosphere reserve, as a habitat of any endangered/ threatened species of flora and fauna and for agriculture purposes for the rehabilitation of the persons displaced from their residences by reason of any river valley or hydroelectric projects etc.

2. The forest land is generally diverted for facilitating developmental activities for non-forestry purposes like construction of power projects, irrigation projects, roads, railways, schools, hospitals, rural electrification, telecommunication, drinking water facilities and mining etc.

B. Main components of conditions imposed on diversion:

3. Forest (Conservation) Act of 1980 stipulates that any diversion of forest land for development projects or other reasons must be approved by the Government of India. Such approvals are known as ‘forest clearances’ and are conditionally issued by the MoEF.

4. As per the Forest (Conservation) Act 1980, whenever forest land is to be diverted for non-forestry purpose usually the conditions relating to transfer, mutation and declaration as Reserve Forest/ Protected Forest the equivalent non forest land for compensatory afforestation and funds for raising compensatory afforestation etc are For mining purposes additional conditions like maintaining a safety zone area, fencing etc. and for major and medium irrigation projects, catchment area treatment plans are stipulated.

5. There are various conditions imposed by MoEF for forest clearance and one of the condition is to make a provision for Compensatory Afforestation.

C. Why Compensatory Afforestation:

6. Article 48A of the Constitution of India requires that the State shall endeavour to protect and improve the environment and to safeguard the forest and wildlife of the country. Under Article 51A, it is the duty of every citizen to protect and improve the natural environment including forests, lakes, rivers and wildlife and to have compassion for living creatures. Since it is the utmost duty to keep & protect the environment for future generation, therefore if someone is using the forest-land for non-forest use then they have to create similar forest or contribute fund for generation of forest land.

D. Compensatory afforestation in lieu of diversion of forest land:

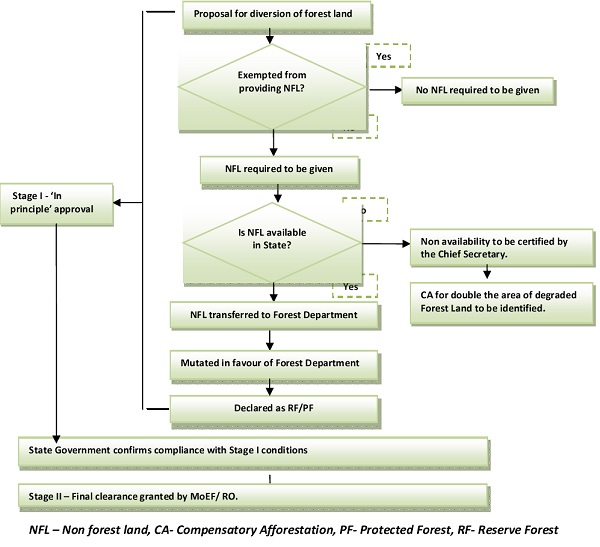

7. Compensatory Afforestation involves identification of non forest land or degraded forest land, work schedule, cost structure of plantation, provision of funds, mechanism to ensure the utilisation of funds and monitoring mechanism etc. Hence, it is one of the most important conditions stipulated by the Central Government while approving proposals for de-reservation or diversion of forest land for non-forest use. As per prevailing environmental law, the proposal for Compensatory afforestation in lieu of diversion of forest land can be made in two way e (i) afforestation of identified non forest land and (ii) provision of funds. The components of conditions for diversion of forest land for non-forest purpose are depicted in the flow Chart.

E. Collection of Net Present Value (NPV):

8. When an user agency applied for forest land diversion for non-forestry use, then Govt, imposed condition on the said user agency to contribute fund for the loss arises due to destruction of environment.

9. Honorable, Supreme Court in its order in the case of T.N. Godavarman Thirumulpad vs. Union of India and Others [Writ Petition (Civil) No. 202 of 1995], dated the 30th October,2002, observed certain issue w.r.t compensatory afforestation related issues and NPV.

10. In consonance to the order of the supreme court, a new act is enacted namely “The Compensatory Afforestation Fund Act, 2016”. The preamble of said act is said t

An Act to provide for the establishment of funds under the public accounts of India and the public accounts of each State and crediting thereto the monies received from the user agencies towards compensatory afforestation, additional compensatory afforestation, penal compensatory afforestation, net present value and all other amounts recovered from such agencies under the Forest (Conservation) Act, 1980; constitution of an authority at national level and at each of the State and Union territory Administration for administration of the funds and to utilise the monies so collected for undertaking artificial regeneration (plantations), assisted natural regeneration, protection of forests, forest related infrastructure development, Green India Programme, wildlife protection and other related activities and for matters connected therewith or incidental thereto.

………….

………………………….

11. From the preamble of the Compensatory Afforestation Fund Act, 2016, it is understood that, a CAMPA fund will be created wherein the user agency will contribute fund to carry out the activities as specified in the proposal given for Forest clearance.

12. As per Section 2 (j) of Compensatory Afforestation Fund Act, 2016 “net present value” means the quantification of the environmental services provided for the forest area diverted for non-forestry uses, as may be determined by an expert committee appointed by the Central Government from time to time in this regard.

13. Further, Section 2(e) of Compensatory Afforestation Fund Act “environmental services” includes:

a. provision of goods such as wood, non-timber forest products, fuel,

b. fodder, water and provision of services such as grazing, tourism, wildlife protection and life support;

c. regulating services such as flood moderation, carbon sequestration and health of soil, air and water regimes;

d. supporting such other services necessary for the production of ecosystem services, biodiversity, nutrient cycling and primary production including pollination and seed dispersal;

14. From the above mentioned information it is understood that, there are several views are arising under:

a. Being NPV paid for forest land is used for non-forest purpose and accordingly it can be said that NPV is paid for use of land i.e renting or leasing charge paid for the using the immovable property. or

b. Being, NPV is to compensate, in money terms, for the loss of tangible as well as intangible benefits flowing from the forest lands and accordingly it can be said that it is a monetary contribution towards the state by the user agency. Or

c. Being, NPV is collected for providing environmental services and accordingly it can be said that Govt will provide environmental services by way of plantation, preservation of forest, ecology etc.

d. Being, NPV is charged for the tolerating the loss suffered by public at large and being the state is the representative of Public and also beneficiary of the public by tolerating the act of the user agency.

F. Applicability of GST:

15. Based on above mentioned scenario if we frame our view with regards to levy of GST on payment NPV, then the following provision to be kept in mind.

16. Section 9(1) of CGST Act state that , there shall be levied a tax called the central goods and services tax on all intra-State supplies of goods or services or both, except on the supply of alcoholic liquor for human consumption, on the value determined under section 15 and at such rates, not exceeding twenty per cent., as may be notified by the Government on the recommendations of the Council and collected in such manner as may be prescribed and shall be paid by the taxable person.

17. The above charging provision state that GST will be levied on supply transaction and as per Section 7(1)(a) of CGST Act, the expression “supply” includes––all forms of supply of goods or services or both such as sale, transfer, barter, exchange, licence, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business;

18. From the above to levy GST, there must be presence of consideration and as per Section 2(31) of CGST Act “consideration” in relation to the supply of goods or services or both includes––

a. any payment made or to be made, whether in money or otherwise, in respect of, in response to, or for the inducement of, the supply of goods or services or both, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government;

b. the monetary value of any act or forbearance, in respect of, in response to, or for the inducement of, the supply of goods or services or both, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government:

19. From the literal meaning of the consideration, the payment of NPV is not qualifies as consideration and only to be treated as transaction in money and accordingly the payment is qualifying as transaction of money and GST will be not levied on it. However, if we treat that the NPV is a consideration and based on the scenario noted above the following issues are to be considered :

NPV is paid for use of forest land for non-forestry purpose:

20. If we consider NPV as consideration toward use of forest land which means that Govt providing the right to use the forest land in terms of lease and accordingly as per serial No.16 of NN.11/2017 CT(R) services by the Central Government, State Government, Union territory or local authority to governmental authority or government entity, by way of lease of land is exempted from GST. Therefore under this clause only Govt or Govt entity can get exemption.

NPV is paid for providing environmental services.

21. If we state that Govt is collecting NPV for providing environmental service, then a question arises who will receiving the environmental services I,e the user agency or the public.

22. Being the nature of payment is toward compensation for the environmental issues by which can be said that Govt collecting NPV to protect the Forest, environment, ecology and also providing the services to public at large and not to the user agency. Hence RCM liability will not arise on the user agency.

23. If we make a contradictory view that the user agency has the obligation to protect the environment and for which the user agency making payment of NPV and agreed that Govt will maintain the forest at it is initial condition and accordingly it will be a services towards the user agency by Govt. Then as per Sl No.3 of NN/12 CT(R) pure service to Government Entity by way of any activity in relation to any function entrusted to a Panchayat under article 243G of the Constitution or in relation to any function entrusted to a Municipality under article 243W of the Constitution is exempted form GST.

24. Under article 243G & article 243W of the Constitution Maintenance of community assets , Urban forestry, protection of the environment and promotion of ecological aspects is listed and as per exemption notification the supply of services for the said activities is exempted from GST.

NPV is charged for the tolerating the loss suffered as liquidated damages.

25. If we consider that the user agency is contributing toward the environmental loss as liquidated damges by way of tolerating the act of others, then it as per GST it will be a services by Govt to the user agency and accordingly as per NN/12 CT(R) services provided by the Central Government, State Government, Union territory or local authority by way of tolerating non-performance of a contract for which consideration in the form of fines or liquidated damages is payable to the Central Government, State Government, Union territory or local authority under such contract is exempted from GST.

26. It may be noted that in a matter of levy of service tax, the CESTAT Allahabad, held that the liquidated damages were received to make good the losses or injuries from unintended events and does not emanate from any obligation on part of any of the parties. Hence, the same cannot be considered as the payments for any service and accordingly we hold the said view then no GST will be payable by the user agency.

Other view

27. Hon’ble Apex ITA No.122 & 1521/Kol/2009 A.Ys. 05-06 & 06-07 ACIT Cir-5 Kol v. M/s. Ghanashyam Misra & Sons (P) Ltd. Page 5 Court observed that the money so received towards NPV should be used for natural assisted re-generation, forest management, protection, infrastructure development, wildlife protection and management, supply of wood and other forest produce saving devices and other allied activities. In the context, Hon’ble Apex Court observed that NPV will not fall under Article 110 or 199 or 195 of the Constitution. It was observed that such payments were levied for rendering service which the state considers beneficial in public interest. It is a fee which falls in entries 47 of List-III of 7th Schedule of the Constitution. The fund set up is a part of economic and social planning which comes within Entry 23 of List III and the charge which is levied for that purpose would come under Entry 47 of List III. In that context, it was held levy of NPV is a fee that means every mining agency using and converting forest land to non-forest purpose has to pay a fee for continuing carrying on of the business.

28. On the basis of said reference, we may hold that the user agency is not paying the NPV for getting the mining lease but paying a fees for getting the statutory clearance for getting the mining right and accordingly the demand by DGGI that the NPV is a consideration toward mining lease is not correct.

29. Further, Payment of tax under RCM is on the supply of “services”. In this context can it be said that certain activities (referred as sovereign functions) carried out by the Central Government, State Government, Union territory or local authority in the capacity of a “sovereign” cannot be regarded as “services” and hence cannot be brought to tax ? This is because such functions are the inherent duty casted on the Government by the Constitution and hence even if any tax/fee is charged for the same, can it still be termed as a “service” supplied by the Government? Before we examine the issue it is worthwhile to understand the term “sovereign functions”.

30. Supreme Court in the case of State of UP v. Jai Bir Singh (Appeal (Civil) 897 of 2002) expressed doubts on the earlier decision and observed that “The concept of sovereignty in a constitutional democracy is different from the traditional concept of sovereignty which is confined to ‘law and order’, ‘defense’, ‘law making’ and ‘justice dispensation’. In a democracy governed by the Constitution the sovereignty vests in the people and the State is obliged to discharge its constitutional obligations contained in the Directive Principles of the State Policy in Part -IV of the Constitution of India. From that point of view, wherever the government undertakes public welfare activities in discharge of its constitutional obligations, as provided in part-IV of the Constitution, such activities should be treated as activities in discharge of sovereign functions falling outside the purview of ‘industry’.”

31. CBEC vide Circular No. 89/7/2006 – S.T dated December 18, 2006 had clarified that fee collected by sovereign/public authorities while performing statutory functions/duties under the provision of law would not be exigible to Service tax. Said circular reiterated an established principle that payment/fee levied and collected by Government authorities under the mandate of a statute are in the nature of compulsory levy and cannot be treated as provision of any service (by such Government authority) to any person/ entity for a consideration.

32. As noted in earlier para NPV qualifies as a fees which falls in entries 47 of List-III of 7th Schedule of the Constitution. The fund set up is a part of economic and social planning and accordingly based on the legal prudence of earlier law we may say that NPV is a fee which is collected for discharging the sovereign function i.e to protect the environment is not a provision of services by Govt to industry.

33. As per Section 3(a) of Land Acquisition Act, 1894, the expression ‘land’ includes benefits that arise out of land and things attached to earth or permanently fastened to anything attached to the earth. As per Section 3(4) of Bombay Land Revenue Code, 1879 ‘land’ includes benefits to arise out of land and things attached to the earth or permanently fastened to anything attached to the earth and also shares in or charges on the revenue or rent of village or other defined portions of territory. In the case of Safiya Bee vs Mohd. Vajahath Hussain – (2011) 2 SCC 94, the Apex court held that ‘land’ includes rights in or over land, benefits to arise out of land. The Apex court in the case of Pradeep Oil Corporation vs Municipal Corporation of Delhi – (2011) 5 SCC 270 observed that land includes benefits to arise out of land.It is thus a benefit out of land included within the word ‘land’.

34. From the above one can infer that the word ‘land’ not just includes full title in land but also rights which gives benefits associated with it. Hence, the expression ‘sale of land’ connotes ‘transfer (irrevocably and permanently) of title in land including rights in the form of benefits arising from it’. Since, one can convey that NPV is paid for getting benefit associated with the land and also can be concluded that NPV is paid for getting the land.

35. As per Clause 5 of Schedule III of CGST Act, sale of land is out of the preview of GST and by considering the above one can said that consideration in form of NPV is paid for getting the land or benefit associated with land will out of the preview of GST.

Note : The author provided his view only and not responsible towards other for any contradictory action.

Source- CAG Report No. 21 of 2013

Beautiful described!!!