ITC Reversal if recipient fails to pay to the Supplier of goods or Services or both (Sec 16(2))

In GST Law provision has been made for reversal of ITC where payment to vendor is not made in 180 days. Below is the clarification with example on the relevant provision:-

ITC availed will be reversed in case of non-payment of consideration within 180 days from the date of Issue Invoice and shall be added to output tax liability along with Interest @ 18% p.a. Interest Computation will be done from the date of credit availed and up-to the date of Reversal.

There is some misunderstanding as to whether ITC will be reversed or ITC claimed will be added to output liability. As heading of the section is using word reversal but main part of the section is saying to add it to output tax liability.

Sec 16(2) was based on GSTR 2 and GSTR 3. But these both were suspended.

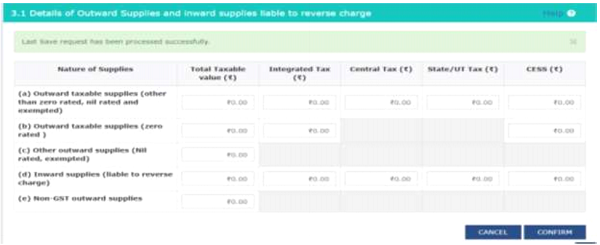

Now only GSTR 3B is filed. In GSTR 3B, In Table 3.1 details to be filled are only regarding Outward Supplies and Inward Supplies liable to reverse charge. We can see from the following screenshot that there is no column for filling adding Input Tax liability

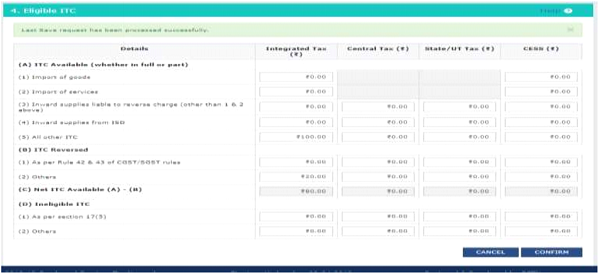

In Table 4 (B) there is a column of reversal where we can reverse the credit ineligible under sec 16(2)

For Example:-

M/s ABC ltd received goods from dealer A worth Rs 10,000 + Gst @ 5% i.e. Rs 500 , invoice dated 21/09/2018. M/s ABC ltd availed credit on 15/10/2018 (date on which GST 3B of Sep 2018 filed). But failed to pay the invoice amount (10500) to the supplier till April 2019.

Solution :

180 days for Reversal of credit will be calculated from 21/09/2018— Means 20/3/2018 . So ITC of Rs 500 will be reversed in the GSTR 3B for the month of March 2019

For Interest Calculation

Date of Availment of credit : 15/10/2018

Date of Reversal : 17/04/2019 (Assumed to be the date filing of GST 3B for March 2019

So interest will be calculated for 184 days : ( 500*18%)*184/365 =Rs 45.36

Interest will be paid in Cash while filing GSTR3B for the month of March 2019.

Proportionate Reversal in case of partial payment : Pro-rata value of tax paid calculated by back calculation, considering the amount paid as cum-tax value

| Invoice | Value (in Rs) | Paid or not paid within 180 days from the date of Invoice | Partially paid | |||

| Goods/ Services | 100 | Not Paid | Paid | Not Paid |

Paid | 50 |

| GST | 28 | Paid | Not Paid | Not Paid |

Paid | 9 |

| Admissibility of ITC | (28/128)*28=6.125 | (28/128)*100=21.875 | No | 28 | 9 | |

| ITC to be reversed | 28-6.125=21.875 | 28-21.875=6.125 | 28 | 0 | 9 | |

Reclaim of Input Tax Credit Reversed earlier upon Payment

ITC can be reclaimed any time in future when the payment is made. No time limit is prescribed for reclaiming.

Important point is that Interest paid on reversal cannot be reclaimed.

Pl answer above questions if possible

Dear Sir,

I have made supply to my customer before March 2020. The payment due from the company to me October 2019 bill onwards.

Pls inform me whether I can claim ITC reversal for the GST paid amount as well as with interest @ 18% thereof.

If I claim ITC reversal, what action will be taken by Government side to my customer who failed / default my payments.

Is Customer forced to return the goods which I supplied to them by GST Invoices. Pls clarify.

Regards

S. Kumar

In the above case if payment done after 180 days but not reversed credit with in 180 days. So how to calculate interest???

If i am reversing credit with in 180 days then whether have to pay interest or not???

Sir,

In the above case, if the supplier fails to realize the due amount from the recipient, and the recipient has availed the ITC for the invoice amount, does the supplier has a chance to revoke the invoice and add the tax liability, which he availed through ITC , to the recipient’s account through GSTR I ?

Regards.