A. FAQs on Filing Reply or Taking Actions during General Penalty Proceedings u/s 125 of Central Goods & Services Tax Act, 2017.

General Penalty:

Q.1 When can a General Penalty be imposed on a taxable person?

Ans: General Penalty can be imposed under Section 125 on a taxable person, when he/she contravenes any provisions of the CGST/ SGST Act or any rules made thereunder, for which no penalty is separately provided for in the Act. Normally, penalties not related to tax deficiency can be covered under General Penalty.

Q.2 Can General Penalty be imposed on a person not registered under the GST Act?

Ans: Yes, under Section 125, General penalty can be imposed on any person—Registered or Unregistered—who had committed offence/contravened provisions of the CGST/SGST Act, for which no penalty is provided under any other section specifically in the Act.

Q.3 Can General Penalty be imposed on a person on whom a penalty is already levied under some other section for the same default?

Ans: No, in case penalty is levied under any other section for some default, then no penalty can be imposed u/s 125 for the same default on the same person.

Q.4 What is the procedure of the General Penalty Assessment Proceedings u/s125?

Ans: Following is the procedure of the General Penalty Assessment Proceedings u/s 125:

> Adjudicating or Assessing Authority(A/A) issues a “Show Cause Notice” to the taxable person and, if personal hearing is required, also schedules a date/time and venueIn case no reply is received from the taxable person, A/A issues a Reminder. Maximum three reminders can be issued.

> Taxable person can reply to the issued notice on the GST Portal and also request for a personal hearing in case A/A has not called for a personal hearing in the issued notice.

> Additionally, if required, he/she can also file for application of extension offline. If A/A approves application of extension, A/A will issue an adjournment with the new date/time and venue of Personal hearing, if required. Adjournment can be allowed maximum 3 times.

> If Personal hearing is not required, A/A, on the basis of taxable person’s reply, issues GENERAL PENALTY or DROP PROCEEDING Order. If Personal hearing is required, A/A conducts the personal hearing and on that basis issues the Order.

> If taxable person does not reply, even after the issue of three reminders, A/A issues the Order as per his/her discretion.

Taking Actions:

Q.5 What are the various tabs available in case detail page?

Ans: Three clickable tabs—NOTICES, REPLIES and ORDERS are available in case detail page.

> NOTICES :To view issued Notices against you by Adjudicating or Assessing Authority (A/A)

> REPLIES :To view or add your reply to the issued Notice

> ORDERS :To download order issued against your case by Assessing Authority (A/A)

Replying to show cause notice:

Q.6 How much time is given to the taxable person for replying to the show cause notice?

Ans: 15 days of time is given for furnishing a reply to the SCN.

Q.7 Where can the taxable persons view the Show Cause Notice issued to them?

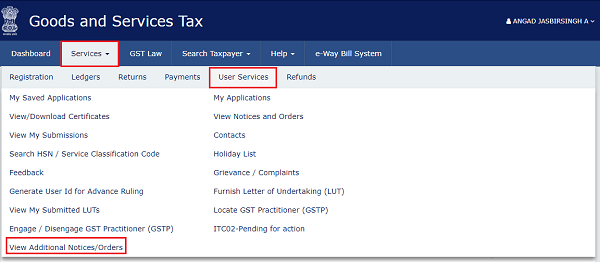

Ans: After logging in to the GST portal, the taxable persons can navigate to Services > User Services > View Additional Notices and Orders option.

Q.8 What are the next steps after a taxable a taxable person has replied to the notice?

Ans: If reply to notice furnished by taxable person within 15 days or extended period is satisfactory, then proceedings can be dropped by the officer by issuing an order to that effect and no further action will be taken in this regard.

If reply to notice furnished by taxable person within 15 days or extended period is not satisfactory, then officer may issue order for imposing penalty.

Q.9 What is the next step if a taxable person neither replies to notice within time specified in notice nor attends personal hearing?

Ans: In such a case, the tax official can issue a reminder to the taxable person to furnish reply or appear for personal hearing. Maximum three reminders can be given. If the taxable person neither replies to notice within time specified in notice nor attends personal hearing even after issue of reminder(s), the tax official can issue the Order.

Q.10 In case notice / order etc., is issued by post / special messenger , then what will be the “Date of issue”?

Ans: Date of delivery will be considered as “Date of issue”.

Q.11 During General Penalty proceedings , at what different stages will a taxable person receive an intimation via SMS or email?

Ans: During General Penalty proceedings, a taxable person will receive an intimation via SMS or email at the following stages:

A. Issue of SCN

B. Submission of each Reply filed by the taxable person

C. Issue of each Adjournment Notice

D. Issue of each Reminder

E. Issue of Penalty Order or Drop Proceeding Order.

Q.12 How Many remainders can be issued to a taxable person after the issue of Show Cause Notice?

Ans: After the issue of SCN, maximum 3 Reminders can be issued on the Portal.

Q.13 How much time is given to the taxable persons for responding and attending the personal hearing”?

Ans: Taxable person in general are given a time of 15 days to attend personal hearing. They can also seek extension (offline). However, the tax officer can accept the application of extension and grant Adjournments up to maximum of three times on the Portal.

Viewing Statuses:

Q.14 During the General Penalty Assessment / Adjudication proceedings, what all Status changes does the case undergo?

Ans: During the General Penalty Assessment/Adjudication proceedings, the case may undergo following Status changes:

a. Pending for reply by taxable person: When A/A issues a “Show Cause Notice” to the taxable person.

b. Reply furnished, pending for Order by tax officer: When taxable person replies to the Notice issued by A/A.

c. Reminder No. 1 issued: When A/A issues first Reminder to the taxable person in case the taxable person has not responded to the Show Cause Notice within the time specified therein.

d. Reminder No. 2 issued: When A/A issues second Reminder to the taxable person in case the taxable person has not responded to the Show Cause Notice within the time specified therein.

e. Reminder No. 3 issued: When A/A issues third Reminder to the taxable person in case the taxable person has not responded to the Show Cause Notice within the time specified therein

f. Reply not furnished, pending for order: When taxable person does not reply to the issued Notice even after 3 reminders and the case is now pending order by A/A.

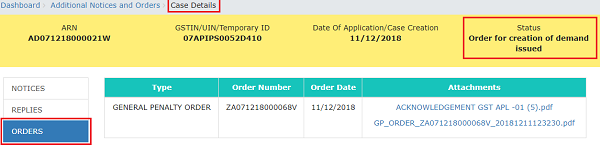

g. Order for creation of demand issued: When GENERAL PENALTY Order is issued by A/A to the taxable person.

h. Order for dropping proceedings issued:When DROP PROCEEDING Order is issued by A/A to the taxable person.

B. Manual on Filing Reply or Taking Actions during General Penalty Proceedings u/s 125 of CGST Act, 2017

How can I file reply or take other actions during General Penalty Proceedings u/s 125 initiated against me by the Adjudication Authority (A/A)?

To file reply or take other actions during General Penalty Proceedings u/s 125 initiated against you by the Adjudication Authority (A / A), perform following steps:

A. Navigate to View Additional Notices/Orders page to view Notices and Orders issued against you by Adjudicating or Assessing Authority (A/A)

B. Take action using NOTICES tab of Case Details screen: View issued Notices

C. Take action using REPLIES tab of Case Details screen: View/Add your reply to the issued Notice

D. Take action using ORDERS tab of Case Details screen: View issued Order

A. View Additional Notices/Orders

To view issued Notices and Orders, perform following steps:

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

2. Login to the portal with valid credentials.

3. Dashboard page is displayed. Click Dashboard > Services > User Services > View Additional Notices/Orders

4. Additional Notices and Orders page is displayed. Click the View hyperlink to go to the Case Details screen of the issued Notice / Order.

- All orders/notices are displayed in descending order. You can search for the orders/notices you want to view using the Navigation buttons provided below.

- Click the View hyperlink to go to the Case Details screen of the issued Notice/Order.

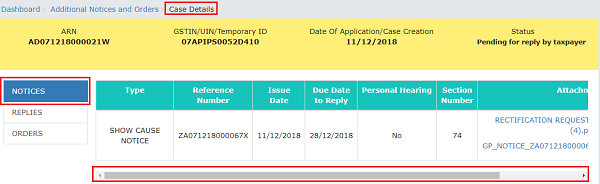

5. Case Details page is displayed. The NOTICES tab is selected by default. Click the tabs provided on the left hand side of the page to view more details about each tab.

- The yellow bar on the top contains details related to the case—Case Reference Number (ARN), your GSTIN/UIN/Temporary ID, Date of Case Creation and Statusof the Case

- The left-side of the page contains three clickable tabs—NOTICES, REPLIES and ORDERS. The NOTICES tab is selected by default. You can click these tabs to view more details about each tab.

- Below the yellow bar, table containing details of the tab is displayed.

B. Take action using NOTICES tab of Case Details screen: View issued Notices

To view issued Notices, perform following steps:

1. On the Case Details page of that particular Case ID, select the NOTICES tab, if it is not selected by default. This tab displays all the notices (Reminder/Adjournment/Show Cause Notice) issued by A/A to you.

2. Scroll to the right and click the document name(s) in the Attachments section of the table to download into your machine and view them.

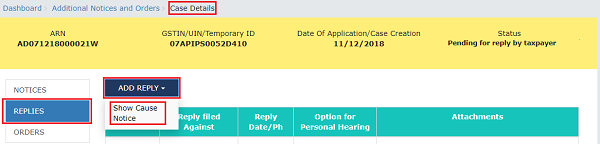

C. Take action using REPLIES tab of Case Details screen: View/Add your reply to the issued Notice

To view or add your reply to the issued Notice, perform following steps:

1. On the Case Details page of that particular Case ID, select the REPLIES tab. This tab will display the replies you will file against the Notices issued by A/A. To add a reply, click ADD REPLY and select SHOW CAUSE NOTICE.

Note: Current Status as displayed is “Pending for reply by taxpayer”. It will change once you add your reply.

2. REPLY page is displayed. The following fields are auto-populated—Type, Date of SCN, SCN Ref No. Enter details in the other fields as mentioned in the following steps. To go to the previous page, click BACK.

2a. In the Personal Hearing Required? field, select Yes or No.

Note: This button is visible to only those taxpayers where the A/A has not called for a personal hearing in the issued notice.

2b. In Reply field, enter details of your reply to the issued notice.

2c. Click Choose File to upload the document(s) related to your reply, if any. This is not a mandatory field.

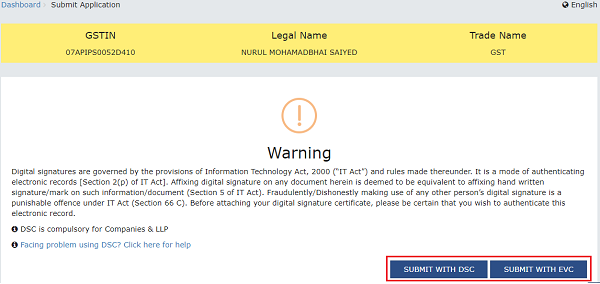

2d. Enter Verification details. Select the declaration check-box and select the name of the authorized signatory. Based on your selection, the fields Designation/Status and Date (current date) gets auto-populated. Enter the name of the place where you are filing this reply.

2e. Click PREVIEW to download and review your reply.

2f. Click FILE.

3. A Warning page is displayed. Click SUBMIT WITH DSC or SUBMIT WITH EVC.

4. A green message is displayed with the generated Reference number. Also, you will receive an acknowledgement intimation via your registered email and SMS, along with the generated RFN. To download the filed reply, click the Click here hyperlink. Then, click OK.

5. The updated REPLIES tab is displayed, with the record of the filed reply in a table and with the Status updated to “Reply furnished, Pending for order by tax officer”. You can also click the documents in the Attachments section of the table to download them.

D. Take action using ORDERS tab of Case Details screen: View Order Issued Against Your Case

To download order issued against your case, perform following steps:

1. On the Case Details page of that particular Case ID, click the ORDERS tab. This tab provides you an option to view the issued order, with all its attached documents, in PDF mode.

2. Click the document(s) in the Attachments section of the table to download and view them.