GST Council Newsletter for the month of January 2024

The Finance Bill 2024 proposes substitution of Section 20 of the IGST Act to make registration as an Input Service Distributor (ISD) mandatory for the procurement of common input services and the distribution of associated Input Tax Credit (ITC) to distinct entities. Additionally, Clause (61) of Section 2 of the IGST Act, which defines ISD, is also amended accordingly. Previously, through CBIC Circular No. 199/11/2023-GST dated 17.07.2023, the Head Office (HO) had the flexibility to distribute ITC either through the ISD mechanism or cross charge. However, this amendment now mandates the distribution or allocation of central tax or integrated tax credit charged on invoices received by the ISD. The aim of this amendment is to streamline the process, ensuring consistency and adherence to specified guidelines in the distribution of credit for common input services.

Further, new Section 122A is inserted in CGST Act, 2017 relating to the penalty for failure to register certain machines used in manufacture of goods as per special procedure notified u/s 148 of the Act. An additional penalty of Rs. 1 lakh per unregistered machine shall be imposed and the other penalties specified under Chapter XV under the CGST Act would continue to apply. Machines may be seized unless penalties are paid and registration is completed within three days. Recent changes rescinded previous notification and introduced new special procedures, including daily record-keeping of inputs, waste, electricity, and production details for registered manufacturers engaged in the production of specific goods.

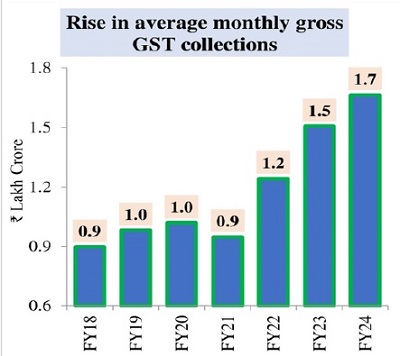

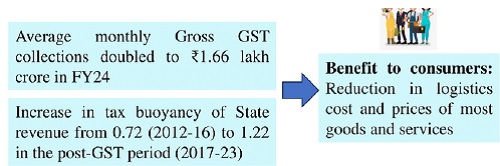

In a significant update during the interim budget 2024, the Hon’ble Finance Minister shared positive news related to GST. GST’s tax base has doubled, with monthly collections nearing ₹1.66 lakh crore. States’ SGST revenue, including compensation, has soared to a buoyancy of 1.22 post-GST, compared to 0.72 previously. Consumers are the ultimate beneficiaries, enjoying lower prices due to reduced logistics costs and taxes. Also, this is the second highest monthly collection ever and marks the third month in this financial year with collection of more than ₹1.70 lakh crore.

Warm Regards.

Pankaj Kumar Singh,

Additional Secretary

GST Revenue Collection

₹1,72,129 crore gross GST revenue collected during January 2024; records 10.4% Year-on-Year growth

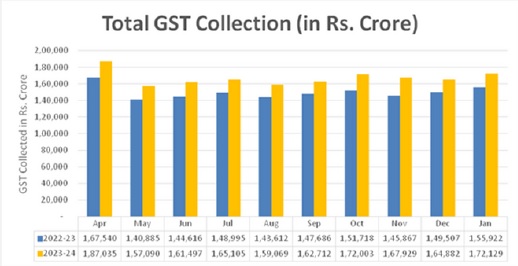

The gross GST revenue collected in the month of January, 2024 (till 05:00 PM of 31.01.2024) is ₹1,72,129 crore, which shows a 10.4% Year-o-Year (Y-oY) growth over the revenue of ₹155,922 crore collected in January 2023 (till 05:00 PM on 31.01.2023).

Notably, this is the second highest monthly collection ever and marks the third month in this financial year with collection of ₹1.70 lakh crore or more. The government has settled ₹43,552 crore to CGST and ₹37,257 crore to SGST from the IGST collection.

During the April 2023 – January 2024 period, cumulative gross GST collection witnessed 11.6% y-o-y growth (till 05:00 PM of 31.01.2024), reaching ₹16.69 lakh crore, as against ₹14.96 lakh crore collected in the same period of the previous year (April 2022-Jannuary 2023).

The chart below shows trends in monthly gross GST revenues during the current year. The data is as of 05:00 PM today (i.e. 31.01.2024). Final collection for the month would be higher.

Chart: Trends in GST Collection

Source: PIB Press Release dated 31.12.2023

Highlights of Interim Budget 2024-25 regarding GST

The Hon’ble Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman, while presenting the Interim Budget 2024-25 in Parliament today asserted that by unifying the highly fragmented indirect tax regime in India, GST has reduced the compliance burden on trade and industry.

“According to a recent survey conducted by a leading consulting firm, 94 per cent of industry leaders view the transition to GST as largely positive and according to 80 per cent of the respondents, it has led to supply chain optimization” she said. Smt. Sitharaman further added that at the same time, tax base of GST more than doubled and the average monthly gross GST collection has almost doubled to ₹ 1.66 lakh crore this year.

Talking about the increased revenue of states, the Finance Minister said that States, SGST Revenue, including compensation released to states, in the post-GST period of 2017-18 to 2022-23, has achieved a buoyancy of 1.22. In contrast, the tax buoyancy of State revenues from subsumed taxes in the pre-GST four-year period of 2012-13 to 2015-16 was a mere 0.72. The Union Finance Minister asserted that the biggest beneficiaries are the consumers, as reduction in logistic costs and taxes have brought down prices of most goods and services.

Key Highlights for GST

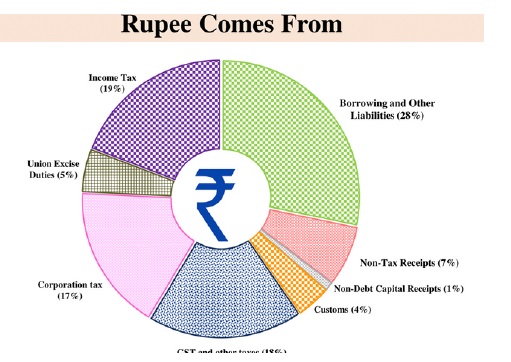

- FM proposes to retain same tax rates for indirect taxes and import duties

- GST unified the highly fragmented indirect tax regime in India Average monthly gross GST collection doubled to Rs 1.66 lakh crore this year

- GST tax base has doubled

- State SGST revenue buoyancy (including compensation released to states) increased to 1.22 in post-GST period(2017-18 to 2022-23) from 0.72 in the pre-GST period (2012-13 to 2015-16)

- 94% of industry leaders view transition to GST as largely positive

- GST led to supply chain optimization

- GST reduced the compliance burden on trade and industry

- Lower logistics cost and taxes helped reduce prices of goods and services, benefiting the consumers.

Some key features of the Budget 2024-25 related to GST are:

–

Positive sentiment about GST

- 94% industry leasers view transition to GST as largely positive

- 80% of respondents feel GST has led to supply-chain optimisation (As per a survey conducted by a leading consulting firm)

Source: PIB Press Release dated 01.02.2024 and https://www.indiabudget.gov.in/doc/bh1.pdf

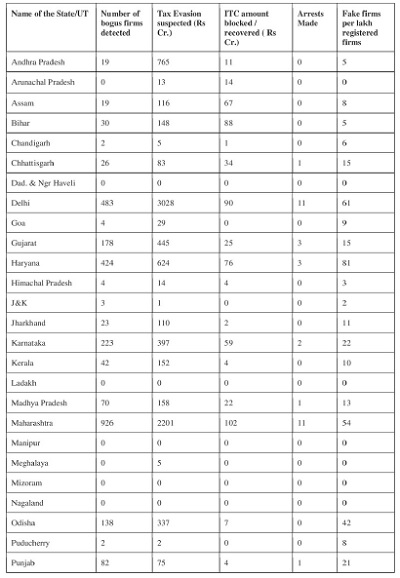

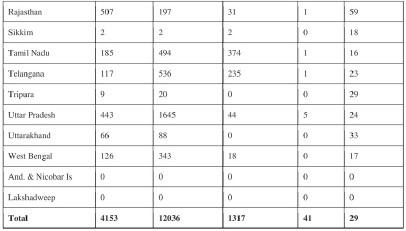

All-India Fake Registration Drive

29,273 bogus firms involved in suspected Input Tax Credit (ITC) evasion of Rs. 44,015 crore detected in a sustained drive against non-existent taxpayers by GST formations across the country since May 2023; 121 arrested

To curb frauds in Goods and Services Tax (GST) and increase compliance, the GST formations, under the Central Board of Indirect Taxes and Customs (CBIC) and the State/UT Governments, across the country are carrying out a focused drive on the issue of non-existent / bogus registrations and issuance of fake invoices without any underlying supply of goods and services.

Since the initiation of the special drive against fake registrations in mid-May 2023, a total of 29,273 bogus firms involved in suspected Input Tax Credit (ITC) evasion of Rs. 44,015 crore have been detected. This has saved Rs. 4,646 crore of which Rs. 3,802 crore is by blocking of ITC and Rs. 844 crore is by way of recovery. So far, 121 arrests have been made in the cases.

In the quarter ending December, 2023, 4,153 bogus firms that involved suspected ITC evasion of around Rs. 12,036 crore were detected. 2,358 of these bogus firms were detected by the Central GST Authorities. This has protected revenue of Rs. 1,317 crore of which Rs. 319 crore has been realised and Rs 997 crore has been protected by blocking ITC. 41 persons were arrested in these cases. 31 of these arrests were by Central GST Authorities. State wise details are annexed.

The Government has taken various measures to strengthen the GST registration process. Pilot projects of biometric based Aadhar authentication at the time of registration have been launched in the States of Gujarat, Puducherry and Andhra Pradesh.

Besides, the Government has endeavoured to curtail evasion of tax through measures such as sequential filing of GST returns, system generated intimation for reconciliation of the gap in tax liability in GSTR-1 & GSTR-3B returns and of the gap between ITC available as per GSTR-2B & ITC availed in GSTR-3B returns, use of data analytics and risk parameters for detection of fake ITC, etc.

Action against bogus firms during Quarter ending in December 2023

–

Source: PIB Press Release dated 07.01.2024

Notifications

> Notification No. 5/2024 – Central Tax dated 30.01.2024 seeks to amend Notification No. 02/2017-CT dated 19.06.2017

> The Central Government vide the said Notification has added the pin code ‘411069’ to the Territorial Jurisdiction of Principal Commissioner/Commissioner of Central Tax in Pune II (Table II).

> Notification No. 03/2024 – Central Tax and Notification No. 04/2024 – Central Tax dated 05.01.2024 seeks to notify special procedure to be followed by a registered person engaged in manufacturing of certain goods and rescind Notification No. 30/2023-CT dated 31.07.2023

The Central Government vide the said Notification No. 04/2024 – Central Tax dated 05.01.2024 has issued a new special procedure for registered manufacturers engaged in the production of specific goods as specified in the Schedule appended in the Notification which is applicable w.e.f 01.01.2024. The Notification outlines FORM GST SRM-I for Registration and disposal of packing machines of pan masala and tobacco products, FORM GST SRM-II for Monthly Statement of inputs used and the final goods produced by the manufacturer of goods specified in the Schedule and FORM GST SRM-III for Certificate of Chartered Engineer.

The Notification No. 30/2023-CT dated 31.07.2023 is rescinded through Notification No. 03/2024 – Central Tax dated 05.01.2024.

> Notification No. 02/2024 – Central Tax dated 05.01.2024, issued to extend due date for filing FORM GSTR-9 and FORM GSTR-9C for the financial year 2022-23 for the persons registered in certain districts of Tamil Nadu

The Central Government vide the said Notification has inserted Rule 80(1B) and (3B) to extend the last date of filing of FORM GSTR-9 and FORM GSTR-9C for the financial year 2022-23 till the 10.01.2024 for the registered persons whose principal place of business is in the districts of Chennai, Tiruvallur, Chengalpattu, Kancheepuram, Tirunelveli, Tenkasi, Kanyakumari, Thoothukudi and Virudhunagar in the state of Tamil Nadu.

> Notification No. 01/2024 – Central Tax dated 05.01.2024, issued to extend due date for filing of return in FORM GSTR-3B for the month of November, 2023 for the persons registered in certain districts of Tamil Nadu

The Central Government vide the said Notification has extended the last date of filing of FORM GSTR-3B for the month of November, 2023 till 20.01.2024, for the registered persons whose principle place of business is in the districts of Tirunelveli, Tenkasi, Kanyakumari, Thoothukudi and Virudhunagar is the state of Tamil Nadu.

> Notification No. 01/2024 – Central Tax (Rate), Notification No. 01/2024 – Integrated Tax (Rate) and Notification No. 01/2024 – Union Territory Tax (Rate) dated 03.01.2024 to amend Notification No. 01/2017 – Central Tax (Rate), Notification No. 01/2017 – Integrated Tax (Rate) and Notification No. 01/2017 – Union Territory Tax (Rate) dated 28.06.2017

The Central Government vide the said Notifications has levied 5% GST rate on LPG (for non-automotive purposes) conforming to the standard IS 4576, falling under tariff item 2711 19 10. The effective GST rate for this item will now be 5%, comprising 2.5% CGST and 2.5% SGST. These changes are effective from 04.01.2024.

GST Portal Updates

> Advisory on the functionalities available on the portal for the GTA taxpayers

The following Functionalities are made available on the portal for the GTA Taxpayers.

1. Filing of Online Declaration in Annexure V and Annexure VI for the existing GTA Taxpayers: As per the Notification No. 06/2023-Central Tax (Rate), dated 26.07.2023, the option by GTA to pay GST on Forward Charge mechanism or the Reverse Charge mechanism respectively on the services supplied by them during a Financial Year shall be exercised by making a declaration in Annexure V or Annexure VI from the 1st January of the current Financial Year till 31stMarch of the current Financial Year, for the next Financial Year.

2. Filing of Online Declaration in Annexure V for the Newly registered GTA Taxpayers: As per the Notification No. 5/2023-Central Tax (Rate), dated 09.05.2023, the option to pay GST on Forward Charge mechanism on the services supplied the Newly registered taxpayers can now be able to file their declaration within the specified due date for the current Financial Year i.e. 2023-2024 and onwards. The due date (before the expiry of forty-five days from the date of applying for GST registration or one month from the date of obtaining registration whichever is later) is now being configured by the system and the same would be displayed to the newly registered taxpayers on their dashboard. The newly registered GTA taxpayers can now file their online declaration on the portal for the current FY within the specified due date.

3. Uploading manually filed Annexure V Form for the FY 2023-24 on the portal: The Existing/ Newly registered GTA taxpayers who have already submitted Declaration in Annexure V Form for the FY 2023-24 manually with the jurisdictional authority are requested to upload their duly acknowledged legible copy of the Annexure V Form on the portal, mentioning with correct particulars date of as mentioned submitted, acknowledgement in the from physical jurisdictional Annexure V office, where such physical Annexure V was filed for the record purposes.

4. As per the above notification, the option exercised by GTA to itself pay GST on the services supplied by it during a Financial Year shall be deemed to have been exercised for the next and future financial years unless the GTA files a declaration in Annexure VI to revert under reverse charge mechanism.

5. For detailed advisory, visit the link provided below.

Portal update on 01.01.2024

> Advisory on introduction of new Tables 14 & 15 in GSTR-1

As per Notification No. 26/2022 – Central Tax dated 26.12.2022 two new tables Table 14 and Table 15 were added in GSTR-1 to capture the details of the supplies made through e-commerce operators (ECO) on which e-commerce operators are liable to collect tax under section 52 of the Act or liable to pay tax u/s 9(5). These tables have now been made live on the GST common portal. These two new tables will be available in GSTR-1/IFF from January-2024 tax periods onwards. Please click here for the complete advisory.

Portal update on 19.01.2024

> Advisory for furnishing bank account details by registered taxpayers under Rule 10A of the Central Goods and Services Tax Rules, 2017 Mandatory Bank Account Details Submission as per law:

All Registered Taxpayers are required under the provisions of CGST Act, 2017 and the corresponding Rules framed thereunder to furnish details of their bank account/s within 30 days of the grant of registration or before the due date of filing GSTR-1/IFF, whichever is earlier.

Taxpayers are therefore advised to promptly furnish their bank account details, who have not provided it so far if 30 Days period is shortly going to expire to avoid disruption in business activities and the subsequent suspension of GSTIN.

A new functionality is being developed with certain features and will be deployed in near future. For detailed advisory, visit the link provided below.

Legal Corner

Caveat emptor

Caveat emptor, (Latin: “let the buyer beware”), in the law of commercial transactions, principle that the buyer purchases at his own risk in the absence of an express warranty in the contract. As a maxim of the early common law, the rule was well suited to buying and selling carried on in the open marketplace or among close neighbours. The increasing complexity of modern commerce has placed the buyer at a disadvantage. He is forced to rely more and more upon the skill, judgment, and honesty of the seller and manufacturer.

Caveat Emptor is a foundational principle in contract law that places the onus on buyers to exercise caution and diligence before making a purchase. This doctrine underscores the idea that buyers should thoroughly inspect and evaluate the goods they intend to purchase, as sellers are not obligated to disclose all information about the product. In essence, Caveat Emptor empowers buyers to make informed decisions by conducting their own research and assessment of the product’s quality, suitability, and condition.

Embedded within the Sale of Goods Act 1930, Caveat Emptor serves as a cornerstone of commercial transactions, emphasizing buyer autonomy and self-reliance in decision-making. Section 16 of the Sale of Goods Act explicitly states that there is no implied warranty or guarantee regarding the nature or fitness of the goods sold, highlighting the buyer’s responsibility to assess the product’s suitability for their needs.

While Caveat Emptor places the burden of due diligence primarily on buyers, there are exceptions outlined within the Sale of Goods Act.

- Section 16(1) specifies that sellers must provide goods that align with the buyer’s stated purpose or requirements, whether expressed explicitly or impliedly.

- Additionally, Section 16(2) imposes a duty on sellers, particularly dealers who are not manufacturers, to deliver goods of merchantable quality that meet market standards.

- Furthermore, Section 16(3) introduces an implied warranty when sellers are aware of the specific trade usages or purposes for which the goods will be used.

Caveat Emptor underscores the importance of buyer discretion and vigilance in commercial transactions, encouraging thorough examination and assessment of goods before purchase. While buyers bear the primary responsibility for due diligence, the Sale of Goods Act provides certain exceptions to protect consumers’ interests and ensure fair and equitable transactions between buyers and sellers.

In Bettini v Gye (1876) case, the buyer purchased tickets to a concert but was unable to attend due to the performer’s illness. The court upheld the principle of Caveat Emptor, stating that the buyer assumed the risk of the performer’s non-appearance when purchasing the tickets, and the seller was not liable for the unforeseen circumstances. In Ranbirsingh Shankarsingh Thakur vs. Hindustan General Electric Corporation Ltd, it was held that Section 16(1) applies where the buyer requires goods for a specific purpose and he expressly or impliedly makes that purpose known to the seller, he relies on the skills of the seller and the seller’s usual course of business is to sell such goods whether he is the actual producer or not.

Source of Newsletter – https://gstcouncil.gov.in/