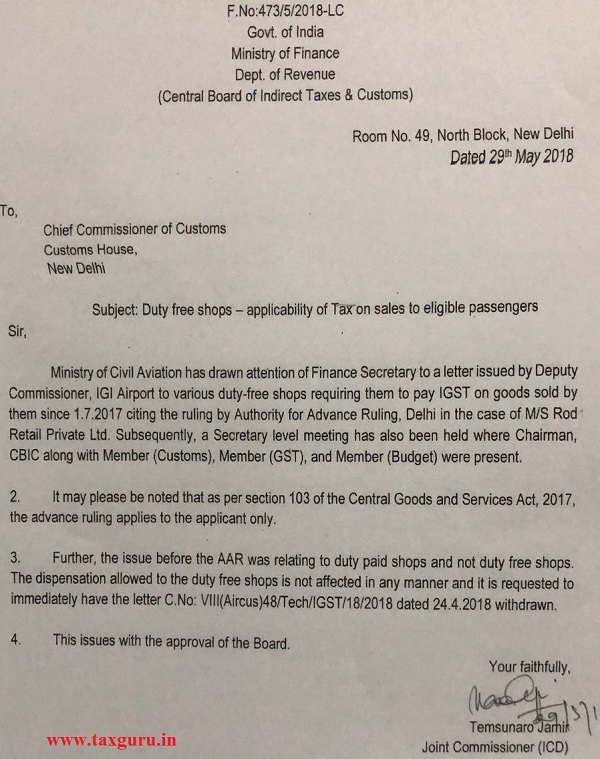

F.No:473/5/2018-LC

Govt. of India

Ministry of Finance

Dept. of Revenue

(Central Board of Indirect Taxes & Customs)

Room No. 49, North Block, New Delhi

Dated 29th May 2018

To,

Chief Commissioner of Customs

Customs House,

New Delhi

Subject: Duty free shops – applicability of Tax on sales to eligible passengers

Sir,

Ministry of Civil Aviation has drawn attention of Finance Secretary to a letter issued by Deputy Commissioner, IGI Airport to various duty-free shops requiring them to pay IGST on goods sold by them since 1.7.2017 citing the ruling by Authority for Advance Ruling, Delhi in the case of M/S Rod Retail Private Ltd. Subsequently, a Secretary level meeting has also been held where Chairman, CBIC along with Member (Customs), Member (GST), and Member (Budget) were present.

2. It may please be noted that as per section 103 of the Central Goods and Services Act, 2017, the advance ruling applies to the applicant only.

3. Further, the issue before the AAR was relating to duty paid shops and not duty free shops. The dispensation allowed to the duty free shops is not affected in any manner and it is requested to immediately have the letter C.No: VIII(Aircus)48/Tech/IGST/18/2018 dated 24.4.2018 withdrawn.

4. This issues with the approval of the Board.

Your faithfully,

Temsunaro Jamir

Joint Commissioner (ICD)

29/05/2018