Article explains about Applicability of Electronic Way Bill, Transportation through GTA, Transportation through other than GTA, Generation of E Way Bill Number, One conveyance to another Conveyance, Consolidated E way bill, Raise of E Way bill through Transporter, Details imported in GSTR-1, Validity of Eway bill, Information uploaded in the Portal, Deemed acceptance, Requirement of E Way Bill is relaxed in the following Circumstances, Storage of goods at Premises of Transporter (Circular No. 61/35/2018), Verification of documents and conveyances [Rule 138B], Inspection and verification of goods [Rule 138C], Facility for uploading information regarding detention of vehicle [Rule 138D] and Restriction on furnishing of information in PART A of FORM GST EWB-01 [Rule 138E].

Page Contents

- A. E Way Bill

- 1. Applicability of Electronic Way Bill:-

- 2. Transportation through GTA:-

- 3. Transportation through other than GTA:-

- 4. Generation of E Way Bill Number:-

- 5. One conveyance to another Conveyance:-

- 6. Consolidated E way bill:-

- 7. Raise of E Way bill through Transporter:-

- 8. Details imported in GSTR-1:

- 10. Validity of Eway bill:

- 11. Information uploaded in the Portal:

- 12. Deemed acceptance:-

- 13. Requirement of E Way Bill is relaxed in the following Circumstances:-

- B. Storage of goods at Premises of Transporter (Circular No. 61/35/2018):-

- C. Verification of documents and conveyances [Rule 138B]:-

- D. Inspection and verification of goods [Rule 138C]:-

- E. Facility for uploading information regarding detention of vehicle [Rule 138D]:-

- F. Restriction on furnishing of information in PART A of FORM GST EWB-01 [Rule 138E]:-

A. E Way Bill

Electronic Way Bill [Sec.68 r.w.r. 138, 138A, 138B, 138C & 138D]

Information to be furnished prior to commencement of movement of goods and generation of e-way bill [Rule 138]:-

1. Applicability of Electronic Way Bill:-

Every Registered Person who Causes Movement of Goods of Consignment Value Exceeding Fifty Thousand Rupees:-

i. In relation to a Supply or

ii. For reasons other than Supply or

iii. Due to inward Supply from a Un-Registered Person,

Shall before such commencement of such movement, furnish information relating to the said goods as specified in Part-A of Form GST EWB-01, electronically and a unique number will be generated on the said portal.

E Way Bill is Mandatory in a case where the goods are being sent by a Principal located in one state to a Job worker located in any other state, the E Way Bill shall be generated by the principal irrespective of the value of the Consignment.

*Consignment Value = value determined in accordance with the provisions of section 15, declared in an invoice, a bill of supply or a delivery challan, as the case may be, issued in respect of the said consignment and also includes the central tax, State or Union territory tax, integrated tax and cess charged, if any in the document.

2. Transportation through GTA:-

The goods are handed over to a transporter for transportation by road, the registered person shall furnish the information relating to the transporter on the common portal and the e-way bill shall be generated by the transporter on the said portal on the basis of the information furnished by the registered person in Part A of FORM GST EWB-01:

Provided also that where the goods are transported for a distance of less than ten kilometers within the State or Union territory from the place of business of the consignor to the place of business of the transporter for further transportation, the supplier or the recipient, or as the case maybe, the transporter may not furnish the details of conveyance in Part B of FORM GST EWB-01.

*The e-way bill shall not be valid for movement of goods by road unless the information in Part-B of FORM GST EWB-01 has been furnished.

3. Transportation through other than GTA:-

- Information in Part-B of Form GST EWB-01 &

- Serial Number and date of the railway receipt or the Air consignment not or Bill of lading as the case may be has to be enclosed.

4. Generation of E Way Bill Number:-

Upon furnishing all the requirements that are required on the common portal, a Unique E Way Bill Number (EBN) shall be made available to the supplier, the recipient and the transporter on the common portal.

5. One conveyance to another Conveyance:-

Where the goods are transferred from one conveyance to another, the consigner or the recipient, who has provided information in Part- A of the FORM GST EWB-01, or the transporter shall, before such transfer and further movement of goods, update the details of conveyance in the e-way bill on the common portal in FORM GST EWB-01:

Provided that where the goods are transported for a distance of less than ten kilometers within the State or Union territory from the place of business of the transporter finally to the place of business of the consignee, the details of conveyance may not be updated in the e-way bill.

6. Consolidated E way bill:-

Where multiple consignments are intended to be transported in one conveyance, the transporter may indicate the serial number of e-way bills generated in respect of each such consignment electronically on the common portal and a consolidated e-way bill in FORM GST EWB-02 maybe generated by him on the said common portal prior to the movement of goods.

[Note: – Concept of Consolidated E Way Bill has not been bought under practical terms, but the concept has got requisite space in the act]

7. Raise of E Way bill through Transporter:-

Where the consignor or the consignee has not generated FORM GST EWB-01 in accordance with the provisions of sub-rule (1) and the value of goods carried in the conveyance is more than fifty thousand rupees, the transporter shall generate FORM GST EWB-01 on the basis of invoice or bill of supply or delivery challan, as the case maybe, and may also generate a consolidated e-way bill in FORM GST EWB-02 on the common portal prior to the movement of goods.

8. Details imported in GSTR-1:

The information furnished in Part A of FORM GST EWB-01 shall be made available to the registered supplier on the common portal who may utilize the same for furnishing details in FORM GSTR-1:

Provided that when the information has been furnished by an unregistered supplier or an unregistered recipient in FORM GST EWB-01, he shall be informed electronically, if the mobile number or the e-mail is available.

9. Cancellation of E way bill:

Where an e-way bill has been generated under this rule, but goods are either not transported or are not transported as per the details furnished in the e-way bill, the e-way bill may be cancelled electronically on the common portal within 24 hours of generation of the e-way bill:

Provided further the unique number generated under sub-rule (1) shall be valid for 72 hours for updation of Part B of FORM GST EWB-01.

10. Validity of Eway bill:

| S.No | Distance | Validity Period |

| 1 | Up to 100 KM | One day in cases other than Over Dimensional Cargo |

| 2 | For Every 100 KM or Part | One additional day in cases other than Over Dimensional Cargo |

| 3 | Up to 20 KM | One day in case of Over Dimensional Cargo |

| 4 | For Every 20 KM or Part | One additional day in case of Over Dimensional Cargo |

Provided further that where, under circumstances of an exceptional nature, including trans-shipment, the goods cannot be transported within the validity period of the e-way bill, the transporter may extend the validity period after updating the details in Part B of FORM GST EWB-01, if required.

Note: – Provided also that the validity of the e-way bill may be extended within eight hours from the time of its expiry.

Relevant date = Mean the date on which the e-way bill has been generated and the period of validity shall be counted from the time at which the e-way bill has been generated and each day shall be counted as twenty-four hours.

11. Information uploaded in the Portal:

The details of E Way Bill generated shall be made available to

- Supplier, if registered, where the information in Part A of Form GST EWB 01 has been furnished by the recipient or the transporter.

- Recipient, if registered where the information in Part A of Form GST EWB 01 has been furnished by the Supplier or the Transporter.

On the common portal, and the supplier or the recipient, as the case maybe, shall communicate his acceptance or rejection of the consignment covered by the e-way bill.

12. Deemed acceptance:-

Where the person to whom the information specified in sub-rule (11) has been made available does not communicate his acceptance or rejection of the details being made available to him on the common portal, it shall be deemed that he has accepted the said details.

13. Requirement of E Way Bill is relaxed in the following Circumstances:-

Notwithstanding anything contained in this rule, no e-way bill is required to be generated:-

- Where the goods being transported are specified in Annexure (Notn.27/2017 dt.30/08/2017).

- Where the goods are being transported by a non-motorized conveyance;

- Where the goods being transported are alcoholic liquor for human consumption, petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas or aviation turbine fuel; and

- Where the goods being transported are treated as no supply under Schedule III of the Act.

- Where the goods being transported are exempt from tax

- Where the consignor of goods is the Central Government, Government of any State or a local authority for transport of goods by rail;

- Where empty cargo containers are being transported; and

- Where the goods are being transported up to a distance of twenty kilometers from the place of the business of the consignor to a weighbridge for weighment or from the weighbridge back to the place of the business of the said consignor subject to the condition that the movement of goods is accompanied by a delivery challan issued in accordance with rule 55.

B. Storage of goods at Premises of Transporter (Circular No. 61/35/2018):-

- In case the consignee/recipient of goods, stores his goods in the godown of the transporter, then the transporter’s godown has to be declared as an additional place of business by the Consignee/recipient.

- Where the transporter’s godown has been declared as the additional place of business by the recipient taxpayer, the transportation under the e-way bill shall be deemed to be concluded once the goods have reached the transporter’s godown (i.e recipient taxpayer’s additional place of business). Hence, e-way bill validity in such cases will not be required to be extended.

- Further, whenever the goods are transported from the transporters’ godown, which has been declared as the additional place of business of the recipient tax payer, to any other premises of the recipient taxpayer then, the relevant provisions of the e-way bill rules shall apply.

Hence, whenever the goods move from the transporter’s godown (i.e, recipient tax payer’s additional place of business) to the recipient taxpayer’s any other place of business; a valid e-way bill shall be required, as per the extant State specific e-way bill rules.

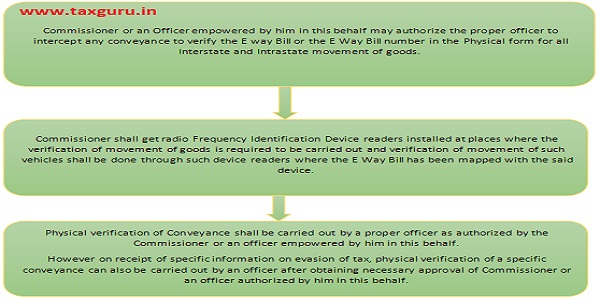

C. Verification of documents and conveyances [Rule 138B]:-

D. Inspection and verification of goods [Rule 138C]:-

- A summary report of every inspection of goods in transit shall be recorded online by the proper officer in Part A of a prescribed form within 24 hours of inspection and the final report in Part B of FORM GST EWB-03 shall be recorded within three days of such inspection.

Provided that where the circumstances so warrant, the Commissioner, or any other officer authorized by him, may, on sufficient cause being shown, extend the time for recording of the final report in Part B of FORM EWB-03, for a further period not exceeding three days.

- Where the physical verification of goods being transported on any conveyance has been done during transit at one place within the State or in any other State, no further physical verification of the said conveyance shall be carried out again in the State, unless a specific information relating to evasion of tax is made available subsequently.

E. Facility for uploading information regarding detention of vehicle [Rule 138D]:-

Where a vehicle has been intercepted and detained for a period exceeding thirty minutes, the transporter may upload the said information in FORM GST EWB-04 on the common portal.

F. Restriction on furnishing of information in PART A of FORM GST EWB-01 [Rule 138E]:-

Notwithstanding anything contained in sub-rule (1) of rule 138, no person (including a consignor, consignee, transporter, an e-commerce operator or a courier agency) shall be allowed to furnish the information in PART A of FORM GST EWB-01 in respect of a registered person, whether as a supplier or a recipient, who:—

(a) Being a person paying tax under section 10 or Notn No. 02/2019– Central Tax (Rate), has not furnished the statement in FORM GST CMP-08 for two consecutive quarters; or

(b) Being a person other than a person specified in clause (a), has not furnished the returns for a consecutive period of two months

Blocking and Unblocking of E way bill portal shall be effective from 21.01.2019 (Notification No. 36/2019 dt.20.08.2019).

Note:- Due to Covid-19, the Validity of E Way Bill which were generated before 24-03-2020 and its period of validity expires during the period 20-03-2020 to 15-04-2020 has been extended to 31-05-2020 (as per Notification No.40/2020 dated 05-05-2020).

Dear Sir,

My companies has 3 branches Mumbai ,Delhi & Bangalore. our Mumbai branch is main branch. we have purchase good from vendor and vendor located @ BNG he rise bill to Mumbai address and good sent @Delhi branch. Mumbai branch rise sales invoice to xxx – @party location in Kolkata and by mistake we mentioned on sales invoice ship to our branch address and all bill is over 50,0000 we rise e-way bill kindly suggest for the same.

Where an invoice and eway bill has been generated on 20th march but due to Covid-19 the material has been physically received by the recipient in May, can the original invoice be cancelled and fresh invoice and Eway bill generated in May2020? kindly confirm. Thank you

Hi Santosh,

Thanks for sharing detailed analysis on EWB.

Have few points for discussion/consideration

{1,}W.r.to storage of goods at transporters premises.

A) if storage was proposed by recipient, he may have get this place registered under his GSTN is ok as explained.

B) Can you please confirm in case this storage is initiated by supplier, then also he may get transport place registered as additional place of business, but this movement attract manual challan

1. Since new place may or may not be added to supplier SAP/ERP system.

2. Storage of goods at transporters premises, may not be covered under insurance.

Plz suggest suitable suggestions on this.

,{2} One circular was issued w.r.to penalties in case of minor mistake on invoice numbers of one digit or two digits by 1500/- during shipment.

In such issues case if transaction have already been completed and while performing reconciliation of (GSTR1 Vs EWB) we came to know about this mistake and we parked a remark on reconciliation, However there is no other mismatch on this as per EWB provisions.

Can you please confirm this still be exposure to us to the extent of 1500 per invoice as per circular?

This circular reference is missing here in writ up shared.

{3} in case of we handed over the goods to transporters/Courier person along with part-A of EWB, and part B of EWB, in case he missed to update and delivered the goods as it is.

Since part-B was not fulfilled EWB stands incomplete/Invalid.

1. In this case who is responsible to bear the notice transporters or supplier?

2. since supplier causing the movement of goods prinafacia his GSTN going to get notice on this,

Dose supplier legally recovered this from transporters?

In both cases

a) in case goods inspected during in transit

B) in case goods delivered on faulty EWB, since this will not get updated on EWB portal. Resulted in reported on GSTR-1 but not reported on EWB.

Kindly help on above points.

Regards/Suresh

9885011401

So

Thank you sir for this good article.