In a communication sent to PM Shri Narendra Modi today, Confederation of All India Traders (CAIT) has raised serious concerns about an arbitrary decision of Maharashtra Govt which violates the very fundamental of GST being ‘one nation- one tax’. We urge the State Govt to immediately withdraw the circular.

“Vyapur Bhawan”

925/1, Naiwala, karol Bagh,New Delhi-110005.

Phone: +91-11-45099884, Telefax:+91-11-45032665

Email: teamcait@gmail.com Website: www.cait.in

Date: 15th January, 2021

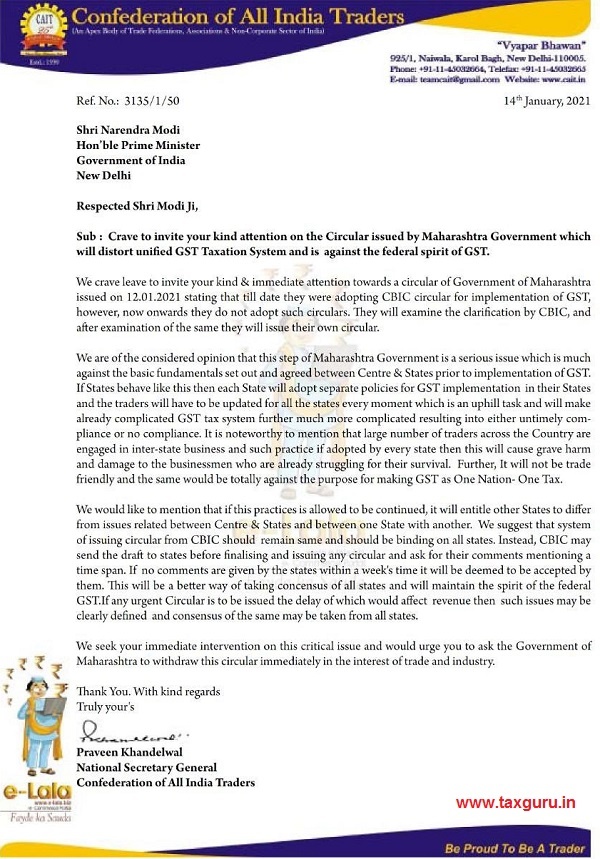

Ref.No. : 3135/1/50

Shri Narendra Modi

Hon’ble Prime Minister

Government of India

New Delhi

Respected Shri Modi Ji,

Sub: Crave to invite your kind attention on the Circular issued by Maharashtra Government which will distort unified GST Taxation System and is against the federal spirit of GST.

We crave leave to invite your kind & immediate attention towards a circular of Government of Maharashtra issued on 12.01.2021 stating that till date they were adopting CBIC circular for implementation of GST, however, now onwards they do not adopt such circulars. They will examine the clarification by CBIC, and after examination of the same they will issue their own circular.

We are of the considered opinion that this step of Maharashtra Government is a serious issue which is much against the basic fundamentals set out and agreed between Centre & States prior to implementation of GST. If States behave like this then each State will adopt separate policies for GST implementation in their States and the traders will have to be updated for all the states every moment which is an uphill task and will make already complicated GOT tax system further much more complicated resulting into either untimely compliance or no compliance. It is noteworthy to mention that large number of traders across the Country are engaged in interstate business and such practice if adopted by every state then this will cause grave harm and damage to the businessmen who are already struggling for their survival. Further, It will not be trade friendly and the same would be totally against the purpose for making GST as One Nation- One Tax.

We would like to mention that if this practices is allowed to be continued, it will entitle other States to differ from issues related between Centre & States and between one State with another. We suggest that system of issuing circular from CBIC should remain same and should be binding on all states. Instead, CBIC may send the draft to states before finalising and issuing any circular and ask for their comments mentioning a time span. If no comments are given by the states within a week’s time it will be deemed to be accepted by them. This will be a better way of taking consensus of all states and will maintain the spirit of the federal GST. If any urgent Circular is to be issued the delay of which would affect revenue then such issues may be dearly defined and consensus of the same may be taken from all states.

We seek your immediate intervention on this critical issue and would urge you to ask the Government of Maharashtra to withdraw this circular immediately in the interest of trade and industry.

Thank You. With kind regards

Truly your’s

Praveen Khandelwal

National Secretary General

Confederation of All India Traders

Sir, Please clarify as 3b is showing red flag when we enter Reverse Charges for Inward supplies i.e. GTA. If it has to be entered in in GSTR-1 and than where to enter the same.