Introduction: This article discusses in detail about How to adjust GSTR-3B tax liability with ITC available.

Query 1: Our as our GST portal account Credit Ledger shows balance of Rs. 13,22,658.00 for the month of July and the payable as per the Liability ledger for July shows Rs. 6,06,618.00.

Hope we need not pay anything for July. We have submitted our account but when we try to file it asks to clear the liability first for Rs. 6,06,618.00 without considering the credit of Rs. 13,22,658.00.

Please help.

Query 2: At the time of GSTR 3B filing We entered the Outward supplies Taxable Value and Tax Values and Inwards Supply’s Tax Value. After submitted the ‘Payment of Tax’ column is shown Tax Liability as our full sales Tax value. The value is not less my Input Tax. So, what can I do in this situation?

Ans: After filling all required details in GSTR-3B, many dealers, on seeing the liability amount in column 6.1 (Payment of tax) , are shocked and think to pay the amount.

But, this is unadjusted amount. We can adjusted it to particular ITC and Cash payments.

Let us take an example.

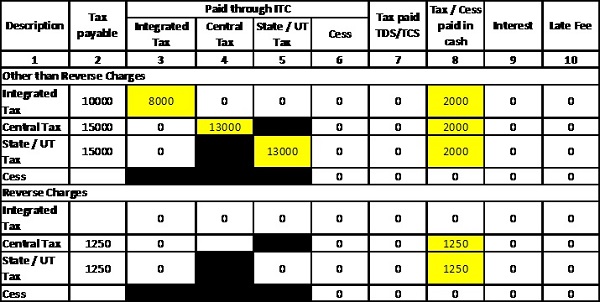

XYX and Co., total supplied goods and Services Rs. 10,00,000.00 (Ass. Value) Taxes are IGST Rs. 10,000, CGST Rs. 15000 and SGST Rs. 15000. ITC available as IGST Rs. 8,000, CGST Rs. 13,000 and SGST Rs. 13,000. RCM related liability Rs. 2500 (CGST Rs. 1250 & SGST Rs. 1250). Already paid, the liability amount Rs. 6,000 and Rs. 2500 as cash. After entering the values in outward supplies in Column no 3.1 and Inward supplies in Column no 4.

So, we need to follow the below process:

After save and submit the return the ‘Payment of Tax’ Column show the liability of Rs. 40,000. But, don’t be panic on seeing the value of the tax liability.

We can adjust the tax liability as below:

- Tax Liability – ITC = Tax Payable

⇓

- Tax payable – Tax paid in Cash = Zero (Tax Liability)

How to adjust this in GSTR-3B

You just open the ‘Payment of Tax’ box as given column 6.1 (Payment of Tax).

It is showing as below:

After ABC and Co, offset (adjust) the ITC available in the following way:

After Offset (adjustment) the liability is ZERO.

So, The system/GSTN portal can’t adjust the ITC.

We only have to adjust our ITC to the TAX Liability.

The author is a practising CA based in Delhi and is registered Insolvency Professional. He can be reached at cavinodchaurasia@gmail.com , Mob. +91 9953587496.

Disclaimer: The views expressed in this article are strictly personal. The content of this document are solely for informational purpose. It doesn’t constitute professional advice or recommendation. The Author does not accept any liabilities for any loss or damage of any kind arising out of information in this article and for any actions taken in reliance thereon.

ADJUSTMENT OF ITC- The gold ornaments showroom owner while purchasing old gold from customer raising bill and charging GST on old gold value. Same time customer is also purchasing some new gold ornaments and the shop is raising invoice showing sale value and GST. The old gold value is not paid in physical form to customer but adjusted against purchase of new ornaments. Now, whether the ITC availed on GST paid on purchase of old gold is proper or not. Is it admissible.

Sir,how can we adjust credit and debit notes with ITC got from supplier.

Dear sir,

I have to informed you that my GSTR 3b and GSTR 1 for the month of Feb & March2018 previous financial year already filed. but problem is when I file my GSTR 3b for month of Feb’2018 return filed mistakenly i nil due to technical problem but paid my tax before return filed which shown till date electronic cash ledger. But gstr 1 filed correctly . That time i thought payment tax adjusted atomically with GSTR 1 tax liability. . now what I do

I HAVE NO SALES IN DECEMBER 2017 BUT PURCHASE TWO BILLS ITC =14338/-

BUT LATE FEES ADJUST ITC gst 3b

sir i have one clarification. i have in igst 22060rs credit liability. how should in adjust in igst, cgst and sgst. tax amount is igst 8861=00, cgst 5926=00 and sgst 5926=00 there is a differnce of 1370rs

UNDER 3B PAYMENT OF TAX:: we adjusted all amount of tax from out put tax to input taxdue , still we have to pay tax under CGST and SGST but remains excess amount in IGST,it has to be adjusted to CGST and SGST balance ,;how do it. please explain in column under payment of tax under 3B .,

HOW TI FILL TRANDZ 2

How to adjust ITC in payment of Tax of GTR 3B.

i am accountant in textiles field. actully i wanted to learn how to fill the gstr3b portal and other gst coloumn. your link is very good but i want practical done video to watch and follow that step. from a to z.

thank you….

My client is having IGST,CGST and SGST itc.As per rule first iGST has to be adjusted in CGST and then SGST, but because of lack of knowledge, IGST has been adjusted 50-50 against tax liabilities and submitted GSTR 3B, and deposited challan of balance amount. Now the form GSTR 3B has been freeze. What step we should do for next.

where i want to put the purchase details only in 4 eligible ITC -> All other ITC – or in 3.1 (4) Inward supplies

We have made a mistake in gstr3b return.one bill dt 5-8-17 of rs.30000.00 mistakely made entry on 5-7-17

and taken input rs.1500.00 now how can i rectify this mistake